- Home

- »

- Advanced Interior Materials

- »

-

MEA Aluminum Extrusion Market Size, Industry Report, 2030GVR Report cover

![MEA Aluminum Extrusion Market Size, Share & Trends Report]()

MEA Aluminum Extrusion Market Size, Share & Trends Analysis Report By Product (Shapes, Rods & Bars, Pipes & Tubes), By End-use (Building & Construction, Automotive), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-898-5

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

MEA Aluminum Extrusion Market Trends

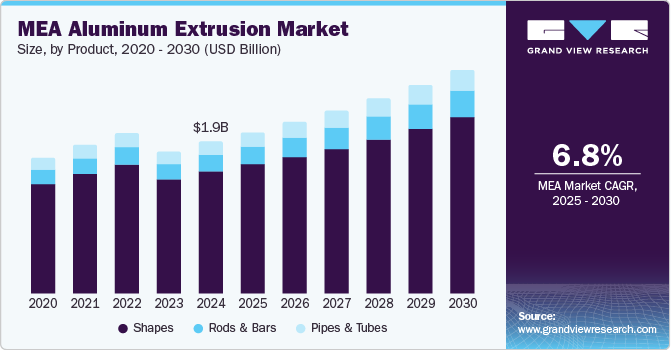

The MEA aluminum extrusion market size was estimated at USD 1.89 billion in 2024 and is projected to expand at a CAGR of 6.8% from 2025 to 2030. This growth is driven by the increasing demand for lightweight and durable materials in the automotive and construction industries is a significant driver. Aluminum extrusions are extensively used in vehicle components and building structures due to their excellent strength-to-weight ratio and corrosion resistance.

The region's commitment to renewable energy projects, such as solar and wind farms, is a significant driver for the aluminum extrusion market. These renewable energy projects require robust infrastructure for energy transmission and storage, and aluminum extrusions are ideal due to their strength, durability, and lightweight properties. The use of aluminum in constructing solar panel frames, wind turbine components, and energy transmission lines is expected to surge as these projects expand. Furthermore, the recyclability and sustainability of aluminum make it a preferred choice for manufacturers aiming to minimize their environmental footprint. Aluminum can be recycled repeatedly without losing its properties, making it a sustainable material that supports the circular economy. This inherent sustainability aligns with the growing environmental consciousness among manufacturers and consumers, driving the demand for aluminum extrusions in the region.

Product Insights

The shapes segment accounted for 79.3% of the MEA shapes extrusion market in 2024 due to the increasing demand for customized aluminum profiles, which offer versatility in design and functionality. These shapes are utilized in many applications, from structural components in buildings to specialized parts in machinery. The construction sector, in particular, has been a major driver of this demand, as aluminum extrusions are favored for their lightweight properties, corrosion resistance, and aesthetic appeal. Furthermore, the push towards sustainable building practices has led to a growing preference for aluminum, given its recyclability and lower carbon footprint than alternative materials.

The pipes and tubes segment is projected to grow at a CAGR of 1.9% from 2025 to 2030, driven by the increasing use of aluminum in construction, automotive, and HVAC industries. The demand for lightweight and corrosion-resistant materials is particularly influencing this trend, as aluminum's durability and efficiency make it an attractive choice for structural components, vehicle manufacturing, and energy-efficient HVAC systems. As these sectors continue to prioritize sustainability and performance, the adoption of aluminum pipes and tubes is expected to expand significantly.

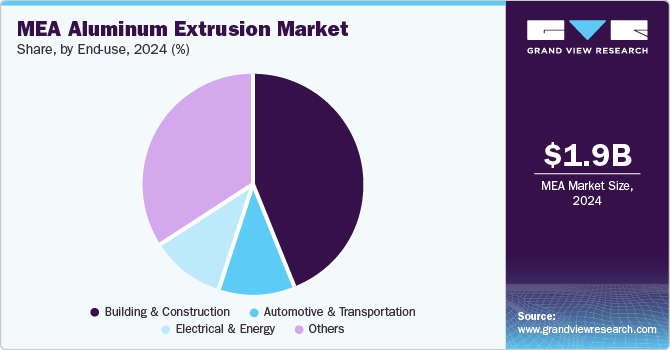

End-use Insights

The building & construction segment held the largest revenue share in 2024. Governments across MEA countries have prioritized construction projects driven by the need for modern housing, commercial spaces, and infrastructure enhancements. Aluminum extrusions, known for their lightweight, strength, and corrosion resistance, are increasingly utilized in structural frameworks, facades, windows, and doors. The rise of green building practices has further fueled demand, as aluminum is a sustainable material that supports energy efficiency and recyclability. Major projects, such as smart cities and high-rise buildings, continue to bolster this segment, indicating that the building and construction sector will likely maintain its dominance in the near term.

The electrical & energy segment is projected to witness the fastest growth from 2025 to 2030. Aluminum extrusions are increasingly favored in this sector due to their favorable electrical conductivity and lightweight nature, making them ideal for components such as solar panel frames, electrical enclosures, and transmission lines. Additionally, the rising demand for energy-efficient solutions in residential and commercial applications propels the adoption of aluminum extrusions in various electrical products. As countries in the MEA region enhance their energy security and invest in smart grid technologies, the electrical and energy segment is poised for significant growth, positioning aluminum extrusion manufacturers to capitalize on these emerging opportunities.

Country Insights

UAE Aluminum Extrusion Market Trends

The UAE dominated the MEA aluminum extrusion market in 2024 due to its robust infrastructure development, rapid urbanization, and significant industrial activities. The UAE's strategic investments in the construction and automotive sectors have driven the demand for aluminum extrusions, making it the leading market in the region.

Saudi Arabia Aluminum Extrusion Market Trends

The aluminum extrusion market in Saudi Arabia is projected to be the fastest in the region over the forecast period, fueled by increasing raw material production, potential renewable energy projects, and the expansion of new automotive plants. The Saudi Arabian market is expected to benefit from rising industrial production and a growing number of plants, further boosting the demand for aluminum extrusions.

Oman’s Aluminum Extrusion Market Trends

Oman’s aluminum extrusion market is anticipated to grow steadily from 2025 to 2030 due to its ongoing efforts to diversify its economy and invest in infrastructure projects. The demand for lightweight and durable materials in the construction and automotive sectors is expected to drive market growth in Oman during this period.

Key MEA Aluminum Extrusion Company Insights

Some of the key players operating in the market include Alupco, Gulf Extrusions Co. LLC, TALEX LLC, NAPCO, Emirates Extrusion Factory LLC, and others:

-

Alupco specializes in producing high-performance aluminum extrusions, which serve a wide range of applications, including structural components in construction, automotive industry parts, and consumer goods products.

-

Emirates Extrusion Factory LLC offers high-quality extrusions for various applications, including construction and interior design. By leveraging the UAE's strategic location and advanced logistics capabilities, Emirates Extrusion Factory has effectively positioned itself to serve the local market and export to neighboring regions.

Key MEA Aluminum Extrusion Companies:

- Alupco

- Gulf Extrusions Co. LLC

- Taweelah Shapes Extrusion Co. (TALEX) LLC

- National Shapes Products Company SAOG (NAPCO)

- Balexco Bahrain Aluminium Extrusion Company

- Emirates Extrusion Factory LLC

View a comprehensive list of companies in the MEA Aluminum Extrusion Market

Recent Developments

-

In August 2024, Hammerer Aluminium Industries (HAI) enhanced its manufacturing capabilities by installing the P61 aluminium extrusion press line in Ranshofen. This advanced press line increases production capacity and facilitates the fabrication of intricate aluminium profiles tailored for the automotive industry.

MEA Aluminum Extrusion Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.00 billion

Revenue forecast in 2030

USD 2.78 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Country scope

Saudi Arabia; UAE; Oman; Qatar; Bahrain; Kuwait

Key companies profiled

Alupco; Gulf Extrusions Co. LLC; TALEX LLC; NAPCO; Emirates Extrusion Factory LLC; Balexco Bahrain Aluminium Extrusion Company; Elite Extrusion LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

MEA Aluminum Extrusion Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global MEA aluminum extrusion market report based on product, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shapes

-

Rods & Bars

-

Pipes & Tubes

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Building & Construction

-

Automotive & Transportation

-

Electrical & Energy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Saudi Arabia

-

UAE

-

Oman

-

Qatar

-

Bahrain

-

Kuwait

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."