- Home

- »

- Petrochemicals

- »

-

Metalworking Fluids Market Size, Share, Growth Report 2030GVR Report cover

![Metalworking Fluids Market Size, Share & Trends Report]()

Metalworking Fluids Market Size, Share & Trends Analysis Report By Product (Mineral, Synthetic), By End-use (Machinery, Transportation Equipment), By Industrial End-use, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-744-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

Metalworking Fluids Market Size & Trends

The global metalworking fluids market size was estimated at USD 12.17 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030. The product demand is anticipated to be driven by increased demand for automotive and heavy industry machinery. Individual end-use sectors, such as machinery, metal fabrication, and transportation equipment, are driving the expansion of the Metalworking Fluids (MWFs) market. The most basic raw source utilized to make the product is crude oil. The crude oil is refined, treated, and blended to create the neat cutting oils, soluble oils, and corrosion-preventive oils that are sought. Base oil, derived from crude oil, is a primary raw material that accounts for approximately 40% of the total MWF cost.

Base oil is manufactured from the refining and heating process of crude oil. It is used to manufacture motor oils, lubricants, and MWFs. The growth of the automobile industry is expected to be one of the key drivers of product demand. The product is used in the automobile industry because it can reduce friction between the workpiece and the tool, eliminate metal chips, offer good surface quality, and extend tool life. Metalworking fluids help improve the efficiency of machining processes, resulting in higher machine production volumes. As a result, the demand for metalworking fluids is likely to be stable over the forecast period.

Manufacturing is one of the core industries in North America and Europe. Advances in the manufacturing methods for producing sophisticated end-use products, coupled with increased exports of construction machinery and power, agricultural, and automotive equipment, have fueled the metalworking fluid market growth. The market growth in North America and Europe is also attributed to the robust growth of end-use industries in Asia Pacific. In Asia Pacific, more consumers prefer advanced machinery and equipment in the agriculture, automotive, and construction industries.

This has led to increased market penetration of MWFs in machinery and transportation equipment end-use industries. The growth of the heavy machinery industry in developing economies of the Asia Pacific and Central & South America is anticipated to drive the market. Increasing exploration & production activities of oil & gas in these regions, especially from Chinese petroleum companies, have been a significant factor in influencing the demand for MWFs in the oilfield equipment industry.

Market Concentration & Characteristics

The global market is highly competitive, with the big international brands focusing on developing long-term relationships with end-users. With a rise in the manufacturing, automotive, and transportation sectors, the competition is also anticipated to increase in the coming years. Companies such as Houghton International Inc., BP plc, Exxon Mobil Corporation, and Total SA have a high degree of integration across the value chain as they are also engaged in producing various MWFs. These companies have established themselves as key manufacturers and focus on R&D for novel product uses.

The metalworking fluid market trend is being driven by increased demand for automotive and heavy industry, as well as the growing preference for lightweight components in high performance applications such as heavy machinery, transportation equipment, automotive and construction.

The global metalworking fluids market is witnessing significant growth, driven by various end-use sectors and regional demand, with the Asia-Pacific region playing a pivotal role in the market expansion.

Product Insights

The mineral segment held the largest share of over 48.06% in 2023. The high share has been attributed to the consumption of mineral-based oils owing to their low cost. Due to price-conscious consumers, small- and medium-scale manufacturers typically use mineral oil-based MWFs. Over the forecast period, this is expected to impact the market growth. Mineral-based fluids are also used in machining processes, such as turning, grinding, broaching, drilling, and milling. Synthetic MWFs are anticipated to witness the fastest CAGR over the forecast period.

The growth is anticipated due to the characteristics imparted by MWFs, such as enhanced tool life and excellent surface finish. Synthetic oils are in high demand due to their ability to reduce friction between work pieces, eliminate waste, and extend sump life. Large-scale manufacturers in many countries have embraced semi-synthetic MWFs, resulting in increased synthetic MWF penetration over the last few years, which is expected to continue during the projected period. Growing concern regarding using petroleum products has resulted in strict environmental restrictions and government measures to promote environmentally friendly products. As a result, the manufacturing of bio-based MWFs has increased.

End-use Insights

Machinery segment accounted for a revenue share of more than 41.61% in 2023 and is likely to dominate the market over the forecast period. The demand is attributed to a rise in the consumption of MWFs in agriculture equipment, earth-moving equipment, and automotive components. Significant growth of the MWFs market is projected to be aided by the rising demand from construction equipment makers. Metalworking fluids are used in machining operations to extend the life of the sump, which saves manufacturers money in the long run. Small-scale enterprises have increased the usage of MWFs owing to their limited procurement budgets.

The transportation equipment segment is expected to grow at the fastest CAGR of 5.4% over the forecast period. The growth is attributed to the high product demand for transportation equipment along with the development of infrastructure. Metalworking fluids are used in operations where heat dissipation is critical for effective machining and producing high-quality products. They are found in various transportation equipment, including high-performance railway engines, ships, and planes. The main areas where these oils are employed to improve engine performance are Maintenance, Repair, & Overhauling (MRO).

Industrial End-use Insights

The construction segment dominated the market with the largest revenue share of 26.98% in 2023 due to increased demand for construction machinery and related parts required for industrial, residential, and commercial construction. The construction industry manufactures various types of equipment, such as excavators, loaders, forklifts, cranes, dozers, and others. Along with this, the industry uses various ferrous and non-ferrous components in interior and exterior applications, such as garage doors, gates, sealing angles, shutters, balconies, window frames, staircase grills, shades for parking spaces, and others. Rapid urbanization, along with a rise in investments in building & construction activities, is likely to fuel the segment growth over the forecast period.

The automobile industry is anticipated to witness the fastest CAGR over the forecast period owing to a rising spending capacity on luxurious cars globally. Different metals, such as steel, aluminum, and others, need the machine shop to use particular metalworking processes to increase productivity and optimize cost. The machine shops need different MWFs during various product processing operations, which is expected to fuel the segment growth during the forecast period. Increasing awareness about using advanced equipment in farming for enhanced productivity will support the demand for agricultural equipment and tools, thereby boosting the demand for MWFs. Low per capita land holding is a primary reason leading to the high demand for and rapid modernization of farm machinery, which, in turn, will drive the segment.

Application Insights

The neat-cutting oil segment accounted for the largest share of more than 42.0% of the global revenue in 2023. The growth is attributed to increased demand from the automobile, aerospace, marine, and construction sectors. They are utilized in a wide range of machining processes, as well as in a variety of cutting operations. Because of their capacity to supply cost-effective solutions, they have significant demand from the high-volume manufacturing industry in Asia Pacific’s emerging economies. The use of high-alloy steels in the heavy equipment manufacturing sector is also likely to drive the demand for neat-cutting oils over the forecast period. The water-cutting oil segment accounted for the second-largest market share in 2023.

The growth is credited to the increase in the consumption of these fluids in various complex machining operations. These fluids are utilized in various procedures where heat dissipation is critical for successful machining and high-quality products. They are diluted in water before using in the machine shop and are used for various cutting activities, such as drilling, milling, and grinding. These fluids are used in heavy equipment production to keep the temperature of the machining operation under control. The semi-synthetic cutting oil segment in water-cutting oil is anticipated to grow at a considerable CAGR from 2022 to 2030.

The growth is credited to its application in cast iron, aluminum components, and machining operations, such as sawing, drilling, turning, and milling. The rising use of these oils in the aforementioned applications is expected to boost segment growth over the forecast period. Corrosion preventive fluids are also expected to grow steadily over the forecast period. These oils are utilized in machining processes where the risk of harming the tool is significant; as a result, these oils are responsible for extending the sump life, resulting in lower overhead expenses for manufacturers. Due to their low production quantities and limited cost structures, small-scale enterprises have increased their usage of corrosion-preventative oils.

Regional Insights

Based on geographies, the global market has been divided into Asia Pacific, North America, Europe, Middle East & Africa, and Central & South America.

Asia Pacific Metalworking Fluids market: Asia Pacific dominated the market and held a revenue share of over 42.0% in 2023. The regional market is estimated to expand further at the fastest CAGR from 2024 to 2030. The high product demand is attributed to a rise in manufacturing units in the Asia Pacific region. China and India, in particular, are projected to dominate the demand for mineral and synthetic MWFs. The market for synthetic MWFs is expected to grow in this region.This is due to the increased requirement for superior lubrication performance in automotive grinding and machining operations.

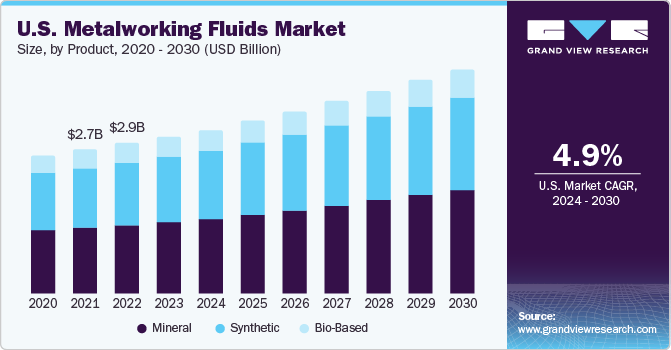

North America Metalworking Fluids market: The market in the North American region is also anticipated to witness significant growth, in terms of value, during the forecast period. Mineral, synthetic, and water-soluble oils are available from MWF producers in North America and are suited for machining and grinding operations on ferrous and non-ferrous metals. Metalworking fluids can be used with ferrous metals and alloys, including cast iron, steel, and stainless steel, as well as non-ferrous metals and alloys, such as aluminum, nickel, copper, and magnesium.

Key Companies & Market Share Insights

Key companies are adopting several organic and inorganic growth strategies, such as capacity expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

On January 2023, Univar Solutions B.V. entered a distribution agreement with Graphics Services Ltd. for their products such as inks, rust preventive oils, coatings, lubricants, and metalworking fluids in Europe.

-

On September 2022, Clariant announced the extension of support for metalworking fluid manufacturers globally by offering their additives to develop high lubricity and fully-synthetic metalworking fluids.

Key Metalworking Fluid Companies:

- Houghton International, Inc.

- Blaser Swisslube AG

- BP plc

- Exxon Mobil Corp.

- Total S.A.

- FUCHS

- Chevron Corp.

- China Petroleum & Chemical Corp.

- Kuwait Petroleum Corp.

Metalworking Fluids Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.71 billion

Revenue forecast in 2030

USD 17.45 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, industrial end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; France; Spain; Italy; U.K.; Switzerland; Denmark; Norway; Belgium; Poland; Czech Republic; Turkey; Sweden; Finland; China; India; Japan; South Korea; Singapore; Malaysia; Thailand; Australia; New Zealand; Brazil

Key companies profiled

Houghton International Inc.; Blaser Swisslube AG; BP plc; Exxon Mobil Corp.; Total S.A.; FUCHS; Chevron Corp.; China Petroleum & Chemical Corp.; Kuwait Petroleum Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metalworking Fluids Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metalworking fluid market report based on product, application, end-use, industrial end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mineral

-

Synthetic

-

Bio-Based

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Neat Cutting Oil

-

Water Cutting Oil

-

Corrosion Preventive Oil

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Metal Fabrication

-

Transportation Equipment

-

Machinery

-

Others

-

-

Industrial End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Electric & Power

-

Agriculture

-

Automobile

-

Aerospace

-

Rail

-

Marine

-

Telecommunications

-

Health Care

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Russia

-

Italy

-

Spain

-

Turkey

-

Switzerland

-

Denmark

-

Norway

-

Belgium

-

Poland

-

Czech Republic

-

Sweden

-

Finland

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Singapore

-

Malayasia

-

Thailand

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global metalworking fluids market size was estimated at USD 10.8 billion in 2021 and is expected to reach USD 11.49 billion in 2022.

b. The global metalworking fluids market is expected to grow at a compound annual growth rate of 3.8% from 2022 to 2030 to reach USD 15.16 billion by 2030.

b. The Asia Pacific dominated the metalworking fluids market with a share of 41.31% in 2021. This is attributable to rising demand from the manufacturing sector in India, China, and other emerging economies.

b. Some key players operating in the metalworking fluids market include FUCHS, Blaser Swisslube AG, CIMCOOL Fluid Technology LLC, Kuwait Petroleum Corporation, and MORESCO Corporation.

b. Key factors that are driving the metalworking fluids market growth include the growth of the heavy machinery industry in the developing economies of Asia Pacific and Central and South America.

Table of Contents

Chapter 1. Metalworking Fluids Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Metalworking Fluids Market: Executive Summary

2.1. Market Insights

2.2. Segmental Outlook

2.3. Competitive Outlook

Chapter 3. Metalworking Fluids Market: Variables, Trends & Scope

3.1. Global Metalworking Fluids Market Outlook

3.2. Industry Value Chain Analysis

3.2.1. Raw Material Outlook

3.3. Technology Overview

3.4. Regulatory Framework

3.5. Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.5.4. Industry Opportunities

3.6. Porter’s Five Forces Analysis

3.6.1. Supplier Power

3.6.2. Buyer Power

3.6.3. Substitution Threat

3.6.4. Threat from New Entrant

3.6.5. Competitive Rivalry

3.7. PESTEL Analysis

3.7.1. Political Landscape

3.7.2. Economic Landscape

3.7.3. Social Landscape

3.7.4. Technological Landscape

3.7.5. Environmental Landscape

3.7.6. Legal Landscape

Chapter 4. Metalworking Fluids Market: Product Outlook Estimates & Forecasts

4.1. Metalworking Fluids Market: Product Movement Analysis, 2023 & 2030

4.2. Mineral

4.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.3. Synthetic

4.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.4. Bio-Based

4.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

4.5. Others

4.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 5. Metalworking Fluids Market: Application Outlook Estimates & Forecasts

5.1. Metalworking Fluids Market: Application Movement Analysis, 2023 & 2030

5.2. Neat Cutting Oils

5.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.3. Water Cutting Oils

5.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.4. Corrosion Preventive Oils

5.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

5.5. Others

5.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 6. Metalworking Fluids Market: End-use Outlook Estimates & Forecasts

6.1. Metalworking Fluids Market: End-use Movement Analysis, 2023 & 2030

6.2. Metal Fabrication

6.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.3. Transportation Equipment

6.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.4. Machinery

6.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

6.5. Others

6.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 7. Metalworking Fluids Market: Industrial End-use Outlook Estimates & Forecasts

7.1. Metalworking Fluids Market: Industrial End-use Movement Analysis, 2023 & 2030

7.2. Construction

7.2.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.3. Electric & Power

7.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.4. Agriculture

7.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.5. Automobile

7.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.6. Aerospace

7.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.7. Rail

7.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.8. Marine

7.8.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.9. Telecommunications

7.9.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

7.10. Healthcare

7.10.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

Chapter 8. Metalworking Fluids Market Regional Outlook Estimates & Forecasts

8.1. Regional Snapshot

8.2. Metalworking Fluids Market: Regional Movement Analysis, 2023 & 2030

8.3. North America

8.3.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.3.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.3.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.3.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.3.6. U.S.

8.3.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.3.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.3.6.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.3.6.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.3.7. Canada

8.3.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.7.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.3.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.3.7.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.3.7.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.3.8. Mexico

8.3.8.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.3.8.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.3.8.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.3.8.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.3.8.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4. Europe

8.4.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.6. Germany

8.4.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.6.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.6.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.7. France

8.4.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.7.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.7.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.7.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.8. UK

8.4.8.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.8.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.8.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.8.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.8.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.9. Russia

8.4.9.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.9.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.9.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.9.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.9.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.10. Italy

8.4.10.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.10.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.10.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.10.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.10.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.11. Spain

8.4.11.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.11.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.11.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.11.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.11.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.12. Turkey

8.4.12.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.12.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.12.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.12.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.12.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.13. Switzerland

8.4.13.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.13.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.13.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.13.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.13.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.14. Denmark

8.4.14.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.14.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.14.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.14.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.14.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.15. Norway

8.4.15.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.15.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.15.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.15.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.15.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.16. Belgium

8.4.16.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.16.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.16.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.16.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.16.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.17. Poland

8.4.17.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.17.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.17.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.17.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.17.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.18. Czech Republic

8.4.18.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.18.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.18.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.18.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.18.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.19. Sweden

8.4.19.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.19.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.19.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.19.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.19.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.20. Finland

8.4.20.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.4.20.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.4.20.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.4.20.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.4.20.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5. Asia Pacific

8.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.4. Market estimates and forecast, by end use, 2018 - 2030 (USD Million) (Kilotons)

8.5.5. Market estimates and forecast, by industrial end use, 2018 - 2030 (USD Million) (Kilotons)

8.5.6. China

8.5.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.5.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.6.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.6.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.7. South Korea

8.5.7.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.7.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.5.7.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.7.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.7.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.8. Japan

8.5.8.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.8.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.5.8.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.8.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.8.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.9. India

8.5.9.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.9.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.5.9.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.9.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.9.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.10. Singapore

8.5.10.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.10.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.5.10.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.10.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.10.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.11. Malaysia

8.5.11.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.11.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.5.11.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.11.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.11.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.12. Thailand

8.5.12.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.12.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.5.12.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.12.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.12.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.13. Australia

8.5.13.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.13.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.5.13.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.13.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.13.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.14. New Zealand

8.5.14.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.5.14.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.5.14.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.5.14.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.5.14.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.6. Central & South America

8.6.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.6.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.6.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.6.4. Market estimates and forecast, by end use, 2018 - 2030 (USD Million) (Kilotons)

8.6.5. Market estimates and forecast, by industrial end use, 2018 - 2030 (USD Million) (Kilotons)Brazil

8.6.5.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.6.5.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.6.5.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.6.5.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.6.5.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

8.7. Middle East & Africa

8.7.1.1. Market estimates and forecast, 2018 - 2030 (USD Million) (Kilotons)

8.7.1.2. Market estimates and forecast, by product, 2018 - 2030 (USD Million) (Kilotons)

8.7.1.3. Market estimates and forecast, by application, 2018 - 2030 (USD Million) (Kilotons)

8.7.1.4. Market estimates and forecast, by end-use, 2018 - 2030 (USD Million) (Kilotons)

8.7.1.5. Market estimates and forecast, by industrial end-use, 2018 - 2030 (USD Million) (Kilotons)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis, By Key Market Participants

9.2. Company Categorization

9.3. Company Ranking, 2023

9.4. Heat Map Analysis

9.5. Vendor Landscape

9.5.1. List of channel partners and distributors

9.5.2. List of potential end-users

9.6. Strategy Mapping

9.7. Company Profiles/Listing

9.7.1. Houghton International, Inc.

9.7.1.1. Company Overview

9.7.1.2. Financial Performance

9.7.1.3. Product Benchmarking

9.7.2. Blaser Swisslube AG

9.7.2.1. Company Overview

9.7.2.2. Financial Performance

9.7.2.3. Product Benchmarking

9.7.3. BP plc

9.7.3.1. Company Overview

9.7.3.2. Financial Performance

9.7.3.3. Product Benchmarking

9.7.4. Exxon Mobil Corp.

9.7.4.1. Company Overview

9.7.4.2. Financial Performance

9.7.4.3. Product Benchmarking

9.7.5. Total S.A.

9.7.5.1. Company Overview

9.7.5.2. Financial Performance

9.7.5.3. Product Benchmarking

9.7.6. FUCHS

9.7.6.1. Company Overview

9.7.6.2. Financial Performance

9.7.6.3. Product Benchmarking

9.7.7. Chevron Corp.

9.7.7.1. Company Overview

9.7.7.2. Financial Performance

9.7.7.3. Product Benchmarking

9.7.8. China Petroleum & Chemical Corp.

9.7.8.1. Company Overview

9.7.8.2. Financial Performance

9.7.8.3. Product Benchmarking

9.7.9. Kuwait Petroleum Corp.

9.7.9.1. Company Overview

9.7.9.2. Financial Performance

9.7.9.3. Product Benchmarking

List of Tables

Table 1. Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 2. Metalworking Fluids market estimates and forecasts, by mineral, 2018 - 2030 (USD Million) (Kilotons)

Table 3. Metalworking Fluids market estimates and forecasts, by synthetic, 2018 - 2030 (USD Million) (Kilotons)

Table 4. Metalworking Fluids market estimates and forecasts, by bio-based, 2018 - 2030 (USD Million) (Kilotons)

Table 5. Metalworking Fluids market estimates and forecasts, by neat cutting oils, 2018 - 2030 (USD Million) (Kilotons)

Table 6. Metalworking Fluids market estimates and forecasts, by water cutting oils, 2018 - 2030 (USD Million) (Kilotons)

Table 7. Metalworking Fluids market estimates and forecasts, by corrosion preventive oils, 2018 - 2030 (USD Million) (Kilotons)

Table 8. Metalworking Fluids market estimates and forecasts, by other application, 2018 - 2030 (USD Million) (Kilotons)

Table 9. Metalworking Fluids market estimates and forecasts, in metal fabrication, 2018 - 2030 (USD Million) (Kilotons)

Table 10. Metalworking Fluids market estimates and forecasts, in transportation equipment, 2018 - 2030 (USD Million) (Kilotons)

Table 11. Metalworking Fluids market estimates and forecasts, in machinery, 2018 - 2030 (USD Million) (Kilotons)

Table 12. Metalworking Fluids market estimates and forecasts, by other end use, 2018 - 2030 (USD Million) (Kilotons)

Table 13. Metalworking Fluids market estimates and forecasts, in construction, 2018 - 2030 (USD Million) (Kilotons)

Table 14. Metalworking Fluids market estimates and forecasts, by electric & power, 2018 - 2030 (USD Million) (Kilotons)

Table 15. Metalworking Fluids market estimates and forecasts, by agriculture, 2018 - 2030 (USD Million) (Kilotons)

Table 16. Metalworking Fluids market estimates and forecasts, by automobile, 2018 - 2030 (USD Million) (Kilotons)

Table 17. Metalworking Fluids market estimates and forecasts, by aerospace, 2018 - 2030 (USD Million) (Kilotons)

Table 18. Metalworking Fluids market estimates and forecasts, by rail, 2018 - 2030 (USD Million) (Kilotons)

Table 19. Metalworking Fluids market estimates and forecasts, by marine, 2018 - 2030 (USD Million) (Kilotons)

Table 20. Metalworking Fluids market estimates and forecasts, by telecommunication, 2018 - 2030 (USD Million) (Kilotons)

Table 21. Metalworking Fluids market estimates and forecasts, by healthcare, 2018 - 2030 (USD Million) (Kilotons)

Table 22. North America Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 23. North America Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 24. North America Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 25. North America Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 26. North America Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 27. North America Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 28. North America Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 29. North America Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 30. North America Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 31. U.S. Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 32. U.S. Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 33. U.S. Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 34. U.S. Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 35. U.S. Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 36. U.S. Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 37. U.S. Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 38. U.S. Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 39. U.S. Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 40. Canada Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 41. Canada Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 42. Canada Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 43. Canada Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 44. Canada Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 45. Canada Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 46. Canada Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 47. Canada Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 48. Canada Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 49. Mexico Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 50. Mexico Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 51. Mexico Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 52. Mexico Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 53. Mexico Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 54. Mexico Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 55. Mexico Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 56. Mexico Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 57. Mexico Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 58. Europe Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 59. Europe Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 60. Europe Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 61. Europe Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 62. Europe Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 63. Europe Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 64. Europe Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 65. Europe Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 66. Europe Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 67. Germany Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 68. Germany Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 69. Germany Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 70. Germany Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 71. Germany Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 72. Germany Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 73. Germany Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 74. Germany Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 75. Germany Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 76. France Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 77. France Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 78. France Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 79. France Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 80. France Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 81. France Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 82. France Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 83. France Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 84. France Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 85. U.K. Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 86. U.K. Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 87. U.K. Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 88. U.K. Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 89. U.K. Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 90. U.K. Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 91. U.K. Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 92. U.K. Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 93. U.K. Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 94. Russia Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 95. Russia Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 96. Russia Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 97. Russia Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 98. Russia Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 99. Russia Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 100. Russia Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 101. Russia Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 102. Russia Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 103. Italy Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 104. Italy Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 105. Italy Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 106. Italy Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 107. Italy Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 108. Italy Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 109. Italy Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 110. Italy Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 111. Spain Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 112. Spain Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 113. Spain Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 114. Spain Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 115. Spain Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 116. Spain Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 117. Spain Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 118. Spain Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 119. Spain Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 120. Turkey Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 121. Turkey Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 122. Turkey Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 123. Turkey Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 124. Turkey Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 125. Turkey Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 126. Turkey Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 127. Turkey Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 128. Turkey Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 129. Switzerland Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 130. Spain Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 131. Switzerland Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 132. Switzerland Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 133. Spain Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 134. Switzerland Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 135. Switzerland Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 136. Switzerland Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 137. Switzerland Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 138. Denmark Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 139. Denmark Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 140. Denmark Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 141. Denmark Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 142. Denmark Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 143. Denmark Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 144. Denmark Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 145. Denmark Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 146. Denmark Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 147. Norway Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 148. Norway Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 149. Norway Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 150. Norway Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 151. Norway Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 152. Norway Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 153. Norway Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 154. Norway Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 155. Norway Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 156. Belgium Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 157. Belgium Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 158. Belgium Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 159. Belgium Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 160. Belgium Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 161. Belgium Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 162. Belgium Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 163. Belgium Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 164. Belgium Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 165. Poland Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 166. Poland Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 167. Poland Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 168. Poland Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 169. Poland Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 170. Poland Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 171. Poland Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 172. Poland Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 173. Poland Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 174. Czech Republic Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 175. Czech Republic Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 176. Czech Republic Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 177. Czech Republic Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 178. Czech Republic Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 179. Czech Republic Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 180. Czech Republic Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 181. Czech Republic Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 182. Czech Republic Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 183. Asia Pacific Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 184. Asia Pacific Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 185. Asia Pacific Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 186. Asia Pacific Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 187. Asia Pacific Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 188. Asia Pacific Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 189. Asia Pacific Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 190. Asia Pacific Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 191. Asia Pacific Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 192. China Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 193. China Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 194. China Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 195. China Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 196. China Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 197. China Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 198. China Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 199. China Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 200. China Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 201. Japan Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 202. Japan Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 203. Japan Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 204. Japan Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 205. Japan Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 206. Japan Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 207. Japan Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 208. Japan Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 209. Japan Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 210. South Korea Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 211. South Korea Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 212. South Korea Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 213. South Korea Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 214. South Korea Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 215. South Korea Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 216. South Korea Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 217. South Korea Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 218. South Korea Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 219. India Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 220. India Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 221. India Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 222. India Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 223. India Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 224. India Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 225. India Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Kilotons)

Table 226. India Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 227. India Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 228. Singapore Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 229. Singapore Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 230. Singapore Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 231. Singapore Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 232. Singapore Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 233. Singapore Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 234. Singapore Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 235. Singapore Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 236. Malayasia Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 237. Malayasia Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 238. Malayasia Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 239. Malayasia Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 240. Malayasia Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 241. Malayasia Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 242. Malayasia Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Kilotons)

Table 243. Malayasia Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 244. Malayasia Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 245. Thailand Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 246. Thailand Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 247. Thailand Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 248. Thailand Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 249. Thailand Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 250. Thailand Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 251. Thailand Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Kilotons)

Table 252. Thailand Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 253. Thailand Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 254. Australia Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 255. Australia Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 256. Australia Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 257. Australia Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 258. Australia Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 259. Australia Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 260. Australia Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Kilotons)

Table 261. Australia Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 262. Australia Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 263. New Zealand Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 264. New Zealand Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 265. New Zealand Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 266. New Zealand Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 267. New Zealand Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 268. New Zealand Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 269. New Zealand Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Kilotons)

Table 270. New Zealand Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 271. New Zealand Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 272. Central & South America Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 273. Central & South America Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 274. Central & South America Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 275. Central & South America Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 276. Central & South America Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 277. Central & South America Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 278. Central & South America Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 279. Brazil Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 280. Brazil Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 281. Brazil Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 282. Brazil Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 283. Brazil Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 284. Brazil Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 285. Brazil Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 286. Brazil Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

Table 287. Middle East & Africa Metalworking Fluids market estimates and forecasts, 2018 - 2030 (USD Million) (Kilotons)

Table 288. Middle East & Africa Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 289. Middle East & Africa Metalworking Fluids market estimates and forecasts, by product, 2018 - 2030 (Kilotons)

Table 290. Middle East & Africa Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 291. Middle East & Africa Metalworking Fluids market estimates and forecasts, by application, 2018 - 2030 (Kilotons)

Table 292. Middle East & Africa Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (USD Million)

Table 293. Middle East & Africa Metalworking Fluids market estimates and forecasts, by end-use, 2018 - 2030 (Kilotons)

Table 294. Middle East & Africa Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (USD Million)

Table 295. Middle East & Africa Metalworking Fluids market estimates and forecasts, by industrial end-use, 2018 - 2030 (Kilotons)

List of Figures

Fig. 1 Market segmentation

Fig. 2 Information procurement

Fig. 3 Data Analysis Models

Fig. 4 Market Formulation and Validation

Fig. 5 Market snapshot

Fig. 6 Segmental outlook - Product, application, end use, and industrial end use

Fig. 7 Competitive outlook

Fig. 8 Metalworking Fluids market, 2018 - 2030 (USD Million) (Kilotons)

Fig. 9 Value chain analysis

Fig. 10 Market dynamics

Fig. 11 Porter’s Analysis

Fig. 12 PESTEL Analysis

Fig. 13 Metalworking Fluids market, by product: Key takeaways

Fig. 14 Metalworking Fluids market, by product: Market share, 2023 & 2030

Fig. 15 Metalworking Fluids market, by application: Key takeaways

Fig. 16 Metalworking Fluids market, by application: Market share, 2023 & 2030

Fig. 17 Metalworking Fluids market, by end-use: Key takeaways

Fig. 18 Metalworking Fluids market, by end-use: Market share, 2023 & 2030

Fig. 19 Metalworking Fluids market, by industrial end-use: Key takeaways

Fig. 20 Metalworking Fluids market, by industrial end-use: Market share, 2023 & 2030

Fig. 21 Metalworking Fluids market, by region: Key takeaways

Fig. 22 Metalworking Fluids market, by region: Market share, 2023 & 2030What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Metalworking Fluids Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Mineral

- Synthetic

- Bio-based

- Metalworking Fluids Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Neat cutting oils

- Water cutting oils

- Corrosion preventive oils

- Others

- Metalworking Fluids End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Metal Fabrication

- Transportation Equipment

- Machinery

- Others

- Metalworking Fluids Industrial End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- Construction

- Electric & Power

- Agriculture

- Automobile

- Aerospace

- Rail

- Marine

- Telecommunication

- Healthcare

- Metalworking Fluids Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

- North America

- North America Metalworking Fluids Market, By Product

- Mineral

- Synthetic

- Bio-based

- North America Metalworking Fluids Market, By Application

- Neat cutting oils

- Water cutting oils

- Corrosion preventive oils

- Others

- North America Metalworking Fluids Market, By End-use

- Metal Fabrication

- Transportation Equipment

- Machinery

- Others

- North America Working Fluids Market, By Industrial End-use

- Construction

- Electric & Power

- Agriculture

- Automobile

- Aerospace

- Rail

- Marine

- Telecommunication

- Healthcare

- U.S.

- U.S. Metalworking Fluids Market, By Product

- Mineral

- Synthetic

- Bio-based

- U.S. Metalworking Fluids Market, By Application

- Neat cutting oils

- Water cutting oils

- Corrosion preventive oils

- Others

- U.S. Metalworking Fluids Market, By End-use

- Metal Fabrication

- Transportation Equipment

- Machinery

- Others

- U.S. Metalworking Fluids Market, By Industrial End-use

- Construction

- Electric & Power

- Agriculture

- Automobile

- Aerospace

- Rail

- Marine

- Telecommunication

- Healthcare

- U.S. Metalworking Fluids Market, By Product

- Canada

- Canada. Metalworking Fluids Market, By Product

- Mineral

- Synthetic

- Bio-based

- Canada Metalworking Fluids Market, By Application

- Neat cutting oils

- Water cutting oils

- Corrosion preventive oils

- Others

- Canada Metalworking Fluids Market, By End-use

- Metal Fabrication

- Transportation Equipment

- Machinery

- Others

- Canada Metalworking Fluids Market, By Industrial End-use

- Construction

- Electric & Power

- Agriculture

- Automobile

- Aerospace

- Rail

- Marine

- Telecommunication

- Healthcare

- Canada. Metalworking Fluids Market, By Product

- Mexico

- Mexico Metalworking Fluids Market, By Product

- Mineral

- Synthetic

- Bio-based

- Mexico Metalworking Fluids Market, By Application