- Home

- »

- Consumer F&B

- »

-

Mexico Pet Supplements Market Size & Share, Report, 2030GVR Report cover

![Mexico Pet Supplements Market Size, Share & Trends Report]()

Mexico Pet Supplements Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, Pet Type (Dogs, Cats), By Form, By Supplement Type, By Application, By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-464-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mexico Pet Supplements Market Trends

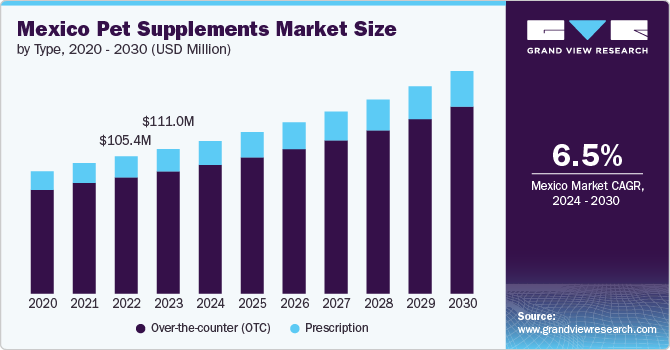

The Mexico pet supplements market size was estimated at USD 111.0 million in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030. The rising demand for pet supplements in Mexico can be attributed to rise in pet humanization which has led to consumers spending significantly on pet food, supplements, and other related products to keep them active, and healthy. Additionally, the increasing awareness about the benefits of pet supplements, such as improved joint health, better digestion, and enhanced immune systems, has further fueled demand. Another key driver is the rising number of aging pets, leading to higher demand for supplements that address age-related health issues like mobility and cognitive function.

One of the prominent trends in the Mexican pet supplements market is the increasing demand for natural and organic products. Pet owners are becoming more health-conscious and prefer supplements with clean labels, free from artificial additives and chemicals. Another trend is the growing popularity of functional supplements, such as probiotics, prebiotics, and digestive enzymes, which target specific health concerns like gut health and immunity. Additionally, there is a rising preference for chewable supplements and other convenient forms, as they make administering supplements easier for pet owners. E-commerce is also on the rise, with more pet owners turning to online platforms for purchasing supplements due to convenience and wider product selection.

Manufacturers in the Mexican pet supplements market are responding to the growing demand by introducing new formulations and innovative products. For example, many companies are expanding their product lines to include supplements targeting specific health issues, such as digestive health, skin and coat care, and joint support. There is also a significant focus on developing natural and organic supplements to cater to the growing consumer preference for clean-label products. Additionally, manufacturers are leveraging advanced technologies to create more palatable and easy-to-administer forms, such as chewables, powders, and liquids, enhancing user convenience.

To meet the increasing demand, companies are also expanding their distribution networks, especially through online channels, to reach a broader customer base. Partnerships with veterinarians and pet stores are becoming more common to ensure product credibility and boost sales through expert recommendations. As pet owners become more educated about their pets' health, manufacturers are emphasizing transparency and detailed labeling to build trust and foster brand loyalty.

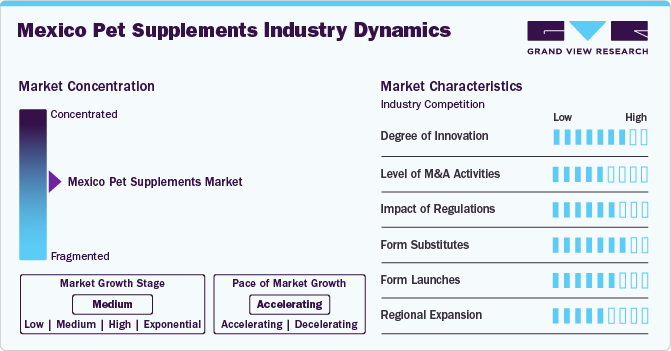

Market Concentration & Characteristics

The degree of innovation in the Mexico pet supplements market is high, driven by growing consumer demand for specialized, effective, and convenient products. Manufacturers are focusing on developing targeted supplements that address specific health concerns, such as digestive health, joint support, and skin and coat improvement. Innovations also include natural and organic formulations, reflecting a global trend towards cleaner, more sustainable products. In addition, advancements in product forms-such as chewables, liquids, and powders-make it easier for pet owners to administer supplements. Technological innovations in manufacturing processes, such as improved bioavailability of ingredients, have further enhanced product effectiveness, driving market growth.

Regulations play a crucial role in the pet supplements market in Mexico, as they help ensure the safety and efficacy of products available to consumers. The Mexican government and relevant regulatory bodies have established guidelines for the labeling, formulation, and marketing of pet supplements, similar to human nutraceuticals. Compliance with these regulations is critical, as non-compliance can result in product recalls, fines, or loss of consumer trust. However, the regulatory environment is evolving, with increased scrutiny on claims made by supplement manufacturers.

The pet supplements market in Mexico faces some competition from alternative products, such as fortified pet foods and functional treats that claim to offer similar health benefits. Many pet owners opt for premium pet foods that contain added vitamins, minerals, and other beneficial nutrients, reducing the need for standalone supplements. Additionally, veterinary-prescribed medications for specific health issues like joint pain or digestive disorders can serve as substitutes for certain supplements. While these alternatives are popular, pet supplements maintain their relevance by offering higher concentrations of specific nutrients or targeting niche health concerns more effectively. However, competition from these substitute products forces supplement manufacturers to differentiate through innovation, quality, and efficacy.

Type Insights

Over the Counter (OTC) pet supplements accounted for a revenue share of 84.5% in 2023. due to their accessibility and convenience for pet owners. Many pet owners prefer OTC products as they don't require a prescription, making it easier to address their pets' immediate health needs. Additionally, the availability of a wide range of OTC supplements for various health concerns, such as skin, coat, and joint issues, contributes to their popularity. OTC products are often perceived as effective and affordable, making them a go-to option for routine pet care in Mexico.

Prescription pet supplements are expected to grow at a CAGR of 7.0% from 2024 to 2030, due to the increasing awareness among pet owners about specific health conditions that require medical guidance. As more veterinarians prescribe specialized supplements for chronic issues like arthritis, digestive problems, or cardiovascular health, the demand for prescription-based products is rising. These supplements often contain higher potency or unique ingredients that are not available OTC, driving their growth as pet owners seek targeted treatments for their pets' health conditions.

Pet Type Insights

Dog pet supplements accounted for a revenue share of 64.5% in the Mexico pet supplements market in 2023 due to the country's large dog ownership base and the growing trend of treating dogs as part of the family. Many dog owners invest in supplements to improve their pets' quality of life, addressing common concerns like joint health, skin issues, and overall vitality. The higher level of care provided to dogs, combined with their larger population compared to other pets, drives the dominance of dog-specific supplements in the market.

On the other hand, the cat pet supplements market is expected to grow with a CAGR of 7.4% from 2024 to 2030, as more cat owners in Mexico become aware of their pets' specific health needs. Historically, cat owners may have been less likely to use supplements, but growing trends toward preventative healthcare and the rising popularity of indoor cats have increased the focus on feline-specific products. Cats often require different formulations than dogs, particularly for issues like urinary health, which has led to increased demand for specialized cat supplements.

Form Insights

Chewable pet supplements accounted for a revenue share of 64.7% in 2023 in the Mexico pet supplements market. Many pet owners prefer chewable supplements as they can be given to pets as a treat, making it easier to ensure consistent dosing. Dogs, in particular, are more likely to consume chewable forms readily, reducing the struggle that sometimes accompanies liquid or powder supplements. The convenience of chewables has contributed to their widespread adoption across the market.

The powdered pet supplements market is expected to grow at a CAGR of 7.2% from 2024 to 2030 in Mexico because of their versatility and ease of mixing with pet food. Powdered supplements often provide a broader range of nutrients and are favored by pet owners looking for more customizable solutions. They are especially useful for multi-pet households or pets with specific dietary needs. Additionally, powdered forms can be more cost-effective and are increasingly sought after by health-conscious pet owners.

Supplement Type Insights

Multivitamin pet supplements accounted for a revenue share of 41.3% in 2023 in the Mexico pet supplements market, as they offer a comprehensive solution for general pet health. Many pet owners use multivitamins to ensure their pets receive a balanced array of essential nutrients, especially if their diet may be lacking. These supplements address multiple health concerns, including skin, coat, and immune support, making them a popular choice for maintaining overall pet wellness and preventing deficiencies.

The probiotics and digestive enzyme pet supplements market is expected to grow at a CAGR of 6.9% from 2024 to 2030 in Mexico due to the rising awareness of digestive health's role in pets' overall well-being. Many pets suffer from digestive issues, and probiotics are increasingly recommended by veterinarians to improve gut health, enhance nutrient absorption, and address issues like diarrhea or bloating. As more pet owners focus on preventative healthcare, these supplements have gained significant traction in the market.

Application Insights

Hip and joint pet supplements accounted for a revenue share of 21.4% in 2023 in the Mexico pet supplements market, as joint issues, especially in older dogs, are a common concern among pet owners. Products containing glucosamine, chondroitin, and MSM are popular for managing conditions like arthritis and mobility problems. As dogs age, many owners seek supplements to improve their pets' quality of life by alleviating joint pain and enhancing flexibility, making this category a leader in the market.

The Digestive health pet supplements market is expected to grow at a CAGR of 7.1% from 2024 to 2030 in Mexico as pet owners become more aware of the importance of gut health in their pets' overall wellness. Digestive issues such as diarrhea, constipation, and food sensitivities are common, and supplements that promote a healthy gut microbiome are increasingly sought after. Probiotics and fiber-based supplements are gaining popularity as preventative measures to support long-term digestive health.

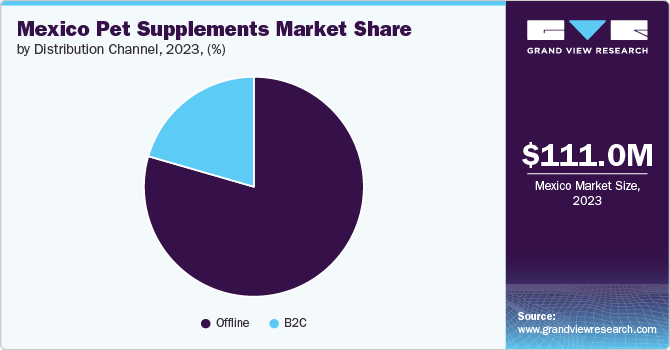

Distribution Channel Insights

Sales through offline distribution channel accounted for a revenue share of 79.4% in 2023 in the Mexico pet supplements market, due to the strong presence of pet stores, veterinary clinics, and supermarkets. Pet owners often prefer purchasing supplements from physical stores, where they can receive guidance from experts, such as veterinarians or store staff. The trust in traditional retail outlets and the ability to see products firsthand drive the dominance of offline channels.

Sales of Mexico pet supplements through online channels are expected to grow with a CAGR of 9.7% from 2024 to 2030, fueled by the increasing adoption of e-commerce. Pet owners are turning to online platforms for convenience, broader product selection, and competitive pricing. The rise of digital shopping platforms, coupled with the ease of home delivery, has accelerated the growth of online sales of pet supplements over the forecast period.

Key Mexico Pet Supplements Company Insights

The Mexico pet supplements market is characterized by the presence of numerous well-established and emerging players. Manufacturers are expanding their portfolios to include a wide variety of pet supplements designed to cater to diverse pet health needs, such as joint support, digestive health, skin and coat care, and immune system enhancement. Leading companies are introducing innovative products that target specific life stages, breeds, or health conditions, such as supplements for aging pets, active dogs, or those with dietary sensitivities. This wide product range allows manufacturers to appeal to different customer segments and address the specific needs of pet owners in Mexico.

Key Mexico Pet Supplements Companies:

- Nestlé S.A (Purina)

- Bimeda Inc.

- Innopharma

- Colgate-Palmolive Company

- Mars Inc.

- Virbac

- Vetoquinol

- Pets Pharma

- Elanco

- Labyes

Recent Developments

-

In April 2023, GrupoNupec launched a new line of specialized diets for dogs and cats that include functional ingredients aimed at improving health. This includes eight new product varieties for dogs and cats, focusing on health issues like digestive health and renal care. This reflects a trend towards integrating health-focused supplements within pet food products.

-

In October 2021, K9 introduced five distinct nutraceutical formulations for dogs to the local market. These include KRES-K, aimed at promoting growth, supporting gestation, and boosting the immune system; Show-K, designed to enhance skin and coat health, assist dogs with cancer, burns, or scarring, and improve the overall nervous system; Bio-K, a probiotic and prebiotic blend targeting sanguinolent gastroenteritis and various forms of diarrhea, such as infectious or osmotic; Geriatri-K, formulated for senior dogs to enhance mobility, mental well-being, and weight management; and Sporty-K, tailored for active dogs to increase vitality, endurance, and fertility.

Mexico Pet Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 117.1 million

Revenue forecast in 2030

USD 170.8 million

Growth rate

CAGR of 6.5% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

7.6Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, pet type, form, supplement type, application, distribution channel

Country scope

Mexico

Key companies profiled

Nestlé S.A (Purina); Bimeda Inc.; Innopharma; Colgate-Palmolive Company; Mars Inc.; Virbac; Vetoquinol; Pets Pharma; Elanco; Labyes

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Pet Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Mexico pet supplements market report on the basis of type, pet type, form, supplement type, application, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Over-the-counter (OTC)

-

Prescription

-

-

Pet Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Pills/Tablets

-

Chewables

-

Powders

-

Others

-

-

Supplement Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Multivitamins

-

Probiotics And Digestive Enzymes

-

Omega-3 Fatty Acids

-

Glucosamine And Chondroitin

-

Antioxidants

-

CBD Supplements

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin & Coat

-

Hip & Joint

-

Digestive Health

-

Immune Support

-

Weight Management

-

Oral/Dental Health

-

Heart Health

-

Cognitive Function

-

Calming/ Anxiety & Stress Relief

-

Muscle & Performance

-

Eye Health

-

Kidney & Liver Support

-

Multivitamins

-

Allergy Relief

-

Urinary Health

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets & Supermarkets

-

Pet Specialty Stores

-

Pharmacy & Drug Stores

-

Convenience Stores

-

Veterinary Clinics

-

Others

-

-

Frequently Asked Questions About This Report

b. The Mexico pet supplements market size was estimated at USD 111.0 million in 2023 and is expected to reach USD 117.1 million in 2024.

b. The Mexico pet supplements market is expected to grow at a compounded growth rate of 6.5% from 2024 to 2030 to reach USD 170.8 million by 2030.

b. Over-the-counter (OTC) pet supplements accounted for 84.5% of revenue in 2023 due to their convenience and accessibility. Pet owners prefer OTC products as they don't require prescriptions, making it easier to address immediate pet health needs. The wide availability of OTC options for common issues like skin, coat, and joint problems adds to their popularity.

b. Some key players operating in Mexico pet supplements market include Nestlé S.A (Purina); Bimeda Inc.; Innopharma; Colgate-Palmolive Company; Mars Inc.; Virbac; Vetoquinol; Pets Pharma; Elanco; Labyes.

b. Key factors that are driving the market growth include the rise in pet humanization which has led to consumers spending significantly on pet food, supplements, and other related products to keep them active, and healthy. Additionally, the increasing awareness about the benefits of pet supplements, such as improved joint health, better digestion, and enhanced immune systems, has further fueled demand

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.