Microbiome Sample Preparation Technology Market Size, Share & Trends Analysis Report By Product (Instruments, Consumables), By Workflow, By Application, By Disease, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-975-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

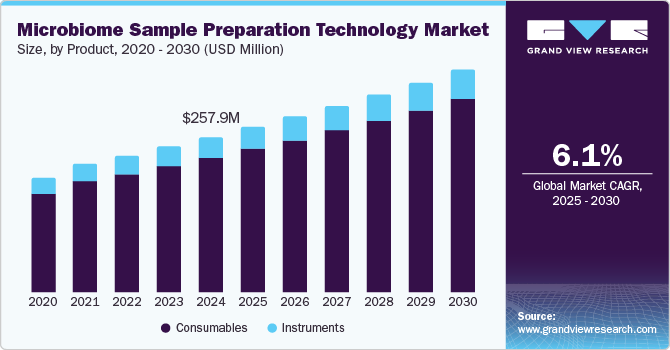

The global microbiome sample preparation technology market size was estimated at USD 257.94 million in 2024 and is expected to expand at a CAGR of 6.09% from 2025 to 2030. The advancement in microbiome-based therapeutics, coupled with the declining cost of sequencing and increasing investment in microbiome research, is anticipated to contribute to market growth. For instance, in October 2021, Corundum Systems Biology Inc. announced to contribute USD 1.0 million to a two-year research initiative by Holobiome Inc. of the U.S. The project is expected to examine the gut microbiome's role in pain sensitivity regulation, paving the way for future microbial therapies, consumer goods, and/or diagnostics aimed at addressing pain in a wide range of patients.

The COVID-19 pandemic has resulted in a sudden spur in demand for consumables and reagents of microbiome sample preparation technology. The need for sequencing SARS-CoV-2 has shown tremendous opportunities for key players within the microbiome sample preparation technology market owing to the rapid mutations. Attributing to the global pandemic, a highly sensitive molecular diagnosis is estimated to reduce false negative reverse transcription PCR (RT-PCR) results, which has been identified as a critical clinical need for a robust diagnostic tool for the identification of COVID-19.

Microbiome-based therapeutics are considered to be a major factor that directly impacts the demand for sampling technologies of microbiome. The compounds produced that affect cellular and organismal activities by the gut microbial community has been discovered to have a significant impact on host physiology in recent years. Since, it serves as an effective route of communication in host-microbe interactions. For instance, in August 2022, Digbi Health, a company involved in gut microbiome and genetic-related care, participated in Global Prevention Accelerator Program by Novo Nordisk. The program was designed to invite potential start-ups to present their solutions and selected players are anticipated to receive funding support from Novo Nordisk.

Other determinants such as a steady reduction in the costs of genomic testing are anticipated to increase the penetration rate of microbiome sampling in emerging countries. For instance, in February 2020, Nebula Genomics launched an at-home whole genome sequencing service for USD299. Nebula's sequencing is a far more extensive test than those offered by 23andMe and Ancestry, which rely on a procedure known as genotyping.

According to research, the gut microbiome has been associated with chronic disorders, including depression, obesity, type 2 diabetes, and some types of cancer. Microbiome tests can assist patients to assess their gut microbes response to different foods, thereby lowering the probability of chronic diseases and their associated medical costs. Similarly, the increasing prevalence of chronic diseases, rising medical expenses, and a greater emphasis on disease-prevention are expected to contribute to the microbiome sample preparation technology. From 2019 to 2027, US health spending is expected to reach a 5.4% annual rate, accounting for USD 6.2 trillion by 2027 which is also expected to have an impact on the demand.

In addition, raising grants and funding programs for microbiome-based research is anticipated to surge the demand for microbiome sample preparation technology from academic and research institutions. In 2022, five academic institutions received grants from the National Cancer Institute, U.S., including Harvard School of Public Health, Columbia University Health Sciences, Graduate School of Public Health and Health Policy, and New York University School of Medicine. The grant ranged from USD 387,513 to 717,936.

Product Insights

The consumables segment dominated the market in 2024, with a share of 86.37% and is expected to witness the fastest growth rate over the forecast period. This growth is driven by the increasing demand for purification/extraction kits and DNA library preparation kits during COVID-19.

For instance, in June 2021, SpeeDx Pty, Ltd., an Australia-based company specializing in molecular diagnostics solutions, and MolGen, an innovative provider of DNA/RNA extraction technology, collaborated for the supply and distribution of their products across Europe and the Asia Pacific. The partnership is set to benefit both companies by combining MolGen's DNA/RNA extraction portfolio along with SpeeDx's diagnostic assay technology.

Instruments, on the other hand, are anticipated to stable and steady growth rate during the forecasted period. Since the purchase frequency by the End users of the product is low owing to a higher lifespan than consumables. Innovations in this domain include automated systems such as Maxwell RSC and Maxwell RSC 48 Instrument, which can work on preprogrammed methods and simultaneously process up to 16 and 48 samples, respectively; is anticipated to improve the growth rate.

Workflow Insights

Sample Extraction/Isolation segment is estimated to dominate the microbiome sample preparation technology market with a share of 24.08% in 2024. Since It is one of the important focus areas for ongoing studies in medicine and diagnostics is the impact of the human microbiome on health. Studies in this domain rely on robust extraction methods that can provide efficient DNA extraction and eliminate inhibitory constituents from the sample. The extraction method used can vary based on the composition of the sample as certain cell types may require harsher methods for efficient extraction.

For instance, MGI Tech Co. offers a DNA extraction kit for purifying and extracting high-quality microbial genomic DNA from frozen and fresh human stool samples. It can be used for numerous areas, such as intestinal flora research, metagenomics analysis, and probiotics research. The product is applicable for PCR, metagenomics sequencing, and RT-PCR.

On the other hand, library preparation is considered to be the most next-generation sequencing platform that requires ligation of adapters to the fragment ends. The fragmented DNA is subjected to end repair to form blunt ends followed by attachment of the deoxyadenosine 5′-monophosphate (dAMP) tail to the 3' end, for applications in the Illumina platform. The tail is required to avoid concatamer formation and facilitates ligation of adaptors having complementary dT overhangs.

Application Insights

The DNA sequencing segment is estimated to dominate the microbiome sample preparation technology market with a share of 25.64% in 2024. Sequencing is essential to various fields, ranging from basic biology to human evolution, and further technological advancement that assurance cost-effective sequencing is expected to support market growth.

For illustration, in June 2022, a start-up company, Ultima Genomics stated at a meeting in Florida, that with the advancement of existing technology, the company can offer human genomes for USD 100, which is one-fifth of the existing rate. However, at present, the majority of the market is captured by Illumina.

The metagenomic segment is anticipated to record the fastest growth rate during the forecasted period. The metagenomics approach can offer identification of a wide range of pathogens, including novel and rare pathogens, and facilitate the characterization of the microbiome. Along with, additional insights about disease epidemiology, the phylogeny of causative agents or aid in the development of diagnostic tests for novel agents. The increasing scope of metagenomics is anticipated to supplement the segment growth.

End Use Insights

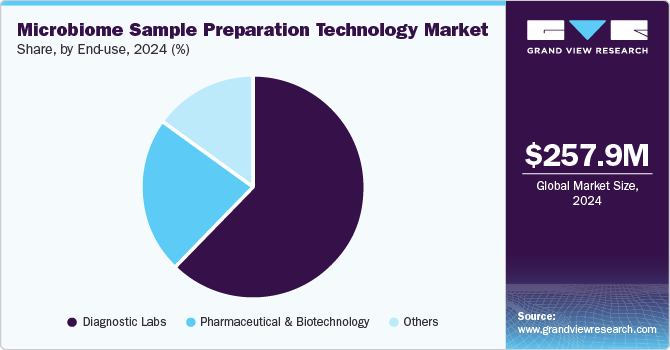

The diagnostic labs segment dominated the market in 2024, with a share of 62.01% and is expected to witness the fastest growth rate over the forecast period. Since the diagnostics lab is one of the key segments wherein microbiome sampling finds its application. Being said, it is used in the diagnosis of various diseases namely autoimmune disorders, various types of cancers, gastrointestinal disorders, and many other medical conditions. There has been observed a historic trend of the rising number of clinical trials analyzing microbial samples in order to diagnose various medical conditions.

The demand for microbiome sample preparation technologies among pharmaceutical and biotechnology companies is driven by the growing interest in microbiome-based therapeutics and personalized medicine. These technologies are crucial for analyzing complex microbial communities, helping companies develop targeted treatments for conditions such as gastrointestinal disorders, metabolic diseases, and even cancer. Efficient sample preparation enhances the accuracy and reliability of downstream sequencing and analysis, which is essential for drug discovery and development processes. Thus, it will boost the market growth.

Disease Insights

Gastrointestinal disorders segment dominated the market in 2024, with a share of 53.96%. The majority of the GI issues can be diagnosed using microbiome sample analysis. Majorly being IBS, C. difficile, Crohn's disease, and many more. IBD, which includes ulcerative colitis (UC) and Crohn's disease (CD), is a relapsing-remitting gastrointestinal inflammatory illness that causes varying degrees of intestine damage and can lead to local and extra intestinal problems.

While, autoimmune disorder segment is expected to grow at the fastest rate during the forecasted period, and support the overall growth of the microbiome sample preparation technology market. Autoimmune disorders have been a key area of research and one of the most emerging fields of medical sciences across the globe. For instance, a study published in January 2022, assessed the association between autoimmune diseases and gut microbiota. The study stated that by implying the relationship between CeD and T1D, and Bifidobacterium genus, offered significant insights into gut microbiota-mediated development process of autoimmune disorder.

Regional Insights

North America accounted for the largest share in 2024 and accounted for around 41.11% of the market size. This major share can be the result of rising funding opportunities coupled with partnerships and collaborative efforts by the regional players. and the expanding use of technological developments in the U.S.For instance, Persephone Biosciences, a microbiome research firm entered into an agreement with Janssen Biotech in Sep 2021, for use of patient samples from Janssen’s cancer clinical trial. Furthermore, the increased usage of instruments and consumables in the North American market has been attributed to the high penetration of genomic research projects in the pipeline throughout the region.

U.S. Microbiome Sample Preparation Technology Market Trends

The U.S. market is driven by a high level of investment in microbiome research, supported by both public and private funding. The growing emphasis on personalized medicine and the integration of microbiome research into precision healthcare have spurred demand. In addition, the robust presence of research institutes and biopharma companies focusing on the human microbiome’s role in various diseases has boosted the need for advanced sample preparation technologies.

Europe Microbiome Sample Preparation Technology Market Trends

In Europe, a strong regulatory framework supports research and development in microbiome studies, especially with initiatives such as the Horizon 2020 program. Countries across the region have seen increased interest in microbiome-based therapies for gastrointestinal disorders and chronic diseases, which drives the demand for sample preparation technologies. The rising awareness of gut health among consumers has also contributed to growth in this market.

The UK's microbiome sample preparation technology market is fueled by significant academic research into the microbiome’s impact on health, with a focus on areas such as digestive health, mental health, and metabolic disorders. The collaboration between research institutions and biopharma companies plays a crucial role in driving advancements in microbiome sample preparation. In addition, the increasing demand for next-generation sequencing technologies further supports the market.

Microbiome sample preparation technology market in France has been focusing on microbiome research for applications in food and nutrition, alongside therapeutic developments. Government initiatives and investment in life sciences have spurred growth in this sector. French research centers and companies are also exploring the microbiome’s role in personalized nutrition, contributing to the need for specialized sample preparation technologies.

Germany’s microbiome sample preparation technology market robust biopharmaceutical industry and emphasis on R&D in life sciences are significant market drivers. The country is home to numerous research institutes that focus on microbiome studies, especially those related to chronic diseases and metabolic health. The strong academic-industry partnerships help accelerate advancements in microbiome sample preparation tools.

Asia Pacific Microbiome Sample Preparation Technology Market Trends

The Asia Pacific is anticipated to be the fastest-growing region due to significant commercial growth of new start-ups and is impacted by the strategic decisions of multinational entities. For instance, in South Korea, CJ CheilJedang invested 4 billion won (USD3.56 million) in 2019 in KO Biolabs, which is developing microbiome-based psoriasis and asthma treatments. In July 2021, the company also acquired a 44% stake at 98.3 billion won in ChunLab, a provider of microbiome precision analysis technology.

China's microbiome sample preparation technology market is driven by growing investments in biotechnology and microbiome research, as the country aims to become a leader in advanced medical research. With increasing awareness of the gut microbiome’s role in health, the demand for sample preparation technologies has risen. Moreover, the integration of AI in microbiome diagnostics has furthered the development of advanced technologies.

Microbiome sample preparation technology market in Japan, the focus on aging-related diseases and personalized medicine has fueled the demand for microbiome research. The country’s advanced healthcare system and investment in precision medicine are key market drivers, with research institutions exploring the microbiome’s role in conditions like diabetes and obesity. This drives the demand for efficient and accurate sample preparation methods.

India's microbiome sample preparation technology market is expanding due to rising awareness of microbiome science and increasing investments in biotechnology. The focus on affordable healthcare solutions and a large population base interested in gut health and personalized nutrition have contributed to market growth. Collaborative projects between Indian and global research entities have further supported the demand for advanced sample preparation technologies.

Middle East & Africa Microbiome Sample Preparation Technology Market Trends

The market in this region is driven by increasing healthcare expenditure and a growing interest in research on infectious diseases and metabolic disorders. Although the region faces challenges such as limited infrastructure for advanced R&D, the focus on improving diagnostic capabilities and personalized healthcare has been a key driver.

Saudi Arabia's microbiome sample preparation technology market growth is supported by its Vision 2030 initiative, which emphasizes the development of the healthcare sector, including biotechnological research. The country is investing in improving research capabilities in microbiome science, with a focus on understanding disease mechanisms that are common in the region, like diabetes.

Microbiome sample preparation technology market in Kuwait increasing investment in healthcare infrastructure and interest in advanced diagnostic methods have spurred growth in microbiome sample preparation technologies. The focus on addressing chronic diseases prevalent in the region, such as obesity and diabetes, has also driven the demand for specialized microbiome studies.

Key Microbiome Sample Preparation Technology Company Insights

Major players in the microbiome sample preparation technology market are designing and implementing various strategies including new product launches, investment in start-ups or related companies through mergers and acquisitions, regional expansion, and strategic collaborations to accelerate their market presence.

Key Microbiome Sample Preparation Technology Companies:

The following are the leading companies in the microbiome sample preparation technology market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- BGI

- Bio-Rad Laboratories, Inc.

- Perkin Elmer, Inc.

- Agilent Technologies Inc.

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

- Danaher Corporation

Recent Developments

-

In August 2024, MGI Tech has introduced the Human Microbiome Metagenomics Sequencing Package. This package offers a complete solution for human microbiome metagenomic sequencing, encompassing all steps from sample collection and extraction to library preparation, sequencing, and analysis. It features high automation and adjustable throughput, making it adaptable to various research needs. Having been validated with numerous biological samples, it serves as an ideal tool for advancing human microbiome research.

-

In November 2023, QIAGEN has introduced the Microbiome WGS SeqSets, offering a comprehensive Sample to Insight workflow. This new solution is designed to streamline microbiome research by enhancing ease of use, ensuring greater efficiency, and improving reproducibility throughout the research process.

-

In May 2021, Bio-Rad Laboratories launched SEQuoia RiboDepletion Kit to streamline the RNA-Seq library prep workflow. This kit is designed to retain sRNA transcripts, thus supporting researchers targeting rare transcripts or working with limited/degraded samples. This strengthened the company's position in the market.

Microbiome Sample Preparation Technology Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 274.42 million |

|

Revenue forecast in 2030 |

USD 368.74 million |

|

Growth rate |

CAGR of 6.09% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, workflow, application, disease, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico, Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil, Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

QIAGEN; BGI; Bio-Rad Laboratories, Inc.; Perkin Elmer, Inc.; Agilent Technologies Inc.; Illumina, Inc.; F. Hoffmann-La Roche Ltd.; Danaher Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Global Microbiome Sample Preparation Technology Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the microbiome sample preparation technology on the basis of product, workflow, application, disease, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Extraction System

-

Workstation

-

Liquid Handling Instrument

-

Other Sample Preparation Instruments

-

-

Consumables

-

Purification/Extraction Kits

-

Library prep kits

-

DNA Library Preparation Kits

-

RNA Library Preparation Kits

-

Library Quantitation & Amplification kits

-

Clean-up and Selection Kits

-

Microbiome DNA Enrichment

-

Others

-

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Sample Extraction/Isolation

-

Sample Quantification

-

Quality Control

-

Fragmentation

-

Library Preparation

-

Target Enrichment

-

Library Quantification

-

Pooling

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA Sequencing

-

Whole-Genome Sequencing

-

RNA Sequencing

-

Methylation Sequencing

-

Metagenomics

-

Single Cell Sequencing

-

Others

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Autoimmune Disorder

-

Cancer

-

Gastrointestinal Disorders

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology

-

Diagnostic Labs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global microbiome sample preparation technology market size was estimated at USD 257.94 million in 2024 and is expected to reach USD 274.42 million in 2025.

b. The global microbiome sample preparation technology market is expected to grow at a compound annual growth rate of 6.09% from 2025 to 2030 to reach USD 368.74 million by 2030.

b. North America dominated the microbiome sample preparation technology market with a share of 41.11% in 2024. This is attributable to a significant number of venture investments and well-established NGS service providers

b. Some key players operating in the microbiome sample preparation technology market include QIAGEN; BGI; Bio-Rad Laboratories, Inc.; Perkin Elmer, Inc.; Agilent Technologies Inc.; Illumina, Inc.; F. Hoffmann-La Roche Ltd.; Danaher Corporation

b. Key factors that are driving the microbiome sample preparation technology market growth include advancements in microbiome-based therapeutics coupled with the declining cost of sequencing

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."