- Home

- »

- Communication Services

- »

-

Mexico Super Apps Market Size, Share, Trends, Report, 2030GVR Report cover

![Mexico Super Apps Market Size, Share & Trends Report]()

Mexico Super Apps Market (2024 - 2030) Size, Share & Trends Analysis Report By Application, By End-user (Businesses, Consumers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-191-4

- Number of Report Pages: 88

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

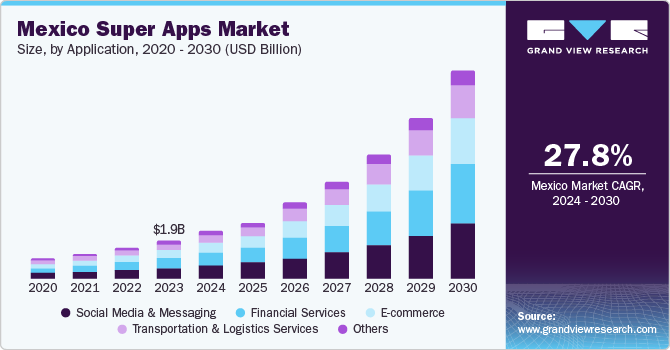

The Mexico super apps market size was valued at USD 1.89 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 27.8% from 2024 to 2030. The growth of the market is attributed to the rapid advancements in digital technologies and the increasing adoption of smartphones. Smartphones have become an essential part of people's lives, offering access to a multitude of services and functionalities at their fingertips. With the increasing affordability and availability of smartphones, a larger portion of the population now has the means to own and use these devices. This has created a massive user base for super apps. Super apps allow users to access multiple services and perform various tasks without switching between different apps. For instance, users can chat with friends, make payments, order food, book tickets, shop online, and more, all within a single app.

Key industry participants in the Mexico super apps market include Rappi Inc.; PicPay Instituição de Paço S/A; Baz Súperapp, S.A. de C.V.; and Kakao Corp. The market is consolidated, with few players dominating the market. Key players are focusing on new product launches, partnerships & collaborations, and expansion of their regional presence. For instance, in August 2023, PicPay Instituiçao de Paço S/A announced that it inaugurated a new business unit dedicated to investments. To support this new business unit, the company also launched new fixed-income products on its app, including Real Estate and Agribusiness Credit Letters (LCIs and LCAs) as well as Bank Deposit Certificates (CDBs) issued by third parties, both in pre-and post-fixed formats.

Market Concentration & Characteristics

Mexico's super apps have demonstrated a high degree of innovation. These platforms often integrate multiple services into a single app, offering users a seamless and convenient experience. Features such as mobile payments, ride-hailing, food delivery, and more are commonly integrated, showcasing a forward-thinking approach to meeting diverse user needs.

While there is a considerable level of innovation, the pace of product and service launches in Mexico's Super App market can be considered medium. These platforms continuously introduce new features and functionalities, but the rate may not be as rapid as in some other highly dynamic tech markets. The focus seems to be on refining existing services and ensuring a stable user experience.

The impact of regulations is high in Mexico's Super App landscape. Government regulations and policies, especially in sectors like finance and transportation, significantly influence the operations of these platforms. Compliance with local laws and adapting to regulatory changes are crucial factors that shape the business strategies of Super Apps in Mexico.

The availability of direct substitutes for the comprehensive services offered by Super Apps in Mexico is relatively low. While individual services like ride-hailing or food delivery may have standalone competitors, the integrated nature of Super Apps, combining various services in one platform, creates a unique value proposition that is not easily replicated by standalone alternatives.

Super Apps in Mexico tend to have a high concentration of end users. These platforms aim to become an essential part of users' daily lives by offering a wide range of services. This high user concentration is often leveraged to cross-sell and upsell additional services within the Super App ecosystem, creating a strong and loyal user base.

Application Insights

Social media & messaging application led the market and accounted for 27.2% of the total revenue in 2023. Entertainment apps across categories such as communication, social media, and gaming are among the most used varieties of apps. Users also spend the most time on social media apps; thus, super apps generate most of their revenue through this application segment. Social media and messaging applications typically serve as communication hubs, offering features such as text messaging, voice and video calls, and multimedia sharing. This communication-centric approach has been a key driver of user engagement, making these apps an integral part of daily life for many Mexicans.

The high level of user engagement associated with social media and messaging applications contributes significantly to user retention within super apps. By offering features that facilitate social connections and communication, these platforms increase the stickiness of the overall app, encouraging users to stay within the ecosystem for longer periods. The influence of social media and messaging applications is a defining factor in the Mexico super apps market. These platforms not only serve as communication tools but also act as catalysts for the integration of diverse services, shaping the landscape of digital interactions and service consumption in the country.

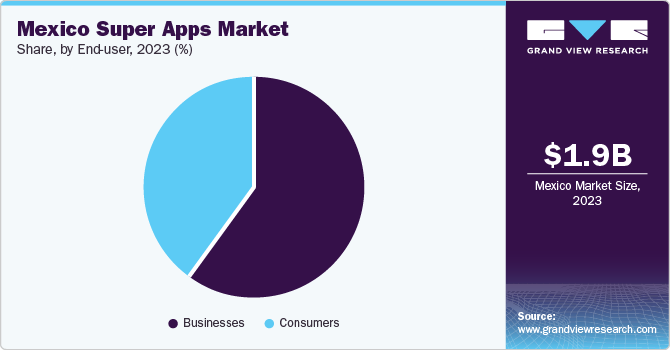

End User Insights

Business end user accounted for largest market revenue share in 2023. Businesses utilize super apps to access financial services and implement advertising strategies. In Mexico, where the consumer base is highly diverse, companies often encounter challenges in customer acquisition. In addition, global restrictions on third-party data sharing may further make it hard for businesses to reach new customers. Super apps present an attractive solution by offering in-app advertising platforms. Businesses can use these platforms to attract and engage customers, making them a valuable tool in overcoming these challenges.

Consumer end user is expected to register the fastest CAGR during the forecast period. The increasing consumer preference for online shopping, coupled with the assurance of secure payment methods and convenient doorstep delivery, is expected to increase the adoption of super apps among consumers. Furthermore, emerging trends in adventure tourism and art tourism are likely to boost the demand for super apps, particularly for flight and hotel bookings. These apps are becoming essential tools for travelers seeking a streamlined and comprehensive solution for planning and booking their trips.Super apps in Mexico primarily attract a tech-savvy urban population. Residents of major cities, such as Mexico City, Monterrey, and Guadalajara, where digital infrastructure is well-established, form a significant portion of the user base. These consumers are accustomed to using technology for various aspects of their lives.

Key Mexico Super Apps Company Insights

Some of the key players operating in the market include Rappi Inc.; PicPay Instituição de Paço S/A;. de C.V.; and Kakao Corp

-

Mercado Libre is a leading e-commerce platform provider in Latin America and is actively used across 18 countries. The company offers a comprehensive range of services for digital and offline commercial transactions. Through its e-commerce platform, the company creates a secure environment for buyers and sellers, fostering a thriving e-commerce community in the region with rapid internet penetration and e-commerce growth.

-

Rappi Inc. is a Latin American tech company that offers a platform to enable consumers to order groceries, food, and pharmacy items. Furthermore, users can send money to others or request a courier to withdraw cash from the user’s bank account or an ATM and have it delivered to their location. The company serves more than 35 million customers in Argentina, Brazil, Chile, Colombia, Costa Rica, Ecuador, Mexico, Peru, and Uruguay.

-

Yummy Inc, and Baz Súperapp, S.A are some of the emerging market participants in the Mexico Super Apps Market.

-

Yummy specializes in creating a food delivery application serving the Latin American region. The application enables users to conveniently place and pay for their orders via the mobile app or website platform. It provides diverse payment options, including international credit cards and cash, allowing users the flexibility to enjoy their selected meals at a location of their preference.

-

Baz Súperapp is an information technology company that provides a mobile application with multiple features of digital transactions.

Key Mexico Super Apps Companies:

The following are the leading companies in the Mexico super apps market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these Mexico super apps companies are analyzed to map the supply network.

- Rappi Inc.

- Baz Súperapp, SA de CV

- Ant Group Co., Ltd.

- LINE Plus Corporation

- Kakao Corp

- Tencent Holdings Ltd.

- MercadoLibre SRL

- Merqueo SAS

- Banco Inter S.A.

- Meta

- Revolut Ltd.

- PicPay Instituição de Paço S/A

- Yummy Inc.

Recent Developments

-

In July 2023, Z Holdings Corporation, which includes LINE Plus Corporation and Yahoo Japan, entered into an enterprise agreement with OpenAI to use all of OpenAI's APIs, including GPT-4, in an effort to enhance operational productivity, service quality, and the development of new services. Approximately 20,000 employees across these companies have access to an original chat-type AI assistant service based on these APIs, with stringent security and privacy measures in place to ensure safe internal use.

-

In February 2023, Banco Inter S.A. announced that it had acquired YellowFi, a fund manager and mortgage originator, to expand its product offerings in the U.S. This acquisition would allow Banco Inter S.A. to add real estate investing to its ecosystem and provide complementary capabilities to its growing base of clients. Through the YellowFi managed fund, YellowFi would also enable the company’s clients to invest in the U.S. real estate sector

-

In August 2022, PicPay Instituiçao de Paço S/A announced its partnership with Google Pay, a digital wallet and payment platform offered by Google LLC. This collaboration would expand the acceptance of PicPay Instituiçao de Paço S/A as a payment method and provide an alternative for Uber users who do not have access to traditional credit cards. By offering a convenient and accessible payment solution, the partnership aimed to enhance the user experience and cater to a broader audience.

Mexico Super Apps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.36 billion

Revenue forecast in 2030

USD 10.27 billion

Growth Rate

CAGR of 27.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-user

Key companies profiled

Rappi Inc., Baz Súperapp, SA de CV, Ant Group Co., Ltd., LINE Plus Corporation, Kakao Corp, Tencent Holdings Ltd., MercadoLibre SRL, Merqueo SAS, Banco Inter S.A., Meta, Revolut Ltd., PicPay Instituição de Paço S/A

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Super Apps Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Mexico super apps market report based on application, and end-user.

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Financial Services

-

Transportation & Logistics Services

-

E-commerce

-

Social Media & Messaging

-

Others

-

-

End User Outlook (Revenue, USD Million, 2017 - 2030)

-

Businesses

-

Consumers

-

By Age

-

Below 18 years

-

18 - 25 years

-

26 - 34 years

-

35 - 50 years

-

Above 50 years

-

-

By Genders

-

Male

-

Female

-

-

-

Frequently Asked Questions About This Report

b. The Mexico super apps market size was estimated at USD 1.89 billion in 2023 and is expected to reach USD 2.36 billion in 2024.

b. The Mexico super apps market is expected to grow at a compound annual growth rate of 27.8% from 2024 to 2030 and reach USD 10.27 billion by 2030.

b. Social media & messaging application led the market and accounted for 27.2% of the total revenue in 2023. Entertainment apps across categories such as communication, social media, and gaming are among the most used varieties of apps. Users also spend the most time on social media apps; thus, super apps generate most of their revenue through this application segment.

b. Some of the key players operating in the market include Rappi Inc., Baz Súperapp, SA de CV, Ant Group Co., Ltd., LINE Plus Corporation, Kakao Corp, Tencent Holdings Ltd., MercadoLibre SRL, Merqueo SAS, Banco Inter S.A., Meta, Revolut Ltd., and PicPay Instituição de Paço S/A .

b. The proliferation of smartphones and rollout of high-speed internet networks, and the Growing popularity of e-commerce are key factors driving the growth of the Mexico Super Apps Market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.