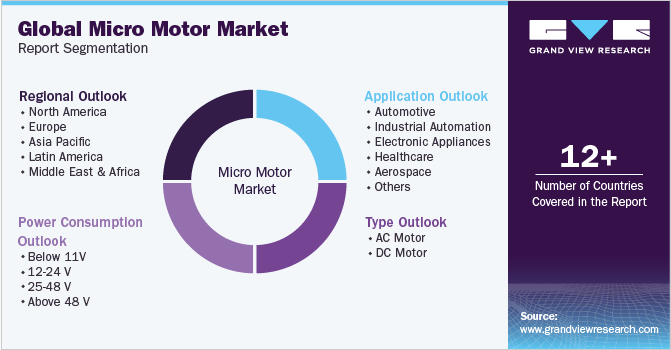

Micro Motor Market Size, Share & Trends Analysis Report By Type (AC Motor, DC Motor), By Power Consumption (Below 11V, 12-24 V, 25-48 V, Above 48 V), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-089-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Report Overview

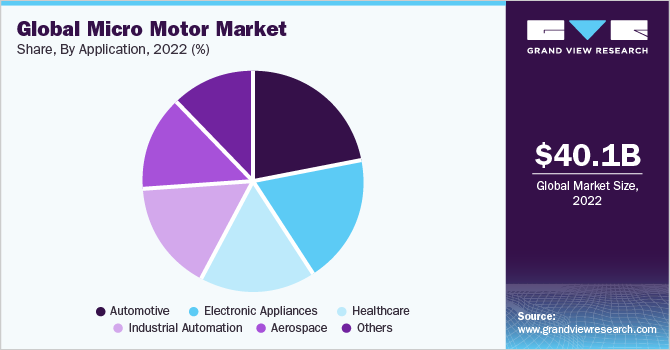

The global micro motor market size was valued at USD 40.07 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. The rising technological advancements, rapid industrialization & urbanization, desire for miniaturization across industries to achieve compact devices, the advent of electric vehicles & autonomous vehicles, and precision manufacturing, among others. For example, the healthcare industry is shifting towards more advanced treatments such as minimally invasive surgeries, drug delivery systems, dental implants, and diagnostic devices, which is boosting the demand for micro motors. Further, the use of micro motors in robotic surgical systems is increasing, enabling surgeons to perform complex procedures with enhanced precision and reduced invasiveness. Additionally, the demand for high-resolution medical imaging systems, such as endoscopy and microscopy, relies on micro motors for accurate positioning and focusing is further driving the growth of the market.

The increasing need for automation in various processes of industries presents a significant opportunity for the growth of the micro motor market. They play a vital role in providing the necessary motion and control for miniaturized robotic systems and automated equipment deployed in the factories. Furthermore, micro motors are extensively used across different components of an automobile, such as fans, water pumps, wipers, anti-braking systems (ABS) pumps, roofs, clutch actuators, alternators, condensers, and steering wheels, among others, to provide accurate & efficient motion control, enhanced vehicle performance, high safety & comfort, precise & reliable actuation, and energy efficiency. Agriculture equipment, 3D printers, and electronic appliances are some other important applications of micro motors.

The target market faces several challenges, including the complexity of miniaturization, maintaining tight tolerances for correct functioning, strict regulatory compliances, and high costs due to the use of specialized equipment, materials, and expertise to produce micro motors. Additionally, the availability of cheaper local variants of micro motors from local manufacturers or unorganized players is impacting the competitiveness of established and organized micro motor manufacturers, leading to a potential loss of market share for established players. To overcome the competition from an unorganized market, the organized players are engaging in growth strategies such as partnerships, collaborations, and mergers with end-use companies such as automotive companies, medical equipment manufacturers, and home appliances manufacturers, among others, to expand their customer base, increase sales, and position themselves as reliable partners.

COVID-19 Impact on the Micro Motor Market

The COVID-19 pandemic led to disruptions in global supply chains due to lockdowns, travel restrictions, reduced manufacturing capacity, and increased logistics costs. This affected the production and availability of micromotors, hindering growth in various sectors and leading to production bottlenecks and delayed deliveries of final products in automotive, consumer electronics, construction, and aerospace & defense, among others. On the other hand, the demand for medical devices, such as ventilators, infusion pumps, and diagnostic equipment, surged during the pandemic. Manufacturers of micromotors used in ventilators experienced a surge in orders as hospitals worldwide required more ventilators to treat COVID-19 patients, increasing demand and positively impacting the micro motor market.

Type Insights

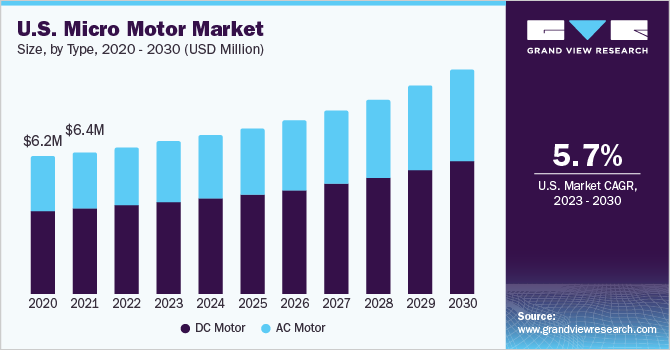

Based on type, the market is segmented into AC micro motors and DC micro motors. The DC micro motor type share was about 61% in 2022 and is expected to grow at a significant CAGR over the forecast period. DC motors have high power density and are used in power tools and personal use appliances such as hair dryers, electric toothbrushes, and electric razors. DC motors are more robust as they have high starting torque and starting and reversing speeds and are cheaper than AC motors. The DC micro motors segment is further bifurcated into two types: brushless and brushed.

The brushed DC micro motor segment dominated the DC micro motor industry in 2022, with a market share of about 54%. Brushed are easy to install and priced at a lower value than brushless motors. These motors operate at a speed of about 1,000 to 10,000 rpm. Several automotive systems, such as windshield wipers, power windows, cooling fans, and so on, use a brushed DC micro motor. On the other hand, brushless are more susceptible to damage and have comparatively higher longevity. Brushless motors have a life expectancy of more than 10,000 hours of operation. Brushless motors even require lesser maintenance and provide higher output per frame size. Although brushless are complex in nature and have high initial costs, their adoption is, however, increasing owing to their longer lifespan as compared to brushed motors.

The AC micro motor segment is anticipated to grow at the fastest CAGR of 6.5% throughout the forecast period. AC micro motors have better energy efficiency and performance than DC micro motors. AC micro motors are suitable for industrial and commercial applications such as compressors, HVAC systems, and pumps. These micro motors are also in high demand for sophisticated automation and control systems in several industries. AC micro motors are more dependable owing to the fewer moving parts and simpler designs possible with AC micro motors.

Power Consumption Insights

Based on power consumption, the market is segmented into below 11 V, 12-24 V, 25-48 V, and above 48 V. Among these, the below 11 V segment dominated the market in 2022, with a market share of about 31%. It is anticipated to grow at a CAGR of 5.6% through the forecast period. The low cost and efficiency of these micromotors have led to the increased adoption of several products that can function on low voltage. Low-voltage motors are being utilized in various products, including coffee machines, vacuum cleaners, air purifiers, mixers, food processors, and dryers.

The above 48 V segment is expected to grow at a considerable CAGR of 7.1% throughout the forecast period. Higher power output, energy efficiency, and higher durability of above 48 V micro motors lead to increased demand. These motors can be employed on heavy-duty machinery, unmanned aerial vehicles, autonomous guided vehicles, and aircraft actuation systems. The high torque of these micromotors enables their applications in the high-end transportation and aerospace sectors.

Application Insights

Based on application, the market is segmented into automotive, industrial automation, electronic appliances, healthcare, aerospace, and others. The automotive application segment dominated the market in 2022, with a market of about 22%. Micromotors are used in several components of automobiles, such as powered window lifters, power seats, parking brakes, door lock actuators, door mirrors, and several other autonomous systems. Safety mechanisms such as anti-lock braking systems also use micromotors.

The healthcare application segment is anticipated to register the fastest CAGR of 7.1% during the forecast period. Micromotors are used in portable medical devices, automated insulin pumps, blood pressure monitors, glucose monitoring systems, pocket ECGs, and portable ultrasounds. Micromotors are also used in several medical equipment related to surgery, diagnostics, and drug delivery. The healthcare sector is one of the major application sectors for micromotors as they enable the miniaturization of the equipment.

Regional Insights

In 2022, the Asia-Pacific region dominated the micro motor market with a market share of approximately 33% and is anticipated to grow at the fastest CAGR of 7.1% over the forecast period. The improved efficiency and productivity across various industries can be attributed to the increasing adoption of automation and the robust manufacturing sector in countries such as China, Japan, and India. Furthermore, the Asia-Pacific region plays a significant role in the automotive manufacturing industry, leading to a high demand for micromotors in automotive components like door locks, mirrors, and windows. For instance, Toyota, a renowned Japanese automaker, incorporates micromotors in their vehicles for features like power windows and mirrors, indicating the growing demand in the region.

The North American region is expected to experience significant growth at a rate of 5.5% during the forecast period. The strong presence of key industry players and the prosperous automotive, aerospace, healthcare, and electronic appliances markets contribute to this growth. For example, Tesla, an electric vehicle (EV) manufacturer based in California, incorporates micro motors for various purposes, such as power steering, HVAC systems, and electric windows. Tesla's innovative approach to EV technology has fueled the demand for advanced micro motor solutions in the North American automotive market. Additionally, the region's high demand for personal care equipment and electronic appliances contributes to the increasing demand for micro motors. Europe is also among the key regional markets owing to the large presence of the automotive industry in the region. For instance, Siemens Healthineers, a German medical technology company, incorporates micro motors in diagnostic imaging equipment such as MRI machines. The company's contribution reflects the growth of micromotors in the European medical technology landscape.

Key Companies & Market Share Insights

The target market is highly fragmented with presence of numerous local manufacturers or unorganized players along with global & regional players. Market players are increasingly focusing on research and development (R&D) to improve their product offerings and reduce costs in order to gain a competitive edge in the price-sensitive market. Further, the market players are working on a competitive pricing strategy that can help them set competitive prices with their rivals and maximize profitability.

Moreover, key players within the market are consistently introducing upgraded products. For example, Mabuchi Motor Co. Ltd. recently unveiled three novel brushless motors in the IS series, tailored specifically for electric vehicle (EV) applications like automated guided vehicles and autonomous mobile robots. Additionally, Nidec Corporation launched a cost-effective single-phase brushless DC motor for electric fans, surpassing AC motors in performance. Companies operating in the micro motor sector can enhance their competitive edge by implementing competitive pricing strategies, pinpointing market segments, product differentiation, and harnessing automation technology. Some of the key market players in the global micro motor market are:

-

Mitsuba Corporation

-

Nidec Corporation

-

Johnson Electric Holdings Limited

-

Mabuchi Motor Company Ltd

-

ABB Ltd.

-

Constar Micromotor Co Ltd

-

Buhler Motor GmbH

-

Robert Bosch GmbH

-

Denso Corporation

-

Maxon Motor AG

-

Arc Systems Inc

-

Siemens AG

Micro Motor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 41.80 billion |

|

Revenue forecast in 2030 |

USD 63.57 billion |

|

Growth Rate |

CAGR of 6.2% from 2023 to 2030 |

|

Historic year |

2017 - 2021 |

|

Base year for estimation |

2022 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

September 2023 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, power consumption, application, and region |

|

Regional scope |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Germany, France, U.K., China, India, Japan, South Korea, Australia, Brazil, Mexico, KSA, UAE, South Africa |

|

Key companies profiled |

Mitsuba Corporation, Nidec Corporation, Johnson Electric Holdings Limited, Mabuchi Motor Company Ltd, ABB Ltd., Constar Micromotor Co Ltd, Buhler Motor GmbH, Robert Bosch GmbH, Denso Corporation, Maxon Motor AG, Arc Systems Inc, Siemens AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Micro Motor Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global micro motor market based on type, power consumption, application, and region.

-

Type Outlook (Revenue, USD Million; 2017 - 2030)

-

AC Motor

-

DC Motor

-

Brushed

-

Brushless

-

-

-

Power Consumption Outlook (Revenue, USD Million; 2017 - 2030)

-

Below 11V

-

12-24 V

-

25-48 V

-

Above 48 V

-

-

Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Automotive

-

Industrial Automation

-

Electronic Appliances

-

Healthcare

-

Aerospace

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global micro motor market size was estimated at USD 40.07 billion in 2022 and is expected to reach USD 41.80 billion in 2023.

b. The global micro motor market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 63.57 billion by 2030.

b. The DC motor type segment led the global market for micro motors in 2022, accounting for the highest share of about 61%. However, the AC motor type segment is expected to register the fastest CAGR during the forecast period owing to the superior performance and high energy efficiency of AC motors.

b. Some key players operating in the micro motors market include Mitsuba Corporation, Nidec Corporation, Johnson Electric Holdings Limited, Mabuchi Motor Company Ltd, ABB Ltd., Constar Micromotor Co Ltd, and Buhler Motor GmbH.

b. The major factors attributing to the growth of the micro motors market are the growing trend of product/component miniaturization; increasing demand for automated personal care devices; and increasing demand for micro motors from medical equipment industry among others.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."