- Home

- »

- Consumer F&B

- »

-

Mexico Chocolate Market Size, Share & Growth Report, 2030GVR Report cover

![Mexico Chocolate Market Size, Share & Trends Report]()

Mexico Chocolate Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Traditional, Artificial), By Type (Bars, Truffles & Blocks, Chocolate Covered with Nuts & Fruits), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-346-5

- Number of Report Pages: 87

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Mexico Chocolate Market Size & Trends

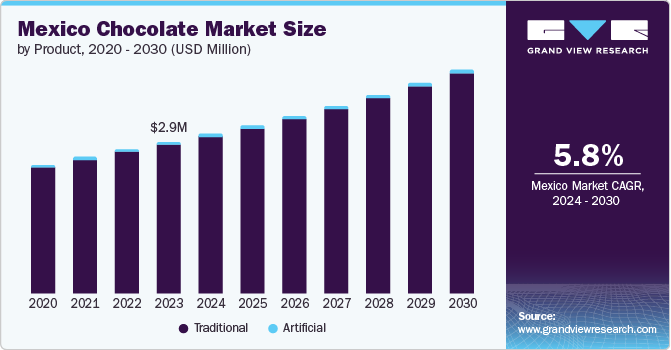

The Mexico chocolate market size was estimated at USD 2.93 billion in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. The high consumption of chocolate and confectionery products has driven the market growth. Several domestic and international players offer high-quality chocolate and cocoa products, looking to capture Mexico's expanding market. The introduction of new and international brands has resulted in increased availability of chocolate products, contributing to the industry growth.

The preference for chocolate confectioneries over sugar confectioneries is steadily rising in Mexico, boosted by increasing awareness of the health benefits of chocolate consumption. Chocolate confectioneries, especially those made from dark chocolate with high cocoa content, have antioxidant properties. These antioxidants, such as flavonoids and polyphenols, improve heart health, reduce inflammation, and enhance cognitive function. On the other hand, sugar confectioneries typically lack these health-promoting compounds and are often associated with empty calories that can contribute to weight gain and other health issues. All these factors are expected to drive the chocolate market in Mexico during the forecast period.

Mexico has been witnessing an increase in demand for premium chocolates. The growing consumer preference for higher-quality and more sophisticated products is a key factor driving this demand. Consumers are becoming more selective about their products and seeking premium options that offer unique flavors, high-quality ingredients, and aesthetic packaging.

Moreover, the growth of gourmet culture in Mexico has played a key role in driving the demand for premium chocolates. Consumers are increasingly interested in exploring new culinary experiences and indulging in luxury food items, including high-end chocolates with unique flavor profiles and artisanal craftsmanship.

Furthermore, chocolate manufacturers and retailers have implemented effective marketing and branding strategies to promote their premium chocolate products. Companies have successfully positioned their products as desirable luxury goods through targeted advertising campaigns, collaborations with renowned chefs or designers, and experiential marketing initiatives. All these factors are expected to augment the demand and overall growth of the market during the forecast period.

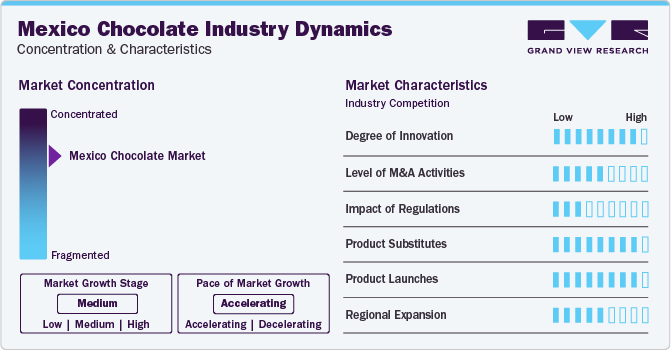

Market Concentration & Characteristics

Manufacturers in the Mexico chocolate market are actively engaged in various initiatives to meet evolving consumer demands and market trends. The market shows a medium degree of innovation. Chocolate manufacturers in Mexico are diversifying their product lines by introducing new flavors, varieties, and formulations. For example, traditional Mexican flavors like cinnamon, chili, and vanilla are incorporated into chocolate products to cater to local preferences and differentiate offerings. Furthermore, there is a gradual shift towards healthier chocolate options in Mexico, thus leading manufacturers to introduce products with organic ingredients, functional additives like vitamins or antioxidants, and reduced sugar.

The high consumption of sugar confectioneries over chocolate confectioneries in Mexico has resulted in a high degree of product substitution. Sugar confectioneries are generally more affordable than chocolate confectioneries, making them accessible to a broader range of consumers, including those from lower-income groups. Furthermore, manufacturers continuously innovate to introduce new sugar confectionery products in terms of flavors, textures, shapes, and packaging that appeal to different consumer tastes and preferences, resulting in a high degree of substitution in the chocolate market.

Companies seek to expand their market presence and diversify their product offerings through strategic acquisitions, which allow them to access new distribution channels, enter new market segments, and acquire complementary brands or technologies. Furthermore, companies in this market also engage in mergers to diversify their brand portfolios and gain access to niche markets or specialized product categories in the chocolate market.

The chocolate industry in Mexico operates under relatively few stringent regulations. While there are food safety standards and labeling requirements set by government agencies, these regulations are generally straightforward and do not impose significant barriers to entry or operation for chocolate manufacturers. Furthermore, many chocolate producers in Mexico are small-scale or artisanal, operating within local communities.

Product Insights

The traditional chocolates segment accounted for a revenue share of 98.2% in 2023. These chocolates are used in various application areas and thus are in high demand. Their widespread availability and popularity as a sweet confectionery item drive the segment growth. Cocoa beans are widely cultivated in Mexico, and their availability as a raw material for traditional chocolate production contributes to its widespread availability and accessibility to manufacturers and consumers. Furthermore, traditional chocolate made from cocoa beans has a well-established presence and penetration in the Mexican market. It is readily available in various forms and sold through multiple distribution channels, thus contributing to its dominance over artificial chocolate in the country.

Among traditional chocolates, milk chocolate accounted for a revenue share of 61.5% in 2023. Milk chocolates have a creamy and sweet flavor profile due to their higher sugar content, making them more appealing to a broader audience. Furthermore, milk chocolates are widely available and more affordable than dark and white chocolate varieties in Mexico, thus contributing to their dominance in the market. Artisanal chocolates are expected to grow at a CAGR of 3.6% from 2024 to 2030. Artificial chocolates fortified with functional ingredients, such as vitamins, minerals, antioxidants, and probiotics, are gaining popularity among health-conscious consumers. Moreover, these chocolates are affordable and have an extended shelf life compared to traditional ones.

Type Insights

The truffles and blocks segment accounted for a revenue share of 65.7% in 2023. Truffles and blocks are readily available in various distribution channels across the country. Furthermore, they come in numerous variants, including milk, dark, white, and flavored, offering consumers a wide selection. Moreover, these chocolates are popular as gifts. In June 2022, Natural Delights strategically launched truffles into Mexico's retail market, capitalizing on the increasing popularity of these luxurious chocolates within the industry, offering consumers access to a range of premium and indulgent chocolate products. Natural Delights aimed to meet the growing demand for luxurious and innovative chocolate products, anticipating further market growth during the forecast period.

The chocolate bars segment is expected to grow at a CAGR of 6.6% from 2024 to 2030. Chocolate bars are convenient for consumption and thus appeal to busy individuals seeking quick indulgences. Furthermore, the variety of chocolate bar types, ranging from classic milk chocolate to innovative flavors like chili-infused or sea salt, caters to diverse taste preferences, expanding their popularity.

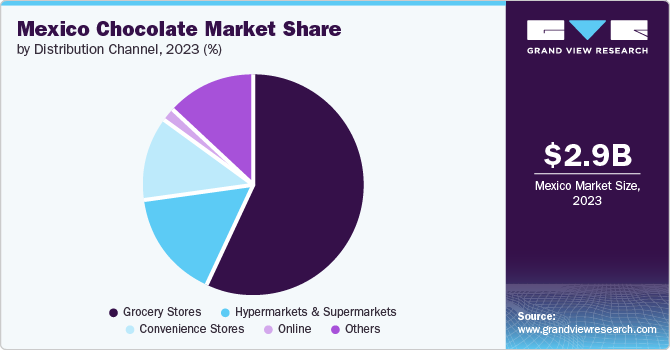

Distribution Channel Insights

Sales through grocery stores accounted for a revenue share of 56.6% in 2023. Mexico has many grocery stores spread across urban and rural areas. These stores, primarily independent small grocers known as tienditas, are easily accessible, offering convenient locations for consumers to purchase chocolate products. Many consumers shop at these stores multiple times a week. According to the National Confectioners Association's 2021 report, retail stores, particularly grocery retailers, dominate the Mexican chocolate market, holding 91.8% of all chocolate sales. Specifically, grocery retailers alone accounted for 39% of total chocolate sales, highlighting their substantial influence in the market. Grocery stores are expected to remain the dominant sales platform for chocolates in the country throughout the forecast period.

Sales of chocolate through online channels are expected to grow with a CAGR of 8.8% from 2024 to 2030. Online platforms offer various chocolate options, ranging from well-known brands to artisanal and niche products. This variety appeals to consumers who enjoy exploring different flavors and types of chocolate that may not be readily available in local stores.

Consumers appreciate the convenience of browsing and purchasing chocolates online. They can compare prices, read reviews, and make informed decisions without leaving their homes. Furthermore, online retailers frequently offer promotional discounts, special deals, and loyalty programs that incentivize consumers to make purchases. All these factors are expected to drive the sales of chocolates through online channels in Mexico during the forecast period.

Regional Insights

The Central Mexico chocolate market accounted for a revenue share of 43.9% in 2023. The region is densely populated, urbanized, and well-connected with multiple distribution networks, making it easier for chocolate manufacturers to supply their products to retailers and consumers. Moreover, cities like Mexico City, Puebla, and Guadalajara have seen a notable rise in specialty chocolate shops offering artisanal and gourmet chocolate products. These factors are expected to drive the chocolate market in Central Mexico during the forecast period.

The Gulf and South Mexico chocolate market is expected to grow at a CAGR of 6.7% from 2024 to 2030. This region is a major cocoa producer, with more than 95% of cocoa being produced here. Consumers in this region are showing an increasing preference for locally sourced chocolate products, thus driving the growth of this regional chocolate market. Furthermore, locally sourced chocolate products often emphasize quality and authenticity, which resonates well with consumers who appreciate the distinct flavors and characteristics of cocoa grown in their region, further driving the growth of the regional market.

Key Mexico Chocolate Company Insights

The Mexico chocolate market is consolidated, with a few major players leading it. Manufacturers in this market are continuously innovating to introduce new chocolate products that cater to evolving consumer preferences. This includes launching new flavors, formulations, and packaging formats to appeal to different consumer segments. Moreover, manufacturers are expanding their product portfolios to offer a broader range of chocolate products targeting diverse consumer preferences and occasions. This includes introducing premium chocolate bars, artisanal truffles, chocolate-covered snacks, and specialty chocolates for holidays and celebrations.

Many manufacturers in the Mexico chocolate market are expanding their presence on online retail channels to tap into the growing trend of online shopping. These manufacturers are also entering new geographic markets, establishing distribution networks, and building strategic alliances with local partners to enhance their market presence in the country.

Key Mexico Chocolate Companies:

- Nestlé

- Chocolate Ibarra

- Mars, Incorporated and its Affiliates

- The Hershey Company

- Ferrero

- Tout Chocolate

- Barry Callebaut

- Mondelēz International

- GRUPO BIMBO

- Feliu Chocolate

- Picard Chocolates México

- Bremen SA de CV

- DULCES DE LA ROSA

- La Suiza, S.A. de C.V.

Recent Developments

-

In October 2023, Barry Callebaut, a manufacturer of premium cocoa and chocolate products, announced an expansion of its chocolate supply agreement with Mars Wrigley LAN, a manufacturer of high-quality chocolates in Mexico. This renewed long-term partnership allows both companies to continue their efforts in driving growth within the Mexican market. This strategic partnership solidifies the strong association between Barry Callebaut and Mars Wrigley LAN

-

In June 2023, Blue Diamond Growers launched its new line of chocolate-dipped almonds in Mexico, offering a healthier option for chocolate-covered nuts. This innovation capitalized on the growing demand for healthier yet indulgent snack options, combining almonds' nutritional benefits with chocolate's deliciousness

-

In May 2023, Barry Callebaut, manufacturer of high-quality chocolate and cocoa products, launched two new chocolates in the Mexican market, Callebaut NXT and SICAO Zero. These products cater to the growing demand for healthier indulgence options without compromising on taste. Callebaut NXT is a dairy-free delight made with 100% plant-based ingredients, while SICAO Zero is a sugar-free chocolate

Mexico Chocolate Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.09 billion

Revenue forecast in 2030

USD 4.35 billion

Growth Rate (Revenue)

CAGR of 5.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

Northern Mexico; Central Mexico; Gulf and South; Pacific Coast; Baja Peninsula; and Yucatan Peninsula

Key companies profiled

Nestlé; Chocolate Ibarra; Mars, Incorporated and its Affiliates; The Hershey Company; Ferrero; Tout Chocolate; Barry Callebaut; Mondelēz International; GRUPO BIMBO; Feliu Chocolate; Picard Chocolates México; Bremen SA de CV; DULCES DE LA ROSA; La Suiza, S.A. de C.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Chocolate Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Mexico chocolate market report on the basis of product, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional

-

Dark

-

Milk

-

White

-

-

Artificial

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bars

-

Truffles & Blocks

-

Chocolate Covered with Nuts & Fruits

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Grocery Stores

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Northern Mexico

-

Central Mexico

-

Gulf And South

-

Pacific Coast

-

Baja Peninsula

-

Yucatan Peninsula

-

Frequently Asked Questions About This Report

b. The Mexico chocolate market size was estimated at USD 2.93 billion in 2023 and is expected to reach USD 3.09 billion in 2024.

b. The Mexico chocolate market is expected to grow at a compounded growth rate of 5.8% from 2024 to 2030 to reach USD 4.35 billion by 2030.

b. Traditional chocolates dominated the Mexico chocolate market with a share of 98.2% in 2023. These chocolates are used in various application areas and are frequently purchased from various retailers such as grocery stores, supermarkets, and hypermarkets among others. Their popularity as a sweet confectionery item that enhances mood backed by their widespread availability is a significant driver of market growth.

b. Some key players operating in Mexico chocolate market include Nestlé; Mars, Incorporated and its Affiliates; Ferrero; Mondelez International; The Hershey Company; GRUPO BIMBO; and Barry Callebaut, among others.

b. Key factors driving market growth include the growing demand for premium and high-quality chocolate products, the rising popularity of dark chocolate owing to its health benefits, and the increasing consumer preference for organic and sustainable chocolate options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.