Micro Mobile Data Center Market Size, Share, & Trends Analysis Report By Rack Unit (Up To 20 RU, 20-40 RU, Above 40 RU), By Enterprise Size, By Application, By Industry Vertical, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-989-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Micro Mobile Data Center Market Trends

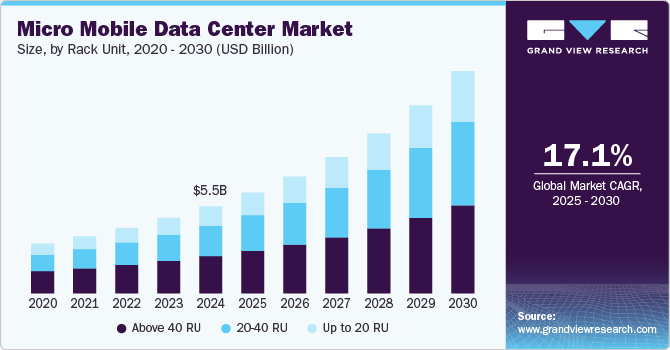

The global micro mobile data center market size was estimated at USD 5.48 billion in 2024 and is projected to grow at a CAGR of 17.1% from 2025 to 2030. As businesses aim to process data closer to the source, micro mobile data centers play a crucial role by providing computing power at the edge of the network. This reduces latency, enhances real-time data processing, and minimizes bandwidth usage, which is particularly valuable in industries such as manufacturing, retail, and telecommunications. The increasing adoption of IoT devices and 5G technology has amplified the need for localized data storage and processing, making micro data centers more relevant.

The proliferation of IoT devices, coupled with the increasing use of artificial intelligence (AI) and machine learning (ML) technologies, is contributing to an unprecedented surge in data creation in micro mobile data center industry. Traditional data centers, often centralized and large-scale, are becoming overwhelmed by the sheer volume of data being generated, particularly in industries where data collection is continuous, such as in autonomous vehicles, smart cities, and industrial IoT applications. Micro mobile data centers provide a scalable enterprise size to this challenge by enabling real-time data processing and storage closer to the data source, relieving strain on traditional infrastructure. AI and ML applications require immense computational power and rapid data processing capabilities, which micro mobile data centers can provide at the network’s edge. By offering localized processing, these data centers enable AI-driven insights to be generated quickly, facilitating decisions in real-time scenarios, such as predictive maintenance in manufacturing or real-time analytics in retail.

The global rollout of 5G technology is another key driver of the micro mobile data center industry. 5G promises ultra-low latency, high bandwidth, and the ability to support a vast number of connected devices simultaneously. However, to fully realize the benefits of 5G, data processing must occur as close to the end-user or device as possible, which is where micro mobile data centers excel. These compact and mobile centers can be strategically placed at the edge of the 5G network, enabling real-time data processing required for applications like autonomous vehicles, remote healthcare, and immersive gaming experiences. As reported by 5G Americas, a trade association of wireless cellular network operators, global 5G connections reached nearly 2 billion in the first quarter of 2024, with 185 billion new connections added. It is expected to rise to 7.7 billion by 2028. In North America, 5G adoption accounts for 32% of all wireless cellular connections, double the global average. The region saw an 11% growth, adding 22 billion new 5G connections during this period.

Rack Unit Insights

Based on rack unit, the above 40 RU segment led the market with the largest revenue share of 42.6% in 2024. The need for edge computing in high-performance environments is a primary driver for the growth of the above 40 RU segment. Applications such as autonomous vehicles, industrial automation, and real-time analytics in manufacturing require substantial processing power, which smaller data centers may struggle to deliver. Above 40 RU micro mobile data centers offer the computing power needed to handle these demanding applications at the network edge, reducing latency and improving response times. As businesses push more workloads to the edge to improve operational efficiency, the demand for larger, more powerful micro mobile data centers grows.

The 20-40 RU segment is expected to grow at the fastest CAGR of 18.6% over the forecast period. The segment offers a cost-effective enterprise size for growing businesses that need more data processing power but cannot justify the investment in larger data centers. Small and medium-sized enterprises (SMEs) are increasingly looking for modular data center enterprise sizes that offer scalability and adaptability without the high costs of larger-scale infrastructure. This segment meets their needs by providing sufficient capacity for growing workloads, while maintaining a relatively low total cost of ownership (TCO).

Enterprise Size Insights

Based on enterprise size, the large enterprises segment led the market with the largest revenue share of 64.9% in 2024. Large enterprises require scalable IT infrastructure to support their growth and expansion into new regions. Traditional data centers can be costly and time-consuming to build and maintain, especially in rapidly changing environments. Micro mobile data centers provide the flexibility and scalability that large enterprises need to quickly adjust their data processing capabilities. These modular enterprise sizes can be deployed in diverse locations and scaled up or down based on demand, which is particularly useful for large companies that need to manage data across multiple global sites. This adaptability reduces the time and cost associated with setting up permanent data centers, enabling large enterprises to remain agile in a competitive business environment.

The SMEs segment is expected to grow at a significant CAGR over the forecast period. The reduced operational and maintenance costs of micro mobile data centers appeal to SMEs. Traditional data centers come with high operational expenses related to power, cooling, and physical security. Micro mobile data centers, with their smaller footprint and energy-efficient designs, help SMEs manage these expenses while ensuring that their data processing needs are met. The combination of low initial investment and manageable ongoing costs makes micro mobile data centers an attractive proposition for resource-constrained SMEs.

Application Insights

Based on application, the edge computing segment led the market with the largest revenue share of 44.2% in 2024, driven by the need for bandwidth optimization and cost reduction. Transmitting vast amounts of data from remote IoT devices or sensors to centralized cloud servers consumes significant bandwidth, leading to high operational costs for businesses. Micro mobile data centers improve this problem by processing data locally and only sending the most critical information to the cloud, thereby reducing bandwidth consumption and lowering costs. This approach allows businesses to manage their data more efficiently while maintaining high performance for mission-critical applications.

The remote & temporary operations segment is expected to grow at a significant CAGR over the forecast period. The defense and military sectors are key drivers for the adoption of micro mobile data centers in remote and temporary operations. Military operations often take place in hostile or remote environments where secure and reliable data infrastructure is essential. Micro mobile data centers offer the mobility and security that defense agencies require, allowing them to set up and manage IT infrastructure on the battlefield or during military exercises. These centers are often equipped with enhanced security features to ensure the protection of sensitive military data.

End-use Insights

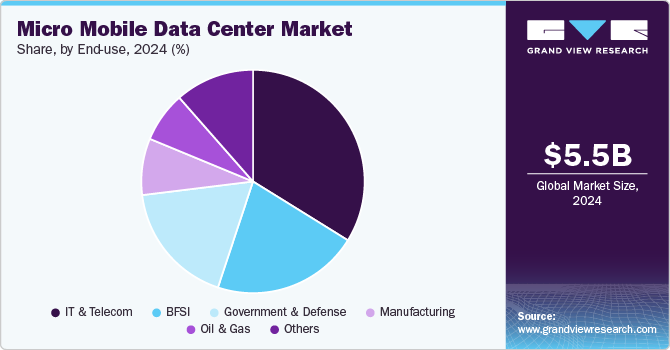

Based on end-use, the IT and telecom segment led the market with the largest revenue share of 33.9% in 2024. The growing demand for cloud application and the shift toward data center decentralization are also key growth drivers in the IT and telecom sector. Enterprises are increasingly adopting hybrid and multi-cloud environments, which require scalable and distributed data infrastructure. Centralized data centers alone are often insufficient to meet the needs of these complex cloud ecosystems, particularly when real-time processing or specific regulatory requirements come into play. Micro mobile data centers help bridge this gap by providing localized, on-premise data processing capabilities that complement cloud application.

The government and defense segment is expected to grow at a significant CAGR over the forecast period. The ability to rapidly deploy data infrastructure in crisis situations is another key growth driver for the micro mobile data center industry in the government and defense sector. During emergencies, such as natural disasters, military operations, or humanitarian missions, there is often an urgent need for reliable data processing and communication capabilities. Micro mobile data centers can be quickly transported and set up in remote or disaster-stricken areas, providing essential applications such as communications, logistics, and data management.

Regional Insights

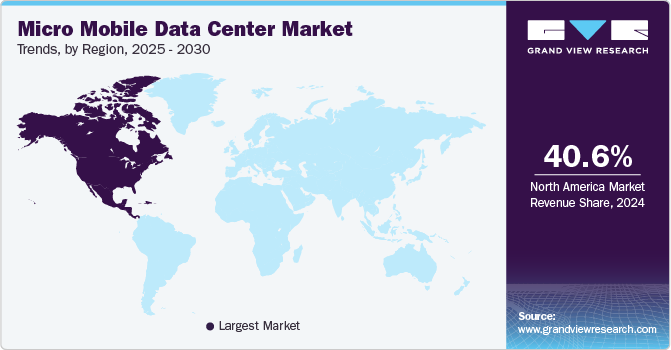

North America dominated the micro mobile data center market with the largest revenue share of 40.6% in 2024. The integration of artificial intelligence (AI) and machine learning (ML) technologies is another notable trend shaping the micro mobile data center landscape in North America. As businesses seek to leverage AI and ML for predictive analytics, automation, and enhanced decision-making, the need for localized data processing capabilities becomes paramount. Micro mobile data centers enable organizations to run AI and ML algorithms closer to the data source, ensuring faster processing times and real-time insights.

U.S. Micro Mobile Data Center Market Trends

The micro mobile data center market in the U.S. is expected to grow at a significant CAGR of 15.6% from 2025 to 2030. The growing adoption of cloud computing has created a surge in data storage and processing requirements. MMDCs offer scalable and flexible infrastructure enterprise sizes, allowing businesses to efficiently handle fluctuating workloads. This adaptability is particularly advantageous for small and medium-sized enterprises (SMEs) seeking to avoid the capital expenditure and operational costs associated with traditional data centers.

Europe Micro Mobile Data Center Market Trends

The micro mobile data center market in Europe is anticipated to grow at a significant CAGR from 2025 to 2030. Sustainability is becoming a key focus for many European organizations, leading to increased interest in energy-efficient and sustainable technologies. Micro mobile data centers, designed for optimal energy consumption, align well with these sustainability goals. These units often incorporate advanced cooling systems, renewable energy sources, and energy-efficient rack units to reduce their carbon footprint and operational costs.

The UK micro mobile data center market is expected to grow at a rapid CAGR during the forecast period. As data privacy and cybersecurity concerns continue to grow, organizations in the UK are increasingly prioritizing secure data management enterprise sizes. Micro mobile data centers can be equipped with advanced security features, such as encryption, access controls, and threat detection systems, to protect sensitive data. This trend is particularly critical in industries such as finance, healthcare, and government, where compliance with data protection regulations is essential

The micro mobile data center market in Germany held a substantial market share in Europe in 2024. The need for flexible, temporary IT enterprise sizes is driving the adoption of micro mobile data centers across various industries in Germany. Businesses often require quick deployment of data infrastructure for temporary projects, events, or field operations. Micro mobile data centers offer the versatility needed to establish IT capabilities in remote locations or during events without the need for permanent installations.

Asia Pacific Micro Mobile Data Center Market Trends

The micro mobile data center market in Asia Pacific is anticipated to grow at a significant CAGR of 19.0% from 2025 to 2030. Asia Pacific is experiencing rapid digital transformation and urbanization, particularly in countries like China, India, and Southeast Asian nations. As urban populations grow, so does the demand for reliable and scalable data infrastructure to support smart city initiatives, e-commerce, and mobile applications. Micro mobile data centers are increasingly seen as an effective enterprise size for addressing the challenges associated with high data traffic and connectivity in urban environments. Their compact size and modular design allow for easy deployment in densely populated areas, facilitating the development of localized data processing capabilities.

The Japan micro mobile data center market is expected to grow at a rapid CAGR during the forecast period. The Japanese government has been actively promoting digital transformation and the development of smart cities as part of its economic revitalization strategy. This includes investments in advanced infrastructure, such as micro mobile data centers, which play a crucial role in supporting the technology backbone of smart cities. By facilitating real-time data processing and analytics, micro mobile data centers enable better management of urban resources, transportation systems, and public safety.

The micro mobile data center market in China held a substantial market share in Europe in 2024. Chinese organizations are increasingly adopting hybrid and multi-cloud strategies to optimize their IT infrastructure and enhance flexibility in data management. Micro mobile data centers play a vital role in these strategies by providing localized processing power that complements cloud applications. Businesses can leverage micro mobile data centers to manage workloads that require real-time processing or data sovereignty, ensuring compliance with local regulations while maintaining access to cloud resources.

Key Micro Mobile Data Center Company Insights

Key players operating in the global market includeSchneider Electric, Dell, Inc., Vertiv Group Corp., and IBM Corporation. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key Micro Mobile Data Center Companies:

The following are the leading companies in the micro mobile data center market. These companies collectively hold the largest market share and dictate industry trends.

- Dell, Inc.

- Eaton

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Panduit Corp.

- Rittal GmbH & Co.

- Schneider Electric

- Vertiv Group Corp.

- Zella DC

Recent Developments

The following are some instances of such initiatives.

-

In October 2024, Zella DC introduced the Zella Outback, an outdoor micro data center tailored for edge computing and optimized for performance in challenging environments. This innovative enterprise size boasts several environmental advantages, including enhanced insulation and modular panels that facilitate easier maintenance and quick replacements during extreme weather conditions. It also features improved security measures, such as upgraded access control with remote pin management and multi-factor authentication, alongside optional fireproofing and a reinforced condenser cage. The Zella Outback is part of a diverse portfolio of micro data center enterprise sizes, all integrated with the Zella Sense intelligence and automation platform.

-

In November 2022, Schneider Electric launched the EcoStruxure Micro Data Center R-Series 42U Medium Density, further enhancing its ruggedized Micro Data Center offerings. This initiative is designed to provide IT professionals and enterprise size providers with a complete, pre-integrated enterprise size that simplifies the ordering and deployment process, ultimately improving operational efficiency.

Micro Mobile Data Center Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.34 billion |

|

Revenue forecast in 2030 |

USD 13.98 billion |

|

Growth rate |

CAGR of 17.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report rack unit |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Rack unit, enterprise size, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

Dell, Inc.; Eaton; Hewlett Packard Enterprise Development LP; Huawei Technologies Co.; Ltd.; IBM Corporation; Panduit Corp.; Rittal GmbH & Co.; Schneider Electric; Vertiv Group Corp.; Zella DC |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Micro Mobile Data Center Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global micro mobile data center market report based on rack unit, enterprise size, application, end-use, and region.

-

Rack Unit Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up To 20 RU

-

20 - 40 RU

-

Above 40 RU

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium-sized Enterprises (SMEs)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Disaster Recover & Emergency Response

-

Remote & Temporary Operations

-

Edge Computing

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT and Telecom

-

Government and Defense

-

Oil & Gas

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global micro mobile data center market size was estimated at USD 5.48 billion in 2024 and is expected to reach USD 6.34 billion in 2025.

b. The global micro mobile data center market is expected to grow at a compound annual growth rate of 17.1% from 2025 to 2030 to reach USD 13.98 billion by 2030

b. The micro mobile data center market in North America held a share of over 40.0% in 2024. The integration of artificial intelligence (AI) and machine learning (ML) technologies is another notable trend shaping the micro mobile data center landscape in North America.

b. Some key players operating in the micro mobile data center market include Dell, Inc., Eaton, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., IBM Corporation, Panduit Corp., Rittal GmbH & Co., Schneider Electric, Vertiv Group Corp., and Zella DC

b. Key factors driving the market growth include the increasing adoption of IoT devices and 5G technology has amplified the need for localized data storage and processing, making micro data centers more relevant.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."