- Home

- »

- Automotive & Transportation

- »

-

Micro-mobility Market Size & Share, Industry Report, 2030GVR Report cover

![Micro-mobility Market Size, Share & Trends Report]()

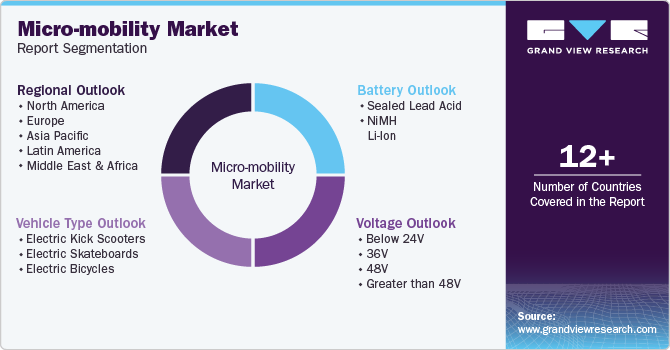

Micro-mobility Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Electric Kick Scooters, Electric Skateboards, Electric Bicycles), By Battery (Sealed Lead Acid), By Voltage, By Region And Segment Forecasts

- Report ID: GVR-4-68038-303-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Micro-mobility Market Summary

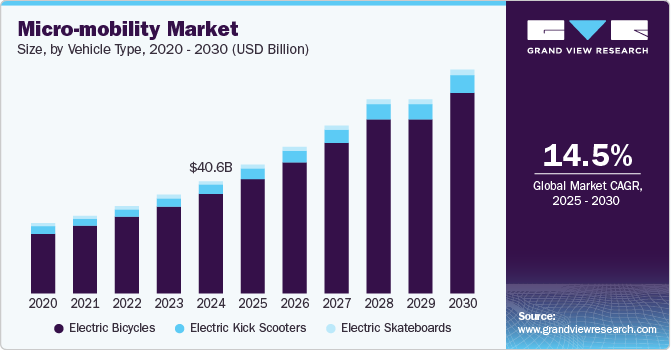

The global micro-mobility market size was estimated at USD 40.6 billion in 2024 and is projected to reach USD 91.2 billion by 2030, growing at a CAGR of 14.5% from 2025 to 2030. Micro-mobility is an evolving field of transportation that includes travel undertaken using a range of light vehicles such as electric kick scooters, electric skateboards, and electric bicycles.

Key Market Trends & Insights

- Asia Pacific micro-mobility market held the largest share of 46.2% in 2024.

- China micro-mobility market held the largest regional market share.

- Based on vehicle type, the electric bicycles segment held the largest revenue share of 88.8% in 2024.

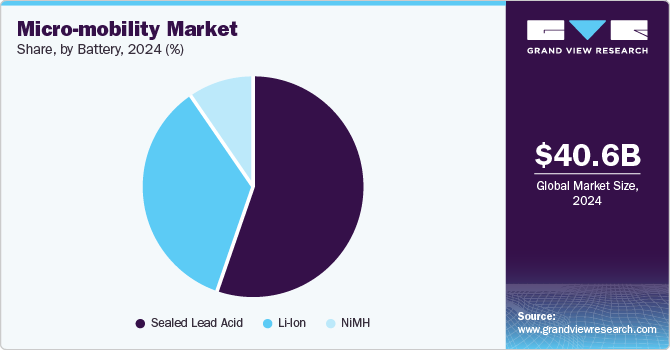

- Based on battery, the sealed lead acid segment held the largest revenue share of the micro-mobility industry in 2024.

- Based on voltage, the below 24V voltage segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 40.6 Billion

- 2030 Projected Market Size: USD 91.2 Billion

- CAGR (2025-2030): 14.5%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Factors such as increasing road congestion, rising oil & gas prices, ease of parking, and saturation within the automotive sector are expected to drive the growth of the micro-mobility industry during the forecast period. Furthermore, factors such as the growing electric bicycles and electric kick scooter renting and sharing services globally are expected to create new opportunities for micro-mobility in the coming years.

Innovations in Lithium technology have boosted the properties of the batteries, including longer-lasting batteries, faster-charging, and lightweight batteries. These batteries have significantly enhanced the performance and affordability of micro-mobility vehicles, particularly e-scooters and e-bikes. These advancements help improve user experience and operational efficiency, driving the micro-mobility industry. In addition, government initiatives and regulations supporting sustainable transportation, such as subsidies, infrastructure development, and stricter emissions standards, are fostering the adoption of these solutions. Providing favorable environments for businesses and consumers contributes to the growing demand for eco-friendly, convenient, and cost-effective urban mobility options.

Vehicle Type Insights

The electric bicycles segment held the largest revenue share of 88.8% in 2024, fueled by their versatility, comfort, and long-range capabilities compared to other micro-mobility options. E-bikes are ideal for both short commutes and long trips and allow riders to tackle varied terrains easily. Their eco-friendliness, backed by advancements in battery technology, makes electric bicycles a popular choice for urban and suburban transportation. Besides, e-bikes promote healthier, faster, and more efficient commuting, attracting consumers seeking an alternative to traditional vehicles or public transport.

The electric kick scooters segment is anticipated to emerge as the fastest-growing segment, with a CAGR of 11.6% over the forecast period. The high growth is attributed to the growing demand for convenient, sustainable transportation in urban areas. Their compact design, speed, and affordability make them ideal for short commutes, while advancements in battery technology provide extended range and improved efficiency. The rising investments in dedicated infrastructure, such as scooter lanes and charging stations, and increasing shared scooter services are expected to drive segment adoption. This trend positions electric kick scooters as a leading solution for tackling urban mobility challenges.

Battery Insights

The sealed lead acid segment held the largest revenue share of the micro-mobility industry in 2024, owing to its cost-effectiveness, reliability, and ease of maintenance. Sealed Lead Acid Batteries (SLA) are durable and offer stable performance over a wide range of temperatures, making them ideal for urban mobility solutions. Their robust design ensures longevity, and their ability to operate in various environmental conditions adds to their robustness. In addition, the widespread availability and recycling infrastructure of SLA batteries has contributed to their dominance in the market, offering a practical solution for both consumers and manufacturers.

The Li-Ion battery segment is projected to grow at the fastest CAGR during the forecast period, driven by its high energy density, lightweight design, and longer lifespan compared to traditional battery types. Lithium-Ion (Li-Ion) batteries offer enhanced performance, extended range, and faster charging times, making them ideal for electric bikes, scooters, and other personal transport vehicles. As consumer demand for efficient, eco-friendly mobility solutions rises, the adoption of Li-Ion batteries is expected to increase further. Moreover, ongoing advancements in battery technology and decreasing costs are expected to further fuel growth, solidifying the prominence of the Li-Ion segment in the market.

Voltage Insights

The below 24V voltage segment accounted for the largest revenue share in 2024, which is attributable to its cost-effectiveness, compactness, and suitability for short-distance travel. These low-voltage systems are commonly used in electric scooters, e-bikes, and other micro-mobility vehicles, offering an efficient and affordable solution for urban commuting. Their lightweight design makes them easier to handle, store, and maintain, appealing to budget-conscious consumers. Furthermore, the lower voltage requirements make these vehicles more accessible, leading to widespread adoption, especially in emerging markets.

The 36V segment is anticipated to emerge as the fastest-growing segment in the micro-mobility industry over the forecast period. This growth can be attributed to its ability to balance power, range, and efficiency. These batteries enable electric scooters, e-bikes, and other vehicles to travel longer distances at faster speeds, offering higher performance than the 24V segment. This makes them ideal for users seeking enhanced urban commuting and recreational performance. With growing demand for more powerful, reliable, and efficient micro-mobility solutions, the 36V segment is set to experience substantial growth in the coming years.

Regional Insights

North America micro-mobility market is projected to be the fastest-growing region and expand at a CAGR of 16.6% from 2025 to 2030, propelled bythe expansion of shared micro-mobility services and their integration with public transit systems. As cities adopt more shared electric scooters, bikes, and mopeds, they provide convenient, affordable, and eco-friendly alternatives for short-distance travel. Integrating these services with public transit enhances the convenience of last-mile connectivity, making them an attractive option for daily commuters. This synergy is set to drive market adoption, contributing to its growth and shaping the future of urban mobility across North America.

U.S. Micro-mobility Market Trends

The U.S. micro-mobility market is expected to grow at the highest rate over the forecast period. The growing emphasis on reducing carbon emissions and the push for more sustainable transportation solutions shape the U.S. micro-mobility market. As cities are investing in better infrastructure, such as dedicated bike lanes and safer pedestrian spaces, micro-mobility options, including electric scooters and bikes, are becoming more viable and appealing. These green alternatives reduce traffic congestion and carbon footprints, making them an attractive option for short-distance travel. With increasing environmental concerns and improving infrastructure, the demand for micro-mobility solutions is set to grow rapidly.

Europe Micro-mobility Market Trends

Europe Micro-Mobility Market is expected to grow over the forecast years. The emphasis on last-mile connectivity and the shift toward subscription-based services along with long-term rentals are propelling the regional market. As cities look for efficient, eco-friendly solutions to address short-distance travel needs, micro-mobility alternatives, including e-scooters and e-bikes, become essential. Moreover, subscription models and long-term rentals offer cost-effective, flexible alternatives to ownership, making these services increasingly popular among urban commuters. This shift, along with the push for sustainable transport, is set to expand the market and encourage wider adoption across European cities.

Asia Pacific Micro-mobility Market Trends

Asia Pacific micro-mobility market held the largest share of 46.2% in 2024. Rising fuel costs and traffic congestion in urban areas drive the demand for micro-mobility solutions in the region as consumers seek cost-effective, efficient alternatives for short-distance travel. Moreover, advancements in battery technology are improving the performance, range, and affordability of electric vehicles such as e-scooters and e-bikes, making them more attractive to users. In addition, the expansion of charging infrastructure is increasing the convenience and accessibility of micro-mobility options, further fueling market growth across the region and promoting the adoption of eco-friendly transportation.

China micro-mobility market held the largest regional market share. This share can be attributed to the rapid growth of e-scooter adoption and the dominance of shared mobility services across China. With increasing urban congestion, e-scooters provide a fast, efficient, and eco-friendly alternative for short-distance travel. Shared mobility platforms further fuel this growth by offering flexible, affordable, and accessible options for commuters. The rise in preference for convenience and sustainability and supportive government policies and infrastructure developments position China for substantial growth, with rising demand for urban transport solutions. In December 2022, Brightway introduced its latest innovations at CES 2023, including the NAVEE V-series electric scooters, NAVEE E-bike, and NAVEE Sharing Scooter, offering commuters compact and reliable solutions for navigating urban roads.

Key Micro-mobility Company Insights

Some of the key companies in the micro-mobility industry includeYadea Technology Group Co. Ltd; Jiangsu Xinri E-Vehicle Co.,Ltd; Xiaomi; SEGWAY INC.; SWAGTRON; Boosted USA; Airwheel Holding Limited; Yamaha Motor Co., Ltd.; Accell Group; and Kalkhoff Werke.

-

Yamaha Motor Co., Ltd. provides motorcycles, marine products, All-Terrain Vehicles (ATVs), snowmobiles, outboard motors, and industrial robots. It specializes in mobility solutions, high-performance engines, and innovative technologies for land, sea, and industrial applications, emphasizing quality, performance, and sustainability.

-

Accell Group offers high-quality bicycles, e-bikes, and cycling accessories through brands like Batavus, Koga, and Haibike. It focuses on innovation, sustainability, and performance, catering to both recreational and professional cyclists across Europe and beyond.

Key Micro-mobility Companies:

The following are the leading companies in the micro-mobility market. These companies collectively hold the largest market share and dictate industry trends.

- Yadea Technology Group Co. Ltd

- Jiangsu Xinri E-Vehicle Co., Ltd

- Xiaomi

- SEGWAY INC.

- SWAGTRON

- Boosted USA

- Airwheel Holding Limited

- Yamaha Motor Co., Ltd.

- Accell Group

- Kalkhoff Werke

Recent Developments

-

In June 2022, Porsche expanded its electric bike business by purchasing new models from the manufacturer of electric bicycles in Germany. The joint venture focuses on developing, producing, and distributing a new generation of high-quality Porsche e-bikes.

-

In February 2022, Bird partnered with WeGo to fill the transit gaps in Nashville via public transportation and micro-mobility integration. As a mobility coordinator, the company sees collaborations with micro-mobility providers like Bird as possibilities to broaden its function from just a transit provider to a mobility coordinator.

-

In March 2022, Segway-Ninebot launched new products, including the GT-series, P-series, and E110A, to enhance micro-mobility. These innovations prioritize performance, reliability, and sustainability, offering a comfortable and stylish commuting experience.

Micro-mobility Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 46.3 billion

Revenue forecast in 2030

USD 91.2 billion

Growth Rate

CAGR of 14.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

March 2025

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, battery, voltage, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; KSA; South Africa

Key companies profiled

Yadea Technology Group Co. Ltd; Jiangsu Xinri E-Vehicle Co., Ltd; Xiaomi; SEGWAY INC.; SWAGTRON; Boosted USA; Airwheel Holding Limited; Yamaha Motor Co., Ltd.; Accell Group; and Kalkhoff Werke.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Micro-mobility Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global micro-mobility market report based on vehicle type, battery, voltage, and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Kick Scooters

-

Electric Skateboards

-

Electric Bicycles

-

-

Battery Outlook (Revenue, USD Million, 2018 - 2030)

-

Sealed Lead Acid

-

NiMH

-

Li-Ion

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 24V

-

36V

-

48V

-

Greater than 48V

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.