Microcontroller Socket Market Size, Share & Trends Analysis Report By Product (DIP, BGA, QFP, SOP, SOIC), By Application (Automotive, Consumer Electronics, Industrial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-324-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Microcontroller Socket Market Size & Trends

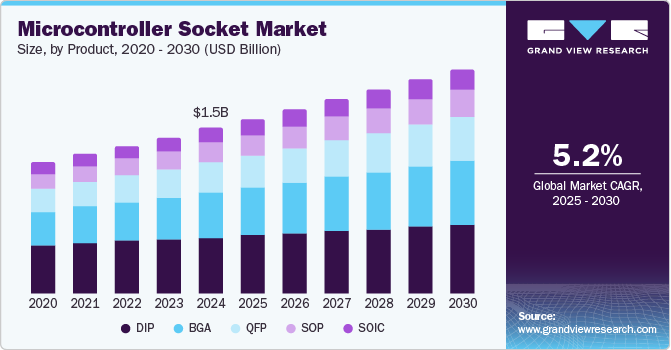

The global microcontroller socket market size was valued at USD 1.47 billion in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030. The extensive use of microcontrollers and integrated circuits in modern industries to ensure smooth operations and the development of reliable and high-efficiency products is expected to aid industry expansion. The increasing application of microcontrollers in the communication, automobile, and industrial sectors has boosted the growth of the package market in recent years. Microcontrollers are installed in electronic devices and control various critical operations they perform, helping in the seamless management of these devices. Technological advancements and increasing demand from key industries have compelled manufacturers to focus on quality, innovation, and sustainability to remain competitive. As the demand for smarter, more connected devices continues to grow, the role of microcontroller sockets is anticipated to become increasingly vital.

Growing sales of electronic devices have highlighted the importance of microcontrollers in this ecosystem, as they are responsible for handling crucial processes and carrying out multiple functions. As devices such as smartphones, wearables, gaming consoles, smart home devices, and laptops witness a steady increase in adoption, further technological innovations have become necessary to optimize device functionality and provide a competitive advantage to manufacturers. This has resulted in a constant need for the efficient integration of microcontrollers, leading to the use of sockets that can seamlessly address the complexities of modern electronic devices. Moreover, advances in edge computing and embedded systems due to trends such as Industry 4.0 and the emergence of the Internet of Things (IoT) are expected to aid market growth in the coming years. Improvements in microcontroller socket designs can ensure their optimal support for high-performance capabilities and lower power consumption. This helps bring reliability and durability across various applications, improving operations.

The industry has witnessed the emergence of various key trends due to advancements in technology, evolving market demands, and optimized design practices, leading to frequent developments. For instance, the increasing compactness of electronic devices has led to a rapidly growing demand for smaller microcontroller packages, including BGAs and chip-scale packages. This has led to the development of smaller sockets supporting such designs. Modular socket designs are becoming very popular among manufacturers, allowing for easy upgrades and replacements without redesigning the entire PCB. This flexibility is particularly important in prototyping and development environments. Additionally, sockets that can ensure improved thermal management have also witnessed increased production, as they can ensure reliable operation under heavy loads. Market players are increasingly considering these parameters during the design and development of their products, leading to the launch of advanced solutions.

Product Insights

The DIP segment accounted for the largest revenue share of 34.2% in 2024 and is anticipated to maintain its leading position during the forecast period. The rapid growth of the consumer electronics industry and the use of integrated circuits across sectors such as automotive and healthcare have driven the demand for dual in-line package (DIP) technology. DIP sockets are suitable for various applications as they offer a reliable and simple method of connecting microcontrollers to PCBs (printed circuit boards) and other components. Additionally, reduced costs of manufacturing and fabrication of DIP microcontrollers and increasing demand for smaller, thinner, and less expensive device packaging solutions are expected to maintain a steady demand for these products in the coming years.

The BGA segment is expected to register the fastest CAGR over the forecast period. A ball grid array (BGA) microcontroller socket is a specialized component that enables the easy installation and removal of microcontrollers that use a BGA package. These packages consist of a grid of solder balls on the underside of the chip, which are used for electrical connections to the circuit board. The socket generally consists of corresponding pads where the solder balls of the BGA microcontroller make contact, allowing for a reliable electrical connection without soldering directly to the printed circuit board (PCB). This helps developers to prototype or replace microcontrollers without requiring reflow soldering, which can be beneficial for testing and debugging. Since the microcontroller can be easily inserted and removed, it can help reduce wear on the chip and the PCB, prolonging the life of both these components. Manufacturers are designing BGA sockets with thermal considerations, which aids in effective heat dissipation and better performance.

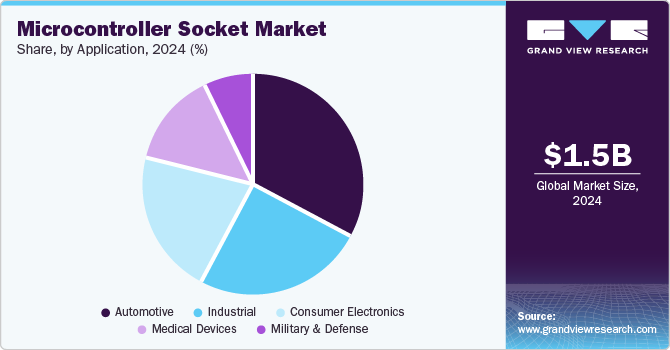

Application Insights

The automotive segment accounted for a leading revenue share in 2024. The rapid growth of the automotive industry, increasing sales of electric and hybrid vehicles, and growing technological integrations and innovations by manufacturers have sharply increased the usage of microcontrollers in vehicles, leading to a corresponding growth in demand for sockets. 8- or 16-bit microcontroller units (MCUs) are used extensively in applications such as position sensors and various ADAS components. Additionally, increasing focus on driver safety and improvements in communication and information systems have further enabled market expansion through the extensive presence of microcontrollers. Manufacturers strive to introduce sockets that can effectively handle harsh automotive environments and variations in humidity, temperature, and vibration.

The consumer electronics segment is expected to witness the fastest growth during the forecast period. Increasing popularity and demand for products such as wearables, home automation systems, and smart appliances have created a substantial demand for advanced MCUs to improve the functionality and efficiency of these devices, leading to a growth in the production of microcontroller sockets. High-quality sockets can prevent common issues such as corrosion and reliable connectivity, particularly in frequently used devices, leading to consistent long-term performance. Introducing advanced technologies such as machine learning and AI is expected to ensure promising growth opportunities for this segment.

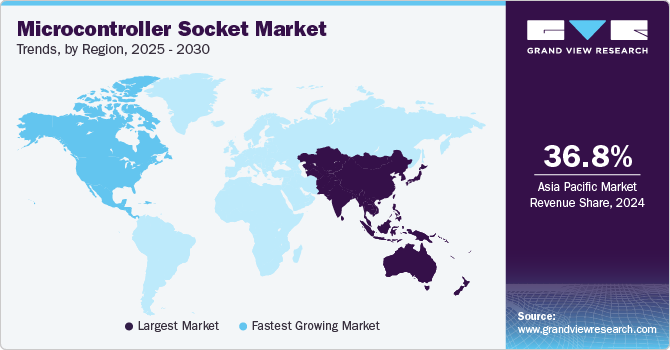

Regional Insights

North America is anticipated to account for the second-largest revenue share in the global market by 2030. The increasing presence of electric vehicles across households in the U.S. and Canada and the modernization of industrial processes and electronics integration in key areas have aided market growth in the region. Furthermore, notable advancements in the smart energy and wireless communications sector have highlighted the need for microcontrollers for advanced and efficient operations, encouraging manufacturers of microcontroller sockets to launch innovative products in the market.

U.S. Microcontroller Socket Market Trends

The U.S. has remained a major global market for microcontrollers due to the presence of a well-established electronics and semiconductors industry. The country is home to many leading technology companies and startups that are investing heavily in research and development activities to innovate socket designs and improve microcontroller performance. Additionally, in recent years, there has been a strong emphasis on developing solutions that cater to emerging technologies such as AI and machine learning. The U.S. market adheres to high-quality standards, including ISO certifications and automotive-specific standards such as AEC-Q100, to ensure the reliability and safety of electronic components in applications. Consequently, manufacturers focus on producing durable and reliable sockets that meet these stringent requirements.

Asia Pacific Microcontroller Socket Market Trends

Asia Pacific led the market with 36.8% of the global revenue share in 2024. The increasing presence of major end-use verticals in regional economies such as China, Japan, and India is expected to drive regional market expansion. The automotive sector has grown significantly due to the launch of electric vehicles, the introduction of favorable government initiatives to encourage the development of energy-efficient passenger and commercial vehicles and the increasing presence of major manufacturers and OEMs. Rising sales of consumer electronics products are also anticipated to boost the use of components such as microcontrollers, enabling the growth of the microcontroller socket market.

China emerged with a dominant revenue share in the regional market in 2024. The country is known for its extensive development in semiconductors and electronics due to the abundant availability of resources. China has a well-established supply chain for electronic components, including microcontroller sockets. Major manufacturers are involved in manufacturing a wide variety of socket types, such as DIP, QFN, and BGA. An increasing presence of local production facilities is expected to reduce costs and lead times for developers and manufacturers substantially. Additionally, the presence of organizations such as the China Electronics Standardization Institute (CESI) and regulations such as China RoHS have significantly impacted product design and manufacturing processes.

Europe Microcontroller Socket Market Trends

Europe accounted for a notable share of the global market in 2024. The region has a well-established automotive industry, owing to the presence of manufacturers such as Mercedes, Aston Martin, and Renault. The regional sector is increasingly adopting advanced microcontroller technologies, particularly in fast-developing areas such as electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Compliance with stringent safety and reliability standards has necessitated high-quality microcontroller sockets, boosting demand in this sector.

Germany is widely known for its technological advancements and innovations in major industries such as industrial automation, telecom, and automotive. Furthermore, increasing demand for smart devices and Internet of Things (IoT) applications have led to steady growth in the economy’s production and usage of components such as microcontrollers. This has created extensive demand for microcontroller sockets for prototyping purposes, protection of integrated circuit (IC) chips, and offering support to advanced microcontrollers that have features such as lower power consumption and enhanced processing power.

Key Microcontroller Socket Company Insights

Some key companies involved in the microcontroller socket market include Amphenol Corporation, TE Connectivity, and Aries Electronics, among others.

-

TE Connectivity is a notable global designer and manufacturer of electrical and electronics components and products catering to the aerospace, defense, automotive, medical, and energy industries. The company offers an expansive range of microcontroller sockets and interconnect solutions designed for high performance and reliability across different applications. TE Connectivity provides sockets that accommodate high-density microcontroller packages, including BGA and LGA types, which are essential for compact designs. Several socket designs incorporate features for effective heat dissipation, ensuring reliable operation of high-performance microcontrollers. The company offers DIP sockets, PGA sockets, and SIP sockets that are part of the DIPLOMATE and HOLTITE families and comply with EU RoHS and EU ELV standards.

-

Amphenol is a leading manufacturer of interconnect solutions, including microcontroller sockets. The company’s products are designed to provide reliable connectivity in various applications, ranging from consumer electronics to industrial systems. Amphenol offers a range of socket types, including BGA (Ball Grid Array), PGA (Pin Grid Array), and LGA (Land Grid Array), suitable for various microcontroller packages. These products are utilized in consumer electronics devices such as wearables and smartphones, in the automotive sector for ADAS and infotainment systems, and industrial enterprises in control systems, automation, and manufacturing equipment.

Key Microcontroller Socket Companies:

The following are the leading companies in the microcontroller socket market. These companies collectively hold the largest market share and dictate industry trends.

- Aries Electronics

- Amphenol Corporation

- CnC Tech, LLC

- FCI USA LLC

- Hon Hai Precision Industry Co., Ltd. (Foxconn)

- Mill-Max Mfg. Corp.

- PRECI-DIP SA

- Samtec

- Silicon Laboratories

- TE Connectivity

Microcontroller Socket Market Report Scope

|

Report Attribute |

Details |

|

Market Size Value in 2025 |

USD 1.55 billion |

|

Revenue Forecast in 2030 |

USD 2.00 billion |

|

Growth Rate |

CAGR of 5.2% from 2025 to 2030 |

|

Base Year for Estimation |

2024 |

|

Historical Data |

2018 - 2023 |

|

Forecast Period |

2025 - 2030 |

|

Quantitative Units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Product, application, region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country Scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, China, Japan, India, Brazil, Argentina, UAE, Saudi Arabia, South Africa |

|

Key Companies Profiled |

Aries Electronics; Amphenol Corporation; CnC Tech, LLC; FCI USA LLC; Hon Hai Precision Industry Co., Ltd. (Foxconn); Mill-Max Mfg. Corp.; PRECI-DIP SA; Samtec; Silicon Laboratories; TE Connectivity |

|

Customization Scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing And Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Microcontroller Socket Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microcontroller socket market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

DIP

-

BGA

-

QFP

-

SOP

-

SOIC

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Industrial

-

Medical Devices

-

Military & Defense

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

-

Asia Pacific

-

Japan

-

India

-

China

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the microcontroller socket market with a share of 36.8% in 2024. The increasing presence of major end-use verticals in regional economies such as China, Japan, and India is expected to drive regional market expansion.

b. The global microcontroller socket market size was estimated at USD 1.47 billion in 2024 and is expected to reach USD 1.55 billion in 2025.

b. The global microcontroller socket market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 2.00 billion by 2030.

b. Some key players operating in the microcontroller socket market include Amphenol Corporation, TE Connectivity, and Aries Electronics.

b. The increasing application of microcontrollers in the communication, automobile, and industrial sectors has boosted the growth of the package market in recent years.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."