Microarray Market Size, Share & Trends Analysis Report By Product And Services (Instruments, Consumables), By Type, By Application (Drug Discovery, Disease Diagnostics), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-965-4

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Microarray Market Size & Trends

The global microarray market size was estimated at USD 6.22 billion in 2024 and is projected to grow at a CAGR of 5.48% from 2025 to 2030. Microarrays have received attention for their use in high-throughput genetic analysis and molecular profiling for cancer research, genetic disorders, and infectious disease diagnosis. Due to increased technological advancements, the rise in demand for genetic analysis, and enhanced investment in research and development, the global infrastructure for microarrays is expected to grow significantly over the forecast period.

Personalized medicine is also a contributing factor, as researchers can use these tools to identify specific markers of diseases, enabling targeted therapies. Microarrays in diagnostics, forensic science, and agricultural biotechnology have further strengthened the market’s expansion. The increasing emphasis on early disease detection and preventative healthcare will drive market growth. Microarrays help researchers and clinicians pinpoint early signs of biomarkers related to various conditions, allowing them to make timely interventions to improve patient outcomes. Early detection is crucial in oncology, where microarrays can identify the genes responsible for tumor growth, facilitating preventive and individualized treatments.

Expanding funding and research in the microarray patch platform will drive market growth. In March 2023, Vaxess Technologies announced that it raised USD 9 million in additional funding to support the development of its MIMIX sustained-release intradermal microarray patch platform. The platform is designed to transform the delivery of vaccines and therapeutics by enabling sustained-release dosing through a simple, self-administered patch. The funding round was backed by existing and new investors, including RA Capital Management and The Engine. Vaxess plans to use the capital to advance clinical trials for multiple programs, including influenza and COVID-19 vaccines, as well as expand applications of its microarray technology into other therapeutic areas.

Microarrays serve as essential tools for the study of plant genomes and enhance productivity by recognizing genetic characteristics that protect against pathogens and climatic changes. Additionally, worldwide, food security has emerged as a major problem; microarrays provide vital information on transgenic modifications and improvements in agriculture. In environmental science, they are used to assess pollutant effects on gene expression patterns among living organisms, hence supporting sustainability initiatives and eco-conservation programs. Therefore, the diverse applicability of microarray technology within different disciplines is another factor driving product demand.

Microarray-based diagnostic tests have emerged as transformative tools in the detection and management of connective tissue diseases (CTDs), such as systemic lupus erythematosus (SLE), systemic sclerosis, Sjögren’s syndrome, mixed connective tissue disease, and polymyositis/dermatomyositis. These complex autoimmune disorders often present with overlapping symptoms, making early and accurate diagnosis challenging. Microarrays provide a high-throughput and precise solution to this diagnostic dilemma. For instance, in May 2022, Quotient Limited and Theradiag announced a partnership to develop a microarray-based diagnostic test for connective tissue diseases. This collaboration aims to leverage Theradiag's expertise in autoimmune diagnostics and Quotient's proficiency in multiplex testing to create a comprehensive diagnostic solution.

Market Concentration & Characteristics

The industry demonstrates a high degree of innovation, driven by continuous advancements in genomics, proteomics, and personalized medicine. Companies are increasingly investing in the development of high-throughput platforms, multiplex assays, and AI-integrated data analysis tools that enhance the precision and speed of diagnostics and research. The transition toward next-generation microarray platforms, such as those supporting simultaneous detection of hundreds of biomarkers, further exemplifies the market’s innovative landscape. In August 2023, Thermo Fisher Scientific introduced the Applied Biosystems CytoScan HD Accel array, a chromosomal microarray designed to enhance cytogenetic research productivity. The array offers a two-day turnaround time and improved coverage across over 5,000 critical genomic regions. It requires up to 50% less DNA input compared to other arrays and supports a wide range of sample types, including buccal swabs, saliva, and blood. This innovation addresses the growing demand for efficient laboratory services amid a shortage of trained professionals. Furthermore, the integration of microarrays into drug discovery pipelines, disease screening, and immunological profiling supports innovation across clinical and translational research.

The industry experiences a high level of mergers and acquisitions (M&A), as major players seek to broaden their technological capabilities, enhance their product portfolios, and enter new regional markets. Strategic acquisitions are also being made to access proprietary microarray platforms, bioinformatics tools, and complementary diagnostic technologies. These activities often aim to accelerate innovation cycles, reduce development timelines, and consolidate market position. Notable M&A trends also include biotech startups partnering with or being acquired by established diagnostics leaders to scale production and expand their commercial reach.

The industry operates under high regulatory scrutiny, particularly in regions like the U.S. and Europe, where FDA and CE approvals are critical for commercialization. Regulations impact various aspects, including test validation, data reproducibility, clinical accuracy, and patient safety. Regulatory frameworks are especially stringent for clinical diagnostics involving genetic data and autoimmune disease detection, where multiplex assays must undergo rigorous performance evaluation. While this can pose entry barriers, it also drives quality assurance, standardization, and trust in clinical applications, further encouraging innovation aligned with regulatory expectations.

Product expansion in the industry is at a high level, driven by increasing demand for precision diagnostics, targeted therapies, and population-scale screening programs. Companies are actively introducing new product formats, such as integrated lab-on-chip microarrays, high-density arrays, and customizable panels tailored to specific diseases like cancer, autoimmune disorders, and infectious diseases. Additionally, the rise of portable microarray devices for point-of-care testing and the expansion of microarray-based research kits across academic and pharmaceutical institutions are enabling greater market penetration. This dynamic product diversification continues to strengthen the competitive landscape and address evolving end-user needs.

The industry is witnessing a medium to high level of regional expansion as companies aim to tap into growth opportunities in emerging markets while solidifying their presence in established regions. Asia-Pacific, Latin America, and the Middle East are becoming key targets due to rising healthcare investments, increasing awareness of diagnostic testing, and expanding healthcare infrastructures. Market leaders are setting up local manufacturing units, establishing partnerships with regional distributors, and customizing product offerings to meet specific market requirements. However, regional expansion efforts are often challenged by varying regulatory landscapes and market access barriers, requiring tailored strategies for each geography.

Some of the Leading Microarray Instruments

|

Instrument |

Manufacturer |

Key Features |

|

GeneChip System |

Thermo Fisher Scientific |

High-density DNA microarrays for gene expression and genotyping studies. |

|

SureScan Microarray Scanner |

Agilent Technologies |

High-resolution scanning with rapid data acquisition for various applications. |

|

iScan System |

Illumina |

High-throughput scanning for genotyping and copy number variation analysis. |

|

ScanArray Express Microarray Scanner |

PerkinElmer |

Flexible scanning system suitable for both DNA and protein microarrays. |

|

InnoScan Series |

Innopsys Inc. |

Compact and versatile scanners designed for research and clinical diagnostics. |

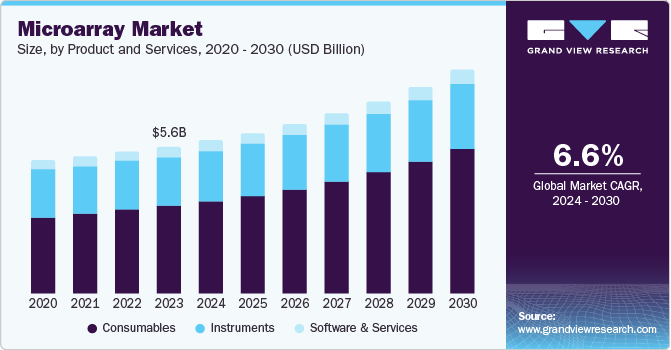

Product And Services Insights

Consumables held the largest market share of 49.73% in 2024. This growth is primarily attributed to the recurring need for assay kits, slides, and reagents used in various experiments, which are essential across genomics, proteomics, and clinical diagnostic settings. The expanding use of gene expression analysis and SNP genotyping has significantly increased the volume of consumables usage in both academic research and commercial laboratories. Recent advancements in nanotechnology have also enabled the production of high-density microarray chips, improving test precision and reducing assay time, further boosting demand. Moreover, the introduction of customizable microarray platforms has opened opportunities for targeted research and personalized diagnostics. Recently, in February 2024, axiVEND entered into a partnership with PolyAn to distribute PolyAn’s microarray consumables in North America. This collaboration enhances axiVEND’s offerings by adding PolyAn’s range of functionalized slides, coverslips, plates, and custom solutions to its existing portfolio, which includes M2-Automation spotters and Bioscience Media microarray imagers.

Instruments are expected to grow at the fastest rate over the forecast period, driven by the increasing demand for automation, precision, and scalability in molecular diagnostics and research applications. These instruments include microarray scanners, hybridization stations, and robotic handling systems, which collectively enhance throughput and minimize human error. Technological innovations have resulted in next-generation platforms offering real-time data acquisition, improved signal resolution, and compatibility with a broader range of microarray formats. One notable advancement includes integration with cloud-based data analytics, enabling researchers and clinicians to process vast datasets efficiently.

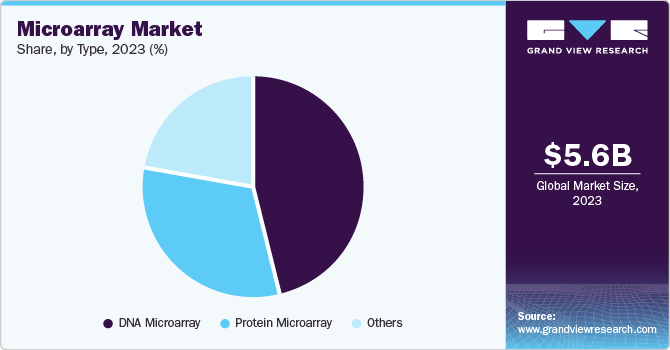

Type Insights

DNA microarrays accounted for the largest revenue share in 2024. The utility of DNA microarrays in identifying disease biomarkers and enabling pharmacogenomic insights continues to drive their adoption in both clinical diagnostics and translational research. Technological enhancements, such as improved probe design and higher array density, have made the platforms more sensitive and cost-effective. Recently, companies like Thermo Fisher and Agilent have introduced updated microarray formats with improved detection capabilities for rare mutations, further enhancing clinical relevance. The use of DNA microarrays is expanding in population health programs and cancer genomics, creating strong opportunities for growth in regions focusing on personalized medicine. In August 2023, Thermo Fisher Scientific introduced two advanced genomic tools aimed at enhancing research capabilities in cytogenetics and population-scale studies. The Applied Biosystems CytoScan HD Accel array offers a comprehensive analysis of the human genome, providing improved coverage in over 5,000 critical genome regions. This array is designed to support a wide range of prenatal, postnatal, and oncology research applications, delivering results with an industry-leading two-day turnaround time. Its efficiency is particularly beneficial for laboratories facing increased demand and a shortage of trained professionals, enabling up to a 100% increase in assay productivity using existing equipment.

Protein microarrays are expected to grow at the fastest rate over the forecast period, owing to their increasing use in drug discovery, immune profiling, and biomarker validation. Unlike DNA microarrays, protein arrays enable the simultaneous analysis of multiple protein interactions, making them indispensable in proteomics research. The rising prevalence of autoimmune and infectious diseases has created demand for rapid, multiplexed diagnostics that protein microarrays can support effectively. Recent developments include the introduction of label-free detection systems and miniaturized formats that reduce sample volumes while maintaining assay sensitivity. Companies like RayBiotech and Arrayit have expanded their product lines to support applications in cytokine profiling, antibody specificity testing, and allergen screening.

Application Insights

The research applications segment dominated the microarray market in 2024, supported by increasing investments in genomics, proteomics, and biomedical innovation. Microarrays are vital tools for understanding gene function, identifying new disease pathways, and discovering novel drug targets. Government-funded programs like the U.S. NIH's All of Us initiative and the EU's Horizon Europe framework have accelerated demand for microarray-based studies, particularly in population genomics and biomarker discovery. In recent years, research institutions have benefited from the introduction of advanced multiplexing technologies that allow for high-throughput analysis with greater accuracy. In addition, in January 2024, Thermo Fisher launched the Axiom PangenomiX Array, its most comprehensive and ethnically diverse array to date. This high-throughput microarray combines four assays: SNP genotyping, whole genome copy number variant detection, fixed copy number discovery, and blood and HLA typing into a single test. It is designed to advance research in disease risk and detection, population-scale disease studies, ancestry and wellness testing, drug efficacy testing, and drug development.

The disease diagnostics segment is anticipated to grow at the fastest rate over the forecast period. Microarray-based diagnostics offer high specificity and multiplex capability, allowing for the simultaneous detection of multiple biomarkers, making them ideal for complex disease profiling. Advancements in chromosomal microarray analysis (CMA) for detecting developmental delays, congenital anomalies, and neurological conditions have positioned microarrays as essential tools in clinical genomics. A notable recent development is Thermo Fisher’s launch of a two-day turnaround chromosomal microarray, which significantly enhances lab efficiency. In parallel, FDA 510(k) submissions like AliveDx’s CTDPlus multiplex microarray test demonstrate the growing clinical acceptance of these platforms.

End-use Insights

Research and academic institutes accounted for the largest revenue share of the market in 2024. Universities and publicly funded research centers are key users of microarray platforms for genomics, transcriptomics, and proteomics investigations. Moreover, many institutes have established core facilities to offer centralized access to microarray technologies, promoting interdisciplinary research. Collaborations between academia and commercial vendors like Agilent and PerkinElmer have led to the co-development of specialized arrays for niche applications, such as rare disease gene panels or epigenetic studies.

The diagnostic laboratories segment is expected to grow at the fastest CAGR during the forecast period. This growth is largely driven by the increasing adoption of molecular diagnostics for disease screening, stratification, and monitoring. Labs are turning to microarrays due to their ability to process multiple patient samples in parallel, deliver quick results, and reduce testing costs through multiplexing. Recent developments include the expansion of CLIA-certified labs in the U.S. and Europe, offering microarray-based tests for prenatal screening, autoimmune diseases, and cancer genetics. Companies like Arrayit Corporation and Bio-Rad have launched compact platforms designed specifically for clinical lab settings, enabling streamlined workflows and higher throughput.

Regional Insights

North America microarray market dominated the global industry and accounted for a 48.27% share in 2024. The growth of the market in the region is attributed to the presence of research institutions, pharmaceutical, and biotechnology companies, which have fueled the demand for microarrays in the region. The high adoption rate of advanced technologies, such as next-generation sequencing, and the growing investment in research and development activities, particularly in the U.S., have further driven the growth of the microarray market in North America. Additionally, the region's well-established healthcare infrastructure and favorable government policies supporting research and innovation have created a conducive environment for the growth of the market, making North America the largest contributor to the global market.

U.S. Microarray Market Trends

The microarray market in the U.S. is driven by extensive R&D investments, a well-established academic and clinical research environment, and strong funding support from institutions like the National Institutes of Health (NIH). The integration of microarrays in genomic studies, cancer diagnostics, and pharmacogenomics is gaining traction, especially in personalized medicine. Recent developments include collaborations between academic institutions and biotech companies aimed at advancing high-density DNA microarrays and protein microarrays. Furthermore, the presence of leading players such as Thermo Fisher Scientific and Agilent Technologies reinforces innovation in microarray platforms and consumables. In April 2025, AliveDx announced that it had submitted a 510(k) premarket notification to the U.S. Food and Drug Administration (FDA) for its MosaiQ Autoimmune Plex (AIPlex) Connective Tissue Diseases (CTDplus) Multiplex Microarray. The AIPlex CTDplus microarray is designed to aid in the diagnosis of autoimmune connective tissue diseases through multiplex detection of multiple biomarkers from a single patient sample. This highlights a growing shift towards multiplex, high-throughput microarray platforms—technologies that align with the U.S. healthcare market’s focus on precision medicine, cost-effective testing, and improved patient outcomes.

Europe Microarray Market Trends

The microarray market in Europe is rapidly evolving, supported by significant growth in genomics research and increasing demand for precision medicine. Countries such as Germany, France, and the Netherlands are leading in the adoption of microarray technologies for both academic and clinical purposes. One of the primary market drivers is the European Union’s investment in large-scale genomic projects and healthcare digitization. In recent years, research institutions across Europe have increasingly employed microarrays for applications such as transcriptomics and biomarker discovery. Regulatory harmonization and an emphasis on data privacy under GDPR have fostered responsible innovation. Companies operating in the region are forming partnerships to localize manufacturing and supply chains. Moreover, the use of microarrays in agricultural genomics and environmental monitoring is gaining interest.

The UK microarray market is experiencing significant growth, driven by government-backed initiatives like Genomics England and the 100,000 Genomes Project have laid a strong foundation for microarray-based diagnostics and research tools. The increasing focus on rare disease diagnosis and personalized cancer therapies has boosted the use of gene expression and SNP arrays. Recent developments include public-private collaborations aimed at enhancing translational research capabilities and scaling up production of next-generation microarray platforms. Universities and NHS-affiliated research labs are among the major adopters of microarray tools for clinical research and validation studies.

The microarray market in Germany is growing. The demand for microarrays is particularly high in oncology, infectious disease diagnostics, and pharmacogenetics. A key driver is the national focus on digital health and precision diagnostics, encouraging the integration of genomic data into healthcare delivery. Recent developments include collaborative projects between German universities and private sector firms to improve the sensitivity and specificity of microarray assays. Notably, the German government’s funding for high-throughput molecular diagnostic platforms has also spurred adoption.

Asia Pacific Microarray Market Trends

The microarray market in Asia Pacific is anticipated to witness significant growth, driven by the increasing investment in research and development activities, particularly in countries such as China, Japan, and South Korea, which are rapidly emerging as hubs for biotechnology and pharmaceutical research. Additionally, the growing demand for personalized medicine, rising healthcare expenditure, and improving research infrastructure in the region will further fuel the growth of the microarray market in the Asia Pacific, making it an attractive destination for market players.

China microarray market held a substantial share in 2023 due to the country's significant investments in genomics and precision medicine initiatives, such as the China Precision Medicine Initiative, which has driven the adoption of microarray technology in research and diagnostic applications. Additionally, China's large patient population, growing biotechnology industry, and increasing government support for research and development activities have further fueled the industry expansion.

The microarray market in Japan is progressing steadily, backed by its mature healthcare system, high R&D intensity, and focus on advanced diagnostics. The country has been a long-standing user of microarray technologies in research and clinical diagnostics, particularly for cancer genomics, pharmacogenetics, and rare disease screening. Key drivers include the aging population and government support for precision medicine through initiatives such as the Japan Agency for Medical Research and Development (AMED). Recent developments involve the integration of microarray data with AI tools to personalize treatment recommendations, and several domestic firms are working on next-gen array formats with faster processing capabilities.

Latin America Microarray Market Trends

The microarray market in Latin America is gradually expanding, primarily driven by improvements in healthcare access, rising interest in genomics, and the growing incidence of chronic diseases. Countries such as Argentina are increasingly investing in molecular diagnostics, where microarrays play a critical role. One of the key drivers is the increasing demand for affordable genetic screening tools for oncology and infectious diseases. Recent developments include pilot genomics programs and partnerships between public health institutes and academic centers to build local sequencing and microarray capabilities.

Brazil microarray market is witnessing substantial growth, fueled by increasing healthcare investments and the national focus on biotechnology development. The country has been advancing in genomic research through institutions like Fiocruz and the University of São Paulo. Key drivers include the rising prevalence of cancer, rare genetic disorders, and the need for efficient diagnostic tools in public health. The market is seeing increased adoption of DNA and protein microarrays in both clinical and agricultural applications. Recent developments include partnerships between domestic companies and global diagnostics providers to localize production and reduce costs.

Middle East & Africa Microarray Market Trends

The microarray market in the Middle East & Africa is in a nascent but promising stage, supported by growing investment in healthcare infrastructure and interest in genomics. Countries such as the UAE and South Africa are leading adoption, particularly for oncology diagnostics and infectious disease screening. A major driver is the region’s increasing burden of chronic and hereditary diseases, necessitating advanced diagnostic tools. Recently, in May 2023, Thermo Fisher Scientific and the Qatar Genome Program (QGP) announced a collaboration to develop a custom Axiom genotyping array tailored for pan-Arab populations. Utilizing whole genome sequencing data from 19 Arab countries, the array comprises approximately 800,000 variants. This initiative aims to advance research into conditions such as diabetes, cardiovascular diseases, autism, inherited genetic disorders, and cancer. The array is intended to provide a cost-effective alternative to whole-genome sequencing, thereby facilitating increased diversity in large-scale genome-wide studies.

Saudi Arabia microarray market is experiencing robust growth. The government’s support for digital health transformation and partnerships with international biotechnology firms are key market drivers. Recent developments include the establishment of national genomics initiatives and collaborations with universities to expand genetic testing capabilities. The Saudi Center for Disease Prevention and Control has shown interest in using microarrays for surveillance and outbreak monitoring.

Key Microarray Company Insights

Some of the key players operating in the microarray and microarray market include Thermo Fisher Scientific Inc (Applied Biosystems), Agilent Technologies, Inc., Illumina, Inc., PerkinElmer, Merck KGaA, Schott (Applied Microarrays), Danaher Corporation, Arrayit Corporation, Bio-Rad Laboratories, Inc., and Microarrays Inc. These mature companies leverage strong R&D capabilities, advanced technological infrastructure, and global distribution networks to lead innovation in genetic testing, precision medicine, and molecular diagnostics. Their strategic focus includes continuous product innovation, large-scale collaborations, and mergers & acquisitions to enhance product portfolios and strengthen market presence.

Emerging participants in the market, such as Arrayjet, Sengenics, Alere Technologies (Abbott), and Creative Biolabs, are increasingly focused on differentiated offerings to penetrate niche segments. These companies prioritize innovation through high-throughput platforms, multiplex assays, and cost-effective diagnostic tools. By forming alliances with academic institutions, biotech firms, and government agencies, these emerging players aim to expand their geographic footprint, tap into underserved markets, and accelerate the adoption of cutting-edge microarray technologies in diagnostics and biomedical research.

Key Microarray Companies:

The following are the leading companies in the microarray market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc (Applied Biosystems)

- Agilent Technologies, Inc

- Illumina, Inc

- PerkinElmer Inc.

- Merck KGaA

- Schott (Applied Microarrays)

- Danaher Corporation

- Arryait Corporation (ARYC)

- Bio-Rad Laboratories, Inc

- Microarrays Inc

Recent Developments

-

In February 2025, PathogenDx launched its rebranded D3 Array assays, including Combined, Bacterial, and Fungal versions, to replace its previous DetectX line. The D3 Array technology enables multiplex detection of up to 100 targets in a single test, offering rapid, cost-effective, and high-throughput solutions for agriculture, food safety, environmental, and clinical testing. The assays provide both quantitative and qualitative results with high sensitivity and specificity, enhancing laboratory efficiency and return on investment.

-

LinkZill announced the launch of its TruArray Std 4K High-Throughput Oligonucleotide Microarray Chip, based on TFT-DNA synthesis technology. The chip achieves high coverage and uniformity, with oligonucleotide lengths up to 150 nucleotides. It offers a balance of high throughput, accuracy, and cost-effectiveness, catering to various applications in genomics research.

-

In August 2024, Illumina, Inc. announced the launch of its NovaSeqX series, a new line of sequencing systems that promises to deliver faster, more cost-effective genomic sequencing. The NovaSeqX series features enhanced performance and scalability, aimed at accelerating research and improving data accessibility for a range of applications. This advancement supports comprehensive genetic studies and facilitates personalized medicine and genomics breakthroughs.

-

In January 2024, Thermo Fisher Scientific introduced the Pangenomix Array, a new genomic tool designed to enhance the study of genetic variations across diverse populations. This advanced array provides comprehensive coverage of human genetic diversity, facilitating more accurate genetic research and personalized medicine.

-

In August 2023, Thermo Fisher Scientific introduced the Applied Biosystems CytoScan HD Accel array, a chromosomal microarray designed to enhance cytogenetic research productivity. The array offers a two-day turnaround time and improved coverage across over 5,000 critical genomic regions. It requires up to 50% less DNA input compared to other arrays and supports a wide range of sample types, including buccal swabs, saliva, and blood. This innovation addresses the growing demand for efficient laboratory services amid a shortage of trained professionals.

Microarray Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.48 billion |

|

Revenue forecast in 2030 |

USD 8.46 billion |

|

Growth rate |

CAGR of 5.48% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product & services, type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Sweden; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Thermo Fisher Scientific Inc. (Applied Biosystems); Agilent Technologies, Inc.; Illumina, Inc.; PerkinElmer; Merck KGaA; Schott (Applied Microarrays); Danaher Corporation; Arrayit Corporation; Bio-Rad Laboratories; Inc.; and Microarrays Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Microarray Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global microarray market report based on product & services, type, application, end-use, and region.

-

Product & services Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumables

-

Software and Services

-

Instruments

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA Microarrays

-

Protein Microarrays

-

Other Microarrays

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research Applications

-

Drug Discovery

-

Disease Diagnostics

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research & Academic Institutes

-

Pharmaceutical & Biotechnology Companies

-

Diagnostic Laboratories

-

Other End Users

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global microarray market size was estimated at USD 6.22 billion in 2024 and is expected to reach USD 6.48 billion in 2025.

b. The global microarray market is expected to grow at a compound annual growth rate of 5.48% from 2025 to 2030 to reach USD 8.46 billion by 2030.

b. DNA Microarrays dominated the microarray market with a share of 40.68% in 2024. This is attributable to its wide range of applications in gene expression analysis, transcription factor binding analysis, and genotyping among others.

b. Some key players operating in the microarray market include Thermo Fisher Scientific Inc (Applied Biosystems), Agilent Technologies, Inc., Illumina, Inc., PerkinElmer, Merck KGaA, Schott (Applied Microarrays), Danaher Corporation, Arrayit Corporation, Bio-Rad Laboratories, Inc., and Microarrays Inc

b. Key factors that are driving the market growth include global rise in the incidence of cancer, an increase in healthcare R&D, and the usage of microarrays in various applications such as antibiotic treatments, gene expression. and NGS.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."