- Home

- »

- Consumer F&B

- »

-

Mexico Flavored Shaved Ice Bars Market Size Report, 2030GVR Report cover

![Mexico Flavored Shaved Ice Bars Market Size, Share & Trends Report]()

Mexico Flavored Shaved Ice Bars Market Size, Share & Trends Analysis Report By Product (Fruity, Creamy, Novelty), By Distribution Channel (Hypermarkets & Supermarkets, Convenience Stores, Specialty Stores, Online), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-490-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

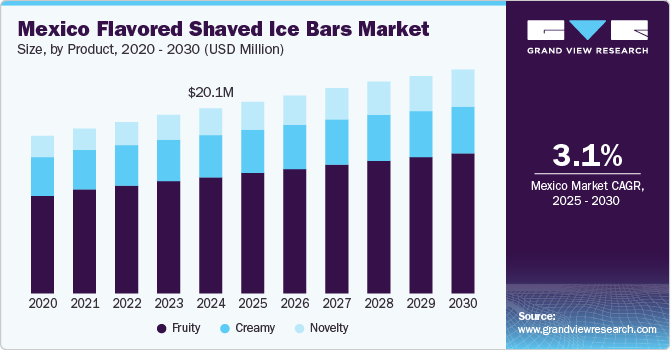

The Mexico flavored shaved ice bars market size was valued at USD 20.1 million in 2024 and is expected to grow at a CAGR of 3.1% from 2025 to 2030. The rising demand and consumption of flavored shaved ice bars can be attributed to several factors that align with current consumer trends and evolving preferences. One of the primary drivers is the growing interest in authentic and bold flavors. Flavored ice bars, which feature popular tastes like mango, tamarind, lime, chili, and horchata, offer a unique combination of spicy, tangy, and sweet notes that differentiate them from traditional frozen treats. These flavors are inspired by traditional Mexican desserts and snacks, which have gained significant traction both within Hispanic communities and among broader consumer groups looking for new, adventurous food experiences. The growing popularity of ethnic cuisines has helped elevate Mexican flavors into the mainstream, and ice bars made from these flavors are seen as a fun and exotic treat.

As more people adopt health-conscious lifestyles, many are seeking snacks that offer a balance of indulgence and nutritional benefits. Mexico flavored ice bars often use real fruit, natural sweeteners, and clean labels free from artificial additives and preservatives, making them a more appealing option compared to conventional ice cream or sugary desserts. Some variations are even marketed as low-calorie or dairy-free, which further taps into the growing trend of healthier frozen snacks. This shift toward cleaner, more natural ingredients in frozen treats is driving the consumption of these flavored ice bars, particularly among health-conscious individuals who still want a flavorful indulgence.

The convenience and accessibility of these ice bars through supermarkets and hypermarkets also play a significant role in their rising demand. As more retailers stock a wide variety of frozen treats, including Mexico flavored ice bars, consumers can easily find these products while doing their regular grocery shopping. Supermarkets and hypermarkets are increasingly focusing on offering diverse, high-quality frozen desserts that cater to a range of tastes. The presence of these ice bars in popular retail outlets makes them more accessible, and attractive pricing and packaging often encourage impulse buys. Additionally, supermarkets often run promotions, such as multi-pack deals or discounts, which make these treats more affordable and appealing to a larger segment of consumers.

Seasonality is another factor contributing to the growth in sales of flavored shaved ice bars. These frozen treats are particularly popular in warmer months, providing a cool and refreshing snack during hot weather. They are commonly consumed in summer, a time when people are seeking easy-to-enjoy, chilled desserts to beat the heat. The seasonal demand during the summer months is bolstered by the general trend of consumers seeking out convenient and refreshing treats. However, the appeal of these ice bars extends beyond just summer, as the unique flavors also make them a popular choice for year-round indulgence, especially among adventurous eaters or those looking for new, exciting frozen snack options.

Product Insights

Fruity flavored shaved ice bars accounted for a revenue share of 62.9% in 2024. The Mexico fruit snacks industry is growing steadily, supported by evolving consumer preferences for healthier, convenient snack options and an increasing demand for innovative products. As consumers become more health-conscious, they are gravitating toward snacks that offer nutritional benefits without compromising taste, and fruit snacks fit this demand perfectly. One of the key trends is the shift towards healthier snacking. Consumers are increasingly looking for natural, low-calorie snacks made with real fruit and minimal added sugar.

Novelty flavored shaved ice bars are expected to grow at a CAGR of 5.7% from 2025 to 2030. As temperatures soar, demand for cold and refreshing treats naturally rises, creating a robust market for ice bars. Additionally, the increasing focus on health-conscious eating has led to innovations in the ice bar sector, with manufacturers introducing products made from natural ingredients, including real fruit, less sugar, and no artificial additives. This aligns with the rising trend of consumers seeking healthier snack options, even in indulgent categories like frozen desserts.

Distribution Channel Insights

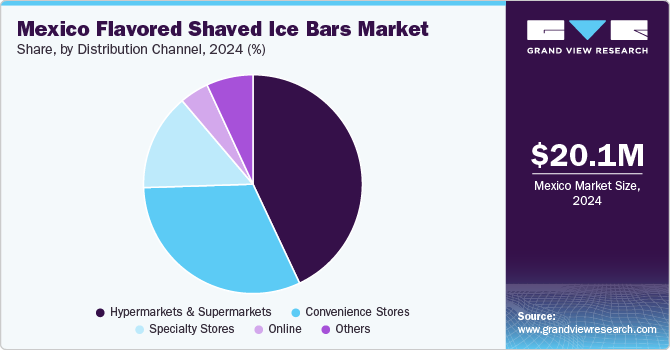

Sales through hypermarkets & supermarket stores accounted for a revenue share of 43.0% in 2024. Hypermarkets and supermarkets offer a one-stop shopping experience, and consumers are increasingly looking for convenience in their purchases. Ice bars, particularly flavored-shaved varieties, are a quick and easy snack option, making them attractive to busy families, young consumers, and those looking for a refreshing treat. The availability of these products in supermarkets allows for easy access to ready-to-eat desserts and frozen snacks that cater to a variety of tastes.

Sales through online channels are expected to grow with a CAGR of 5.4% from 2025 to 2030. The increasing penetration of the e-commerce industry, growing dependence on smartphones and other smart devices, increasing accessibility of the internet, and entry of multiple applauded brands in the online shopping market. As frozen snacks grow in popularity, retailers are expanding their frozen dessert ranges to include diverse offerings, such as Mexico-flavored ice bars. Increased shelf space, better visibility, and promotions help boost sales in these high-traffic retail environments.

Key Mexico Flavored Shaved Ice Bars Company Insights

The Mexico flavored shaved ice bars industry is characterized by numerous well-established and emerging players. Manufacturers are engaging in a variety of strategic initiatives to keep pace with evolving consumer demands and market trends.

Key Mexico Flavored Shaved Ice Bars Companies:

- Mondelēz International, Inc.

- Mount Franklin Foods

- PepsiCo

- WK Kellogg Co (Kellanova)

- Welch's (PIM Brands, Inc.)

- Grupo Bimbo

- BonIce

- Barcel (Grupo Bimbo)

- Sonrics

- Fresca Mexican Foods

Recent Developments

-

In October 2024, PepsiCo acquired Garza Food Ventures LLC, dba Siete Foods. This allowed the company to complement its product portfolio and accelerate the growth in better-for-you food offerings.

-

In April 2024, Mondelēz International, Inc. acquired Mexican confectionary company Ricolino from GrupoBimbo, enabling Mondelēz International, Inc. to expand in Mexico and accelerate growth and scale in the snacks category.

Mexico Flavored Shaved Ice Bars Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.8 million

Revenue forecast in 2030

USD 24.3 million

Growth Rate

CAGR of 3.1% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

Mexico

Mondelēz International, Inc., Mount Franklin Foods, PepsiCo, WK Kellogg Co (Kellanova), Welch's (PIM Brands, Inc.), Grupo Bimbo, BonIce, Barcel (Grupo Bimbo), Sonrics, Fresca Mexican Foods.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Mexico Flavored Shaved Ice Bars Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Mexico flavored shaved ice bars market report on the basis of product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruity

-

Creamy

-

Novelty

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."