Microcontroller Market Analysis by Product (8-Bit, 16-Bit, 32-Bit, 64-Bit), By Type (Peripheral Interface Controller (PIC), ARM, 8051, TriCore, Others), By Architecture, By Instruction Set, By Application, And Region Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-141-2

- Number of Report Pages: 168

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Report Overview

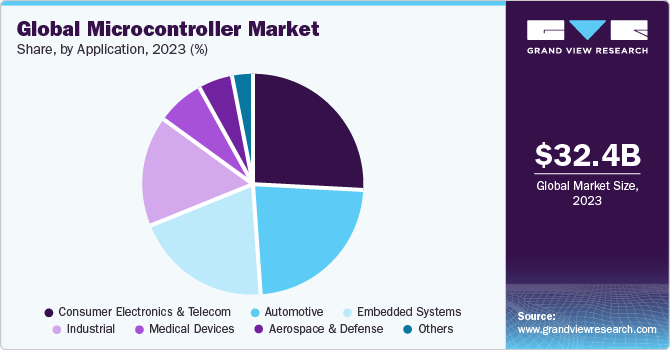

The global microcontroller market size was valued at USD 32.37 billion in 2023 and is projected to expand at a compound annual growth rate CAGR of 11.7% from 2024 to 2030. The growth is expected to be driven by the increasing adoption of MCUs across the smart grid systems for smart meter applications and the rising demand for microcontrollers from the automotive and medical sectors. The expenditure on global healthcare services is on the rise due to the increasing prevalence of immunodeficiency disorders, the growing percentage of elderly individuals, and the occurrence of diseases like diabetes and high blood pressure. Consequently, there is a growing need for electronic medical devices to measure blood pressure and sugar levels. Medical device manufacturers are introducing affordable and dependable medical equipment into the market.

Microcontrollers play a crucial role in various medical care devices, ensuring higher affordability and reliability. Devices including blood glucose meters incorporate a significant number of microcontrollers (MCUs). Therefore, there is a high demand for microcontrollers from the medical and healthcare industry. In addition, prominent companies in sectors such as telecommunications, consumer electronics, and automotive are focusing intensely on integrating artificial intelligence into their products. For example, Qualcomm Technologies, Inc. has made significant investments in on-device AI research and development.

Microcontroller manufacturers are actively developing innovative products and consistently delivering groundbreaking solutions, thereby creating significant opportunities for market growth. The emergence of a network of interconnected devices including smart meters, home appliances, security systems, tablets, gaming consoles, televisions, and smartphones has led to numerous advancements in microcontroller technology. This, in turn, is expected to drive the demand for IoT microcontrollers.

Many of these connected devices, designed to operate on batteries for extended periods without requiring replacement or maintenance, rely on the Internet of Things (IoT) end-node applications. The declining costs of essential components such as processors and sensors, coupled with the increasing utilization of wireless connectivity, has facilitated the development of intelligent products capable of seamless communication with one another without human intervention.

Advancements in computing power and enhanced AI algorithms are enabling the integration of machine learning in various domains such as automobiles, smartphones, robots, and drones. This progress has facilitated the rise of on-device AI, which offers improved security and privacy protection by processing data offline directly on the device. Embedded artificial intelligence is becoming increasingly prevalent in the AI industry. These cutting-edge developments in AI and machine learning are opening up new avenues for the utilization of microcontrollers in fields including medical, smart cities, smart factories, IoT, and more. As a result, the market for microcontrollers is expected to witness growth opportunities.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The market is consolidated, with the top players capturing a significant market share. The major manufacturers in the microcontroller market are designing innovative products and are consistently investing in Research and Development (R&D) to provide breakthrough solutions. They are developing ultra-low-power MCUs, such as STM32L4 series microcontrollers by STMicroelectronics, to conserve energy as they use less energy and are ideal for use in battery-powered devices. The growing availability of low-power consumption microcontrollers bodes well for the ultra-low-power microcontroller market.

The microcontroller market is characterized by a high number of product launches by the leading players. For instance, in March 2023, STMicroelectronics announced the launch of STM32WBA52 microcontrollers that are boosted by Arm Cortex-M33 core. The microcontrollers can be used in various applications, including portable medical devices, sensors, and smart homes.

The microcontroller market players are subject to various regional laws and regulations, such as data privacy and environmental, health, & safety laws. Moreover, the market players have to consider the regulatory requirements of their customers. For instance, home appliance manufacturers need to comply with the IEC60730 safety standard, which mandates the inclusion of features that can avoid the failure of the appliance or safeguard the user from hazards in case of failure. For this purpose, microcontroller manufacturers design their products to include enhanced safety features.

Field Programmable Gate Arrays (FPGAs) can substitute microcontrollers in applications such as radar systems, military-grade global positioning system (GPS) devices, and others due to their high degree of robustness. However, the microcontroller is used widely in applications that exhibit top buyer and end-user demand, thus making the substitute power moderate.

Microcontrollers are used for numerous applications, including consumer electronics, automotive, embedded systems, and medical devices, among others. As microcontrollers become more powerful and capable, buyers are increasingly looking for devices that consume low power and offer advanced features such as high-speed communication, advanced signal processing, and sophisticated security features.

COVID-19 Impact

The COVID-19 pandemic has significantly impacted the microcontroller industry, affecting both the production and demand for these devices. One of the significant impacts of the pandemic has been disruptions to global supply chains. The shutdown of factories and other manufacturing facilities has led to shortages of key components and materials, causing delays and bottlenecks in production. This has resulted in longer lead times for microcontrollers and other electronic components and increased prices for some devices.

In 2020, the rapidly rising number of COVID-19 cases across key countries such as China, Germany, the U.S., Japan, and South Korea compelled their respective federal governments to levy stringent regulations. These regulations mainly included lockdowns in highly spreading cities, sealing of international borders for trade, and allowing companies to provide employees with work-from-home facilities.

However, the overall trade of microcontrollers in Q2 of 2020 witnessed a decline owing to the temporary shutdown of production facilities and international borders across several countries globally. Countries such as China, Japan, South Korea, and Singapore are the key suppliers of microcontrollers globally and were substantially impacted by COVID-19. The decline in production and exports of microcontrollers in these countries, coupled with a labor shortage, resulted in a significant decline in the overall market growth in Q1 and Q2 of 2020.

Product Insights

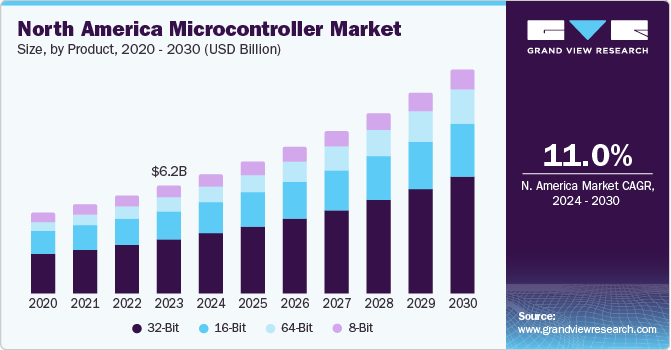

In terms of product, the microcontroller market is classified into 8-Bit, 16-Bit, 32-Bit, and 64-Bit. Among these, the 32-Bit segment dominated in 2023, gaining a revenue share of over 50.0%. It is expected to grow at a CAGR of 12.3% throughout the forecast period A 32-bit microcontroller is a type of embedded SoC with a CPU capable of handling 32 bits of data at a time. It often features a high memory capacity (up to several megabytes) and a comprehensive set of cutting-edge peripherals, including fast ADCs, Digital Signal Processors (DSPs), and cutting-edge communication interfaces such as Gigabit Ethernet, USB 3.0, and CAN bus.

One of the primary advantages of 32-bit microcontrollers is their increased processing power. With a more comprehensive data bus, they can perform more calculations and process larger amounts of data than 16-bit microcontrollers. This makes them well-suited for high-performance computing applications, such as industrial control, automotive applications, and complex embedded systems.

The 16-Bit segment is anticipated to grow at a considerable CAGR of 10.0% throughout the forecast period. A 16-bit microcontroller is a type of embedded SoC that has a CPU capable of processing 16 bits of data at a time. It features more peripherals, including Analog-to-Digital Converters (ADCs), Digital-to-Analog Converters (DACs), and communication interfaces such as USB, Ethernet, and Wi-Fi.

Compared to 8-bit microcontrollers, 16-bit microcontrollers offer greater processing capability and memory (up to a few hundred kilobytes), which makes them ideal for applications that require more advanced algorithms and higher performance. They are often used in automobile systems, consumer electronics, industrial automation, and medical equipment. 16-bit microcontrollers typically include a range of on-chip peripherals, such as memory, timers, interrupts, and communication interfaces such as UART, SPI, and I2C, to support various applications. These peripherals make it easier to interface with other electronic components and perform more complex tasks.

Type Insights

In terms of type, the microcontroller market is classified into Peripheral Interface Controller (PIC), ARM, 8051, TriCore, and Others. The ARM segment dominated in 2023, gaining a revenue share of over 47.0%. It is expected to grow at a CAGR of 12.8% throughout the forecast period. The growing innovations and the rising penetration of smartphones and wearables are driving the segment growth. Advanced RISC Machine (ARM) microcontrollers are built on Reduced Instruction Set Computer (RISC). ARM microcontrollers are generally available in 32-bit and 64-bit variants and are used widely in various consumer electronic devices, such as tablets, smartphones, wearables, and multimedia players. They perform fewer instructions, enabling them to operate at high speed and perform a Million Instructions Per Second (MIPS).

The TriCore segment is anticipated to grow at a considerable CAGR of 12.5% throughout the forecast period. The growing advancements in Autonomous Vehicles (AVs) and the rising adoption of Electric Vehicles (EVs) are driving the segment growth. TriCore is a 32-bit microcontroller family launched by Infineon Technologies AG, a Germany-based company, in 1999. This family of microcontrollers is designed for real-time embedded systems. TriCore microcontrollers can be used in various automotive applications, such as hybrid and electrical vehicles, airbags, electric powering systems, and advanced driver assistance systems.

Architecture Insights

In terms of architecture, the microcontroller market is classified into Harvard architecture, Von Neumann architecture, and others. The Von Neumann architecture segment dominated in 2023, gaining a revenue share of over 42.0%. It is expected to grow at a CAGR of 10.1% throughout the forecast period. The affordability and simplicity of the Von Neumann architecture are driving the segment growth. The design and development of the Von Neumann architecture is simpler compared to Harvard architecture. Moreover, less physical space is required and it is cheaper compared to Harvard architecture.

The Harvard architecture segment is anticipated to grow at a considerable CAGR of 12.3% throughout the forecast period. The usability of Harvard architecture in critical real-time applications and the high performance of Harvard-architecture-based microcontrollers are driving the segment growth. Harvard architectures are more complex compared to the Von Neumann architecture. However, Harvard architectures provide high performance and reduce the chance of data corruption. With growing complexity and data usage across applications, Harvard architecture is likely to witness significant growth.

Instruction Set Insights

In terms of instruction set, the microcontroller market is classified into Reduced Instruction Set Computer (RISC) and Complex Instruction Set Computer (CISC). The Reduced Instruction Set Computer (RISC) segment dominated in 2023, gaining a revenue share of over 72.0%. It is expected to grow at a CAGR of 11.9% throughout the forecast period. A Reduced Instruction Set Computer (RISC) instruction set architecture in a microcontroller is an architecture type that utilizes reduced but highly optimized instruction sets. RISC architecture is used in high-end applications such as image and video processing and telecommunications. Microcontroller families using RISC architecture include ARM and TriCore. RISC instructions are simple, and each instruction is of similar length, enabling reduced execution time.

The Complex Instruction Set Computer (CISC) segment is anticipated to grow at a considerable CAGR of 11.2% throughout the forecast period. The demand for smart home automation is steadily increasing as people prefer more convenience in their homes. CISC instruction set is often used in automation devices; hence, with the growing adoption of smart home automation devices, CISC instruction set-based microcontrollers are likely to witness significant growth over the forecast period.

Application Insights

In terms of application, the market is classified into consumer electronics & telecom, automotive, medical devices, industrial, aerospace & defense, embedded systems and others. The consumer electronics & telecom segment dominated the overall market with a revenue share of 25.0% in 2023. The segment is expected to witness a CAGR of 10.7% during the forecast period. Microcontrollers are employed in consumer electronics and telecom applications owing to their capability to process data, regulate functions, and interact with other devices.

They are used to handle user inputs, interact with other devices, and control a variety of operations in smart home appliances such as smart locks, smart thermostats, and smart lighting systems. One of the primary uses of microcontrollers in consumer electronics is to control various functions of these devices. For example, a microcontroller can be used to regulate the temperature in a refrigerator or to control the display and user interface of a smartphone. They can also be used to manage power consumption, extend battery life, and optimize performance.

Embedded systems are increasingly used across industries such as consumer electronics, automotive, and industrial control systems. With growing digitization and automation across industries, the demand for embedded system development hardware and software solutions is likely to grow significantly. Developing a microcontroller-based embedded system can become a complex task. Various factors must be considered while developing embedded systems, such as microcontroller selection and system architecture development.

Embedded system hardware and software development tools can help developers design and develop embedded systems. Challenges such as power consumption, system hardware and software updating, and seamless integration must be addressed. Moreover, the design should be safe and have no unintended actions. Hence, the need to ensure user safety and minimize embedded system development costs is driving the microcontroller embedded systems market growth.

The automotive microcontroller market is anticipated to witness a considerable CAGR of 12.9% throughout the forecast period. Microcontrollers are electronic components that are often used in the automotive sector to manage and control several systems in automobiles. They are compact, low-power integrated circuits made for real-time data processing and control in embedded systems. Automotive applications that use microcontrollers include Advanced Driver Assistance Systems (ADAS), Anti-lock Braking Systems (ABS), airbag control, entertainment systems, and gearbox control. Microcontrollers can process sensor data, interface with other electronic systems inside the car, and control a variety of actuators, thereby enhancing the performance, safety, and comfort of the vehicle.

Regional Insights

The Asia Pacific microcontroller market dominated in 2023, gaining a revenue share of over 59.0%. It is expected to grow at the fastest CAGR of 12.6% throughout the forecast period. The region includes countries with a sizable and diverse electronics industry, including China, Japan, South Korea, India, and Taiwan. One of the biggest applications for microcontrollers in the region, particularly in countries such as Japan, South Korea, and China, is the automotive industry. The demand for microcontrollers in this industry is driven by the rising demand for safety features, ADAS, and electric automobiles. In Asia Pacific, the industrial segment is also a prominent end user of microcontrollers, particularly in countries such as China and India, which have substantial and expanding manufacturing industries.

North America is anticipated to grow at a considerable CAGR of 11.0% throughout the forecast period. The rising need for smart and connected devices is one of the key factors influencing the market growth. The region is at the forefront of the development of Internet of Things (IoT) technologies, which connect commonplace gadgets to the Internet and allow them to communicate and exchange data, driving the growth of the IoT microcontroller market The demand for microcontrollers with cutting-edge features such as connectivity, sensing, and low power consumption is driving the regional market growth. Some of the key players operating in the region include Texas Instruments Incorporated; Microchip Technology Inc.; NXP Semiconductors; Renesas Electronics Corporation; and STMicroelectronics.

China Microcontroller Market Trends

The microcontroller market in China is projected to grow at a CAGR of 11.5% from 2024 to 2030. The growing demand for advanced features such as wireless connectivity, touchscreen interfaces, and low power consumption is one of the main trends in the Chinese microcontroller market. The rising demand for smartphones and other smart devices, as well as the growing use of automation and control systems in industrial, is a driving factor in the Chinese microcontroller market.

Japan Microcontroller Market Trends

The microcontroller market in Japan is witnessing significant growth owing to the presence of a large and advanced electronics industry that includes leading manufacturers such as Sony Group Corporation, Panasonic Holdings Corporation, and TOSHIBA CORPORATION. The country is a significant producer of industrial and automotive equipment, as well as electronic devices such as smartphones, tablets, and other smart devices.

The microcontroller market in Europe was valued at USD 4.83 billion in 2023. The increasing demand for automation and the Internet of Things (IoT) across industries such as automotive, healthcare, and consumer electronics is driving the growth of the microcontroller market in Europe. Microcontrollers are a critical component in these industries, providing the necessary processing power and control to various devices and systems.

U.K. Microcontroller Market Trends

The microcontroller market in the U.K. accounted for over 14.0% share of the European market in 2023. The U.K. microcontroller market is expected to continue to witness growth in the coming years, driven by the increasing automation and the growing demand for connected devices. Additionally, the U.K. government's focus on developing advanced technologies and infrastructure is expected to also drive the growth of the microcontroller market in the country.

Germany Microcontroller Market Trends

The microcontroller market in Germany is expected to grow at a CAGR of 9.3% from 2024 to 2030. Germany is a significant market for microcontrollers owing to its extensive and technologically advanced electronics industry, which is characterized by the presence of major producers such as Siemens, Robert Bosch GmbH, and Infineon Technologies AG. The country is a major producer of electronic goods, including energy management systems, smart homes, and industrial automotive equipment.

France Microcontroller Market Trends

The microcontroller market in France is projected to grow due to activities supporting semiconductor production in the country. For instance, in July 2022, STMicroelectronics and GF, a U.S.-based semiconductor manufacturer, announced that they would open a semiconductor manufacturing facility in Crolles, France. This would have a positive impact on semiconductor manufacturing in France, positively impacting the microcontroller market in France.

The microcontroller market in Middle East and Africa (MEA) is anticipated to reach USD 1.81 billion by 2030. The Middle East & Africa (MEA) microcontroller market is expanding steadily as a result of the rising demand for microcontrollers across industries such as automotive, industrial, healthcare, and consumer devices.

Saudi Arabia Microcontroller Market Trends

The microcontroller market in Saudi Arabia is witnessing significant growth owing to growing smartphone penetration in the country. Moreover, the growing automotive industry in the country, supported by government initiatives, is likely to drive the demand for microcontrollers.

Key Microcontroller Company Insights

Some of the key players operating in the market include STMicroelectronics, NXP Semiconductors, Infineon Technologies AG, and Microchip Technology Inc.

-

NXP Semiconductors is a semiconductor manufacturer that provides products and solutions for secure identification, automotive, and digital networking applications. The company offers microcontrollers, processors, sensors, single-chip modules, identification & security products, media & audio processing products, and automotive products. In addition, it provides interface & connectivity solutions and power management solutions to its customers.

-

STMicroelectronics is an electronics and semiconductor manufacturer. It offers various products, including sensors, analog, automotive, microcontrollers, memories, imaging, and digital ICs. The microcontrollers offered by the company include the STM8S series, STM8L series, STM8AL series, STM8AF series, STM32F1 series, and STM32F0 series.

TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION and Broadcom are some of the emerging microcontroller manufacturers.

-

TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION is a Japan-based company that manufactures electrical and electronics products. The company operates as a subsidiary of Toshiba Corporation, a public limited company. It provides a wide range of products categorized under storage products. Under the microcomputer category, the company offers ARM core-based microcontrollers, original core-based microcontrollers, and microcontrollers motor control (microcontrollers designed for control applications).

-

Broadcom is a technology firm that specializes in developing and delivering a variety of semiconductor and infrastructure software solutions. The company's offerings include products for data center, networking, broadband, enterprise software, wireless, storage, and industrial applications. Its solutions cover data center networking and storage, cybersecurity software, automation, monitoring, security, smartphone components, and factory automation.

Key Microcontroller Companies:

The following are the leading companies in the microcontroller market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these microcontroller companies are analyzed to map the supply network.

- Infineon Technologies AG

- Fujitsu

- Microchip Technology Inc.

- NXP Semiconductors

- Renesas Electronics Corporation

- STMicroelectronics

- TE Connectivity

- Texas Instruments Incorporated

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- Yamaichi Electronics Co., Ltd.

- Zilog, Inc.

- Broadcom

Recent Developments

-

In January 2023, STMicroelectronics unveiled the STM32C0 series, a cost-effective lineup of 32-bit microcontrollers targeted at applications in home appliances, industrial pumps, fans, and smoke detectors, traditionally served by simpler 8-bit and 16-bit MCUs. The modern design of the STM32C0 enabled enhanced performance, faster response, additional functionalities, and network connectivity at comparable cost and power consumption.

-

In March 2023, NXP Semiconductors released the MCUXpresso toolset, empowering developers with enhanced scalability, usability, and portability for faster development of complex embedded applications. The toolset included a custom-built MCUXpresso extension for Microsoft's Visual Studio Code (VS Code), open-source hardware abstraction for code reuse, streamlined partner code delivery via Open-CMSIS-Packs, and an intuitive Application Launch Pad for easy access to application software and NXP documentation.

-

In April 2023, Renesas Electronics Corporation revealed the successful manufacturing of its inaugural microcontroller (MCU) using cutting-edge 22-nm process technology. This advanced process facilitated improved performance, lower power consumption through reduced core voltages, and seamless integration of a diverse feature set, including RF capabilities, providing customers with a superior product offering.

-

In May 2023, STMicroelectronics launched the second generation of its STM32 MPUs (microprocessors), featuring an enhanced architecture within the existing ecosystem to deliver elevated performance and security for industrial and IoT edge applications. The STM32MP2 Series devices showcased 64-bit Arm Cortex-A35 cores operating at 1.5GHz, complemented by a 400MHz Cortex-M33 embedded core for real-time processing, providing a powerful and efficient solution.

-

In January 2022, Infineon Technologies AG introduced the latest iteration of its AURIX™ microcontroller family, the AURIX TC4x series, specifically engineered to cater to evolving trends in the automotive industry, including eMobility, advanced driver assistance systems (ADAS), automotive electric-electronic (E/E) architectures, and cost-effective artificial intelligence (AI) applications.

-

In June 2022, NXP Semiconductors unveiled the innovative MCX portfolio of microcontrollers, aimed at driving progress in smart homes, factories, cities, and various emerging industrial and IoT edge applications. The portfolio leveraged the widely adopted MCUXpresso suite of development tools and software, enabling developers to expedite development by maximizing software reuse across the range of products.

-

In November 2022, NXP Semiconductors unveiled the MCX N94x and MCX N54x, the pioneering families in the N series of the innovative MCX microcontroller portfolio. The multi-core design of the MCX N series enhanced system performance and minimized power consumption by intelligently distributing workloads to analog and digital peripherals. These MCX N devices were supported by the widely adopted MCUXpresso suite of software and tools, streamlining and expediting embedded system development for developers.

-

In April 2022, TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION commenced mass production of 21 microcontrollers (MCUs) in the M3H group as part of the new TXZ+ Family Advanced Class products. These microcontrollers are manufactured using a 40nm process and feature an ARM Cortex-M3 core that can run up to 120MHz. They also have up to 512KB of code flash and 32KB of data flash memory, which can endure up to 100,000 write cycles.

Microcontroller Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 32.37 billion |

|

Revenue forecast in 2030 |

USD 69.87 billion |

|

Growth rate |

CAGR of 11.7% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in million units, revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, type, architecture, instruction set, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; South America; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; China; Japan; South Korea; India; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Infineon Technologies AG; Fujitsu; Microchip Technology Inc.; NXP Semiconductors; Renesas Electronics Corporation; STMicroelectronics; TE Connectivity; Texas Instruments Incorporated; TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION; Yamaichi Electronics Co., Ltd.; Zilog; Inc.; Broadcom |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Microcontroller Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global microcontroller market report based on product, type, architecture, instruction set, application, and region:

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

8-Bit

-

16-Bit

-

32-Bit

-

64-Bit

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Peripheral Interface Controller (PIC)

-

ARM

-

8051

-

TriCore

-

Others

-

-

Architecture Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Harvard Architecture

-

Von Neumann Architecture

-

Others

-

-

Instruction Set Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Reduced Instruction Set Computer (RISC)

-

Complex Instruction Set Computer (CISC)

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Consumer Electronics & Telecom

-

Industrial

-

Embedded Systems

-

Hardware

-

Software/Embedded Development Tools

-

-

Medical Devices

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some prominent players in the market include NXP Semiconductors, Microchip Technology Inc., Renesas Electronics Corporation, STMicroelectronics, and Infineon Technologies AG, among others.

b. Key factors such as increasing adoption of smart meters in smart grid systems and the growing demand from medical and automotive sectors drive the adoption of microcontroller market

b. The global microcontroller market size was estimated at USD 20.61 billion in 2022 and is expected to reach USD 22.73 billion in 2023.

b. The global microcontroller market is expected to grow at a compound annual growth rate of 11.0% from 2023 to 2030 to reach USD 47.16 billion by 2030.

b. Asia Pacific microcontroller market is expected to dominate in 2022, gaining a market share of 58.1%. It is expected to grow at the fastest CAGR of 11.6% throughout the forecast period. This is attributed to growing adoption of microcontrollers in industrial segment in countries such as China and India, which have a substantial and expanding manufacturing industry.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.3. Information Procurement

1.3.1. Information analysis

1.3.2. Market formulation & data visualization

1.3.3. Data validation & publishing

1.4. Research Scope and Assumptions

1.4.1. List to Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Market Variables, Trends & Industry Outlook

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ Ancillary market outlook

3.2. Microcontroller Market - Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Trends

3.3.2. Market Driver Analysis

3.3.2.1. Increasing Adoption of Smart Meters in Smart Grid Systems

3.3.2.2. Growing Demand from Medical and Automotive Sectors

3.3.2.3. Emergence of Internet of Things (IOT)

3.3.3. Market restraint Analysis

3.3.3.1. Unfavorable Macroeconomic Conditions

3.3.3.2. Challenges Associated with the Operational Failure in Extreme Climatic Condition

3.3.4. Market Opportunity Analysis

3.3.4.1. Rising Focus on Artificial Intelligence

3.4. Microcontroller Market - Porter’s Analysis

3.5. Microcontroller Market - PESTLE Analysis

Chapter 4. Microcontroller Market - Product Estimates and Trend Analysis

4.1. Microcontroller Market: Product Movement and Market Share Analysis

4.1.1. Microcontroller Market Estimates & Forecast, By Product (USD Million)

4.1.2. Microcontroller Market Estimates & Forecast, By Product (Million units)

4.1.3. 8-Bit Microcontroller

4.1.4. 16-Bit Microcontroller

4.1.5. 32-Bit Microcontroller

4.1.6. 64 Bit Microcontroller

Chapter 5. Microcontroller Market - Type Estimates and Trend Analysis

5.1. Microcontroller Market: Type Movement and Market Share Analysis

5.1.1. Microcontroller Market Estimates & Forecast, By Type (USD Million)

5.1.2. Microcontroller Market Estimates & Forecast, By Type (Million units)

5.1.3. Peripheral Interface Controller (PIC)

5.1.4. ARM

5.1.5. 8051

5.1.6. TriCore

5.1.7. Others

Chapter 6. Microcontroller Market - Architecture Estimates and Trend Analysis

6.1. Microcontroller Market: Architecture Movement and Market Share Analysis

6.1.1. Microcontroller Market Estimates & Forecast, By Architecture (USD Million)

6.1.2. Microcontroller Market Estimates & Forecast, By Architecture (Million units)

6.1.3. Harvard Architecture

6.1.4. Von Neumann Architecture

6.1.5. Others

Chapter 7. Microcontroller Market - Instruction Set Estimates and Trend Analysis

7.1. Microcontroller Market: Instruction Set Movement and Market Share Analysis

7.1.1. Microcontroller Market Estimates & Forecast, By Instruction Set (USD Million)

7.1.2. Microcontroller Market Estimates & Forecast, By Instruction Set (Million units)

7.1.3. Reduced Instruction Set Computer (RISC)

7.1.4. Complex Instruction Set Computer (CISC)

Chapter 8. Microcontroller Market - Application Estimates and Trend Analysis

8.1. Microcontroller Market: Application Movement and Market Share Analysis

8.1.1. Microcontroller Market Estimates & Forecast, By Application (USD Million)

8.1.2. Microcontroller Market Estimates & Forecast, By Application (Million units)

8.1.3. Automotive

8.1.4. Consumer Electronics & Telecom

8.1.5. Industrial

8.1.6. Embedded systems

8.1.6.1. Hardware

8.1.6.2. Software/Embedded Development Tools

8.1.7. Medical Devices

8.1.8. Aerospace & Defense

8.1.9. Others

Chapter 9. Microcontroller Market - Regional Estimates and Trend Analysis

9.1. Microcontroller Market: Regional Movement Analysis

9.2. North America

9.2.1. U.S.

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. U.K.

9.3.2. Germany

9.3.3. France

9.4. Asia Pacific

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. South Korea

9.4.5. Australia

9.5. South America

9.5.1. Brazil

9.6. Middle East & Africa

9.6.1. KSA

9.6.2. UAE

9.6.3. South Africa

Chapter 10. Microcontroller Market - Competitive Landscape

10.1. Recent Developments & Impact Analysis by Key Market Participants

10.2. Company Categorization

10.3. Company Market Positioning

10.4. Company Market Share Analysis

10.5. Strategy Mapping

10.5.1. Expansion

10.5.2. Mergers & Acquisition

10.5.3. Partnerships & Collaborations

10.5.4. New Transport Launches

10.5.5. Research And Development

10.6. Company Profiles

10.6.1. Infineon Technologies AG

10.6.1.1. Participant’s Overview

10.6.1.2. Financial Performance

10.6.1.3. Product Benchmarking

10.6.1.4. Recent Developments

10.6.2. Fujitsu

10.6.2.1. Participant’s Overview

10.6.2.2. Financial Performance

10.6.2.3. Product Benchmarking

10.6.2.4. Recent Developments

10.6.3. Microchip Technology Inc.

10.6.3.1. Participant’s Overview

10.6.3.2. Financial Performance

10.6.3.3. Product Benchmarking

10.6.3.4. Recent Developments

10.6.4. NXP Semiconductors

10.6.4.1. Participant’s Overview

10.6.4.2. Financial Performance

10.6.4.3. Product Benchmarking

10.6.4.4. Recent Developments

10.6.5. Renesas Electronics Corporation

10.6.5.1. Participant’s Overview

10.6.5.2. Financial Performance

10.6.5.3. Product Benchmarking

10.6.5.4. Recent Developments

10.6.6. STMicroelectronics

10.6.6.1. Participant’s Overview

10.6.6.2. Financial Performance

10.6.6.3. Product Benchmarking

10.6.6.4. Recent Developments

10.6.7. TE Connectivity

10.6.7.1. Participant’s Overview

10.6.7.2. Financial Performance

10.6.7.3. Product Benchmarking

10.6.7.4. Recent Developments

10.6.8. Texas Instruments Incorporated

10.6.8.1. Participant’s Overview

10.6.8.2. Financial Performance

10.6.8.3. Product Benchmarking

10.6.8.4. Recent Developments

10.6.9. TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

10.6.9.1. Participant’s Overview

10.6.9.2. Financial Performance

10.6.9.3. Product Benchmarking

10.6.9.4. Recent Developments

10.6.10. Yamaichi Electronics Co., Ltd.

10.6.10.1. Participant’s Overview

10.6.10.2. Financial Performance

10.6.10.3. Product Benchmarking

10.6.10.4. Recent Developments

10.6.11. Zilog, Inc.

10.6.11.1. Participant’s Overview

10.6.11.2. Financial Performance

10.6.11.3. Product Benchmarking

10.6.11.4. Recent Developments

10.6.12. Broadcom

10.6.12.1. Participant’s Overview

10.6.12.2. Financial Performance

10.6.12.3. Product Benchmarking

10.6.12.4. Recent Developments

List of Tables

Table 1 List of Abrevation

Table 2 Global Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 3 Global Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 4 Global Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 5 Global Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 6 Global Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 7 Global Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 8 Global Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 9 Global Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 10 Global Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 11 Global Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 12 North America Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 13 North America Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 14 North America Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 15 North America Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 16 North America Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 17 North America Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 18 North America Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 19 North America Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 20 North America Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 21 North America Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 22 U.S. Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 23 U.S. Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 24 U.S. Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 25 U.S. Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 26 U.S. Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 27 U.S. Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 28 U.S. Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 29 U.S. Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 30 U.S. Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 31 U.S. Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 32 Canada Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 33 Canada Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 34 Canada Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 35 Canada Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 36 Canada Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 37 Canada Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 38 Canada Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 39 Canada Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 40 Canada Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 41 Canada Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 42 Mexico Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 43 Mexico Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 44 Mexico Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 45 Mexico Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 46 Mexico Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 47 Mexico Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 48 Mexico Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 49 Mexico Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 50 Mexico Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 51 Mexico Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 52 Europe Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 53 Europe Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 54 Europe Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 55 Europe Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 56 Europe Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 57 Europe Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 58 Europe Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 59 Europe Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 60 Europe Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 61 Europe Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 62 U.K. Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 63 U.K. Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 64 U.K. Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 65 U.K. Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 66 U.K. Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 67 U.K. Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 68 U.K. Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 69 U.K. Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 70 U.K. Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 71 U.K. Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 72 Germany Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 73 Germany Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 74 Germany Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 75 Germany Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 76 Germany Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 77 Germany Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 78 Germany Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 79 Germany Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 80 Germany Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 81 Germany Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 82 France Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 83 France Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 84 France Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 85 France Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 86 France Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 87 France Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 88 France Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 89 France Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 90 France Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 91 France Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 92 Asia Pacific Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 93 Asia Pacific Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 94 Asia Pacific Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 95 Asia Pacific Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 96 Asia Pacific Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 97 Asia Pacific Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 98 Asia Pacific Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 99 Asia Pacific Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 100 Asia Pacific Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 101 Asia Pacific Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 102 China Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 103 China Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 104 China Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 105 China Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 106 China Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 107 China Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 108 China Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 109 China Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 110 China Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 111 China Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 112 India Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 113 India Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 114 India Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 115 India Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 116 India Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 117 India Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 118 India Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 119 India Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 120 India Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 121 India Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 122 Japan Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 123 Japan Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 124 Japan Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 125 Japan Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 126 Japan Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 127 Japan Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 128 Japan Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 129 Japan Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 130 Japan Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 131 Japan Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 132 South Korea Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 133 South Korea Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 134 South Korea Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 135 South Korea Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 136 South Korea Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 137 South Korea Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 138 South Korea Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 139 South Korea Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 140 South Korea Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 141 South Korea Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 142 Australia Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 143 Australia Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 144 Australia Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 145 Australia Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 146 Australia Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 147 Australia Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 148 Australia Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 149 Australia Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 150 Australia Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 151 Australia Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 152 South America Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 153 South America Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 154 South America Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 155 South America Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 156 South America Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 157 South America Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 158 South America Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 159 South America Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 160 South America Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 161 South America Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 162 Brazil Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 163 Brazil Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 164 Brazil Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 165 Brazil Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 166 Brazil Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 167 Brazil Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 168 Brazil Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 169 Brazil Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 170 Brazil Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 171 Brazil Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 172 Middle East & Africa Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 173 Middle East & Africa Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 174 Middle East & Africa Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 175 Middle East & Africa Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 176 Middle East & Africa Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 177 Middle East & Africa Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 178 Middle East & Africa Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 179 Middle East & Africa Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 180 Middle East & Africa Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 181 Middle Est & Africa Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 182 KSA Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 183 KSA Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 184 KSA Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 185 KSA Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 186 KSA Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 187 KSA Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 188 KSA Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 189 KSA Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 190 KSA Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 191 KSA Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 192 UAE Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 193 UAE Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 194 UAE Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 195 UAE Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 196 UAE Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 197 UAE Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 198 UAE Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 199 UAE Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 200 UAE Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 201 UAE Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 202 South Africa Microcontroller Market revenue estimates and forecast, by Product, 2017 - 2030 (USD Million)

Table 203 South Africa Microcontroller Market volume estimates and forecast, by Product, 2017 - 2030 (Million Units)

Table 204 South Africa Microcontroller Market revenue estimates and forecast, by Type, 2017 - 2030 (USD Million)

Table 205 South Africa Microcontroller Market volume estimates and forecast, by Type, 2017 - 2030 (Million Units)

Table 206 South Africa Microcontroller Market revenue estimates and forecast, By Architecture, 2017 - 2030 (USD Million)

Table 207 South Africa Microcontroller Market volume estimates and forecast, By Architecture, 2017 - 2030 (Million Units)

Table 208 South Africa Microcontroller Market revenue estimates and forecast, by Instruction Set, 2017 - 2030 (USD Million)

Table 209 South Africa Microcontroller Market volume estimates and forecast, by Instruction Set, 2017 - 2030 (Million Units)

Table 210 South Africa Microcontroller Market revenue estimates and forecast, By Application, 2017 - 2030 (USD Million)

Table 211 South Africa Microcontroller Market volume estimates and forecast, By Application, 2017 - 2030 (Million Units)

Table 212 Participant’s Overview

Table 213 Financial Performance

Table 214 Product Benchmarking

Table 215 Key companies undergoing expansion

Table 216 Key companies involved in mergers & acquisitions

Table 217 Key companies undertaking partnerships and collaboration

Table 218 Key companies launching new product/service launches

List of Figures

Fig. 1 Microcontroller Market Segmentation

Fig. 2 Information Procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation And Validation

Fig. 5 Data Validating & Publishing

Fig. 6 Market snapshot (revenue)

Fig. 7 Market snapshot (volume)

Fig. 8 Segment snapshot, by Product and Type, 2022 & 2030 (USD Million)

Fig. 9 Segment snapshot, by Architecture and Instruction Set, 2022 & 2030 (USD Million)

Fig. 10 Segment snapshot, by Application, 2022 & 2030 (USD Million)

Fig. 11 Segment snapshot, by Product and Type, 2022 & 2030 (Million Units)

Fig. 12 Segment snapshot, by Architecture and Instruction Set, 2022 & 2030 (Million Units)

Fig. 13 Segment snapshot, by Application, 2022 & 2030 (Million Units)

Fig. 14 Competitive landscape snapshot

Fig. 15 IoT Microcontroller Market, 2022 & 2030 (USD Billion)

Fig. 16 Microcontroller Market- Value Chain Analysis

Fig. 17 Microcontroller Market- Market Trends

Fig. 18 Global electric car sales (2016- 2022), Million units

Fig. 19 Global private AI investment (2016- 2021), USD Billion

Fig. 20 Microcontroller Market- Porter’s Analysis

Fig. 21 Microcontroller Market- PESTLE Analysis

Fig. 22 Microcontroller Market, by Product: Key Takeaways (Value)

Fig. 23 Microcontroller Market, by Product: Key Takeaways (Volume)

Fig. 24 Microcontroller Market, by Product: Market Share, 2022 & 2030 (Value)

Fig. 25 Microcontroller Market, by Product: Market Share, 2022 & 2030 (Volume)

Fig. 26 8-Bit Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 27 16-bit Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 28 32-bit Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 29 64 bit Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 30 Microcontroller Market, by Type: Key Takeaways (Value)

Fig. 31 Microcontroller Market, by Type: Key Takeaways (Volume)

Fig. 32 Microcontroller Market, by Type: Market Share, 2022 & 2030 (Value)

Fig. 33 Microcontroller Market, by Type: Market Share, 2022 & 2030 (Volume)

Fig. 34 Peripheral Interface Controller (PIC) market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 35 ARM Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 36 Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 37 TriCore Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 38 Others Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 39 Microcontroller Market, by Architecture: Key Takeaways (Value)

Fig. 40 Microcontroller Market, by Architecture: Key Takeaways (Volume)

Fig. 41 Microcontroller Market, by Architecture: Market Share, 2022 & 2030 (Value)

Fig. 42 Microcontroller Market, by Architecture: Market Share, 2022 & 2030 (Volume)

Fig. 43 Harvard architecture market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 44 Von Neumann Architecture Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 45 Others Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 46 Microcontroller Market, by Instruction Set: Key Takeaways (Value)

Fig. 47 Microcontroller Market, by Instruction Set: Key Takeaways (Volume)

Fig. 48 Microcontroller Market, by Instruction Set: Market Share, 2022 & 2030 (Value)

Fig. 49 Microcontroller Market, by Instruction Set: Market Share, 2022 & 2030 (Volume)

Fig. 50 Reduced Instruction Set Computer (RISC) Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 51 Complex Instruction Set Computer (CISC) Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 52 Microcontroller Market, by Application: Key Takeaways (Value)

Fig. 53 Microcontroller Market, by Application: Key Takeaways (Volume)

Fig. 54 Microcontroller Market, by Application: Market Share, 2022 & 2030 (Value)

Fig. 55 Microcontroller Market, by Application: Market Share, 2022 & 2030 (Volume)

Fig. 56 Automotive Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 57 Consumer Electronics & Telecom Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 58 Industrial Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 59 Embedded Systems Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million)

Fig. 60 Medical Devices Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 61 Aerospace & Defense Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 62 Others Microcontroller market estimates & forecasts, 2017 - 2030 (USD Million) (Million Units)

Fig. 63 Microcontroller Market revenue– by region, 2022 & 2030 (USD Million)

Fig. 64 Microcontroller Market, by Region: Key Takeaways (Value)

Fig. 65 Microcontroller Market, by Region: Key Takeaways (Volume)

Fig. 66 Microcontroller Market, by Region: Market Share, 2022 & 2030 (Value)

Fig. 67 Microcontroller Market, by Region: Market Share, 2022 & 2030 (Volume)

Fig. 68 North America Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 69 U.S. Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 70 Canada Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 71 Mexico Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 72 Europe Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 73 U.K. Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 74 Germany Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 75 France Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 76 Asia Pacific Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 77 China Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 78 Japan Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 79 India Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 80 South Korea Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 81 Australia Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 82 South America Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 83 Brazil Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 84 Middle East & Africa Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 85 Kingdom of Saudi Arabia (KSA) Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 86 UAE Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 87 South Africa Microcontroller Market estimates & forecast, 2017- 2030 (USD Million) (Million Units)

Fig. 88 Key Company Categorization

Fig. 89 Company Market Share Analysis, 2022

Fig. 90 Strategic framework

Fig. 91 Key company categorization

Market Segmentation

- Microcontroller Product Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

- 8-Bit

- 16-Bit

- 32-Bit

- 64-Bit

- Microcontroller Type Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

- Peripheral Interface Controller (PIC)

- ARM

- 8051

- TriCore

- Others

- Microcontroller Architecture Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

- Harvard Architecture

- Von Neumann Architecture

- Others

- Microcontroller Instruction Set Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

- Reduced Instruction Set Computer (RISC)

- Complex Instruction Set Computer (CISC)

- Microcontroller Application Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

- Automotive

- Consumer Electronics & Telecom

- Industrial

- Embedded Systems

- Hardware

- Software/Embedded Development Tools

- Medical Devices

- Aerospace & Defense

- Others

- Microcontroller Regional Outlook (Volume, Million Units; Revenue, USD Million, 2017 - 2030)

- North America

- North America Microcontroller Market by Product

- 8-Bit

- 16-Bit

- 32-Bit

- 64-Bit

- North America Microcontroller Market by Type

- Peripheral Interface Controller (PIC)

- ARM

- 8051

- TriCore

- Others

- North America Microcontroller Market by Architecture

- Harvard Architecture

- Von Neumann Architecture

- Others

- North America Microcontroller Market by Instruction Set

- Reduced Instruction Set Computer (RISC)

- Complex Instruction Set Computer (CISC)

- North America Microcontroller Market by Application

- Automotive

- Automotive

- Consumer Electronics & Telecom

- Industrial

- Embedded Systems

- Hardware

- Software/Embedded Development Tools

- Medical Devices

- Aerospace & Defense

- Others

- U.S.

- U.S. Microcontroller Market by Product

- 8-Bit

- 16-Bit

- 32-Bit

- 64-Bit

- U.S. Microcontroller Market by Type

- Peripheral Interface Controller (PIC)

- ARM

- 8051

- TriCore

- Others

- U.S. Microcontroller Market by Architecture

- Harvard Architecture

- Von Neumann Architecture

- Others

- U.S. Microcontroller Market by Instruction Set

- Reduced Instruction Set Computer (RISC)

- Complex Instruction Set Computer (CISC)

- U.S. Microcontroller Market by Application

- Automotive

- Automotive

- Consumer Electronics & Telecom

- Industrial

- Embedded Systems

- Hardware

- Software/Embedded Development Tools

- Medical Devices

- Aerospace & Defense

- Others

- U.S. Microcontroller Market by Product

- Canada

- Canada Microcontroller Market by Product

- 8-Bit

- 16-Bit

- 32-Bit

- 64-Bit

- Canada Microcontroller Market by Type

- Peripheral Interface Controller (PIC)

- ARM

- 8051

- TriCore

- Others

- Canada Microcontroller Market by Architecture

- Harvard Architecture

- Von Neumann Architecture

- Others

- Canada Microcontroller Market by Instruction Set

- Reduced Instruction Set Computer (RISC)

- Complex Instruction Set Computer (CISC)

- Canada Microcontroller Market by Application

- Automotive

- Automotive

- Consumer Electronics & Telecom

- Industrial

- Embedded Systems

- Hardware

- Software/Embedded Development Tools

- Medical Devices

- Aerospace & Defense

- Others

- Canada Microcontroller Market by Product

- Mexico

- Mexico Microcontroller Market by Product

- 8-Bit

- 16-Bit

- 32-Bit

- 64-Bit

- Mexico Microcontroller Market by Type

- Peripheral Interface Controller (PIC)

- ARM

- 8051

- TriCore

- Others

- Mexico Microcontroller Market by Architecture

- Harvard Architecture

- Von Neumann Architecture

- Others

- Mexico Microcontroller Market by Instruction Set

- Reduced Instruction Set Computer (RISC)

- Complex Instruction Set Computer (CISC)

- Mexico Microcontroller Market by Application

- Automotive

- Automotive

- Consumer Electronics & Telecom

- Industrial

- Embedded Systems

- Hardware

- Software/Embedded Development Tools

- Medical Devices

- Aerospace & Defense

- Others

- Mexico Microcontroller Market by Product

- North America Microcontroller Market by Product

- Europe

- Europe Microcontroller Market by Product

- 8-Bit

- 16-Bit

- 32-Bit

- 64-Bit

- Europe Microcontroller Market by Type

- Peripheral Interface Controller (PIC)

- ARM

- 8051

- TriCore

- Others

- Europe Microcontroller Market by Architecture

- Harvard Architecture

- Von Neumann Architecture

- Others

- Europe Microcontroller Market by Instruction Set

- Reduced Instruction Set Computer (RISC)

- Complex Instruction Set Computer (CISC)

- Europe Microcontroller Market by Application

- Automotive

- Automotive

- Consumer Electronics & Telecom