- Home

- »

- Advanced Interior Materials

- »

-

Mexico Air Conditioning And Ventilation System Market, Report, 2030GVR Report cover

![Mexico Air Conditioning And Ventilation System Market Size, Share & Trends Report]()

Mexico Air Conditioning And Ventilation System Market Size, Share & Trends Analysis Report By Product (Air Conditioning System, Ventilation System), By Application (Commercial, Industrial), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-455-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

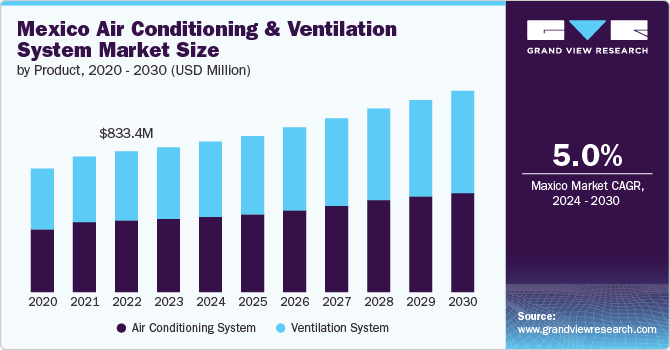

The Mexico air conditioning and ventilation system market size was estimated at USD 857.5 million in 2023 and is projected to grow at a CAGR of 5.0% from 2024 to 2030. The market growth is driven by the continuous expansion of the commercial sector in the country, which includes retail spaces, office buildings, and hospitality establishments. Moreover, the push toward sustainability and the presence of a regulatory environment in the country that favors green technologies are encouraging investments in eco-friendly air conditioning & ventilation systems.

Increasing requirements for comfortable and controlled environments in the hospitality, IT, retail, and manufacturing industries are contributing to the growth of this segment of the market. The industrial sector in Mexico has been increasingly adopting air conditioning systems that not only provide efficient cooling but also adhere to stringent environmental regulations.

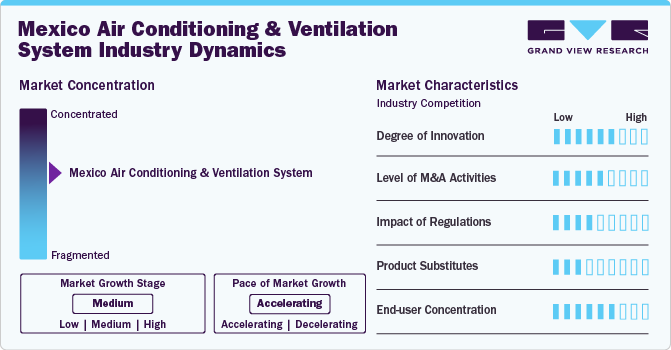

Market Concentration & Characteristics

The market shows a moderate level of concentration, with a mix of domestic and global manufacturers competing within the space. Leading global brands, along with established Mexican companies, dominate the market, leveraging their brand reputation, extensive distribution networks, and comprehensive service offerings. The presence of international players has significantly influenced the market dynamics, injecting technological innovation and competitive pricing strategies. This environment fosters a competitive landscape where companies continuously invest in R&D to offer energy-efficient, environmentally friendly, and technologically advanced systems to meet the growing demands of both residential and commercial customers.

Market characteristics in Mexico reflect a growing demand for air conditioning and ventilation systems, driven by the country's economic growth, increasing urbanization, and the rising temperatures associated with climate change. There's an evident shift towards energy-efficient and smart HVAC systems, propelled by government regulations aimed at reducing energy consumption and environmental impact.

Drivers, Opportunities & Restraints

The economic growth of Mexico, coupled with ongoing urbanization, has led to a boom in commercial and industrial construction in the country. As several new businesses are investing in the establishment of their production facilities, with the existing companies expanding their current capacities, there is a surge in requirement for modern office buildings, retail spaces, manufacturing plants, and warehouses in Mexico. For instance, in October 2023, Lingong Machinery Group (LGMG) announced its plan to establish an industrial park in the northern state of Nuevo Leon in the country that is expected to generate an investment worth USD 5.00 billion. Such initiatives are anticipated to drive commercial construction projects in the country during the forecast period.

Moreover, multinational corporations that are aiming to operate in Mexico require modern, well-equipped facilities that meet international standards. This has spurred the demand for advanced HVAC systems that can provide reliable climate control in various settings, from large-scale manufacturing plants to sophisticated office complexes. In addition, the investments by the Government of Mexico in the development of infrastructures, including airports, hospitals, and schools, are further driving the requirement for robust air conditioning and ventilation systems in the country.

Product Insights

“The demand for the ventilation system segment is expected to grow at a significant CAGR of 5.3% from 2024 to 2030 in terms of revenue.”

The air conditioning system segment held 50.6% of the Mexico revenue share in 2023. Air conditioning systems have become essential to modern living, offering comfort and improved air quality in various settings. Their applications spread across residential, commercial, and industrial environments, providing cooling and humidity control to create optimal conditions for inhabitants and processes. For instance, offices, shopping malls, restaurants, and other commercial spaces utilize air conditioning to offer a pleasant environment for customers and employees, enhancing productivity and customer satisfaction.

The ventilation system segment is expected to reach USD 605.5 million by the end of 2030. Ventilation systems serve various purposes across different applications, stretching from commercial to industrial uses. These regulate temperature and control humidity levels in commercial spaces such as offices, museums, and shopping centers, ensuring a pleasant and safe environment for occupants. Industrial applications, including manufacturing plants and data centers, utilize more complex ventilation and air handling units to manage air quality, remove excess heat, and maintain optimal operating conditions.

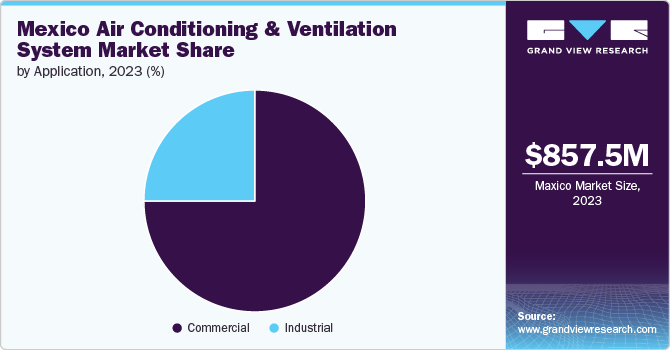

Application Insights

“The growth of the industrial segment is expected to grow at a significant CAGR of 4.6% from 2024 to 2030 in terms of revenue.”

The commercial segment held 75% of Mexico's revenue share in 2023. Air conditioning & ventilation systems in commercial applications play critical roles in ensuring comfortable and healthy environments for both employees and customers. For instance, centralized air conditioning (AC) systems in large office buildings regulate the temperature across various floors, maintaining a comfortable working environment that contributes to increased productivity and employee satisfaction. In addition, shopping malls utilize extensive AC systems to provide a comfortable shopping experience and to control humidity levels, thereby protecting the merchandise and reducing the levels of airborne bacteria and viruses.

Industrial air conditioning systems play a crucial role in maintaining the optimal functioning of machinery and equipment that operate under specific environmental conditions. They also facilitate certain industrial processes that generate significant heat, which must be effectively removed. These specialized AC units deliver greater power, efficiency, and accuracy compared to conventional HVAC systems, offering stable cooling and moisture control. This ensures that high standards of production and operational effectiveness are maintained.

Country Insights

“The growth of the Morelos region is expected to grow at a significant CAGR of 5.0% from 2024 to 2030 in terms of revenue.”

Mexico City air conditioning & ventilation system market was valued at USD 135.8 million in 2023. The market is driven by the city's expanding urban population, its modern architectural developments, and the increasing recognition of the importance of indoor air quality. As one of the largest and most densely populated cities in the world, Mexico City faces unique challenges related to air pollution and temperature control, making the adoption of efficient and environmentally friendly HVAC systems a priority for both residential and commercial sectors.

Morelos air conditioning & ventilation system market is expected to grow at a significant CAGR of 5.0% in terms of revenue over the forecast period. The market growth is primarily attributed to its bustling industrial sector, burgeoning tourism industry, and increasing investment in infrastructure development. Morelos’ proximity to major economic hubs, coupled with its efforts to foster a business-friendly environment, further bolsters its attractiveness to both domestic and international investors.

Key Mexico Air Conditioning And Ventilation System Company Insights

Some of the key players operating in the market include Carrier Corporation., DAIKIN INDUSTRIES, Ltd, and Johnson Controls.

-

Carrier Corporation business segments include refrigeration, HVAC, and fire & security. It offers heat pumps, air conditioners, boilers, furnaces, air purifiers, humidifiers, dehumidifiers, ventilators, air scrubbers, thermostats, UV lamps, energy services, and building controls to the retail, commercial, transport, and food service sectors.

-

DAIKIN INDUSTRIES Ltd manufactures and sells air conditioning systems and chemical products. The company owns 313 consolidated subsidiaries worldwide and offers air conditioning systems, room heating and heat pumps, hot water supply systems, room air conditioning systems, packaged air conditioning systems, and air conditioning systems for plants, facilities, and office buildings.

Key Mexico Air Conditioning And Ventilation System Companies:

- Carrier

- DAIKIN INDUSTRIES, Ltd

- Johnson Controls Inc.

- Lennox International, Inc.

- Trane

- Samsung Electronics Co., Ltd.

- LG Electronics

- Mitsubishi Corporation

- Honeywell International Inc.

- Panasonic Holdings Corporation

- Fujitsu

- Midea

- Rheem Manufacturing Company

- Danfoss

- Robert Bosch GmbH

Recent Developments

-

In July 2024, Bosch Group acquired the global residential and light commercial HVAC business of Johnson Controls and the Johnson Controls-Hitachi Air Conditioning (JCH) joint venture for USD 8 billion.

-

In January 2024, LG Electronics announced the opening of a new scroll compressor production line at its factory in Monterrey, Mexico. This new line will bolster LG’s scroll compressor manufacturing infrastructure, enabling the company to produce more of its acclaimed, eco-conscious solutions while creating a shorter supply chain for servicing customers across North America.

Mexico Air Conditioning And Ventilation System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 890.7 million

Revenue forecast in 2030

USD 1,191.8 million

Growth Rate

CAGR of 5.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Key companies profiled

Carrier, DAIKIN INDUSTRIES, Ltd, Johnson Controls Inc., Lennox International, Inc., Trane, Samsung Electronics Co., Ltd., LG Electronics, Mitsubishi Corporation, Honeywell International Inc., Panasonic Holdings Corporation, Fujitsu, Midea, Rheem Manufacturing Company, Danfoss, Robert Bosch GmbH.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Mexico Air Conditioning And Ventilation System Market Report Segmentation

This report forecasts revenue and volume growth at a country level and analyzes industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Mexico air conditioning and ventilation system market report based on product, application, and country.

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Air Conditioning System

-

Package Air Conditioners

-

Split Air Conditioning Systems

-

Window Unit Air Conditioning System

-

Ductless Mini-Split Systems

-

-

Ventilation System

-

Air Purifier

-

Standalone/Portable

-

In-duct/Fixed

-

-

Air Handling Units

-

Modular AHU

-

Packaged AHU

-

-

Axial Fans

-

Roof Vents

-

Centrifugal Fans

-

Dehumidifier

-

Refrigerative Dehumidifier

-

Desiccant Dehumidifier

-

Electronic/Heat Pump Dehumidifier

-

-

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Retail Shops

-

Offices

-

Healthcare Facilities

-

Hospitality

-

Schools & Educational Institutions

-

Transport

-

Others

-

-

Industrial

-

-

Country Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Aguascalientes

-

Baja California

-

Baja California Sur

-

Campeche

-

Chiapas

-

Chihuahua

-

Coahuila

-

Colima

-

Durango

-

Guanajuato

-

Guerrero

-

Hidalgo

-

Jalisco

-

México

-

Mexico City

-

Michoacán

-

Morelos

-

Nayarit

-

Nuevo León

-

Oaxaca

-

Puebla

-

Querétaro

-

Quintana Roo

-

San Luis Potosí

-

Sinaloa

-

Sonora

-

Tabasco

-

Tamaulipas

-

Tlaxcala

-

Veracruz

-

Yucatán

-

Zacatecas

-

Frequently Asked Questions About This Report

b. The Mexico air conditioning & ventilation system market size was estimated at USD 857.5 million in 2023 and is expected to reach USD 890.7 million in 2024.

b. The Mexico air conditioning & ventilation system market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030, reaching USD 1,191.8 million by 2030.

b. Air conditioning systems have become essential to modern living, offering comfort and improved air quality in various settings. Their applications spread across residential, commercial, and industrial environments, providing cooling and humidity control to create optimal conditions for inhabitants and processes. For instance, offices, shopping malls, restaurants, and other commercial spaces utilize air conditioning to offer a pleasant environment for customers and employees, enhancing productivity and customer satisfaction.

b. Some of the key players operating in the Mexico air conditioning & ventilation system market include Carrier, DAIKIN INDUSTRIES, Ltd, Johnson Controls Inc., Lennox International, Inc., Trane, Samsung Electronics Co., Ltd., LG Electronics, Mitsubishi Corporation, Honeywell International Inc., Panasonic Holdings Corporation, Fujitsu, Midea, Rheem Manufacturing Company, Danfoss, Robert Bosch GmbH.

b. Mexico air conditioning & ventilation system market is driven by the continuous expansion of the commercial sector in the country that includes retail spaces, office buildings, and hospitality establishments. Moreover, the push toward sustainability and the presence of a regulatory environment in the country that favors green technologies are encouraging investments in eco-friendly air conditioning & ventilation systems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."