MICE Market Size, Share & Trends Analysis Report By Event Type (Meetings, Incentives, Conferences), By Booking Mode (Direct Booking, Online Travel Agents & Agencies (OTAs), Destination Management Companies (DMCs)), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-999-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

MICE Market Size & Trends

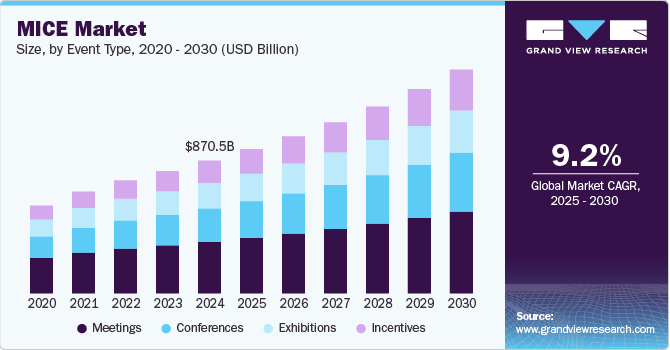

The global MICE market size was estimated at USD 870.46 billion in 2024 and is expected to grow at a CAGR of 9.2% from 2025 to 2030. MICE travel is a division of the travel and tourism market in which people travel for business-oriented purposes that include meetings, incentives, conferences, and exhibitions (MICE). MICE seeks to unite top professionals from every industry in an enhanced, tailor-made hospitality setting a rise in the number of companies offering MICE services across the globe is favoring the market growth. The COVID-19 pandemic increased the demand for virtual and hybrid events.

As companies expand their international footprint, the need for cross-border collaboration has intensified, leading to a surge in corporate meetings, training sessions, and client events. Major financial and commercial hubs like Singapore and Dubai have emerged as preferred destinations for large-scale conferences and exhibitions, offering world-class venues and seamless connectivity. Furthermore, organizations are increasingly adopting incentive travel programs to reward top performers, foster team bonding, and enhance employee motivation. Luxury resorts in destinations such as the Maldives and cultural capitals like Paris are frequently selected for these experiential reward programs, contributing to the growth of MICE tourism. Governments and tourism boards have also recognized the economic potential of MICE travel and are actively investing in infrastructure development.

Notable examples include the Abu Dhabi National Exhibition Centre and AsiaWorld-Expo in Hong Kong, which have bolstered regional tourism and positioned these cities as global MICE destinations. Additionally, the integration of advanced event management technologies and hybrid event formats has further expanded the reach of conferences and exhibitions, making them accessible to a broader audience. High-profile events such as the Consumer Electronics Show (CES) in Las Vegas and the Mobile World Congress in Barcelona exemplify how the MICE sector fosters knowledge exchange, innovation showcases, and strategic networking opportunities. With continuous investments in modern infrastructure and supportive government policies, the MICE travel market is poised for sustained growth, underscoring its essential role in facilitating global business collaboration and

The significant improvement in the use of technology for MICE events is bolstering MICE industry growth. With hybrid and virtual events for meetings, incentives, conferences, and exhibitions being the only option during the COVID-19 period, several companies turned to this medium for all events. They preferred not to spend on offline events and earn profits instead. This online shift eliminated many traditional costs, such as transport, food, and venue rental, costing these businesses enormous amounts in lost opportunities. Since the early 20th century, MICE travel has evolved tremendously with the emergence of the internet and smartphones.

The availability of unlimited apps specifically designed to suit the needs of different kinds of travelers has increased awareness about the MICE of various nations and has made the entire process easier and more exciting. These travel apps and websites help explore new ways to travel in luxury. The advent of the internet, various technologies, and digital intermediaries in the travel distribution sector has resulted in the introduction of agents. These serve as online travel shopbots, which frequently make current industry intermediaries more exposed, particularly to information and infrastructure. The rising millennial workforce is driving the demand for bleisure travel, which is likely to favor the market growth.

Consumer Survey & Insights

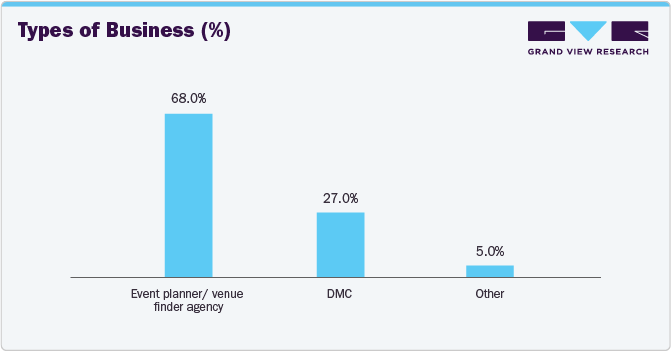

According to the Kent MICE survey conducted in 2023, which involved event planner agencies, destination management companies (DMCs), and other stakeholders in the MICE industry, data was collected through an online survey distributed to DMCs and buyers in the incentive and business events market. After removing duplicates and test submissions, the final sample size consisted of 22 businesses. Most participants identified as event planners or venue-finding agencies, with 27% classified as DMCs. Nearly all respondents (96%) operated within the corporate/business events market.

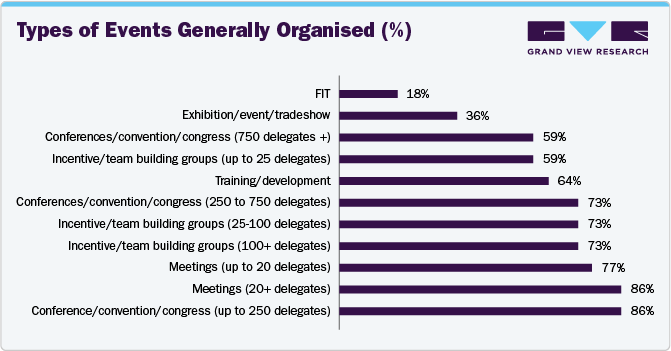

The Kent MICE survey revealed that the manufacturing industry had the highest representation, with the manufacturing, creative, and digital sectors being the most active. Respondents were asked about the types of events they typically organize. Excluding FIT, exhibitions, and trade shows, most organizations reported a diverse range of MICE events. Conferences and conventions, as well as meetings with up to 250 delegates, were the most common (86%), followed by smaller meetings (77%), incentive/team-building groups (73%), and training/development events (64%).

Event Type Insights

Meetings accounted for a revenue share of 38.9% of the overall MICE industry in 2024, driven by the rising number of business events globally. Some types include shareholder meetings, management meetings, and general meetings. A rise in the popularity of regional destinations coupled with less densely populated tier cities is also driving the demand for meetings in such regions. For instance, several governments offer grants to encourage business events and travel. The Australian government announced USD 50 million for the MICE industry to apply for grants that cover up to 50% of their expenses.

Demand for incentives service in the overall MICE industry is set to grow at a CAGR of 10.8% from 2025 to 2030. The rise in demand for offbeat travel experiences among millennials is driving the incentive travel segment’s growth. Incentives are termed travel rewards offered by organizations to their teams, staff, partners, and affiliates to show support and appreciation to boost their morale. The rise in demand for traveling among millennials has compelled companies to look for exciting destinations that are easily accessible. In addition, the growing trend of tailor-made programs by organizations is also supporting the growth of leisure travel.

Booking Mode Insights

Booking of MICE service through direct booking accounted for a revenue share of 39.8% in 2024, driven by the ease of online platforms, cost-effectiveness, personalized services, and the ability for clients to tailor their bookings to specific needs. Additionally, advancements in technology and the increased reliability of direct booking systems played a significant role. Direct booking refers to when event planners or corporate clients book MICE services directly with the service provider without any intermediaries. This includes contacting hotels, conference centers, or venues directly to arrange accommodations, meeting spaces, and related services. Direct booking typically happens through the venue's sales team, website booking engines, or dedicated corporate booking portals. Many large hotel chains and convention centers have specialized MICE departments that handle direct inquiries.

Booking of MICE services through online travel agents (OTAs) in the overall MICE industry is expected to grow at a CAGR of 11.0% from 2025 to 2030. Increasing digitalization and the widespread adoption of online platforms make booking through OTAs more accessible and convenient. The cost-effectiveness and competitive pricing offered by OTAs attract more businesses seeking budget-friendly options. Additionally, the ability of OTAs to provide comprehensive and customizable booking solutions, coupled with advancements in technology and user-friendly interfaces, enhances the overall experience, encouraging more organizations to utilize their services.

Regional Insights

The North America MICE market accounted for a revenue share of 16.2% in 2024. The increasing globalization of businesses has led to a rise in international conferences and events, boosting demand for meeting spaces and services. Additionally, advancements in transportation infrastructure have made travel more convenient and efficient, further encouraging organizations to host events in the region. The robust economic environment and the presence of world-class facilities and venues also contribute to the market's growth. Furthermore, technological innovations and the integration of hybrid event solutions have enhanced the appeal of the MICE industry in North America, attracting more international participants and fostering industry expansion.

U.S. MICE Market Trends

The MICE market in U.S. is expected to grow significantly from 2025 to 2030. A rise in business travel and high demand for business leisure trips is anticipated to drive this growth. For instance, as per an American Express Survey, 75% of travelers are interested in business travel. Work training, networking, and conferences propel consumers to opt for business travel.

Europe MICE Market Trends

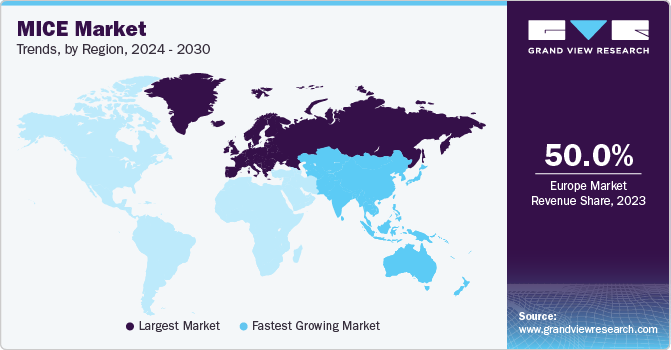

The MICE market in Europe accounted for a revenue share of 50.4% of the global revenue in 2024. The regional market is growing rapidly, with a beneficial impact on the growth of enterprises, communities, and destinations. As the penetration of MICE events increases in Europe, resorts in the region are adapting to specialized MICE hotel locations and services. This diversification of hotel operations provides a greater advantage for MICE reservations. European companies have been reconsidering corporate travel policies and introducing new expense technologies to respond to shifting economic and workforce situations. For instance, Europe Incoming- a provider of hotels, European tours, and ground services- offers specialized MICE tour bookings.

Asia Pacific MICE Market Trends

The Asia Pacific MICE industry is expected to grow at a significant CAGR from 2025 to 2030. The expansion of the MICE sector has the potential to significantly boost economic growth, interregional collaboration, and intellectual progress. The rapid rise of SMEs, the expansion of corporate industries, and the globalization of businesses have all led to a significant increase in the aforementioned activities. Along with an increase in business travel, business travelers’ changing travel habits toward leisure travel, rapid urbanization, and rising disposable incomes are important drivers that support the market expansion.

Key MICE Company Insights

The MICE market is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in this market are Global Air-American Express Travel Services (Global Business Travel Group, Inc.), CWT Meetings & Events, BCD Meetings & Events, Maritz, Conference Care, and others.

-

CWT Meetings & Events is a global leader in the MICE (Meetings, Incentives, Conferences, and Exhibitions) market. The company offers end-to-end services, including incentive travel, venue sourcing, strategic meetings management, and more. Their expertise spans various sectors, such as life sciences, automotive, and high tech, providing innovative and sustainable event solutions.

-

BCD Meetings & Events is another prominent player in the MICE industry. It focuses on delivering creative and impactful solutions for meetings and events, emphasizing cost control and personalization. Their services include event planning, logistics, and strategic meetings management. BCD M&E is known for its comprehensive industry insights and trend reports, helping clients stay ahead in the evolving MICE landscape.

Key MICE Companies:

The following are the leading companies in the meetings, incentives, conferences, and exhibitions (MICE) market. These companies collectively hold the largest market share and dictate industry trends.

- Global Air-American Express Travel Services (Global Business Travel Group, Inc.)

- CWT Meetings & Events

- BCD Meetings & Events

- Maritz

- Conference Care

- ATPI Ltd.

- FCM Meetings & Events

- Global Cynergies, LLC

- Capita plc

- AVIAREPS AG

- ITL World Company (MICEMINDS)

- Questex

- Beyond Summits

- American Express Global Business Travel (GBT)

- Meetings and Incentives Worldwide, Inc.

- One10, LLC

- Creative Group, Inc.

- Cambria DMC

- Carlson Wagonlit Travel

- Ci Events

View a comprehensive list of companies in the MICE Market

Recent Developments

-

In November 2024, Dubai Business Events (DBE), part of the Dubai Department of Economy and Tourism, launched the second edition of its MICE Star Awards program to recognize and celebrate the performance of MICE intermediaries in India. Following a strong response earlier this year, eight intermediaries were rewarded for their advocacy for Dubai. This edition will evaluate intermediaries' performance from 1 October 2024 to 30 September 2025, considering the volume and value contribution to Dubai's business events and tourism ecosystem.

-

In September 2024, Langham Hotels Group and HXE announced their collaboration to develop new global MICE venue online booking services. Starting in September, companies in China and Asia can book conferences and events at Langham hotels worldwide through HXE. This partnership marks a significant step in the digital transformation of the MICE industry.

MICE Market Report Scope

|

Report Attribute |

Details |

|

Market revenue in 2025 |

USD 945.59 billion |

|

Revenue forecast in 2030 |

USD 1,466.94 billion |

|

Growth rate |

CAGR of 9.2% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion/trillion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Event type, booking mode, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Austria; Netherlands; China; Japan; India; Australia; Brazil; South Africa; UAE |

|

Key companies profiled |

Global Air-American Express Travel Services (Global Business Travel Group, Inc.); CWT Meetings & Events; BCD Meetings & Events; Maritz; Conference Care; ATPI Ltd.; FCM Meetings & Events; Global Cynergies, LLC; Capita plc; AVIAREPS AG; ITL World Company (MICEMINDS); Questex; Beyond Summits; American Express Global Business Travel (GBT); Meetings and Incentives Worldwide, Inc.; One10, LLC; Creative Group, Inc.; Cambria DMC; Carlson Wagonlit Travel; Ci Events |

|

Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global MICE Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global MICE market report based on event type, booking mode, and region:

-

Event Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Meetings

-

Incentives

-

Conferences

-

Exhibitions

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Online Travel Agents and Agencies (OTAs)

-

Destination Management Companies (DMCs)

-

Travel Management Companies (TMCs)

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Austria

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global MICE market was estimated at USD 870.46 billion in 2024 and is expected to reach USD 945.59 billion in 2025.

b. The global MICE market is expected to grow at a compound annual growth rate of 9.2% from 2025 to 2030, reaching USD 1,466.94 billion by 2030.

b. Europe dominated the MICE market, with a share of 50.4% in 2024. The regional growth is driven by its beneficial impact on the growth of enterprises, communities, and destinations. As the penetration of MICE events increases in Europe, resorts in the region are adapting to specialized MICE hotel locations and services.

b. Some of the key players operating in the MICE market include Global Air-American Express Travel Services (Global Business Travel Group, Inc.); CWT Meetings & Events; BCD Meetings & Events; Maritz; Conference Care; ATPI Ltd.; FCM Meetings & Events; Global Cynergies, LLC; Capita plc; AVIAREPS AG; ITL World Company (MICEMINDS); Questex; Beyond Summits; American Express Global Business Travel (GBT); Meetings and Incentives Worldwide, Inc.; One10, LLC; Creative Group, Inc.; Cambria DMC; Carlson Wagonlit Travel; and Ci Events.

b. The growth of the global MICE market is primarily driven by globalization, increasing business activities, technological advancements, and the growing demand for professional development and networking.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."