- Home

- »

- Renewable Energy

- »

-

Metal-air Battery Market Size, Share & Trends Report, 2030GVR Report cover

![Metal-air Battery Market Size, Share & Trends Report]()

Metal-air Battery Market (2024 - 2030) Size, Share & Trends Analysis Report By Metal (Zinc, Lithium, Aluminum), By Voltage (Low, Medium, High), By Type, By Application (Electric Vehicles, Military Electronics, Electronics Devices), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-271-1

- Number of Report Pages: 218

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal-air Battery Market Summary

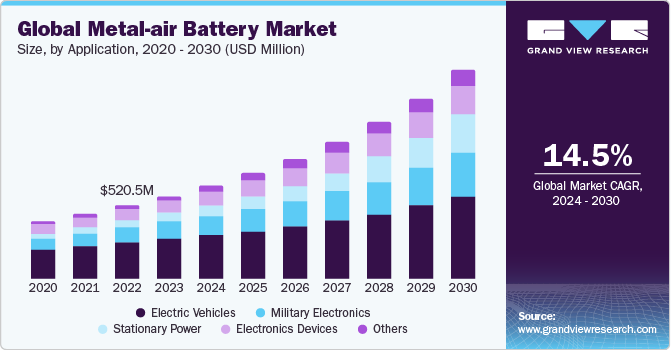

The global metal-air battery market size was estimated at USD 585.30 million in 2024 and is anticipated to reach USD 1,486.89 million by 2030, growing at a CAGR of 14.5% from 2024 to 2030. The market is experiencing significant growth, driven by the adoption of metal-air batteries across various industries.

Key Market Trends & Insights

- Asia Pacific dominated the market and accounted for the largest revenue share of 49.11% in 2023.

- China held significant share of about 39.87% in the Asia Pacific region in 2023.

- By metal, zinc emerged as the largest metal segment with a market share of about 69.13% in 2023.

- By voltage, low (<12 V) voltage emerged as the largest segment with a revenue share of about 66.48% in 2023.

- By application, electric vehicles emerged as the largest application segment with a market share of about 48.63% in 2023

Market Size & Forecast

- 2023 Market Size: USD 585.30 Million

- 2030 Projected Market Size: USD 1,486.89 Million

- CAGR (2024-2030): 14.5%

- Asia Pacific: Largest market in 2023

One of the primary drivers is the increasing demand for energy storage solutions with higher energy density and longer cycle life. Metal-air batteries, characterized by their high energy density and potential for significant advancements in energy storage technology, have garnered attention as a promising alternative to traditional lithium-ion batteries.A significant contributor to the expansion of the metal-air battery market is the rising adoption of electric vehicles (EVs). With the automotive industry transitioning towards electrification to meet stringent emissions regulations and address environmental concerns, there is a growing need for batteries capable of delivering extended driving ranges. Metal-air batteries offer a compelling solution due to their superior energy density, enabling EV manufacturers to develop vehicles with longer ranges and improved performance. As a result, the demand for metal-air batteries in the EV market is expected to surge, driving market growth over the forecast period.

Furthermore, ongoing advancements in battery technology and materials science play a crucial role in driving the market growth. Continuous research and development efforts aimed at improving electrode materials, electrolytes, and battery designs have led to significant enhancements in performance, efficiency, and cost-effectiveness of metal-air batteries. These advancements have strengthened the value proposition of metal-air batteries, making them increasingly attractive for a wide range of applications beyond electric vehicles, including consumer electronics, grid energy storage, and off-grid power solutions.

Market Concentration & Characteristics

This market is a dynamic and competitive space with established players and innovative newcomers vying for dominance. Also, the industry is facing fierce competition from established players in various sectors. Leading companies like GP Batteries International Limited; Arotech; Energizer Holdings, Inc.; and Duracell Inc. have been in industry for years, boasting extensive experience and established customer bases. Startups and smaller companies are entering fray with innovative technologies and disruptive business models.

Companies are increasingly focusing on expansion of metal-air battery facility in order to increase their foothold in market. For instance, in February 2024, Indian Oil Corporation Limited, one of the leading state-owned multinational energy companies, has completed its second round of investment in one of the leading Israeli companies, Phinergy, for its stake in metal-air technology manufacturing up to 17%, with an investment of US$12.5 million. The investment will be used by Phinergy to expand its operations in India and increase the production of systems used to provide power backup in the telecom sector.

Metal Insights

Zinc emerged as the largest metal segment with a market share of about 69.13% in 2023 and is expected to witness robust growth over the forecast period. This commanding presence is poised to continue its momentum over the forecast period, largely attributed to the favorable characteristics and widespread availability of zinc. As a relatively abundant and cost-effective metal, zinc offers a compelling proposition for manufacturers and end-users seeking energy storage solutions for various applications. Its affordability and accessibility make zinc-based metal-air batteries an appealing choice for industries ranging from electric vehicles to grid energy storage systems.

Furthermore, the robust growth expected in the zinc segment can be attributed to ongoing advancements in battery technology and materials science. Research and development efforts focused on optimizing zinc-based batteries for improved energy density, longer cycle life, and enhanced safety features are driving innovation within the industry. These advancements are unlocking new opportunities for zinc-based metal-air batteries, further solidifying zinc's position as the leading metal segment in the market.

Voltage Insights

Low (<12 V) voltage emerged as the largest segment with a revenue share of about 66.48% in 2023 and is expected to witness robust growth over forecast period. This segment's strong performance is expected to continue its upward trajectory over the forecast period, driven by several factors contributing to its robust growth. One significant factor is the increasing demand for low-voltage batteries in a wide range of applications, including portable electronics, automotive accessories, and small-scale renewable energy systems. These applications require compact and lightweight energy storage solutions with lower voltage requirements, making low-voltage batteries a preferred choice for manufacturers and consumers alike.

Moreover, the robust growth expected in the low voltage segment can also be attributed to advancements in battery technology, leading to improved performance, efficiency, and cost-effectiveness. Continuous research and development efforts aimed at enhancing the energy density, cycle life, and safety features of low-voltage batteries are driving innovation within the industry. Additionally, the growing emphasis on sustainability and environmental responsibility is fueling the demand for energy-efficient and eco-friendly battery solutions, further bolstering the prospects of the low-voltage segment.

Application Insights

Electric vehicles emerged as the largest application segment with a market share of about 48.63% in 2023 and is expected to witness robust growth over forecast period. This segment is poised to experience robust growth over the forecast period, driven by increasing global demand for electric vehicles as countries strive to reduce greenhouse gas emissions and transition towards cleaner and more sustainable transportation solutions. Metal-air batteries offer a promising energy storage option for EVs due to their high energy density, which enables longer driving ranges and improved performance compared to traditional lithium-ion batteries.

Furthermore, the expected robust growth in the EV segment can also be attributed to ongoing advancements in battery technology and manufacturing processes. Research and development efforts aimed at enhancing the energy density, longevity, and safety features of metal-air batteries are driving innovation within the industry, making them increasingly suitable for electric vehicle applications. Additionally, government incentives, subsidies, and regulations aimed at promoting the adoption of electric vehicles are further fueling the demand for metal-air batteries in this segment.

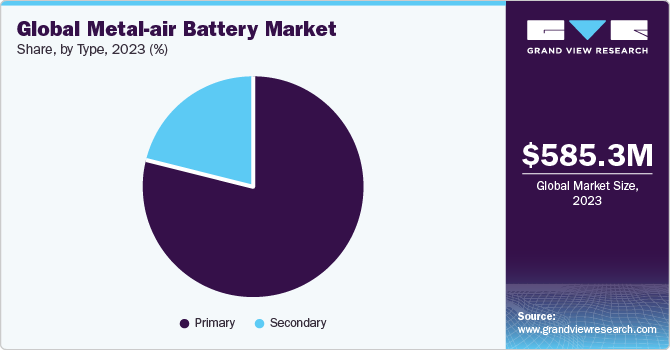

Type Insights

Primary emerged as the largest type segment with a market share of about 79.46% in 2023 and is expected to witness robust growth over forecast period. This segment is expected to continue experiencing robust growth over the forecast period, driven by several factors contributing to its strong performance. One key factor is the widespread adoption of primary metal-air batteries in various applications where long-term reliability and durability are essential. Primary batteries offer a one-time use, making them ideal for applications such as medical devices, remote sensors, and military equipment, where continuous power supply is critical and recharging is impractical or unfeasible.

Moreover, the robust growth anticipated in the primary type segment can also be attributed to advancements in battery technology, leading to improved performance and efficiency. Continuous research and development efforts aimed at enhancing the energy density, shelf life, and reliability of primary metal-air batteries are driving innovation within the industry. Additionally, the growing demand for portable and disposable power sources in remote and off-grid locations is further fueling the adoption of primary batteries, contributing to the segment's growth in the market.

Regional Insights

The North American metal-air battery market is poised for significant growth, driven by the increasing demand for long-duration energy storage solutions for renewable energy integration and grid stability. With its abundance of raw materials like zinc and aluminum, North America presents a favorable environment for the development of cost-effective metal-air batteries. However, challenges like limited cycle life and energy density compared to lithium-ion batteries need to be addressed for wider adoption in electric vehicles and grid-scale applications.

U.S. Metal-air Battery Market Trends

U.S. metal-air battery market is expected to grow at a CAGR of 13.9% from 2024 to 2030. Key factors contributing to growth of market are increasing demand for high-energy-density batteries in electric vehicles and consumer electronics, advancements in battery technology driving improved performance and efficiency, growing investments in research and development, the rising adoption of renewable energy storage solutions, and the expanding applications of metal-air batteries in grid energy storage systems and off-grid power solutions.

Europe Metal-air Battery Market Trends

The metal-air battery market in Europe is on the rise, fueled by its potential for clean energy solutions. Emphasis on sustainability and renewables aligns well with metal-air batteries' high energy density and use of abundant materials. Supportive government policies and a collaborative scientific environment can accelerate advancements in rechargeable technology. While challenges like cost competitiveness remain, the Europe market is poised for significant growth, potentially transforming how we power devices and achieve a greener future.

The metal-air battery market in France is anticipated to grow at a CAGR of over 15.3%. This growth can be attributed to several factors, including increasing government initiatives and incentives to promote clean energy technologies, rising demand for electric vehicles and renewable energy storage solutions, advancements in battery technology driving improved performance and cost-effectiveness, and growing investments in research and development. Additionally, the expanding applications of metal-air batteries in various sectors such as transportation, telecommunications, and grid energy storage are expected to contribute to the market's robust growth in France.

Asia Pacific Metal-air Battery Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of 49.11% in 2023 and is likely to continue dominating over the forecast period. The growth, driven by rapid industrialization and urbanization witnessed across the countries in Asia Pacific, led to increased demand for energy storage solutions in various sectors such as automotive, electronics, and renewable energy. As the world's largest manufacturing hub and a key market for electric vehicles, Asia Pacific presents significant opportunities for the adoption and growth of metal-air batteries in diverse applications.

Moreover, the expected continued dominance of Asia Pacific in the metal-air battery market is due to constant technological innovation and infrastructure development. Governments and industry stakeholders in countries such as China, Japan, and South Korea are investing heavily in research and development initiatives aimed at advancing battery technology and promoting the adoption of clean energy solutions.

Additionally, supportive government policies, incentives, and subsidies aimed at promoting the use of electric vehicles and renewable energy sources are further driving the demand for metal-air batteries in the region. With its conducive business environment, robust manufacturing capabilities, and strategic sustainability initiatives, Asia Pacific is poised to maintain its leadership position and significantly drive the market growth.

The metal-air battery market in China held significant share of about 39.87% in the Asia Pacific region in 2023. This surge is driven by a combination of factors like government support for clean energy solutions, a strong electronics manufacturing base, and rapidly growing demand for EVs, all potentially creating a potential market for metal-air battery adoption.

Middle East & Africa Metal-air Battery Trends

The Middle East & Africa metal-air battery market is expected to grow at a CAGR of approximately 17.7% over the forecast period. This growth is fueled by the increasing focus on offshore renewable energy projects, such as wind farms and floating solar installations, leading to increased demand for metal-air battery to store and manage energy generated from these sources.

The Saudi Arabia metal-air battery market held a dominant share of about 24.06% in the Middle East & Africa region in 2023. The Saudi Arabian government has policies that support the development and adoption of clean energy technologies, potentially including metal-air batteries. This could involve financial incentives for manufacturers or consumers or streamlined regulations for faster commercialization.

Key Metal-air Battery Company Insights

The market is moderately fragmented with the presence of a sizable number of medium and large-sized companies. Key players mainly cater to electric vehicles (EVs), consumer electronics, renewable energy storage, and grid energy storage systems industries. Key companies are adopting several organic and inorganic growth strategies, such as facility expansion, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In March 2024, Stryten Energy LLC, one of the leading U.S.-based energy storage solutions providing companies, launched a new line of Class I, II, and III lithium batteries with the brand name M-Series Li600, at MODEX 2024 in Atlanta, Georgia.

-

In February 2024, Indian Oil Corporation Limited, one of the leading state-owned multinational energy companies, completed its second round of investment in one of the leading Israeli companies, Phinergy, for its stake in metal-air technology manufacturing up to 17%, with an investment of US$12.5 million. The investment will be used by Phinergy to expand its operations in India and increase the production of systems used to provide power backup in the telecom sector.

Key Metal-air Battery Companies:

The following are the leading companies in the metal-air battery market. These companies collectively hold the largest market share and dictate industry trends.

- GP Batteries International Limited

- Arotech

- Energizer Holdings, Inc.

- Duracell Inc.

- Renata SA

- Phinergy

- Log9 Materials

- Poly Plus Battery

- Zinc8 Energy Solutions

- Panasonic Energy Co., Ltd.

Metal-air Battery Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 660.81 million

Revenue forecast in 2030

USD 1,486.89 million

Growth rate

CAGR of 14.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Metal, voltage, type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

GP Batteries International Limited; Arotech; Energizer Holdings, Inc.; Duracell Inc.; Renata SA; Phinergy; Log9 Materials; Poly Plus Battery; Zinc8 Energy Solutions; Panasonic Energy Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal-air Battery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the metal-air battery market report based on metal, voltage, type, application, and region:

-

Metal Outlook (Revenue, USD Million, 2018 - 2030)

-

Zinc

-

Lithium

-

Aluminum

-

Iron

-

Others

-

-

Voltage Outlook (Revenue, USD Million, 2018 - 2030)

-

Low (<12 V)

-

Medium (12 - 36 V)

-

High (>36 V)

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary

-

Secondary

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric Vehicles

-

Military Electronics

-

Electronics Devices

-

Stationary Power

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global metal-air battery market size was estimated at USD 585.30 million in 2023 and is expected to reach USD 660.81 million in 2024.

b. The global metal-air battery market is expected to grow at a compound annual growth rate of 14.5% from 2024 to 2030, reaching USD 1,486.89 million by 2030.

b. Based on application, electric vehicles were the dominant segment in 2023, with a revenue share of about 48.63%. This is attributable to the increasing global demand for clean transportation solutions and the growing adoption of electric vehicles to reduce greenhouse gas emissions. Metal-air batteries offer higher energy density and longer driving ranges, making them an ideal choice for electric vehicle manufacturers aiming to improve performance and meet consumer demands for longer-lasting batteries.

b. Some of the key players operating in this industry include GP Batteries International Limited, Arotech, Energizer Holdings, Inc., Duracell Inc., Renata SA, Phinergy, Log9 Materials, Poly Plus Battery, Zinc8 Energy Solutions, Panasonic Energy Co., Ltd.

b. The key factors driving the metal-air battery market include increasing demand for high-energy-density batteries in electric vehicles and consumer electronics, advancements in battery technology improving performance and efficiency, growing investments in research and development, and expanding applications in renewable energy storage and grid energy storage systems. These factors collectively contribute to the market's growth by addressing the need for reliable and sustainable energy storage solutions across various industries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.