- Home

- »

- Advanced Interior Materials

- »

-

Metal Forging Market Size, Share And Growth Report, 2030GVR Report cover

![Metal Forging Market Size, Share & Trends Report]()

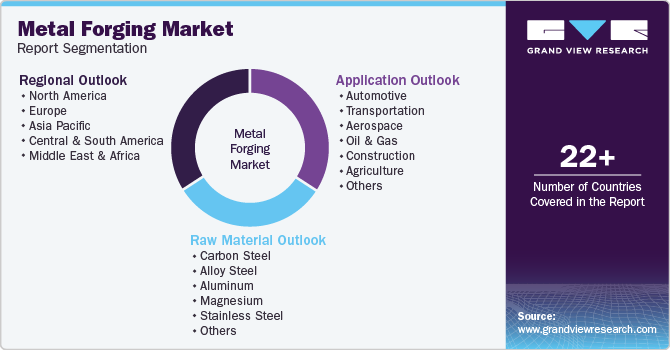

Metal Forging Market (2025 - 2030) Size, Share & Trends Analysis Report By Raw Material (Carbon Steel, Alloy Steel, Aluminum, Magnesium, Stainless Steel), By Application (Automotive, Transportation, Aerospace, Oil & Gas, Construction), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-308-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Forging Market Summary

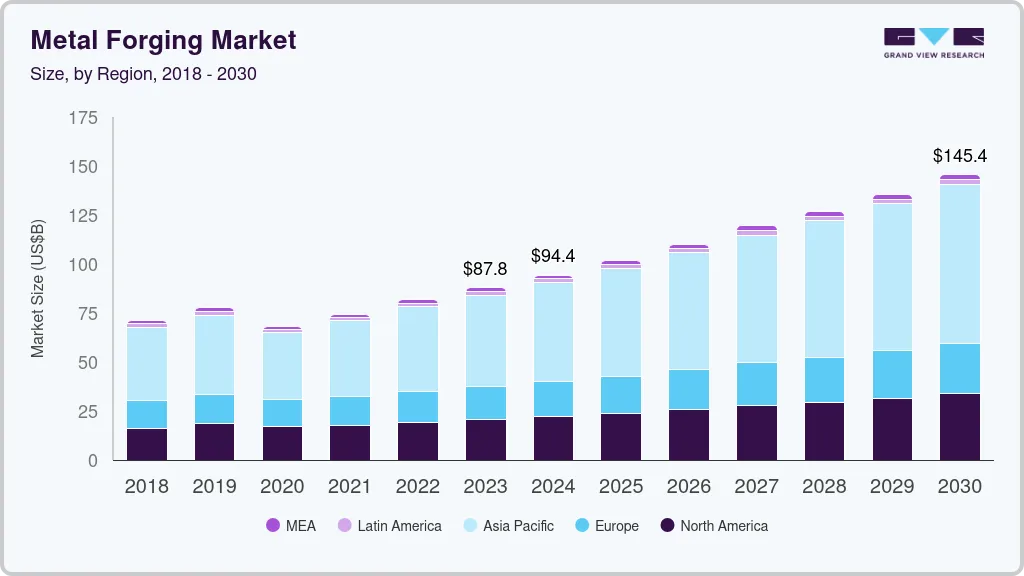

The global metal forging market size was estimated at USD 94.38 billion in 2024 and is projected to reach USD 145.46 billion by 2030, growing at a CAGR of 7.4% from 2025 to 2030. The market is driven by the increasing demand for lightweight and high-strength materials across various industries such as automotive, aerospace, and construction.

Key Market Trends & Insights

- Asia Pacific metal forging market dominated the region and accounted for a revenue share of 53.5% in 2024.

- The U.S. metal forging market is anticipated registering a CAGR of 7.7% over the forecast period.

- Based on application, the power generation segment is expected to grow at fastest CAGR of 11.3% over the forecast period.

- Based on raw material, the aluminum segment is expected to grow at the fastest CAGR of 8.4% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 94.38 Billion

- 2030 Projected Market Size: USD 145.46 Billion

- CAGR (2025-2030): 7.4%

- Asia Pacific: Largest market in 2024

As manufacturers demand improved performance and fuel efficiency, the use of forged components has gained traction due to their superior mechanical properties compared to cast or machined parts.

The ongoing advancements in forging technologies, such as closed-die and precision forging, are enhancing production efficiency and product quality, further propelling market growth. For instance, the automotive industry's shift towards electric vehicles (EVs) is driving the need for innovative forging solutions to produce lightweight components that contribute to overall vehicle efficiency.

Advancements in forging technologies, including closed-die and precision forging, are further driving the market by improving production efficiency and product quality. These technological innovations allow manufacturers to achieve greater accuracy and consistency in their products while minimizing material waste, companies are increasingly investing in modern forging equipment and processes to meet the evolving demands of their customers.

Rising investments in infrastructure development and construction projects globally are fueling the demand for forged products, especially in structural applications. Governments and private entities are focusing on building and upgrading transportation networks, energy facilities, and housing, all of which require durable and reliable forged components. This ongoing infrastructure boom is expected to significantly contribute to the overall growth of the metal forging market.

Drivers, Opportunities & Restraints

Innovations in forging technologies, such as precision forging and the integration of automation and robotics, are driving market growth. These advancements help improve the quality and accuracy of forge products while reducing production costs and time. The increased use of computer-aided design (CAD) and simulation software also enhances process optimization, allowing for more complex and high-performance forged parts, which are in demand in various industries.

The development of advanced forging technologies like automated forging systems, presents significant opportunities for market growth. Companies have been investing in these innovations to enhance production efficiency, reduce material waste, and meet the demand for complex, custom-designed components. Additionally, the rise in renewable energy projects, especially wind and solar power, has created new opportunities for forged metal parts, particularly in the manufacturing of turbine and structural components.

One of the key restraints facing the metal forging market is the volatility in raw material prices, particularly for steel and aluminum. These fluctuations increase production costs and create challenges for manufacturers in maintaining stable pricing. Another restraint is the growing emphasis on sustainability and environmental regulations, which require forging companies to adopt greener technologies and processes, potentially leading to higher operational costs and the need for continuous investments in compliance measures.

Application Insights

The growing demand for vehicles globally, especially in emerging economies like India, China, and Brazil, is a major driver for metal forging in the automotive sector. Forged components are widely used in various parts of vehicles, including engine parts, transmission systems, and suspension systems. In 2023, electric vehicle sales reached close to 14 million units, with the vast majority 95% concentrated in China, Europe, and the United States. These regions have seen the most rapid adoption due to government incentives and growing infrastructure.

Power generation segment is expected to grow at fastest CAGR of 11.3% over the forecast period. Rising global energy consumption is driving investments in both conventional and renewable energy infrastructure. Forged components are essential in power plants due to their durability and ability to withstand extreme conditions like high temperatures and pressures.

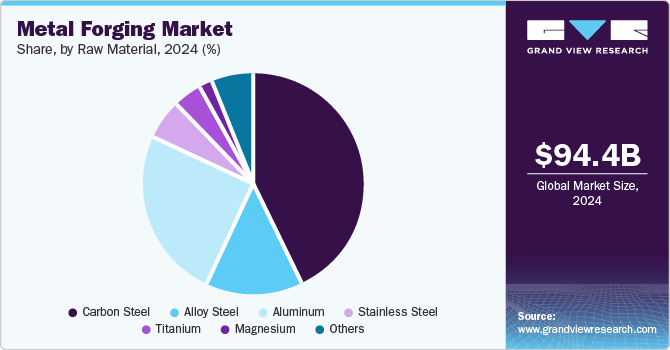

Raw Material Insights

Carbon steel is more affordable than alloys like stainless steel or aluminum, making it a cost-effective choice for mass-produced forged parts. Its lower price makes it highly appealing to industries looking to optimize cost without compromising quality. The automotive industry is a key driver for carbon steel forging. The rising demand for lightweight, durable, and cost-efficient automotive parts increases the use of carbon steel in forged components.

Aluminum segment is expected to grow at the fastest CAGR of 8.4% over the forecast period. Aluminum offers a high strength-to-weight ratio, making it ideal for applications that require both durability and lightness. This is particularly beneficial in industries like defense and sports equipment. Aluminum’s natural corrosion resistance makes it suitable for use in harsh environments, where other metals may degrade more quickly. Aluminum is 100% recyclable, and its use aligns with global sustainability goals, driving demand in industries focused on reducing environmental impact.

Regional Insights

North America metal forging market is expected to register a CAGR of 4.8%, in terms of volume, from 2025 to 2030. Significant investments in infrastructure development, driven by government initiatives and funding programs, are fueling demand for forged metal products in construction and public works of North America. Further, increasing investments in both traditional and renewable energy sectors are driving demand for forged components, including those used in power generation and transmission equipment.

U.S. Metal Forging Market Trends

The U.S. metal forging market is anticipated registering a CAGR of 7.7% over the forecast period. The U.S. government’s focus on improving infrastructure, including roads, bridges, and public transportation systems, increases the demand for forged components used in heavy machinery, construction equipment, and structural applications. Public and private sector investments in renewable energy infrastructure, for example, wind turbines and solar panels are also expected to fuel the demand for forged parts over the coming years.

Asia Pacific Metal Forging Market Trends

Asia Pacific metal forging market dominated the region and accounted for a revenue share of 53.5% in 2024. Countries in the Asia Pacific, especially China, India, and Japan, are undergoing rapid industrialization and urbanization, increasing demand for forged metal products in infrastructure and industrial machinery. The construction of highways, bridges, and commercial buildings requires a significant volume of forged steel, aluminum, and iron components, including beams, girders, and other heavy-duty parts. Expansion in manufacturing sectors such as machinery and equipment also drive the demand for forged components in various industrial applications.

The metal forging market in China is anticipated to progress due to the growth of the aerospace and defense industries which are driving demand for high-quality forged components used in aircraft and military vehicles. China’s focus on self-reliance in aerospace manufacturing, through companies like COMAC and AVIC, is creating a substantial need for forged components in aircraft frames, engines, and landing gear.

Europe Metal Forging Market Trends

The metal forging market in Europe held a revenue share of over 19% in 2024. Growth in aerospace and defense sectors is encouraging manufacturers to expand their industry footprints. For instance, on January 15, Aubert & Duval ordered a hydraulic closed-die forging press from SMS group for its Pamiers site in France, aiming to enhance its position as a leading European metallurgy company in aerospace, energy, and defense, and to prepare for the next generation of aircraft.

Central & South America Metal Forging Market Trends

The market for metal forging in CSA is anticipated to register a CAGR of 4.9% over the forecast period. Growth in industrial machinery is boosting the demand for forged components, especially those made from aluminum. Further, government initiatives and private investments in infrastructure projects are driving demand for forged materials, particularly in countries like Colombia and Chile, where significant construction projects are underway.

Middle East & Africa Metal Forging Market Trends

The region holds the smallest share of the global market, however, growth in automotive industry is propelling the demand for forged products in the region. For instance, according to OICA, the vehicle production in South Africa rose by 14% in 2023, on a y-o-y basis.

Key Metal Forging Company Insights

Some of the key players operating in the market include Aronic, ATI, Bharat Forge Ltd.

-

Aronic is a prominent player in the global metal forging market, specializing in providing high-quality forged components and solutions to various industries, including automotive, aerospace, energy, and construction. Aronic has developed a comprehensive range of products that includes precision forged parts, custom forgings, and specialized components tailored to meet the unique needs of its clients. The company employs advanced forging technologies and manufacturing processes, ensuring that its products meet stringent quality standards and performance requirements.

-

Allegheny Technologies Incorporated (ATI) is a leading global manufacturer of technically advanced specialty materials and complex components, primarily serving the aerospace, defense, oil and gas, and energy industries. The company offers a comprehensive range of products, including forged bars, discs, and shapes, which are engineered for demanding applications. ATI's forging capabilities enable the production of high-strength, lightweight components that meet stringent quality and performance standards.

-

Bharat Forge operates across various sectors, including automotive, aerospace, defense, railways, and energy, providing a diverse range of forged products. The company's product offerings include critical components such as crankshafts, connecting rods, gears, chassis parts, and various specialty forged products. Bharat Forge's advanced manufacturing capabilities are supported by state-of-the-art technology, including computer numerical control (CNC) machines and automated forging lines.

Key Metal Forging Companies:

The following are the leading companies in the metal forging market. These companies collectively hold the largest market share and dictate industry trends.

- Bruck GmbH

- China First Heavy Machinery Co., Ltd.

- ELLWOOD Group, Inc.

- Jiangyin Hengrun Heavy Industries Co., Ltd.

- Nippon Steel Corp.

- Precision Castparts Corp.

- Larsen & Toubro Ltd.

Recent Developments

-

In May 2024, Balu Forge Industries Ltd. announced the strategic acquisition of 72,000-tonne forging lines in Karnataka, India significantly enhancing its manufacturing capabilities and market position in the metal forging sector. This acquisition is a critical step in the company's efforts to expand its production capacity and meet the growing demand for high-quality forged components across various industries, including automotive, aerospace, and defense. The new forging lines are equipped with advanced technology, allowing Balu Forge to produce a wider range of precision-engineered products while ensuring superior quality and efficiency in manufacturing processes.

-

In October 2024, Bharat Forge Ltd. announced an agreement to acquire AAMIMCPL, a strategic move aimed at bolstering its position in the global metal forging market. This acquisition will enable Bharat Forge to integrate AAMIMCPL's advanced manufacturing technologies and extensive expertise in producing high-quality forged components. The collaboration is expected to enhance Bharat Forge’s product offerings, particularly in the automotive and aerospace sectors, by leveraging synergies in research and development, operational efficiencies, and supply chain management.

Metal Forging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 101.76 billion

Revenue forecast in 2030

USD 145.46 billion

Growth Rate

CAGR of 7.4% from 2025 to 2030

Base year for estimation

2024

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, raw material, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea

Key companies profiled

Arconic; ATI; Bharat Forge; Bruck GmbH; ELLWOOD Group Inc.; Jiangyin Hengrun Heavy Industries Co.,Ltd. ,Nippon Steel Corp., Precision Castparts Corp., Larsen & Toubro Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Forging Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global metal forging market report on the basis of raw material, application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Automotive

-

Transportation

-

Aerospace

-

Oil & Gas

-

Construction

-

Agriculture

-

Power Generation

-

Marine

-

Others

-

-

Raw Material Outlook (Volume, Kil0tons; Revenue, USD Million; 2018 - 2030)

-

Carbon Steel

-

Alloy Steel

-

Aluminum

-

Magnesium

-

Stainless Steel

-

Titanium

-

Others

-

-

Regional Outlook (Volume, Kil0tons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The metal forging market size was estimated at USD 94.38 billion in 2024 and is expected to reach USD 101.76 billion in 2025.

b. The metal forging market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach USD 145.46 billion by 2030.

b. Based on application segment, automotive held the largest revenue share of more than 53.0% in 2024 owing to rising production of electric vehicles.

b. Some of the key vendors of the Metal Forging market are Arconic; ATI; Bharat Forge; Bruck GmbH; ELLWOOD Group Inc.; Jiangyin Hengrun Heavy Industries Co.,Ltd.

b. Increasing demand for lightweight and high-strength materials across various industries such as automotive, aerospace, and construction is driving growth of metal forging market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.