Middle East & Africa Home Healthcare Market Size, Share & Trends Analysis Report By Components (Equipment, Services), By Indication (Maternal Disorders, Cancer), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-200-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

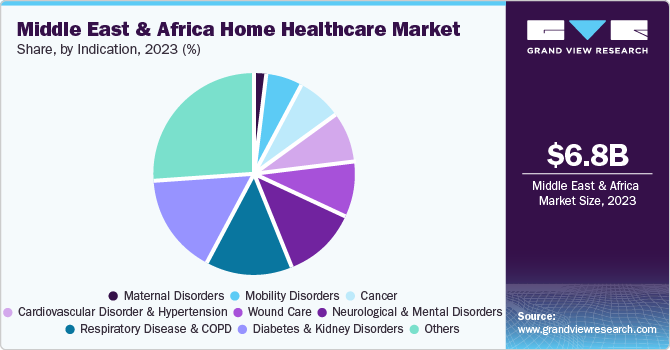

The Middle East and Africa home healthcare market size was estimated at USD 6.8 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.38% from 2024 to 2030. This can be attributed to the rising prevalence of chronic diseases, government initiatives, technological advancements, and the increasing geriatric population. As per the World Health Organization, the number of elderly in sub-Saharan Africa is expected to increase from an estimated 43 million in 2010 to 67 million by 2025 and 163 million by 2050. Technological advancements are anticipated to fuel the expansion of this market. Technology-driven innovations in this industry include telemedicine and remote patient monitoring.

These innovations improve patient outcomes and lower healthcare costs by enabling home health agencies to monitor patients remotely and intervene promptly. For instance, Saudi Arabia’s Ministry of Health started the Saudi Telehealth Network initiative to improve the quality and accessibility of healthcare services by utilizing telemedicine technologies to link hospitals and primary care centers in remote locations with specialist healthcare facilities. Chronic conditions, such as cardiovascular diseases, diabetes, cancer, and respiratory disorders, are on the rise in Middle East and Africa. Home healthcare offers a convenient and cost-effective way to manage these conditions.

According to the World Health Organization, diabetes in Africa is a serious, long-term, and expensive condition that is estimated to rise to 23.9 million cases by 2030. Moreover, the Eastern Mediterranean region has the highest diabetes prevalence rates, ranging from 7% in Somalia to 18% in Egypt. Government initiatives and expenditures aimed at improving healthcare access and delivery have also fueled the expansion of home healthcare services in MEA. For instance, Saudi Arabia is focusing on implementing multiple strategies to adopt the digitalization of healthcare, which would significantly transform care delivery & patient experience and support overall efficiency improvement. Kingdom Vision 2030 is an initiative undertaken by the government bodies of Saudi Arabia to bring transformations to the healthcare industry.

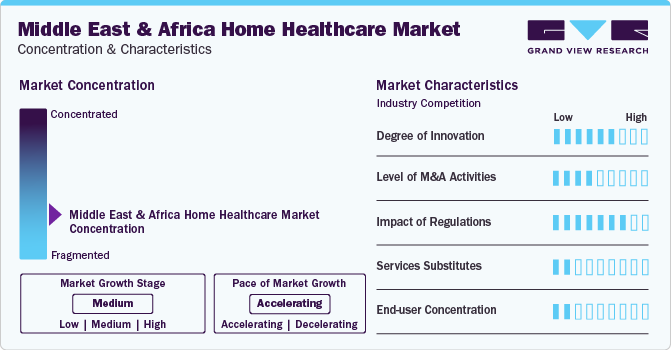

Market Concentration & Characteristics

The market growth stage is medium, and the pace of its growth is accelerating. The Middle East and Africa home healthcare market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors, such as advancements in telemedicine, telehealth, and remote patient monitoring.

The Middle East and Africa home healthcare market is also characterized by a medium level of merger and acquisition (M&A) activity by the leading players. The level of mergers and acquisitions in the market has steadily increased over the past few years. Many companies are looking to expand their services and reach new markets through strategic acquisitions or mergers with other companies. For instance, in September 2023, National Medical Care Company announced that it signed a share purchase agreement with Saudi Medicare Company to purchase the whole share capital of Chronic Care Specialized Medical Hospital Company.

The level of regulatory scrutiny in the Middle East and Africa home healthcare market is increasing. This is due to a high emphasis on establishing and enforcing quality standards to ensure that patients receive safe and effective care in their homes, and technologies, such as telemedicine and remote monitoring, which have led to increased regulatory scrutiny to address the unique challenges and opportunities of digital health solutions.

There are a limited number of direct product substitutes for home healthcare. However, several community support services include meal delivery programs, transportation assistance for medical appointments, social support groups, and community-based wellness programs. By leveraging these services, individuals can access practical support. These communities can substitute for home healthcare but typically offer a different level of personalized care than home healthcare.

End-user concentration is a significant factor in this market. Home healthcare services cater to a diverse range of end-users, including elderly individuals, patients with chronic illnesses, individuals with disabilities, and those in need of post-operative care.

Components Insights

The services segment dominated the market and accounted for a share of 84.1% in 2023. It is further segmented into skilled nursing services and unskilled nursing services. Skilled nursing services include a broad range of services licensed healthcare professionals provide. Unskilled nursing services are provided by caregivers or home health aides, who are not certified medical professionals but are skilled in offering patients non-medical support.

Home-based care is becoming increasingly prevalent as a more affordable option to hospitalization or institutional care. Skilled nursing services have gained traction due to their convenience and ability to promote patient independence. For instance, in January 2024, NeoHealth, a home healthcare startup, was launched in the United Arab Emirates. It offers continuity of care, flexible services, and a team of nurses accredited by the Dubai Health Authority.

The equipment segment is expected to register the fastest CAGR during the forecast period. It is segmented into therapeutic, diagnostic, and mobility assistance. Diagnostic equipment accounted for the largest share and is expected to grow at a lucrative rate over the forecast period. Technological advancements in sensors, medical devices, and software result in the development of precise and portable diagnostic equipment. This is anticipated to fuel the segment. For instance, in July 2022, Huawei Technologies Co., Ltd. launched its wrist-type ECG and blood pressure monitoring device, the Watch D, in the UAE. It includes a range of workout modes and health monitoring features, such as blood pressure detection using a tiny pump.

Indication Insights

The diabetes & kidney disorders segment accounted for a significant share in 2023. In the Middle East and Africa, diabetes and kidney-related conditions are major health concerns. These areas are witnessing an alarming rise in the prevalence of diabetes, which is leading to rising incidences of disorders related to kidneys. The impact of these conditions on patients is substantial, necessitating home healthcare. For instance, in September 2020, GluCare Integrated Diabetes Center was launched in Dubai. It offers remote continuous data monitoring for diabetic patients.

The mobility disorder segment is expected to register the fastest CAGR from 2024 to 2030. Mobility disorders make it difficult for an individual to do routine activities, necessitating specialized care and assistance. The growing incidence of musculoskeletal ailments, including osteoarthritis, rheumatoid arthritis, and others, has created a demand for home healthcare services that address mobility impairments across the Middle East and Africa. These services include a variety of non-medical and medical interventions aimed at enhancing the quality of life for those who struggle with mobility.

Country Insights

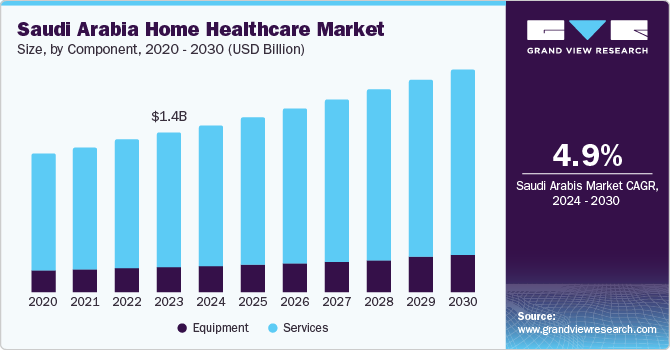

Saudi Arabia Home Healthcare Market Trends

Saudi Arabia dominated the regional market in 2023 and accounted for a share of 21.6% of the overall revenue owing to a growing aging population, rising incidence of chronic diseases, and government measures to enhance healthcare services. According to the International Trade Administration, Gulf Cooperation Council (GCC) countries spend 60% of their total on Saudi Arabia's healthcare. The Saudi Arabian government has allocated about USD 65 billion toward developing the nation's healthcare system as part of Vision 2030.

Oman Home Healthcare Market Trends

Oman is anticipated to witness significant growth. Several key factors, including demographic shifts, technological advancements, and government initiatives, are driving the market growth. For instance, in October 2023, at the ninth meeting of the Gulf Cooperation Council's Committee of Ministers of Health and the 86th General Conference of the GCC and Yemen, the Sultanate of Oman proposed integrating specialized health services and opening telemedicine clinics for rare diseases in the member states.

Egypt Home Healthcare Market Trends

The drivers propelling market growth in Egypt are growing awareness of the advantages of virtual healthcare, an aging population, and a rise in chronic illnesses. In December 2022, Valu and GSK announced a collaboration to provide flexible financing options for various GSK vaccinations available at numerous pharmacies throughout Egypt. By introducing innovative financing solutions, the alliance aims to provide accessibility to GSK's vaccines for a broader population, ultimately improving the state of healthcare in Egypt.

UAE Home Healthcare Market Trends

The growing prevalence of various chronic diseases, as well as favorable government initiatives and the market player’s activities, are the main factors propelling the market growth.For instance, in July 2022, Pyramid Health Services, a Hayat Health division governed by the Ghobash Group, entered the Dubai market. The organization provides a range of adult, pediatric, and geriatric patients with skilled and superior medical care.

South Africa Home Healthcare Market Trends

The market in South Africa has grown significantly due to various factors, such as the rising prevalence of chronic illnesses, government efforts that promote in-home care, and the need for personalized care. The market is driven by an aging population, increasing medical expenditures, the shift toward value-based care, and technological advancements, such as telemedicine. A few of the African startups driving telemedicine services include Clafiya, Waspito, DabaDoc, Quro Medical, Tibu Health, and Carepoint.

Key Middle East & Africa Home Healthcare Company Insights

Some of the key players operating in the market include Koninklijke Philips N.V.; Medtronic; Air Liquide; and Amana Healthcare.

-

Koninklijke Philips N.V. offers health technology solutions, which include home healthcare products, such as sleep apnea therapy equipment, remote patient monitoring systems, and respiratory care devices. The company's presence in MEA has made advanced home healthcare solutions more accessible to patients and caregivers

-

Amana Healthcare provides specialized facilities for long-term care, post-acute rehabilitation, and home healthcare services in the Middle East. It directly delivers integrated care solutions to patients' homes, ensures continuity of care, and extends support for patients with complicated medical needs

Manzil Healthcare Services, Al Tadawi Medical Centre, NMC Healthcare, and Abeer Medical Group are some of the other market participants in the home healthcare market.

-

Manzil Healthcare Services offers a wide range of home healthcare services, including elderly care, caregiver service, ventilation at home, doctor at home, infusion at home, and post-operative care

-

Al Tadawi Medical Centre provides comprehensive home healthcare services including Lab Test, Physiotherapy, Nurse care at Home/Hotel, IV Therapy Clinic and doctor at Home/Hotel

Key Middle East & Africa Home Healthcare Companies:

The following are the leading companies in the Middle East and Africa home healthcare market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Middle East and Africa home healthcare companies are analyzed to map the supply network.

- Koninklijke Philips N.V.

- Omron Healthcare, Inc.

- Air Liquide

- Amana Healthcare

- B. Braun SE

- Medtronic

- Manzil Healthcare Services

- Al Tadawi Medical Centre

- NMC Healthcare

- Abeer Medical

- Davita Inc.

- Cardinal Health

- Sunrise Medical

- GE Healthcare

- F. Hoffmann-La Roche Ltd.

- Linde Plc

- Mediclinic Middle East

Recent Developments

-

In September 2023, Aims Healthcare LLC announced the inauguration of its new branch in Sharjah, United Arab Emirates. The Sharjah branch aims to offer a wide range of home healthcare and diagnostic services to patients in Sharjah and surrounding areas

-

In September 2023, HCAH expanded its footprint from India to South Africa with the acquisition Medwell SA. The company aims to combine the clinical knowledge from India with the experience from Assisted Living institutions in South Africa to build a comprehensive ecosystem for senior citizens

-

In March 2023, Koninklijke Philips N.V. launched the Philips Virtual Care Management solutions and services portfolio, which has been designed to improve patient engagement and health outcomes through a more comprehensive telehealth approach

-

In March 2022, Mediclinic Middle East announced the launch of Mediclinic at Home, a program designed to manage chronic diseases. This program seamlessly combines virtual and physical healthcare to enhance patient compliance with treatment plans. It offers integrated care to chronic disease patients from the comfort of their homes or workplaces

-

In January 2022, Mediclinic Middle East announced the acquisition of Ayadi Home Healthcare, which offers patients in Al Ain and Abu Dhabi home healthcare services. Through this acquisition, the company will be able to execute its expansion strategy along the continuum of care

Middle East & Africa Home Healthcare Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.19 billion |

|

Revenue forecast in 2030 |

USD 9.84 billion |

|

Growth rate |

CAGR of 5.38% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, indication, country |

|

Regional scope |

Middle East and Africa |

|

Country scope |

South Africa; Saudi Arabia; Oman; Egypt; UAE |

|

Key companies profiled |

Koninklijke Philips N.V.; Omron Healthcare, Inc.; Air Liquide; Amana Healthcare; B. Braun SE; Medtronic; Manzil Healthcare Services; Al Tadawi Medical Centre; NMC Healthcare; Abeer Medical; Davita Inc.; Cardinal Health; Sunrise Medical; GE Healthcare; F. Hoffmann-La Roche Ltd.; Linde Plc ; Mediclinic Middle East |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Middle East & Africa Home Healthcare Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Middle East and Africa home healthcare market report based on component, indication, and country:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Therapeutic

-

Home Respiratory Equipment

-

Insulin Delivery Market

-

Home IV Pumps

-

Home Dialysis Equipment

-

Other Therapeutic Equipment

-

-

Diagnostic

-

Diabetic Care Unit

-

BP Monitors

-

Multi Para Diagnostic Monitors

-

Home Pregnancy And Fertility Kits

-

Apnea And Sleep Monitors

-

Holter Monitors

-

Heart Rate Meters (Including pacemakers)

-

Other

-

-

Mobility Assist

-

Wheel Chair

-

Home Medical Furniture

-

Walking Assist Devices

-

-

-

Services

-

Skilled Nursing Services

-

Physician Primary Care

-

Nursing Care

-

Physical/Occupational/Speech Therapy

-

Nutritional Support

-

Hospice & Palliative

-

Other Skilled Nursing Services

-

-

Unskilled Nursing Services

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Disorder & Hypertension

-

Diabetes & Kidney Disorders

-

Neurological & Mental Disorders

-

Respiratory Disease & COPD

-

Maternal Disorders

-

Mobility Disorders

-

Cancer

-

Wound Care

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

South Africa

-

Saudi Arabia

-

Oman

-

Egypt

-

UAE

-

Frequently Asked Questions About This Report

b. The Middle East and Africa home healthcare market size was estimated at USD 6.8 billion in 2023 and is expected to reach USD 7.19 billion in 2024.

b. The Middle East and Africa home healthcare market is expected to grow at a compound annual growth rate (CAGR) of 5.38% from 2024 to 2030 to reach USD 9.84 billion by 2030.

b. The services dominated the component segment in the market with the largest market share of 84.1% in 2023. This high share is attributable to services being a more affordable option for hospitalization and institutional care.

b. Some of the key players operating in the Middle East and Africa home healthcare market include Koninklijke Philips N.V.; Medtronic; Air Liquide; and Amana Healthcare; among others.

b. Key factors driving the market growth include the rising prevalence of chronic diseases, government initiatives, technological advancements, and the rising geriatric population.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."