Metal Cutting Machine Market Size, Share & Trends Analysis Report By Product (Laser Cutting Machine, Waterjet Cutting Machine), By Application (Automotive, Defense & Aerospace), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-561-8

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

The global metal cutting machine market size was estimated at USD 5.84 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. Metal-cutting machines are in high demand due to factors, such as the growing implementation of Industry 4.0 systems, the increasing demand for automatic metal-cutting technologies, and the quickly developing global building & construction industry. The market has grown steadily in recent years due to the rising need for metal products in various industries. The creation of more inventive cutting tools due to improvements in metal cutting technology has increased productivity, decreased waste, and enhanced the general quality of metal goods. The increased demand for metal-cutting equipment from various sectors drives the market's growth.

The pandemic-related slowdown in production had a significant impact on the metal-cutting sector. Metal-cutting products demand fell in 2020 as a result of the disruption in manufacturing activities brought on by the widespread implementation of lockdowns and social distancing policies. Numerous metal-cutting manufacturers temporarily halted operations as a result of the pandemic or lowered their capacity as a result of a slowdown in orders. As a result, the market's revenue and profitability decreased during 2020.

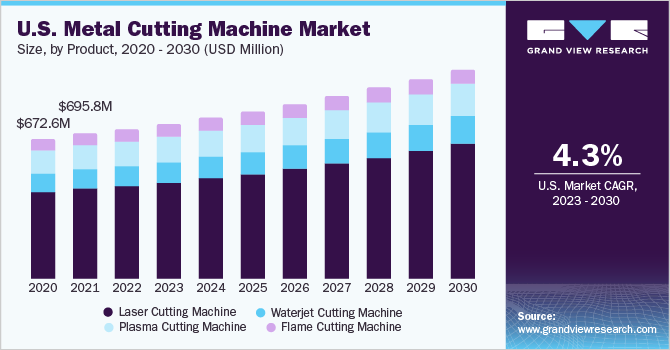

The U.S. is a central manufacturing hub for various companies due to the country’s strategic location. Favorable conditions such as the availability of highly skilled labor at low cost, affordable modern infrastructure, and proximity to high-demand markets that ensure smooth exports for starting new manufacturing facilities in the U.S. are expected to augment the number of manufacturing facilities in the country. This, in turn, is anticipated to boost the demand for metal-cutting machines over the forecast period.

The increasing implementation of industry 4.0 technologies such as the Internet of Things (IoT), data analytics, and automation, is maximizing the productivity of laser-cutting machines through real-time data exchange, which enables optimum production. Manufacturers aim to improve production, decrease downtime, and operate cost-efficiency, which is likely to positively influence the metal-cutting machine industry's growth.

According to Aerospace Industries Association (AIA), the U.S. aerospace & defense industry exported to 205 countries, and between 2020 & 2021 the U.S. industry exports rose by 11.2% to a total valuation of USD 100.4 billion. The metal-cutting machine also plays a vital role in the manufacturing of aviation and military components, and equipment. It provides efficient and effective solutions for the various application segments in the aerospace industry such as engine parts, turbines, ignitors, ammunition, and guns. Thus, the growing aerospace industry is expected to fuel the adoption of metal-cutting machines over the forecast period.

Fiber laser cutting machine has various advantages such as improved process for micro cutting, high-quality cuts, and precise shaping of structural steel. Moreover, the market growth of fiber laser cutting equipment is fueled by various significant benefits such as high power safety, swift operation, and machine ergonomics. Many fiber laser cutting machines are equipped with pre-focused optical systems with suitable deflection lenses, and laser light transmission, which improves their accuracy and performance. Thus, the emergence of new cutting technologies is driving market growth.

Product Insights

The laser cutting machine product segment dominated the metal cutting machines industry in 2022 by accounting for a share of over 62.2% of the market in terms of revenue as these machines offer excellent power efficiency and higher precision than mechanical cutting. They work exceptionally well on hard metals such as steel and mild steel but not on highly reflective metals such as aluminum and copper.

The waterjet cutting machine product segment registered a CAGR of 5.2% from 2023 to 2030. Waterjet cutting machines utilize a mixture of water or pure water and abrasive material as a cutting media for over 10-inch-thick metal sheets or plates. For instance, Flow International Corporation Mach 500 machine can quickly and accurately cut up to 24 inches in thickness. Furthermore, the machine is equipped with the latest technology including, a dynamic waterjet system, a 94 thousand psi pump for precision shapes, and rapid drilling.

Plasma-cutting machines are often used in salvage and scrapping operations, industrial construction facilities, automotive repair, and restoration and fabrication shops. Owing to their low cost, precision cuts, and high speed, plasma-cutting machines are used in various end-use industries.

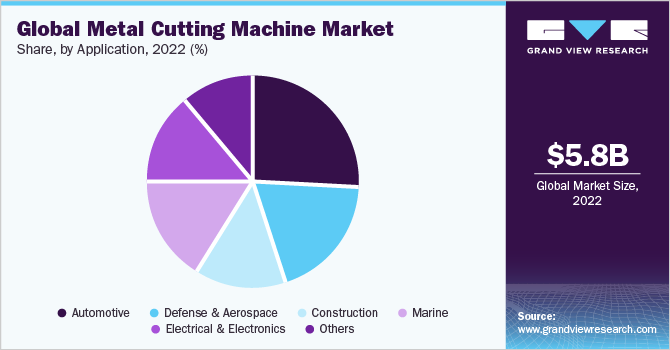

Application Insights

The automotive application dominated the metal cutting machines industry in 2022 with a revenue share of over 26.5%. The automotive industry uses metal cutting machines extensively to cut a wide range of interior and exterior components of SUVs and passenger cars. These machines are also used to produce components ranging from weather stripping and carpets to door panels and chassis.

Metal cutting machines are widely used to manufacture paving & earth moving equipment and cranes required in industrial construction. They also cut holding tanks, corrugated steel, gates, elevators, stairs, bridges, and other metal components used in residential and commercial construction.Increasing infrastructural activities in major economies such as China and India will fuel the demand for metal-cutting machines in the next few years.

In electronics, metal cutting machines, especially of the laser category, are extensively used to produce superior edge quality, high-dimensional, and high-precision components. They cut springs, capacitors, motherboards, circuits, and other small parts with high accuracy levels. This segment growth can be attributed to the rising consumer awareness about innovative technologies and the increasing purchasing power of the middle-class population, which is anticipated to fuel the demand for smart consumer appliances over the forecast period.

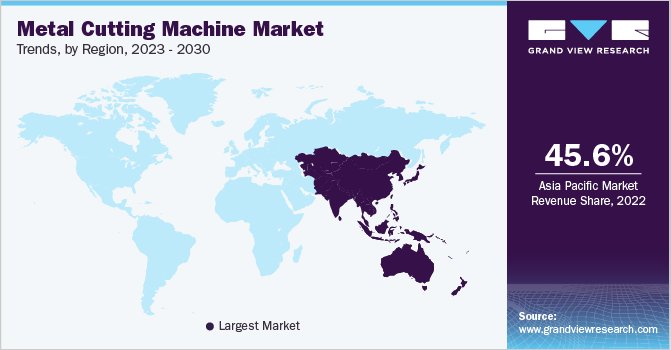

Regional Insights

The European space & defense industry is expected to surpass the U.S. aerospace and defense industry in terms of growth over the forecast period, owing to the slight increase in defense spending by Germany and France. The industry experienced moderate growth against the economic slowdown and uncertainties. However, the Europe industry is expected to be highly concentrated due to few major players accounting for a large share of the market. The rapid growth of the aerospace & defense industry in the region is predicted to boost the demand for metal-cutting machines over the forecast period.

Asia Pacific dominated the market with a revenue share of 45.6% in 2022. The region presents significant opportunities for aerospace manufacturers including maintenance, repair & overhaul, general aviation, and military equipment manufacturing. In addition, rapid economic developments in countries such as China, and India are expected to fuel the product demand in the coming years. The extensive use of metal cutting machinesin construction, automotive, aerospace & defense industries due to the machine’s superior optical properties such as coherence, diffraction, monochromaticity, and radiance is expected to be one of the significant factors influencing market growth in this region.

The Middle East and Africa regional growth is expected to be driven by the escalating construction industry coupled with the increasing private & public investment in infrastructural development in this region. Israel is one of the major players in the region. Robust aviation, electronics, and telecommunication sectors in the country are anticipated to drive product demand over the forecast period.

Key Companies & Market Share Insights

The manufacturers adopt several strategies, including acquisitions geographical expansions, new joint ventures, product developments, and mergers to enhance market penetration and cater to the changing technological requirements from various applications such as automotive, defense & aerospace, construction, marine, electrical & electronics, and others.

For instance, in February 2023, AMADA Co. Ltd. announced the launch of its NC equipment 'AMNC 4ie' for fiber laser cutting and press brakes. Equipping the machines with AMNC 4ie advances them into environmentally friendly machines. Some prominent players in the global metal cutting machine market include:

-

TRUMPF

-

AMADA Co. Ltd.

-

ESAB Corporation

-

Bystronic Laser AG

-

WARDJet

-

Koike Aronson, Inc.

-

Nissan Tanaka Corporation

-

Lincoln Electric Company

-

Water Jet Sweden AB

-

Flow International Corporation

-

Coherent Corp.

-

Messer Cutting Systems GmbH

-

Omax Corporation

-

Boye Laser Applied Technology Co., Ltd.

-

Han's Laser Technology Industry Group Co., Ltd.

Metal Cutting Machine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 6.11 billion |

|

Revenue forecast in 2030 |

USD 8.80 billion |

|

Growth rate |

CAGR of 5.2% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

August 2023 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; Italy; UK; China; India; Japan; South Korea; Brazil; Argentina; Israel; South Africa |

|

Key companies profiled |

TRUMPF, AMADA Co. Ltd.; ESAB Corporation; Bystronic Laser AG; WARDJet; Koike Aronson, Inc.; Nissan Tanaka Corporation; Lincoln Electric Company; Water Jet Sweden AB; Flow International Corporation; Coherent Corp.; Messer Cutting Systems GmbH; Omax Corporation; Boye Laser Applied Technology Co., Ltd.; Han's Laser Technology Industry Group Co., Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Metal Cutting Machine Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metal cutting machine market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Laser Cutting Machine

-

Waterjet Cutting Machine

-

Plasma Cutting Machine

-

Flame Cutting Machine

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Defense & Aerospace

-

Construction

-

Marine

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Israel

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global metal cutting machine market size was estimated at USD 5.84 billion in 2022 and is expected to be USD 6.11 billion in 2023.

b. The global metal cutting machine market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.2% from 2023 to 2030 to reach USD 8.80 billion by 2030.

b. Asia Pacific dominated the metal cutting machine market in 2022. The region presents significant opportunities for aerospace manufacturers, maintenance, repair & overhaul, general aviation, and military equipment manufacturers. In addition, rapid economic developments in countries such as China, and India are expected to fuel the product demand in the coming years.

b. Some of the key players operating in the metal cutting machine market include TRUMPF, AMADA Co. Ltd., ESAB Corporation, Bystronic Laser AG, WARDJet, Koike Aronson, Inc., Nissan Tanaka Corporation, Lincoln Electric Company, among others.

b. The ongoing developments in digital technology, especially in embedded systems have enabled lower operational costs for machines and less labor interference in metalworking for real-time applications. Sheet metal cutting is essential in many industries such as construction, automotive, electronics, shipbuilding, and aerospace. The growth of the above-mentioned industries is expected to drive the demand for the metal cutting machines over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."