Middle East Cables Market Size, Share & Trends Analysis Report By Application (Commercial, Industrial), By Voltage (Low, Medium, High, Extra High), By Country (Saudi Arabia, UAE, Qatar), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-414-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Middle East Cables Market Size & Trends

The Middle East cables market size was valued at USD 10.97 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. The Middle East cables market experiencing a significant growth due to technological developments, infrastructural development resulting from the process of economic diversification, increasing use of and demand for renewable energy, construction activities due the increasing rate of urbanization, communication needs, government support on safety and supply chain management, and other more.

One of the primary drivers is government infrastructure investments, particularly in countries such as Saudi Arabia, UAE, Qatar, and Egypt. The governments have launched initiatives to diversify their economies beyond oil dependency, with Saudi Vision 2030 and the UAE’s Vision 2021 aiming to develop sectors such as tourism, entertainment, and renewable energy. These initiatives have led to significant investments in urban development, transportation, and energy generation projects, resulting in a heightened demand for both medium and high voltage cables.

The increasing need for electricity has prompted manufacturers to enhance their production capacities and focus on high voltage and extra high voltage cables to meet future requirements, posing as another driver for market growth in the region. For instance, Saudi Arabia’s power demand is projected to rise from 55GW to 90GW, making it essential for manufacturers to produce high-quality cables that can meet this increased demand. Moreover, the development of smart cities across the Middle East is driving the demand for low voltage cables, which are critical for integrating advanced technologies in urban infrastructure.

The region’s strategic location as a connectivity hub has created a demand for robust submarine cable infrastructure, enabling high-speed internet and data transfer. Furthermore, the rise in offshore wind power generation and other renewable energy initiatives is fostering demand for submarine and power cables. The establishment of local manufacturing facilities by global players has also improved the availability of raw materials and reduced lead times, supporting the growth of the cables market as manufacturers can source materials more efficiently and cost-effectively.

Voltage Insights

The low voltage segment led the market with a revenue share of 43.2% in 2023. Growing population in the region necessitates increased housing projects, driving demand for low-voltage cables. The region is a leader in smart city initiatives, incorporating technologies to enhance urban living. Low-voltage cables play a crucial role in these projects, enabling smart lighting, energy management, and communication networks, significantly increasing demand.

The extra high voltage segment is expected to register the fastest CAGR of 7.3% during the forecast period. Rapid urbanization drives up per capita electricity consumption, prompting governments to invest heavily in new power plants, transmission lines, and substations. High-voltage transmission networks require advanced cables, exemplified by projects such as NEOM in Saudi Arabia and smart city initiatives. Governments are allocating significant budgets to meet these demands.

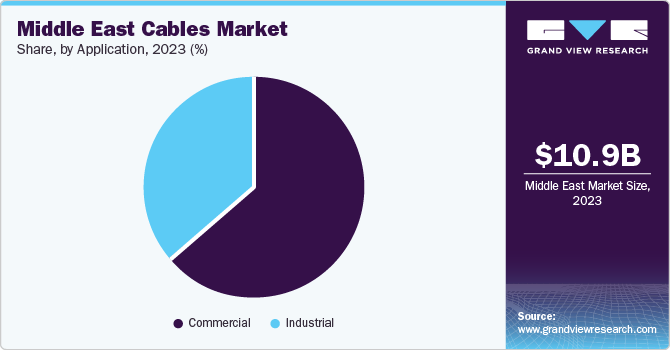

Application Insights

Commercial application held the highest market share of 64.5% in 2023. The Middle East has witnessed rapid urbanization, with cities such as Dubai, Abu Dhabi, Riyadh, and Doha experiencing significant population growth and infrastructure development. This urban expansion necessitates the installation of extensive electrical and telecommunication networks, driving demand for various cables, including power cables and fiber optic cables, to support residential and commercial needs.

Industrial application is expected to register the fastest CAGR of 5.5% over the forecast period. The Middle East has undergone rapid industrialization in oil and gas, manufacturing, and construction, driving demand for improved power transportation and essential services. Quality cables are essential for these industries, and governments have implemented policies to reduce reliance on oil, investing in infrastructure development and necessitating large-scale cable and wiring systems.

Regional Insights

Saudi Arabia cables market dominated the Middle East cables market with a market share of 34.6% in 2023. Saudi Arabia’s authorities has made substantial investments in telecommunications infrastructure over the past decades, driven by Vision 2030’s goal to diversify the economy and reduce dependence on oil sales. To achieve this, significant funds have been allocated to upgrade superior fiber optic networks and enhance existing cable systems.

Qatar Cables Market Trends

The cables market in Qatar is expected to register the fastest CAGR of 6.1% between 2024 and 2030. Qatar has launched various strategic financial initiatives, driven by a focus on infrastructure development, particularly for hosting major global events such as the FIFA World Cup 2022. Significant investments have been made in creation projects requiring large-scale cabling solutions. Urbanization has also fueled growth in residential and industrial development projects.

Key Middle East Cables Company Insights

Some key companies in the Middle East cables market include Bahra Electric; Belden Inc.; Ducab; ElsewedyElectric.com; and FAHAD CABLES INDUSTRY FZE (UAE); among others. Market participants are adopting strategies such as new product launches, expanded distribution networks, geographic expansion, and other initiatives to maintain market share and competitiveness.

-

Bahra Electric is a manufacturer of cables in the industry, offering a diverse range of products, including power cables, instrumentation cables, and solar cables, all conforming to international standards. The company prioritizes quality and sustainability, partnering with major infrastructure projects across the GCC and contributing to Saudi Vision 2030 initiatives.

-

Ducab is a UAE-based cable manufacturer, offering a comprehensive range of high-quality cables and accessories for diverse sectors, including construction, oil and gas, and renewable energy. The company is renowned for its dedication to innovation and sustainability, producing products that conform to international standards and meet specific customer needs.

Key Middle East (Saudi Arabia, UAE, Qatar, Egypt) Cables Companies:

- Bahra Electric

- Belden Inc.

- Ducab

- ElsewedyElectric.com

- FAHAD CABLES INDUSTRY FZE (UAE)

- HELUKABEL GmbH

- Nexans

- Prysmian S.p.A.

- Riyadh Cables

- Saudi Cable Company

- Sumitomo Electric Industries, Ltd.

Recent Developments

-

In May 2024, Belden Inc. Belden 5320UV and 5220UV Cables to its portfolio of addressable fire alarm cables, enhancing its offerings with secure, high-quality products designed for critical applications, previously meeting the demands of discerning customers.

-

In February 2024, Elsewedy Electric’s high-voltage cable technology set new standards in Egypt and the Middle East by partnering with Pfisterer to conduct pioneering type tests on 150kV cable systems, previously pushing the boundaries of innovation.

Middle East Cables Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 11.49 billion |

|

Revenue forecast in 2030 |

USD 15.52 billion |

|

Growth Rate |

CAGR of 5.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, voltage, region |

|

Regional scope |

Middle East |

|

Country scope |

Saudi Arabia, UAE, Qatar, Egypt |

|

Key companies profiled |

Bahra Electric; Belden Inc.; Ducab; ElsewedyElectric.com; FAHAD CABLES INDUSTRY FZE (UAE); HELUKABEL GmbH; Nexans; Prysmian S.p.A.; Riyadh Cables; Saudi Cable Company; Sumitomo Electric Industries, Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Middle East Cables Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East cables market report based on application, voltage, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Industrial

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low

-

Medium

-

High

-

Extra High

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Saudi Arabia

-

UAE

-

Qatar

-

Egypt

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."