- Home

- »

- Advanced Interior Materials

- »

-

Metal Aerosol Can Market Size, Share & Trends Report, 2030GVR Report cover

![Metal Aerosol Can Market Size, Share & Trends Report]()

Metal Aerosol Can Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Aluminum, Steel), By Type (Liquified Gas Propellant), By Product (1-Piece, 3-Piece), By Application (Personal Care), And Segment Forecasts

- Report ID: GVR-1-68038-129-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Aerosol Can Market Size & Trends

The global metal aerosol can market size was valued at USD 9.18 billion in 2023 and is projected to grow at a CAGR of 4.2% from 2024 to 2030. The demand for aerosol cans is expected to be driven by their portability, recyclability, safety and durability, and the rising visual appeal of the item. The rise in the personal care and pharmaceutical sector along with the growing need for beauty products indicate a promising potential for the market to expand.

The demand for aerosol cans is escalating, driven by the importance of reusing and recycling these eco-friendly packaging solutions. Made from materials such as metal, glass, or plastic like PET, aerosol cans can be recycled indefinitely, reducing waste and supporting sustainability goals. Manufacturers produce these cans in accordance with environmental guidelines, offering customers cost savings and peace of mind.

Aerosol cans have gained popularity due to their convenience and ability to hold products and propellants in a pressurized form for dispensing as spray, mist, or foam. Common items packaged in aerosol containers include bug sprays, cooking oils, cleaning solutions, and paints. The majority of aerosol cans are made from recyclable steel or aluminum, making them a user-friendly and affordable option.

The aerosol can market is expected to continue growing, fueled by expanding demand in the automotive and personal care sectors, particularly in Europe. As consumers become increasingly environmentally conscious, they seek out products with minimal ecological footprints. Aerosol cans’ rigidity, stability, and superior barrier properties make them a preferred choice for products requiring an extended shelf life. With a focus on sustainability and convenience driving the market, the aerosol can industry is poised for continued growth in the coming years.

Material Insights

Aluminum dominated the market and accounted for a share of 85.6% in 2023. The high recyclability of aluminum encourages sustainable initiatives, boosting revenue and a positive environmental image for metal packaging. This attracts eco-conscious consumers, driving market growth. Aluminum aerosol cans are well-positioned to meet consumer demands for convenience, as a Nielsen survey shows 60% of global consumers prioritize convenience in their purchasing decisions.

Steel is expected to witness considerable growth over the forecast period. The trend towards environment-friendly packaging options has resulted in a higher need for steel aerosol cans, due to their ability to be recycled and their longevity. The growth of personal care and household product segments is driven by increasing urbanization and disposable income levels in emerging economies, leading to a higher demand for steel aerosol cans.

Type Insights

Liquified gas propellants accounted for the largest market share of 64.0% in 2023. The natural characteristics of this propellant guarantee that while the content decreases, evaporation maintains a steady pressure inside the can. This feature guarantees that the spray will perform consistently from beginning to end, highlighting the dominant market position of the segment.

Compressed gas propellants are expected to register rapid growth from 2024 to 2030. These propellants are widely used in aerosol cans to offer various important advantages, such as being eco-friendly and enhancing safety measures. Compressed gas propellants include gases like carbon dioxide (CO2), nitrogen (N2), or nitrous oxide (N2O). Compressed gas propellants are more environment-friendly than other types of propellants due to their zero ozone depletion potential and low global warming potential.

Product Insights

1-piece cans dominated the market with a revenue share of 66.5% in 2023. 1-piece cans create a seamless structure that can withstand higher pressure. This makes them ideal for products that require a strong, consistent spray, such as whipped cream or certain air fresheners. They also tend to be more resistant to leaks, damage from light and air, and can hold up better under heat and corrosion.

3-piece cans are expected to grow significantly over the forecast period as the industry adapts to changing consumer preferences and environmental concerns. Manufacturers are exploring new materials and design methods to reduce environmental impact as consumer interest in eco-friendly packaging increases. Moreover, increasing numbers of businesses are dedicating extra resources to establish unique brands and personalized products in order to differentiate themselves in a competitive marketplace.

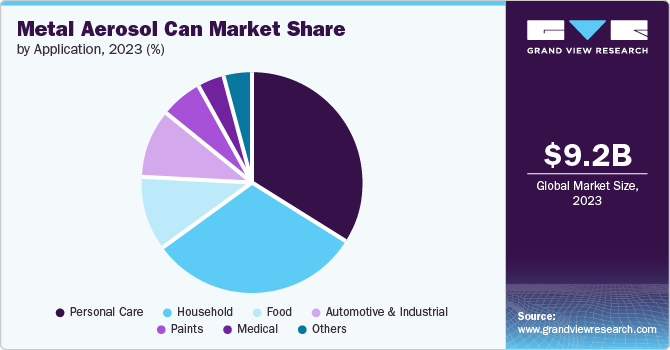

Application Insights

Personal care accounted for the largest market revenue share of 34.7% in 2023. Aerosol cans are becoming more popular as the preferred packaging choice for a wide range of personal care products, including deodorants, perfumes, and face and body creams. Increased disposable incomes, especially in growing economies, are supporting the buoyancy in this sector.

The household segment is projected to be the fastest-growing application of metal aerosol cans over the forecast period with a CAGR of 5.0%. The rising need for personal care items boosts the popularity of aerosol cans in households. The increasing utilization of aerosol cans in paints, medical items, food, adhesives, and vehicles is boosting the market’s expansion.

Regional Insights

North America metal aerosol can market is anticipated to witness significant growth in the global metal aerosol can market due to the widespread use of aerosol cans driven by their convenience and improved portability. The product experiences high demand due to the significant disposable income of consumers in the U.S. and Canada. Moreover, the abundance of key container fillers and end-product manufacturers leads to a wide variety of end-products available for consumers, increasing their options.

U.S. Metal Aerosol Can Market Trends

The metal aerosol can market in the U.S. is driven by growing demand for personal care and household products, fueled by a large consumer base and rising incomes. The popularity of travel-sized products and high recycling rate of aluminum (the primary material) are additional growth drivers. Aluminum’s benefits, including lightweight, durability, and product freshness, make it an attractive choice for various industries.

Europe Metal Aerosol Can Market Trends

Europe metal aerosol can market is anticipated to witness rapid growth in coming years due to the market dynamics of the region are being driven by the expansion of the automotive and cosmetics and personal care industries. The increasing popularity of hygiene and shifts in lifestyle choices are driving up the demand for cosmetics and personal care items in Europe.

Metal aerosol can market in Germany held a substantial market share in 2023, driven by a focus on sustainable packaging, cost-effectiveness, and growing demand across industries. The emphasis on recyclable aluminum cans, cost-effective extension of shelf life, and attractiveness to personal care, household, and automotive sectors contribute to growth. The expanding automotive and manufacturing sectors, as well as Germany’s affluent consumer base, further boost demand.

Asia Pacific Metal Aerosol Can Market Trends

Asia Pacific metal aerosol can market dominated the global metal aerosol can market dominated with revenue share of 36.04% in 2023. The driving forces behind this growth are multifaceted, including the significant increases in disposable incomes in key markets such as China and India, as well as the ongoing trends of industrialization. The rapid expansion of the convenience food industry, the growth of manufacturing activities, and robust retail sales also contribute to the momentum.

China metal aerosol can market held a revenue share of 15.0% in the global market in 2023. As per the Chinese government, the urbanization rate of the nation’s permanent residents hit 64.7% in 2021. As per the 14th Five-Year Plan of China, the goal is to increase the urbanization rate to 65%. These developments are predicted to lead to a positive market environment for aerosol cans.

Key Metal Aerosol Can Company Insights

Some key companies in the metal aerosol can market are Crown Holdings, Inc.; CCL Container; Ball Corporation; Ardagh Group; Toyo Seikan Co. Ltd.; ITW Sexton; and Trivium Packaging. The metal aerosol can market is a competitive landscape of global and regional players, with major companies dominating through product portfolios and distribution networks. Regional players offer customized solutions, while all focus on innovation, cost optimization, and sustainability to gain an edge.

-

Ball Corporation provides creative and eco-friendly aluminum packaging options for beverage, personal care, and household product clients. Ball Corporation is proud of its extensive history and acknowledges that the entire company is more valuable than its individual components. Ball Corporation places utmost importance on individuals, culture, and the capacity to provide value to all stakeholders. Ball Corporation embrace diversity and foster inclusivity.

-

Trivium Packaging provide a variety of metal containers with creative designs and unique ways to open them. Trivium Packaging shape techniques consist of mechanical expansion, impact extrusion, and blow molding, enabling to create both standard and personalized shapes to match the product and brand demands.

Key Metal Aerosol Can Companies:

The following are the leading companies in the metal aerosol can market. These companies collectively hold the largest market share and dictate industry trends.

- Ball Corporation

- Trivium Packaging

- Crown

- BWAY Corporation

- Nampak Ltd

- Toyo Seiken Co. Ltd

- CCL Containers

- COLEP Packaging

- CPMC Holdings Limited

- Guangdong Sihai Iron-Printing And Tin-Making Co.,Ltd.

- ALUCON

- Ds Containers

- Jamestrong Packaging

- ITW SEXTON

- Swan Industries(Thailand) Co., Ltd.

- Berry Global, Inc

- G. STAEHLE GMBH U. CO. KG.

- Kian Joo Can Factory Berhad

- Graham Packaging

- Massilly Holding S.A.S

- Bharat Containers .

- LINHARDT

- Technocap S.PA

- Montebello

- Spray Products

Recent Developments

-

In May 2024, Mauser Packaging Solutions, a worldwide provider of rigid packaging products and services, announced that BWAY Corporation acquired Taenza, S.A. de C.V., a tin-steel cans, steel pails, and aerosol cans manufacturing company from Mexico.

-

In March 2024, Ball Aluminum Cups installed a Cycle Reverse Vending Machine at the Copper Mountain Resort aimed at increasing aluminum recycling and educating consumers about the sustainability of aluminum packaging.

Metal Aerosol Can Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.55 billion

Revenue forecast in 2030

USD 12.23 billion

Growth rate

CAGR of 4.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, type, product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Ball Corporation; Trivium Packaging; Crown; BWAY

Corporation; Nampak Ltd; Toyo Seiken Co. Ltd; CCL Containers; COLEP Packaging; CPMC Holdings Limited; Guangdong Sihai Iron-Printing And Tin-Making Co.,Ltd.; ALUCON; Ds Containers; Jamestrong Packaging; ITW SEXTON; Swan Industries(Thailand) Co., Ltd.; Berry Global, Inc; G. STAEHLE GMBH U. CO. KG.; Kian Joo Can Factory Berhad; Graham Packaging; Massilly Holding S.A.S; Bharat Containers; Technocap S.PA.; LINHARDT; Montebello \; Spray ProductsCustomization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Aerosol Can Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global metal aerosol can market report based on material, type, product, application, and region.

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aluminum

-

Steel

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Liquefied Gas Propellant

-

Compressed Gas Propellant

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

1-Piece Cans

-

3-Piece Cans

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Personal Care

-

Household

-

Automotive & Industrial

-

Food

-

Paints

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.