- Home

- »

- Advanced Interior Materials

- »

-

Metal Shim Market Size, Share And Growth Report, 2030GVR Report cover

![Metal Shim Market Size, Share & Trends Report]()

Metal Shim Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Stainless Steel, Brass), By Product (Stock/Sheet, Slotted), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-359-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Shim Market Size & Trends

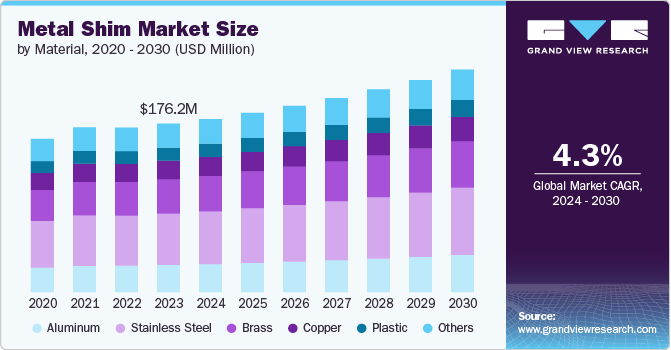

The global metal shim market size was estimated at USD 176.2 million in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. The growth of the market can be attributed to the surge in manufacturing activities across the automotive, aerospace & defense, and construction industries that fosters the demand for metal shims for the precise alignment of different types of machinery and equipment used in these industries.

Increasing adoption of automated manufacturing processes, such as CNC machining and laser cutting, for precise production of metal shims is expected to aid market growth. Further, integration of digital technologies such as CAD/CAM for design and customization capabilities has been acquiring considerable prominence.

Drivers, Opportunities & Restraints

The expansion of infrastructure across economies worldwide is one of the major growth drivers of the market. This growth is propelled by extensive projects aimed at developing transportation networks, urban infrastructure, and commercial facilities. In construction, metal shims play a critical role in ensuring the precise alignment and structural integrity of buildings and infrastructure.

The renovation and modernization of existing infrastructure contribute to the demand for metal shims. Retrofitting older structures with updated systems and technologies often necessitates the use of shims to achieve proper alignment and integration of new components with existing ones. This enhances functionality and extends the lifespan of infrastructure assets, addressing both functional and aesthetic requirements.

The market growth is further anticipated to be aided by advances in 3D printing, CNC machining, and digital modeling, which enhance the capabilities of metal shim production. The adoption of Industry 4.0 principles, such as automation and IoT, streamlines manufacturing processes and supports just-in-time production, benefiting market growth.

The growth, however, faces restraints owing to fluctuations in the prices of materials. Metals, such as aluminum, stainless steel, and copper, commonly used in the production of metal shims, are subject to volatile price movements influenced by global supply and demand dynamics, geopolitical factors, and economic uncertainties.

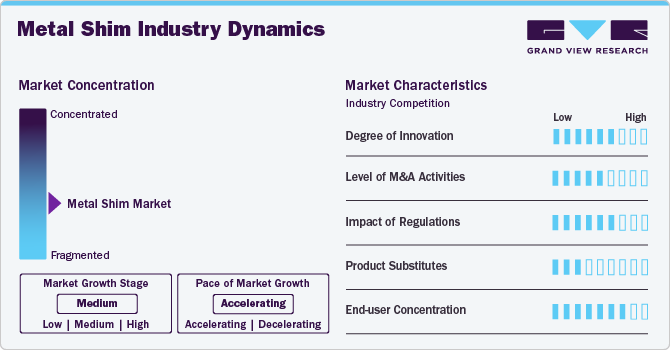

Industry Dynamics

Global metal shim market is fragmented, with numerous market players worldwide. Mature players have opted for strategies such as regional expansion through mergers & acquisitions and adoption of new technologies. For instance, in March 2023, SPIROL acquired UK-based Ford Aerospace to expand its product offerings and technical expertise in precision metal components and shims for the aerospace, industrial, and high-tech sectors.

Metal shims are specialized products used for specific applications in machinery alignment and adjustment. As a result, the availability of comparable alternatives is limited, which makes the threat of substitutes low.

Impact of regulations is moderately high for the market as the regulations that apply to metal shims relate to the materials used and the industries they are applied in. These are made from metals such as stainless steel, aluminum, and brass, so they must comply with relevant material safety and quality standards.

Material Insights

“Aluminum is expected to register a CAGR of 4.8% over the forecast period.”

Aluminum is renowned for its lightweight, strength, and durability. During the manufacturing of metal shims, this characteristic is particularly advantageous as it allows for the development of thin, yet sturdy shims. Aluminum shims can effectively adjust gaps, provide support, and ensure precise alignment without adding significant weight to the overall structure or component. These factors lead to the surged demand for aluminum shims from the aerospace, automotive, and electronics industries wherein weight reduction is a critical design consideration.

Stainless steel maintains its mechanical properties from cryogenic temperatures to high temperatures. This thermal stability makes stainless steel shims suitable for use in aerospace, automotive, and industrial applications. The components used in these applications are required to withstand extreme temperature variations without deforming or degrading.

Product Type Insights

“Shim shock/sheet held the largest revenue share of over 28% in 2023 of the global market.”

As shim stocks are extremely thin, it allows for their easy development into various custom shapes using metal shears or waterjet cutting techniques to cater to the specific requirements of specific applications. One of the primary drivers for the increasing demand for shim stocks across the world is their versatility and adaptability in addressing diverse engineering challenges.

Slotted shims are a vital product segment of the market. Their demand is witnessing notable growth across the world owing to their versatility, precision, and efficiency in addressing specific engineering and industrial requirements. These shims, also known as shim plates or shim stocks, are characterized by their precise slots or perforations, which allow for easy adjustment of machinery, equipment, and structural components.

Custom shims are anticipated to register fastest growth across the forecast period. They play a crucial role in addressing unique engineering challenges wherein standard shim sizes and configurations may not suffice. This acts as a key factor contributing to the demand for these shims worldwide. Industries such as aerospace, automotive, and energy require custom shims to meet specific dimensional tolerances, alignment requirements, and performance specifications. These shims are meticulously designed and manufactured to fit exacting standards and ensure optimal functionality, reliability, and safety in critical applications.

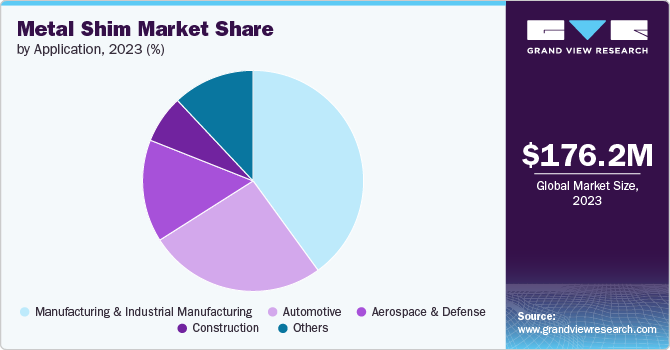

Application Insights

“Automotive held a share of around 26% in 2023 of the global market.”

Shims play a significant role in automotive manufacturing and maintenance by providing precise alignment, spacing, and adjustment to various critical components and assemblies. They are used for achieving optimal performance, reliability, and safety across numerous automotive applications, including engines, transmissions, chassis, braking systems, and electrical components. One notable driver behind the segment growth is rising sales of electric vehicles, which grew by 34.8% in 2023 compared to 2022.

Manufacturing and industrial machinery hold major share in the market. Shims are integral components of machinery, serving critical roles in achieving precise alignment, spacing, and adjustment of components. They play an important part in optimizing machinery performance, reducing downtime, and enhancing operational reliability across various industries including heavy machinery and consumer goods production.

A major factor driving the demand for shims in manufacturing and industrial machinery is their ability to achieve precise alignment of gears, bearings, shafts, and other components within assemblies. This minimizes wear, reduces friction, and prevents misalignments that can lead to equipment failures and costly downtime, thereby improving equipment effectiveness and production output.

Regional Insights

The metal shim market in North America is witnessing substantial growth owing to the diverse industrial landscape of the region. Another primary driver is surging manufacturing activities in the region in industries such as automotive, aerospace, electronics, and renewable energy.

U.S. Metal Shim Market

“U.S. held a share of over 78% of the North America metal shim market.”

U.S. metal shim market is anticipated to grow owing to rise in automotive manufacturing in the country. The product finds applications ranging from brake systems to engine components, and growth in vehicle production aids product demand.

Europe Metal Shim Market

The commitment of the region to renewable energy and sustainability initiatives is creating new opportunities for the growth of the metal shim market in Europe. Metal shims are essential in renewable energy generation plants, where they are used in wind turbines and solar panels for assembling and mounting them, as well as for offering them structural support.

The Germany metal shim market holds largest share in Europe. Germany, known for its robust automotive manufacturing sector, drives significant demand for metal shims in Europe primarily due to the high volumes of vehicles produced in the country. According to the German Association of the Automotive Industry, there was an 18% increase in domestic production of automobiles from 2022 to 2023

The metal shim market in the UK is growing as the aerospace industry plays a significant role in its growth. The country has a well-established aerospace industry with over 3,000 companies operating and records a robust export volume of products such as aircraft and related components.

Asia Pacific Metal Shim Market

The market for metal shim in Asia Pacific benefits from its growing demand in automotive, electronics, mining, construction, and renewable energy industries. Moreover, technological advancements in different verticals across key countries of the region also drive product demand.

The manufacturing sector is a primary driver of the growth of the China metal shim market. According to the State Council Information Office of China, in 2023, the country's total value-added industrial production was estimated to be around USD 5.6 trillion.

Central & South America Metal Shim Market

The region's increasing focus on industrialization and the expansion of manufacturing activities plays a significant role in driving the growth of the metal shim market in Central and South America. As the region continues to develop its industrial sectors, there is a surging demand for metal shims used in machinery, equipment manufacturing, and industrial processes.

Middle East & Africa Metal Shim Market

The construction industry is expanding in the region owing to the developments in large-scale infrastructure projects, commercial developments, and residential construction. As construction activities continue to increase in Middle East and Africa, the demand for metal shims is expected to grow in the region in the coming years.

Key Metal Shim Company Insights

Some of the key players operating in the market include Starret, Spirol, and MW Industries, Inc.

-

Starrett was established in 1880 and is headquartered in Massachusetts, U.S. The company is best known for its precision tools in the U.S., and it also produces a wide range of shim products. It generated a revenue of USD 256.2 million in 2023.

-

Spirol was established in 1948 and is headquartered in Connecticut, U.S. The company with its global presence serves diverse industries, including automotive, aerospace, and electronics. It offers a wide range of products through its advanced manufacturing capabilities, including precision shims designed for exact applications.

-

MW Industries was established in 1995 and is headquartered in Charlotte, North Carolina, U.S. It is engaged in the manufacture of shims, coiled springs, machined springs, flat springs, fasteners, metal bellows, and couplings. The company has 30 facilities operating on an international scale.

Key Metal Shim Companies:

The following are the leading companies in the metal shim market. These companies collectively hold the largest market share and dictate industry trends.

- AccuTrex Products, Inc

- Aloma Shim and Manufacturing Company

- American Metals Corporation (RELIANCE, INC.)

- Georg Martin GmbH.

- Houston Manufacturing Specialty Co., Inc.

- Huyett

- Mercer Gasket & Shim

- MW Industries, Inc.

- Northern Industrial Mfg.

- Precision Micro

- Queensland Gaskets

- SPIROL

- Starrett

- Stephens Gaskets Ltd

- Superior Washer & Gasket Corp.

- The ShimShack

- Trinity Brand Industries

Recent Developments

-

In May 2024, Mercer Gasket & Shim expanded its double-jacketed gasket and custom gasket production facilities. As part of this expansion, Mercer Gasket & Shim dedicated 7,000 square feet of its plant exclusively for the manufacturing of these specialized products.

-

In March 2024, Starret announced a merger agreement with an affiliate company of MiddleGround Capital at a cash transaction valued at USD 16.19 per share, a 63% premium over the closing stock price on March 8, 2024.

-

In March 2023, Georg Martin GmbH developed M-TechL PET, a non-metallic laminated shim made of polyethylene terephthalate Mylar from DuPont. These 0.1 mm laminated plastic foil shims are particularly suitable for lightweight structures and mechanical assemblies where electrical insulation is required, such as in automotive, aerospace, electrical, and measuring applications.

Metal Shim Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 181.0 million

Revenue forecast in 2030

USD 232.9 million

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative Units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; France; Italy; China; India; Japan; South Korea; Australia; Thailand; Singapore; Brazil; Chile; Colombia; Panama

Key companies profiled

Spirol; Queensland Gaskets; Mercer Gasket & Shim; Precision Micro; American Metals Corporation; Georg Martin GmbH; Stephens Gaskets Ltd.; MW Industries, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Shim Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global metal shim market report on the basis of material, product, application, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Stainless Steel

-

Brass

-

Copper

-

Plastic

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Slotted Shims

-

Shim Stock/Sheet

-

Arbor Shim

-

Custom Shim

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Manufacturing & Industrial Manufacturing

-

Construction

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Singapore

-

-

Central & South America

-

Thailand

-

Brazil

-

Chile

-

Colombia

-

Panama

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global metal shim market size was estimated at USD 176.2 million in 2023 and is expected to reach USD 181.0 million in 2024.

b. The global metal shim market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 232.9 million by 2030.

b. Based on application segment, manufacturing & industrial machinery held the largest revenue share of more than 40.0% in 2023.

b. Some of the key vendors of the global metal shim market are Spirol, Queensland Gaskets, Mercer Gasket & Shim, Precision Micro, American Metals Corporation, Georg Martin GmbH, Stephens Gaskets Ltd., MW Industries, Inc.

b. Growing investments towards infrastructural developments coupled with rising production activities in automotive, industrial machinery, and aerospace & defense are the major growth drivers of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.