- Home

- »

- Advanced Interior Materials

- »

-

Metallurgical Coke Market Size, Share & Growth Report 2030GVR Report cover

![Metallurgical Coke Market Size, Share & Trends Report]()

Metallurgical Coke Market Size, Share & Trends Analysis Report By End Use (Iron & Steel, Chemical, Industrial), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-317-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Metallurgical Coke Market Size & Trends

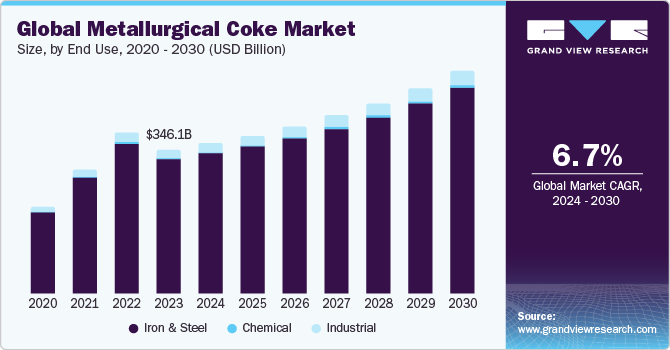

The global metallurgical coke market size was estimated at USD 346.15 billion in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. Growing steel production is expected to push the demand for metallurgical coke over the forecast period. Metallurgical coke, also known as metcoke, plays a key role during oxygen blast furnace steelmaking. It provides the heat energy required to melt the ore and acts as a reducing agent to produce pure iron. During the coking process, which operates at 1000-1100 °C, metcoke is produced from low-sulfur and low-ash coking coal.

In the U.S., steel production drives demand for metcoke manufactured from metallurgical coal. As per the World Steel Association, the U.S. ranked fourth in global crude steel production. Production in the country reached 80.7 million tons in 2023 compared to 80.5 million tons in 2022.

The U.S. is also the largest producer and exporter of coal products. As per U.S. Energy Information Administration, coal production in the country reached 142.3 million short tons in second quarter of 2023, a decline of 4.3% from previous quarter. Coal exports from U.S. reached 24.1 million short tons in second quarter of 2023.

In 2022, total coal exports reached 84.8 million short tons in 2022 compared to 85.1 million short tons in 2021. Out of total coal exports, metallurgical coal accounted share of 55% in 2022. Top exporting destinations were Brazil, Japan, India, the Netherlands, and South Korea. India was major importer of metallurgical coal, with volume of 8.4 million short tons in 2022.

The replacement of blast furnaces with electric arc furnaces is expected to hinder market growth. According to the Steel Manufacturers Association, the share of the electric arc furnace route in overall steel production in the U.S. is expected to reach 85% by 2025 from 70% in 2020. Thus, the growing number of electric arc furnaces is expected to negatively impact metcoke demand.

Metallurgical Coke Price Trends

Historically, metallurgical coke prices have experienced significant price fluctuations driven by factors such as supply chain disruptions, changes in global demand, and shifts in the global economy. The COVID-19 pandemic and geopolitical tensions have impacted the market, which has led to export restrictions and reduced steel demand, negatively affecting the industry. However, the market is expected to recover over the coming years, driven by increasing demand for steel products and the recovery of the global economy. Key industry developments, such as investments in R&D and diversification of product portfolios, are also expected to drive market growth.

Market Concentration & Characteristics

The market is at a moderate stage of growth, with an accelerated pace. It is highly fragmented, with a diverse mix of small, medium, and large-scale producers spread across different regions. This fragmentation promotes a competitive environment as companies strive to meet the specific demands of their regional markets.

Innovation activities are at a moderate level, with a significant focus on enhancing production efficiency and product quality. Companies are increasingly investing in technological advancements and R&D activities aimed at developing cleaner and more efficient coke production methods. This drive for innovation is fueled by the need to meet stringent environmental regulations and to produce higher-quality coke that meets the evolving requirements of end-users, particularly in the steel industry.

Merger and acquisition (M&A) activity is moderately high, driven by key players aiming to consolidate market positions and achieve economies of scale. Market leaders are acquiring smaller firms with advanced technologies, efficient processes, and strong regional presence. The market's high end-user concentration in the steel industry highlights its sensitivity to fluctuations in steel production and demand.

The regulatory impact is substantial, with stringent rules on production processes, environmental standards, and worker safety. Compliance is essential to avoid severe penalties and reputational damage. The sustainability push has heightened focus on recycling and waste management, driving adoption of eco-friendly technologies to minimize the environmental footprint of coke production.

The presence of product substitutes, such as alternative reductants in steelmaking process, poses a moderate threat to metallurgical coke industry. However, superior performance characteristics of metallurgical coke, such as its high carbon content and ability to support blast furnace process, ensure its continued preference among steel producers.

End-Use Insights

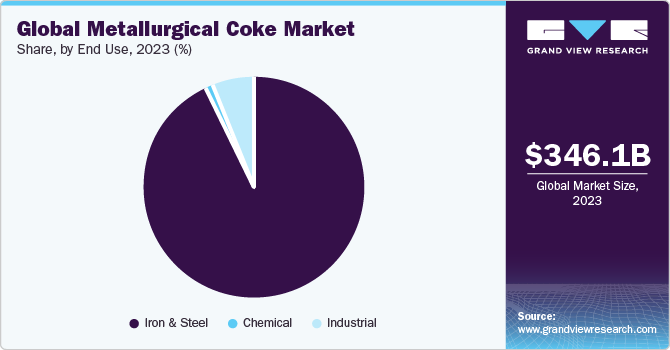

Iron and steel was the largest end-use segment, with a share of over 92% in 2023, and is expected to maintain its position over the forecast period. Metcoke is used in blast furnaces to chemically reduce iron oxides to form pig iron, which is further used to manufacture different grades of steel. The dominance of blast furnaces in countries such as China, India, Brazil, and Russia is likely to maintain demand momentum for metallurgical coke.

Demand for metallurgical coke in production of ferroalloys is another driving factor for market growth. Capacity expansion by ferroalloy-producing companies is expected to contribute to metcoke demand. For instance, in September 2023, Indian Metals and Ferro Alloys announced a new ferrochrome plant with 1,00,000 tons of annual smelting capacity at Kalinganagar. The project is expected to start in December 2023.

Besides iron & steel and alloys, metcoke is also used in applications where high-quality carbon is required. Some of the applications include corrosion materials, foundry coatings, conductive flooring, friction materials, ceramic packaging media, reducing agents, foundry carbon raiser, oxygen exclusion, heat treatment, poly-granular carbon products, and drilling applications.

Regional Insights

The North America metallurgical coke market growth, is expected to be driven by the demand for steel products, as these products are critical in construction and infrastructure projects. The North America market held a significant global revenue share in 2023.

U.S. Metallurgical Coke Market Trends

The growth of the metallurgical coke market in the U.S. is attributed to the increasing production of automotive vehicles in North America, as steel is a key material in vehicle manufacturing.

Asia Pacific Metallurgical Coke Market Trends

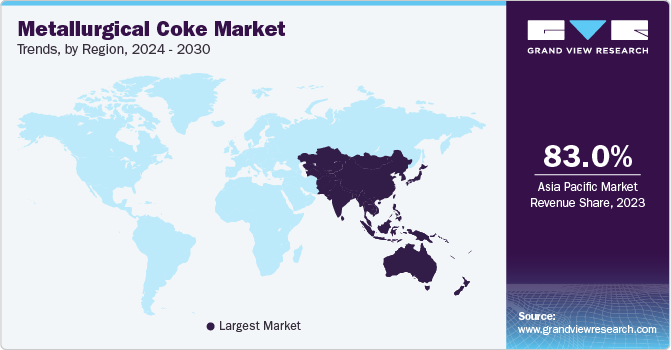

Asia Pacific metallurgical coke market dominated globally with a revenue share of over 83% in 2023. Investments by iron & steel companies are expected to benefit market demand. For instance, in August 2023, NMDC Limited, a state-owned iron mining company in India, announced commencement of operations at its blast furnaces in Chhattisgarh, India. This is India’s second-largest blast furnace and is expected to produce 9,500 tons of molten metal per day. and is an environment-friendly and energy-efficient blast furnace technology to manufacture steel.

The China metallurgical coke market dominated the Asia Pacific region with the largest revenue share in 2023.The supply of metallurgical coal is widely distributed around world, with China being a major producer and exporter of metcoke. In 2022, China exported nearly 9 million tons of metallurgical coke. Colombia and Poland were also top exporters in first half of 2022, however, exports declined in second quarter of the year.

Europe Metallurgical Coke Market Trends

The metallurgical coke market in Europe is witnessing trends that highlight the adoption of electric arc furnaces (EAF) over blast oxygen furnaces (BOF), which is expected to remain a major trend in Europe, thus critically impacting demand for metallurgical coal. As per the World Steel Association, EAF route steel production in European Union countries accounted for a share of around 43.7% as of 2022. The government's pressure to reduce carbon emissions is expected to play a key role in adoption of electric arc furnaces.

Central & South America Metallurgical Coke Market Trends

The metallurgical coke market in Central & South America is expected to grow in the coming years.As per the World Steel Association, crude steel production in Central & South America reached 41.5 million tons in 2023 from 42.4 million tons in 2022, thus driving the demand for metcoke.

Middle East & Africa Metallurgical Coke Market

The growth of the metallurgical coke market in Middle East & Africa is driven by the key growth factor of rising crude steel production. The production in the Middle East was 53.2 million tons in 2023, 5.5% more than in 2022. Furthermore, increasing production of automotive vehicles in the region and infrastructural developments are also expected to contribute to market growth over the forecast period.

Key Metallurgical Coke Company Insights

Some of the key players operating in the market include ArcelorMittal and CHINA SHENHUA.

-

ArcelorMittal employs a vertically integrated strategy to maintain a competitive edge. This includes owning and operating its coking coal mines, coke production facilities, and steel manufacturing plants. ArcelorMittal also invests heavily in advanced technologies to enhance efficiency and environmental sustainability of its coke production processes, reducing emissions and waste.

-

CHINA SHENHUA, a major player in metcoke market, leverages its vast coal reserves and extensive logistic network to optimize production and distribution. It focuses on operational efficiency by integrating its coal mining, coke production, and power generation activities. It helps minimizes costs and maximizes utilization of its resources. In addition, it invests in R&D to develop cleaner coke production technologies, aligning with China's stringent environmental regulations and global sustainability trends.

Key Metallurgical Coke Companies:

The following are the leading companies in the metallurgical coke market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Bluescope Steel

- CHINA SHENHUA

- ECL

- GNCL

- Hickman Williams & Company

- Jastrzębska Społka Weglowa (JSW)

- Mechel

- Nippon Steel Corporation

- OKK Koksovny, a.s.

- SunCoke Energy Inc.

Recent Developments

-

In November 2023, Glencore announced entering into an agreement to acquire 77% interest in Teck Resources's steel-making coal business, Elk Valley Resources. The transaction is for USD 6.93 billion. Also, it is anticipated that Nippon Steel Corporation will acquire additional equity in Elk Valley Resources from Teck Resources and eventually hold a total of 20% equity interest.

-

The coal miners in the U.S. are ramping up production for metallurgical coal, used in steel-making, and investing little in coal used in electricity generation. For instance, the U.S.-based Warrior Met Coal Inc. invested USD 127.8 million in Q4 2023 in its Blue Creek Growth project, making the total investment for 2023 USD 319.1 million. An additional expenditure for 2024 is expected between USD 325 to USD 375 million.

Metallurgical Coke Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 361.92 billion

Revenue forecast in 2030

USD 534.56 billion

Growth Rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End Use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Spain; Türkiye; Russia; China; Japan; India; South Korea; Brazil; South Africa; Iran

Key companies profiled

ArcelorMittal; Bluescope Steel; CHINA SHENHUA; ECL; GNCL; Hickman Williams & Company; Jastrzębska Społka Weglowa (JSW); Mechel; Nippon Steel Corporation; OKK Koksovny, a.s.; SunCoke Energy Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metallurgical Coke Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metallurgical coke market report based on end-use, and region:

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Iron & Steel

-

Chemical

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Spain

-

Türkiye

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Iran

-

-

Frequently Asked Questions About This Report

b. The global metallurgical coke market size was estimated at USD 346.15 billion in 2023 and is expected to reach USD 361.92 billion in 2024.

b. The global metallurgical coke market is expected to grow at a compound annual growth rate of 46.7% from 2024 to 2030 to reach USD 534.56 billion by 2030.

b. Based on end use segment, iron & steel held the largest revenue share of more than 93.0% in 2023 owing to rising and constant growth of steel production.

b. Some of the key vendors of the global metallurgical coke market are ArcelorMittal, Bluescope Steel, CHINA SHENHUA, ECL, GNCL, Hickman Williams & Company, Jastrzębska Społka Weglowa (JSW), Mechel, Nippon Steel Corporation, OKK Koksovny, a.s. and SunCoke Energy Inc.

b. Demand for steel products including rebar, sheets, coils and structural steel in building & construction and infrastructure sectors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."