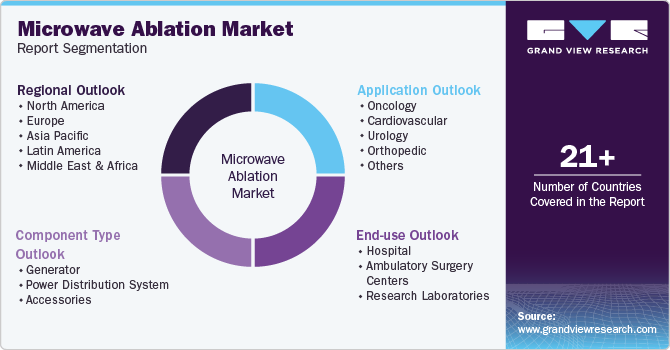

Microwave Ablation Market Size, Share & Trends Analysis Report By Component Type (Generator, Power Distribution System), By Application (Oncology, Cardiovascular, Urology, Orthopedic), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-001-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Microwave Ablation Market Size & Trends

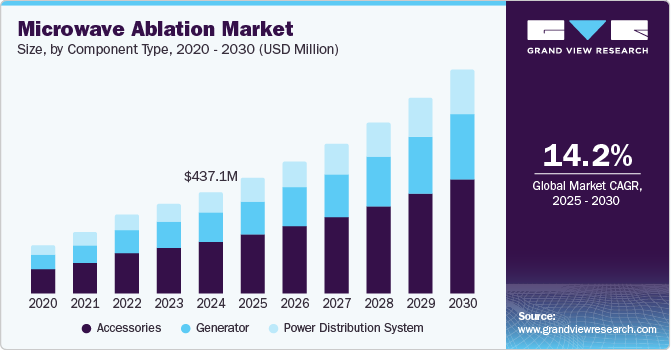

The global microwave ablation market size was estimated at USD 437.1 million in 2024 and is projected to grow at a CAGR of 14.2% from 2025 to 2030. The market growth can be attributed to the increasing incidence of various cancers, including liver, lung, kidney, and bone cancers. According to the American Cancer Society, in 2024, the U.S. projected approximately 2,001,140 new cancer cases, with notable figures of 234,580 for lung cancer, 41,630 for liver cancer, and 81,610 for kidney cancer. These statistics underscore the rising demand for effective treatment options, particularly those such as microwave ablation that offer minimally invasive solutions targeting tumors with precision and safety.

Advancements in medical technology serve as another catalyst for market growth. Continuous improvements in microwave ablation devices have enhanced their effectiveness through innovations such as real-time imaging guidance and artificial intelligence integration. Such technological developments are becoming essential as the cancer treatment landscape evolves, resulting in improved treatment outcomes and reduced complications for patients diagnosed with increasingly prevalent cancers. This trend aligns with the growing focus on employing advanced methodologies to address the rising number of cancer diagnoses effectively.

In 2024, around 65% of patients undergoing cancer treatment expressed a preference for minimally invasive techniques, which typically provide shorter recovery times and decreased postoperative pain compared to traditional surgical methods. This notable demand for innovative treatment modalities, such as microwave ablation, highlights the changing attitudes toward surgical interventions in the oncology field, making them more appealing to both patients and providers.

This trend is especially pronounced in North America and Europe, where collaborative efforts between healthcare institutions, research organizations, and medical device manufacturers are fostering innovation. Such partnerships enhance access to microwave ablation technologies and drive market growth, as they enable the development of new solutions tailored to meet the rising demands of cancer treatment amid an evolving healthcare landscape.

Component Type Insights

Accessories dominated the market and accounted for a share of 51.4% in 2024. The accessories segment predominantly comprises applicator antennas, which effectively deliver energy to tissue and offer numerous advantages and clinical applications. Typically, multiple antennas are utilized in a single procedure to create extensive and reproducible ablation zones. Key attributes of these antennas include minimal invasiveness and high efficiency in penetrating deep tissues for optimal active heating. However, anatomical structures such as airways, blood vessels, bile ducts, and the bowel can impact antenna performance. Leading companies, such as Medtronic, are advancing this market with innovative products such as the Emprint SX navigation antenna and Emprint Percutaneous Antennas featuring Thermosphere Technology.

Generators are expected to grow at the fastest CAGR of 14.4% over the forecast period. Generators play a crucial role in delivering power to multiple antennae, adhering to stringent safety standards in human medicine due to close proximity to patients. Features include integrated DC/DC protection, real-time temperature and RF power monitoring, and durable connectors for extended service life. Notable advancements include AMICA Microwave and RF System Gen by Mermaid Medical, a programmable, combined RFA and MWA technology.

Application Insights

Oncology led the market and accounted for a share of 31.3% in 2024, driven by rising cancer incidence, particularly among liver, lung, kidney, and bone cancer patients, creating a need for effective treatment options. Factors contributing to the demand include the minimally invasive nature of microwave ablation, technological advancements, and increased awareness and acceptance among healthcare professionals and patients.

Cardiovascular applications are expected to register the fastest CAGR of 14.3% over the forecast period. Microwave ablation has become a safe and effective treatment for atrial fibrillation (AF), particularly in patients with concurrent cardiac conditions, with significant success in achieving stable sinus rhythm. Its minimally invasive nature allows for procedures on a beating heart, which reduces recovery times. Continuous technological advancements enhance efficacy and safety, driving demand as the prevalence of cardiovascular diseases rises.

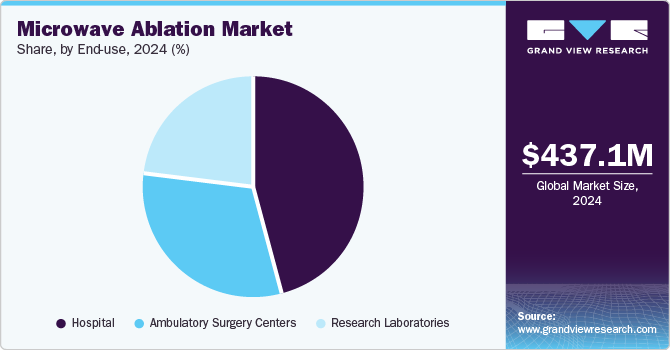

End-use Insights

Hospitals held the largest revenue share of 46.3% in 2024 as they serve as primary healthcare providers for patients requiring microwave ablation, particularly for cancer treatment, due to their comprehensive services that enhance access to advanced care. Equipped with state-of-the-art technology and specialized expertise, hospitals efficiently perform complex procedures. According to the American Hospital Association, insurance reimbursement supports affordability, while the extensive network of over 6,200 hospitals in the U.S. underscores their capacity for delivering these services.

Research laboratories are projected to grow at the fastest CAGR of 14.3% over the forecast period. Research laboratories drive innovation in microwave ablation technologies and techniques, enhancing their efficacy and safety. They conduct clinical trials to validate effectiveness, particularly for cancer treatment, which bolsters acceptance in clinical practice. Collaborations with medical institutions further enhance credibility, while educational initiatives inform healthcare professionals about microwave ablation's benefits. In 2023, approximately 1.3 million researchers globally contribute to these advancements.

Regional Insights

North America microwave ablation market dominated the global market with a revenue share of 31.2% in 2024. It is projected that the region would continue to grow as a result of technological advancements and the rising prevalence of chronic diseases. There is a strong demand for imaging analysis due to the rising prevalence of chronic diseases in this area, such as cardiovascular disorders. For instance, the CDC estimates that about 805,000 Americans get a heart attack each year. Over the projected period, the region is anticipated to continue to dominate.

U.S. Microwave Ablation Market Trends

The microwave ablation market in the U.S. dominated the North America microwave ablation market with a revenue share of 72.0% in 2024. Market growth in the country is driven by substantial investments in healthcare technology and research. The presence of leading medical device manufacturers encourages innovation, while the high incidence of cancer cases escalates demand for effective treatment options. Favorable insurance coverage and reimbursement policies incentivize hospitals to implement microwave ablation procedures.

Europe Microwave Ablation Market Trends

Europe microwave ablation market held substantial market share in 2024. Increasing cancer incidence rates and heightened awareness of minimally invasive procedures are driving industry growth in the country. Elevated healthcare expenditures across European countries promote the adoption of advanced medical technologies. Furthermore, regulatory approvals for microwave ablation devices and growing collaborations between healthcare providers and manufacturers enhance market growth in this region.

The microwave ablation market in UK is expected to grow in the forecast period, influenced by a growing aging population, with approximately 18% aged 65 and older as of 2023. The rising incidence of cancers, such as liver and lung cancer, necessitates effective treatment options such as microwave ablation. Moreover, advancements in medical technology and supportive healthcare policies facilitate the adoption of these innovative therapies in clinical practice.

Asia Pacific Microwave Ablation Market Trends

Asia Pacific microwave ablation market is expected to register the fastest CAGR of 14.5% in the forecast period, driven by increased healthcare investments and a rising prevalence of chronic diseases, including cancer. Countries such as China and India are experiencing notable growth due to expanded healthcare infrastructure and enhanced access to advanced medical technologies. Moreover, a larger patient population seeking efficient treatment options fuels demand for microwave ablation procedures.

Japan microwave ablation market dominated the Asia Pacific microwave ablation market in 2024, supported by an aging population, with approximately 28% of citizens aged 65 and older as of 2023. The high prevalence of cancers, particularly liver and lung cancers, drives the demand for effective treatment options such as microwave ablation. Japan's advanced healthcare system further facilitates the adoption of innovative medical technologies, improving patient access to these therapies.

Key Microwave Ablation Company Insights

Some key companies operating in the market include AngioDynamics; Medtronic; Emblation Ltd.; HUBER+SUHNER; Johnson & Johnson Services, Inc.; among others. The market is fragmented owing to high competition at the global level as it has the presence of severe key players. These players focus on growth strategies, such as new product launches, collaborations, partnerships, operational expansion, mergers & acquisitions, and patient awareness campaigns.

-

AngioDynamics specializes in microwave ablation systems designed for soft tissue treatment, particularly the Solero MTA System. This system utilizes a solid-state generator to achieve effective spherical ablations of up to 5 cm in just 6 minutes.

-

HUBER+SUHNER supplies essential connectivity components for microwave ablation devices, including low-loss cables and connectors. Their solutions enhance energy transfer efficiency and ensure compliance with medical safety standards, supporting both miniaturization and reliability in ablation technology.

Key Microwave Ablation Companies:

The following are the leading companies in the microwave ablation market. These companies collectively hold the largest market share and dictate industry trends.

- AngioDynamics

- Medtronic

- Emblation Ltd.

- HUBER+SUHNER

- Johnson & Johnson Services, Inc.

- MedWaves, Inc.

- SympleSurgical Inc.

- Mermaid Medical

- Varian Medical Systems, Inc.

- Terumo Corporation

Recent Developments

-

In December 2024, AngioDynamics received FDA clearance for the NanoKnife System, enabling prostate tissue ablation and enhancing treatment options.

-

In November 2024, Johnson & Johnson MedTech received FDA approval for the VARIPULSE Platform in the U.S. for treating atrial fibrillation.

-

In October 2024, Medtronic received FDA approval for the Affera Mapping and Ablation System with Sphere-9 Catheter in the U.S., enhancing treatment options for persistent atrial fibrillation.

-

In July 2024, Varian received FDA 510(k) clearance for its IntelliBlate microwave ablation system in the U.S., providing clinicians with enhanced predictability, precision, and control during procedures.

-

In February 2024, Biosense Webster obtained CE mark approval for the VARIPULSE Platform in Europe, enabling real-time integrated 3D mapping for treating recurrent paroxysmal atrial fibrillation through pulsed field ablation.

Microwave Ablation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 494.9 million |

|

Revenue forecast in 2030 |

USD 962.1 million |

|

Growth rate |

CAGR of 14.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Component type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

AngioDynamics; Medtronic; Emblation Ltd.; HUBER+SUHNER; Johnson & Johnson Services, Inc.; MedWaves, Inc.; SympleSurgical Inc.; Mermaid Medical; Varian Medical Systems, Inc.; Terumo Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Microwave Ablation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microwave ablation market report based on component type, application, end-use, and region:

-

Component Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Generator

-

Power Distribution System

-

Accessories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular

-

Urology

-

Orthopedic

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Ambulatory Surgery Centers

-

Research Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."