- Home

- »

- Renewable Chemicals

- »

-

Microcrystalline Cellulose Market Size & Share Report, 2030GVR Report cover

![Microcrystalline Cellulose Market Size, Share & Trends Report]()

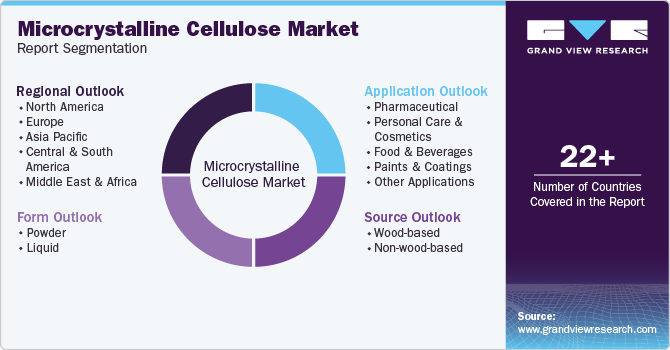

Microcrystalline Cellulose Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Wood-based, Non-wood Based), By Form (Powder, Liquid), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-342-8

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Microcrystalline Cellulose Market Summary

The global microcrystalline cellulose market size was estimated at USD 1,110.54 million in 2023 and is projected to reach USD 1,805.06 million by 2030, growing at a CAGR of 6.3% from 2024 to 2030. Microcrystalline cellulose (MCC) is commonly used as a binder, filler, and disintegrant in pharmaceutical tablets, as well as a bulking and anticaking agent in food products.

Key Market Trends & Insights

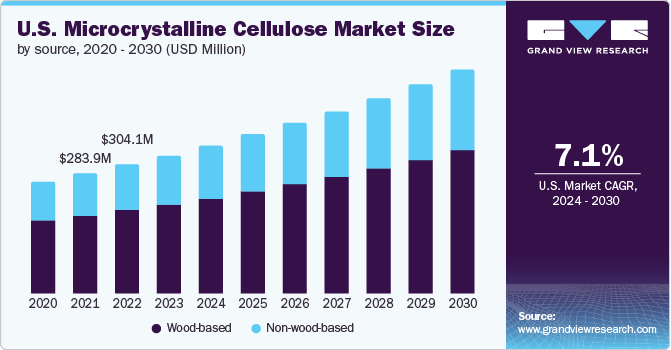

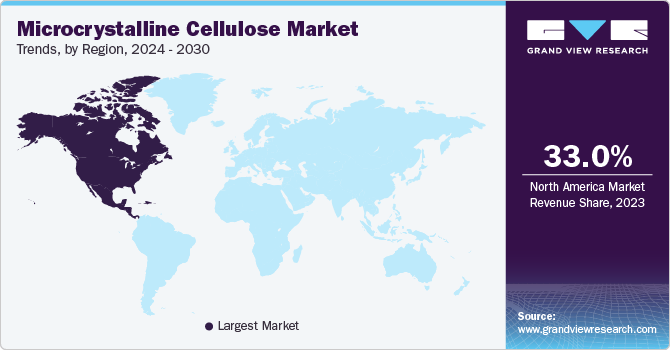

- North America microcrystalline cellulose market dominated the global industry with a share of 33.0% in 2023.

- The U.S. microcrystalline cellulose market will witness steady growth in the coming years.

- By source, the wood-based microcrystalline cellulose segment accounted for a share of 64.7% in 2023.

- On the basis of form, the powder segment dominated the market in 2023.

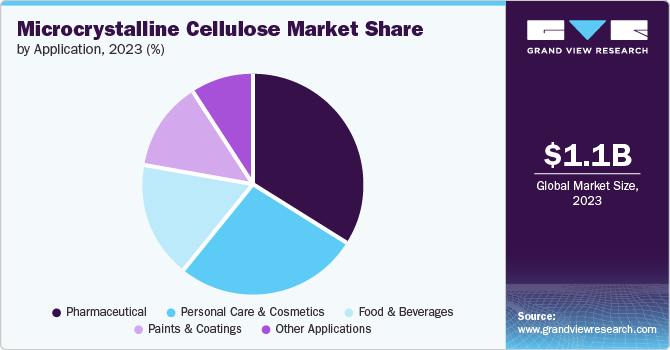

- By application, the pharmaceutical segment accounted for a share of 34.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1,110.54 Million

- 2030 Projected Market Size: USD 1,805.06 Million

- CAGR (2024-2030): 6.3%

- North America: Largest market in 2023

In addition, its inert nature, high compressibility, and ability to improve the flow properties of powders make it a popular choice for various manufacturing processes. MCC is a refined wood pulp derived from cellulose, a natural polymer found in plants. It comprises small, loosely packed microcrystals with a high surface area. It is widely used in various industries, including food & beverages, pharmaceuticals, personal care, and more, due to its unique properties, such as low bulk density, excellent binding capability, and high compressibility. MCC is produced by undertaking numerous steps, such as pulping, purification, hydrolysis, depolymerization, washing & drying, sizing & shaping, and packaging.

MCC is widely used in the pharmaceutical industry as an excipient in tablet formulations. It is preferred for its inertness, compressibility, and disintegration properties, making it an essential component in manufacturing tablets and capsules. In addition, with the growing health consciousness among consumers globally, there's an increasing demand for dietary supplements and functional foods. MCC is often used as a bulking or anti-caking agent in these products, contributing to its increased demand.

In personal care & cosmetics, MCC finds applications as a texture modifier, absorbent, and binding agent. With the growth of the cosmetics industry and consumer demand for high-quality personal care products, the demand for MCC in this sector is also on the rise. The product's versatility makes it desirable among end-use industries.

MCC production involves processing cellulose from various sources, including wood pulp or cotton. The cost of sourcing, processing, and manufacturing MCC can make it relatively expensive compared to alternative excipients or additives, limiting its use in cost-sensitive applications or regions. While MCC generally enjoys regulatory approval for use in pharmaceuticals, food, cosmetics, and other applications, there may be specific regulatory restrictions or limitations in certain regions or for certain uses. Compliance with regulatory requirements can add complexity and cost to the use of MCC in some cases.

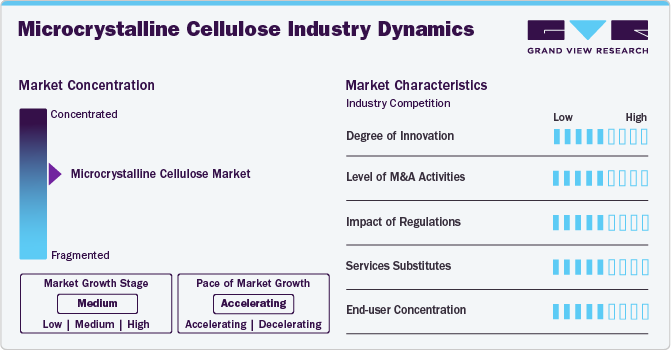

Market Concentration & Characteristics

Market growth stage is exponential, and the pace of its growth is accelerating. The microcrystalline cellulose market is characterized by a high degree of innovation. Ongoing research and development activities in the field of enzymatic hydrolysis, nanocellulose conversion, green solvent & ionic liquids, among others, drive innovations in microcrystalline cellulose. Researchers and companies invest in understanding the complexities of the functions of the product, leading to the discovery of novel enzyme variants with improved properties. For instance, in September 2023, International Flavors & Fragrances, Inc. (IFF) featured their novel excipient product Avicel PH LN, a robust low-nitrile microcrystalline cellulose (MCC) for the pharmaceutical industry.

The microcrystalline cellulose market is also subject to increasing regulatory scrutiny. Various regulatory bodies, such as the US FDA, Health Canada, and EPA, are governing the utilization of these products in numerous end-use applications globally. Regulatory approval is often a prerequisite for introducing microcrystalline cellulose into the market. Stringent approval processes ensure that these products meet safety and quality standards. The time and effort required for regulatory clearance can impact the speed at which new products reach consumers. On the contrary, regulatory requirements can drive innovation in the development of microcrystalline cellulose. Manufacturers may invest in R&D to create products that meet regulatory standards and offer improved performance, influencing consumption patterns.

End-user concentration is a significant factor in the global microcrystalline cellulose market. Since a number of application areas are increasingly utilizing these products in their product formulation, this often leads to larger-volume purchases. This can lead to economies of scale for microcrystalline cellulose suppliers, potentially resulting in cost efficiencies in production and distribution. High end-user concentration may lead to long-standing relationships between microcrystalline cellulose suppliers and major players in the end-use industries. This stability can foster collaboration, mutual understanding, and consistent business partnerships.

Source Insights

The wood-based microcrystalline cellulose segment dominated the market and accounted for a share of approximately 64.7% in 2023, due to its versatility and eco-friendliness. MCC is used in various industries, such as pharmaceuticals, cosmetics, food, and paper, as a stabilizer, thickener, and binder. In addition, its renewable nature and biodegradability make it an attractive alternative to synthetic ingredients, driving its growing popularity.

Non-wood-based MCC sources, such as agricultural residue (e.g. cotton, rice, husk, sugarcane bagasse), or microbial sources, offer more sustainable alternatives to wood-derived MCC, aligning with the growing global emphasis on sustainability and reducing dependence on finite resources like wood. In some cases, non-wood-based MCC sources may be more cost-effective compared to wood-derived MCC depending on factors such as availability, transportation costs, and local regulations. This cost advantage can drive increased adoption by industries seeking to optimize production costs.

Form Insights

The powder segment dominated the market in 2023 due to its stability, versatility, ease of handling, controlled release, and cost-effectiveness. The powdered form of the product has a longer shelf life and is more stable than liquid forms, which can degrade or spoil more easily. In addition, powders are typically easier to store, handle, and measure than other product forms. Furthermore, powder MCC may be more cost-effective to some producers in the manufacturing and transportation processes than liquid MCC. Such benefits of the powdered form make the product more attractive to numerous end-users.

On the other hand, liquid formulations can enhance the bioavailability of active ingredients by improving their solubility and absorption rates, leading to better therapeutic outcomes. Moreover, its liquid form allows for easier handling and processing in manufacturing, reducing production time and costs. Furthermore, with an increasing consumer preference regarding clean label/natural products, liquid MCC derived from cellulose aligns well with this trend, as it is perceived as a natural and sustainable ingredient. Such factors are responsible for the growth of liquid MCC in numerous application areas and are expected to continue over the following years.

Application Insights

The pharmaceutical segment dominated the market and accounted for a share of approximately 34.0% in 2023 on account of its versatile applications, compatibility, and regulatory acceptance. The product has become an indispensable ingredient in the pharmaceutical/medical industry, especially in pharmaceutical formulations, contributing to its dominance in the pharmaceutical industry. MCC is widely used as a binder in tablet formulation. It provides excellent compressibility, binding properties, and disintegration characteristics, making it ideal for creating tablets with uniform drug distribution and consistent release profiles.

In cosmetic products such as lotions, makeup products, and creams, MCC acts as a texture enhancer, imparting a smooth and creamy consistency while improving spreadability and application. In addition, MCC can absorb excess oil and moisture, making it useful in formulations for oily skin or products designed to control shine, such as mattifying powders and blotting papers.

In the food & beverages industry, MCC can be used as a fat-replacement ingredient in low-fat food products. It helps mimic the texture and mouthfeel of fats while reducing overall calorie contents. In addition, MCC serves as a bulking agent in food formulations, adding volume and structure without significantly affecting taste or flavors. It is commonly used in baking goods, desserts, and powdered drink mixes.

Regional Insights

The microcrystalline cellulose market in North America dominated the global industry and accounted for a share of 33.0% in 2023. This high share is attributable to several factors, including its widespread application in pharmaceutical, food & beverage, and personal care & cosmetics. The region’s large population, advanced pharmaceutical and food industries, and the demand for functional food & dietary supplements contribute to its high consumption of MCC. Additionally, regulatory approvals and favorable market conditions have also played a role in gaining popularity among the population in the region.

U.S. Microcrystalline Cellulose Market Trends

The U.S. microcrystalline cellulose market will witness steady growth in the coming years. The U.S. is one of the largest markets for food & beverage products. According to the USDA Economic Research Service, the U.S. witnessed the biggest spending on consumption of food & beverages in 2022, even after adjusting the inflation. The bakery goods, according to Rabobank, is witnessing high dollar sales. The bakeries in the U.S. have opportunities to rebuild margins, resulting in growth trends in 2024. The high consumption of food & beverages, especially bakery products, in the U.S. leads to higher consumption of food additives like microcrystalline cellulose, thereby positively impacting the market in the country.

Europe Microcrystalline Cellulose Market Trends

The France microcrystalline cellulose market is expected to witness rapid growth as France is among the leading countries in terms of production and consumption of personal care & cosmetics products in the world. The country witnessed high production and exports related to cosmetics products. According to the French Federation for Beauty Companies (FEBEA), in 2023, French exports of cosmetics increased by 10.8%, reaching a record high of EUR 21.3 billion (USD 22.95 billion). This is the third consecutive year in which the country has achieved double-digit growth in terms of production and exports of cosmetic products. Such factors are driving the market for microcrystalline cellulose in France.

Asia Pacific Microcrystalline Cellulose Market Trends

The China microcrystalline cellulose marketisprojected to register significant growth in the coming years. According to Nantong Hermeta Chemicals Co., Ltd., China's coatings sector is anticipated for bright growth, driven by numerous significant factors determining its development projections. As China advances in construction and infrastructure projects, the demand for paints and coatings rises exponentially, establishing significant prospects for the industry. Further, according to Qingdao Zhuoli Yang International Trading Co., Ltd., from January to June 2023, the comprehensive production of paints & coatings in China was about 16.875,000 tons, an upsurge of 3.2% YoY. The total revenue of the main business was about 193.29 billion yuan (USD 27.16 billion), decreased by 5.3% YOY. However, the total profit was about 10.57 billion yuan (USD 1.49 billion), an increase of 12.9% YoY. The growth rate of the industry's total output and total profits has returned to positive since April, and the growth rate of the main business income has narrowed, and the overall trend is good.

The microcrystalline cellulose market in India willwitness exponential growth over the forecast years. According to the Pharmaceutical Ingredients (CPHI) annual report, the Indian pharmaceutical sector is observing a transformation from a generics-oriented hub to a novelty-driven pharmaceutical market, chiefly credited to its Contract Development and Manufacturing Organizations (CDMOs). According to the U.S. FDA, Indian companies are anticipated to bag a 48%–50% share of approvals for new drugs from the regulatory body in 2023. Such factors are expected to drive the market for the product in India.

Central & South America Microcrystalline Cellulose Market Trends

The microcrystalline cellulose market in Brazilis likely to witness significant expansion. According to USDA, Brazil is the fourth largest cheese producer, accounting for almost 3% of the total cheese production in 2023. The Paraná state has a meaningful cheese production. 1.3 million gallons are used to produce cheese out of the 3 million gallons of milk produced daily, representing 43% allocation to cheese production. Blending the innovation of farmers in Brazil with technological know-how, cheese production has become prominent in the national scenario and is ready to capture the world. Such factors are expected to drive the consumption of the product in Brazil.

Key Microcrystalline Cellulose Company Insights

Some of the key players operating in the market include Roquette Frères, JRS PHARMA, Asahi Kasei Corporation, SEPPIC, and International Flavors & Fragrances Inc., among others.

-

Roquette Frères is a global leader in plant-based ingredients and a key player in the food, nutrition, and pharmaceutical industries. The company is renowned for its expertise in the production of microcrystalline cellulose (MCC), a versatile ingredient widely used in pharmaceutical, food & beverages, and cosmetics, among other end-use industries

-

Asahi Kasei Corporation is a diversified Japanese multinational conglomerate with a global presence across various industries, including chemical, fibers, electronics, healthcare, and construction materials. The company is a prominent player in the production and development of MCC. The company is committed to sustainability across its operations, from raw material sourcing to manufacturing process and product lifecycle management

Apollo Scientific Ltd., Ankit Pulps, and Godavari Biorefineries Ltd. are some of the emerging market participants in the microcrystalline cellulose market.

-

Apollo Scientific Ltd. is a leading manufacturer and supplier of chemicals, intermediates, and research-grade chemicals to the pharmaceutical, biotechnology, and chemical industries. The company’s product portfolio encompasses a diverse array of organic compounds, heterocycles, organometallics, and other specialty chemicals

-

Ankit Pulps and Boards is an established manufacturing, distribution, and wholesale company. With proficiency and persistent superiority in R&D, the company has continuously pushed its boundaries and developed a remarkably high-quality product. The manufacturing factory is constructed with enhanced technology and is approved by numerous certified industrial standards. The company follows all the GMP principles to ensure absolute product safety

Key Microcrystalline Cellulose Companies:

The following are the leading companies in the microcrystalline cellulose (MCC) market. These companies collectively hold the largest market share and dictate industry trends.

- Roquette Frères

- JRS PHARMA

- Asahi Kasei Corporation

- Apollo Scientific Ltd

- SEPPIC

- Ankit Pulps

- GODAVARI BIOREFINERIES LTD.

- International Flavors & Fragrances Inc.

- DFE Pharma

- Fengchen Group Co., Ltd.

- Foodchem International Corporation

Recent Developments

-

In September 2023, International Flavors & Fragrances, Inc. (IFF) featured their novel excipient product Avicel PH LN, a robust low nitrile microcrystalline cellulose (MCC) for the pharmaceutical industry

-

In February 2023, Asahi Kasei Corporation completed the construction of its second manufacturing plant dedicated to Ceolus Microcrystalline Cellulose at its Mizushima Works in Kurashiki, Okayama, Japan. The company invested a total of USD 87 million (¥13 billion). With the new facility, the company underlines its commitment to meet the substantially growing demand for its MCC

-

In October 2023, Roquette Frères announced the addition of three new excipient grades to its unmatched portfolio of solutions for moisture-sensitive active pharmaceutical and nutraceutical ingredients. Unveiled on-stand at CPHI Barcelona, LYCATAB® CT-LM partially pregelatinized starch, MICROCEL® 103 SD, and MICROCEL® 113 SD microcrystalline cellulose offers a unique range of stabilizing and moisture protective benefits, giving pharmaceutical manufacturers the tools they need to optimize any drug delivery, regardless of production method or formulation type

Microcrystalline Cellulose Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,180.06 million

Revenue forecast in 2030

USD 1,805.06 million

Growth rate

CAGR of 6.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, form, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Roquette Frères; JRS PHARMA; Asahi Kasei Corp.; Apollo Scientific Ltd.; SEPPIC; Ankit Pulps; Godavari Biorefineries Ltd.; International Flavors & Fragrances Inc.; DFE Pharma; Fengchen Group Co., Ltd.; Foodchem International Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Microcrystalline Cellulose Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microcrystalline cellulose market report based on source, form, application, and region:

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wood-based

-

Non-wood-based

-

-

Form Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Personal Care & Cosmetics

-

Food & Beverages

-

Paints & Coatings

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global microcrystalline cellulose (MCC) market size was valued at USD 1,110.54 million in 2023 and is anticipated to reach USD 1180.05 million in 2024.

b. The global microcrystalline cellulose maret is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 1,805.06 million in 2030.

b. North America dominated the goba microcrystalline cellulose market with a share of 33.62% in 2023. This high share is attributable to several factors including its widespread application in pharmaceutical, food & beverage, and personal care & cosmetics, among others.

b. Some of the key players operating in the market include Roquette Frères, JRS PHARMA, Asahi Kasei Corporation, SEPPIC, and International Flavors & Fragrances Inc., among others.

b. The demand for microcrystalline cellulose is set to increase due to its versatility and wide rage of applications in numerous end-use industries like food & beverages, pharmaceuticals, personal care & cosmetics, and more

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.