- Home

- »

- Power Distribution Systems

- »

-

Middle East Distribution Panel Market, Industry Report, 2030GVR Report cover

![Middle East Distribution Panel Market Size, Share & Trends Report]()

Middle East Distribution Panel Market Size, Share & Trends Analysis Report By Voltage (Low Voltage, Medium Voltage, High Voltage), By Mounting, By Application, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-638-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Middle East Distribution Panel Market Trends

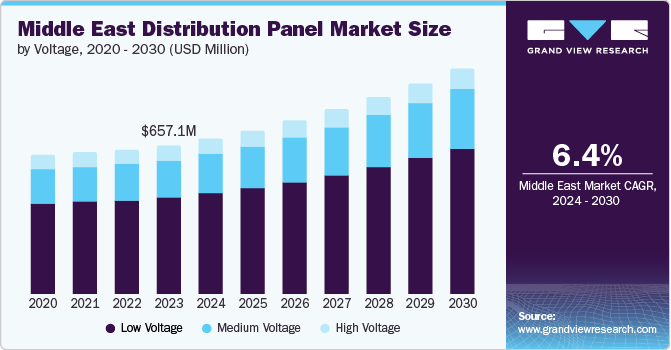

The Middle East distribution panel market size was valued at USD 657.1 million in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. A distribution panel is a necessary part of electrical systems that distribute and handle energy within a residence or business. Factors attributing to the projected growth include rapid industrialization and urbanization, a growing need for energy efficiency and safety, and increasing demand for energy conservation and security within industrial facilities.

Distribution panels can be personalized to fit the facility's needs and these panels are suitable for both indoor and outdoor installation. Often, these are designed to reduce power wastage and enhance energy control. For instance, certain panels are equipped with added functions such as surge protection, overload protection, and remote monitoring. Additionally, rising environmental concerns and awareness towards sustainability have led to an increase in production of renewable electricity and are expected to boost demand for this market during the forecast period.

Advancements in panel manufacturing technology have greatly simplified the process of installation and maintenance. The telecommunication industry is projected to surpass the growing demand due to the rising need for panels to ensure an efficient electricity supply along with a protective fuse for each circuit. With the rising need for digitalization and growing penetration of technology advancements such as artificial intelligence and the Internet of Things (IoT), technologies such as smart grid and smart metering are expected to play a vital role in market growth.

Voltage Insights

The low voltage (LV) segment dominated the market and accounted for a share of 65.0% in 2023. Low voltage panels are increasingly adopted owing to various advantages such as increased safety by guarding against electrical dangers, improved energy efficiency with optimal power distribution and enhanced energy management. Additionally, it has the capacity to provide personalized solutions to meet specific needs, and offers enhanced diagnostic capabilities for real-time monitoring and predictive maintenance. Distribution panels are often used in residential buildings, commercial spaces, and renewable energy systems such as solar power plants and wind farms.

Medium Voltage (MV) segment is expected to register the fastest CAGR during the forecast period. MV systems offer multiple benefits over LV systems such having smaller conductors and reduced need of copper in the system, lessening the voltage drops, and offering greater efficiency with lesser power losses. MV Systems play a critical role in high power loads such as industrial machine sites and large office buildings, as well as providing distribution capabilities to LV systems. However, efficient protection measures are implemented in both type of voltage distribution panels. Growing use of electricity in multiple industries, invention and unceasing adoption of heavy load machines in food processing and other manufacturing businesses and availability of uninterrupted supplies by governments to encourage industrial productions are expected to drive growth for this market in approaching years.

Mounting Insights

Flush mounting segment held the largest revenue share in 2023. The rise in smart home setups and the increasing utilisation of media distribution boxes is leading to an increase in the production of cables. Flush-mounted distribution panel provides a solution to this problem by becoming a modern design element in any type of interior. Flush-mounted distributors featuring see-through doors provide the benefit of enabling a quick and easy observation of all internal components. These benefits of flush mounting panels are expected to generate greater demand for the segment during forecast period.

Surface mounting is expected to experience the fastest CAGR from 2024 to 2030. Surface mounting leads to lightweight and compact designs as it allows components to be placed closer together. Some of the factors contributing to the growth of this segment include easy installations, enhanced high-frequency performance and ability to enable lower resistance and induction at the connection. Growing demand for efficient installations in residential, commercial and industrial settings in terms of space is also acting as a key growth driver for this segment.

Application Insights

Power distribution segment dominated the market in 2023. Often, power distribution panels are equipped with multiple elements such as circuit breakers or fuses, which allow the controlled and protected distribution of power. Factors contributing to the growth of this segment include unceasing demand for electricity across the globe, growing expansions of power grids, and increased dependability of population and businesses on electricity leading to need for reliable power distribution networks.

Motor control segment is projected to grow at the fastest CAGR over the forecast period. Motor control are mainly utilized in commercial buildings with interlinked electrical motors, controlled centrally. The packaging of a motor control center is compact and provides great flexibility in configuration and maintenance can also be coordinated from a central location. The rising industrial sectors, including banking, manufacturing, and telecommunication are driving demand for motor control distribution panels.

End Use Insights

The residential segment held the largest revenue share in 2023. Distribution panels are increasingly utilized in residential spaces and apartments for efficient and safe power distribution. They have a vital role in distributing electricity to different circuits in homes. Residential areas require energy to operate various devices and tools in the home such as air conditioners, water heaters, refrigerators, and others. The rising adoption of home appliances, kitchen appliances, connected devices, and technological advancements that utilize electricity have paved the way for efficient energy management systems, leading to market growth.

The industrial sector is projected to grow at the fastest CAGR from 2024 to 2030. Advancements in automation, digitalization, and energy efficiency have fueled rapid growth in the industrial distribution panel market. Modern distribution panels improve control, supervision, and overall energy efficiency. Growing energy consumption in industrial sectors has led to a rise in the need for effective power distribution systems.

Country Insights

KSA distribution panel market dominated the market in 2023. Growing population, increasing industrial growth, dynamic islanding, reduction in fossil fuel dependence have resulted in an increased demand for electricity.The establishment of urban centers, business quarters, and large-scale industrial projects in the regions of Saudi Arabia is driving the demand for distribution panels market. Moreover, Saudi Arabia is experiencing significant investments into smart grid technologies to enhance sustainability and efficiency. Anticipated advancements within the nation are expected to result in greater self-sufficiency by reduced reliance on imported energy sources like fossil fuels.

Qatar Distribution Panel Market Trends

The Qatar distribution panel market is anticipated to experience the fastest CAGR of 8.1% during the forecast period. The key drivers for this market include inexpensive labor and extensive infrastructure growth. Additionally, the increased level of industrialization in the nation has created a demand for extra-durable components like aluminium and copper. Furthermore, the need for enhanced energy savings and efficient power supply is expected to boost the market demand.

UAE Distribution Panel Market Trends

Distribution panel market in UAE is anticipated to experience a surge in demand due to rapid population growth and rising urbanization. Some of the factors driving growth for this market include increased renewable energy usage, need for controlled distribution of power, and improved efficiencies provided by the products are expected to generate greater growth for this market during the forecast period.

Key Middle East Distribution Panel Company Insights

Some of the key companies in the Middle East distribution panel market include ABB; AGS.; General Electric Company; alfanar; and others. Owing to the highly competitive market scenario, the major market participants are adopting strategies such as innovation, technology advances, enhanced research & development efforts, collaborations and partnerships, and mergers & acquisitions.

-

General Electric Company (GE), an American conglomerate operating in multiple industries, offers distribution panels for industrial spaces and data center applications. Some of the noteworthy product features of GE’s portfolio include higher electrical capacity and compact space footprint.

-

ABB, a power and automation technology company, provides a distribution panel portfolio for low-voltage power distribution. The company also delivers type A and type B distribution boards.

Key Middle East Distribution Panel Companies:

- ABB

- AGS.

- General Electric Company

- alfanar

- EAMFCO

- Eaton

- Hager Group

- LARSEN & TOUBRO LIMITED

- Legrand

- Meba Electric Co.,Ltd

- Schneider Electric

- Siemens

Recent Developments

-

In January 2024, Larsen & Toubro's Renewable EPC division in the Power Transmission & Distribution division won a huge EPC order and the company was appointed as the full-service engineering, procurement, and construction provider to build an 1800 MWac Solar Photovoltaic Plant in Dubai, United Arab Emirates. The project is part of the Mohammed bin Rashid Al Maktoum Solar Park.

-

In September 2023, ABB introduced the 500 mm panel edition of the UniGear ZS1, its advancement in air-insulated medium-voltage switchgear technology, at the Abu Dhabi International Petroleum Exhibition and Conference (ADIPEC) 2023.

Middle East Distribution Panel Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 996.9 million

Growth rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Voltage, mounting, application, end use, country

Country scope

KSA, Qatar, UAE, Kuwait, Rest of MEA

Key companies profiled

ABB; AGS.; General Electric Company; alfanar; EAMFCO; Eaton; Hager Group; LARSEN & TOUBRO LIMITED; Legrand; Meba Electric Co.,Ltd; Schneider Electric; Siemens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Middle East Distribution Panel Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East distribution panel market report based on voltage, mounting, application, end use, and region:

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low Voltage

-

Medium Voltage

-

High Voltage

-

-

Mounting Outlook (Revenue, USD Million, 2018 - 2030)

-

Flush Mounting

-

Surface Mounting

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Distribution

-

Motor Control

-

Lighting Control

-

Safety and Protection

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Utilities

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

KSA

-

Qatar

-

UAE

-

Kuwait

-

Rest of MEA

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."