- Home

- »

- Advanced Interior Materials

- »

-

Mercury Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Mercury Market Size, Share & Trends Report]()

Mercury Market Size, Share & Trends Analysis Report, By Product Type (Metal, Alloy, Compound), By Application (Batteries, Electrical & Electronics, Measuring & Controlling Devices), By Region, And Segment Forecasts, 2023 To 2030

- Report ID: GVR455952

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Data: ---

- Forecast Period: 1 - 2030

- Industry: Advanced Materials

Mercury Market Size & Trends

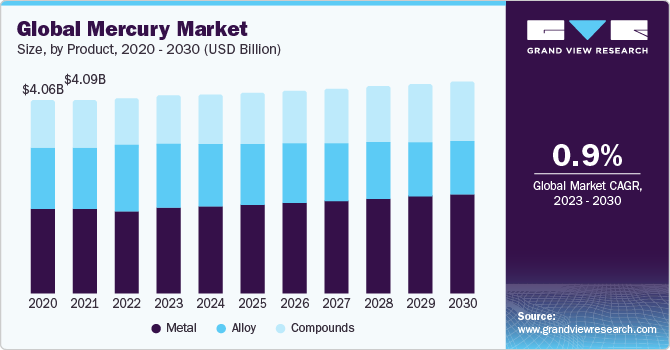

The global mercury market size was valued at USD 4.12 billion in 2022 and is expected to grow at a CAGR of 0.9% over the forecast period. The expanding consumer electronics market, coupled with technological advancements requiring mercury-based components, fuels the demand for mercury in this sector. As electronic devices evolve and become more pervasive, the sustained growth in the electronics manufacturing industry is a primary driver, underpinning the continued relevance and demand for mercury.

The COVID-19 pandemic has significantly impacted the mercury market, causing disruptions across the industry. The pandemic directly impacted both production and demand for mercury, with widespread supply chain disruptions further aggravating the situation. As businesses faced operational challenges, the mercury market experienced market disruptions, influencing supply and demand dynamics. The financial implications were witnessed by individual businesses and resonated in the broader financial markets. The uncertainties introduced by the pandemic prompted a reassessment of strategies within the industry. Moreover, the emphasis on health and safety during the pandemic led to increased scrutiny and awareness regarding the use of mercury, affecting its application in specific sectors.

One significant driver propelling the mercury market is the increasing demand within the electronics manufacturing sector. Mercury is essential in producing various electronic devices, including switches, relays, and other components crucial to electronic applications. The expanding consumer electronics market, coupled with technological advancements requiring mercury-based components, fuels the demand for mercury in this sector. As electronic devices continue to evolve and become more pervasive, the sustained growth in the electronics manufacturing industry acts as a primary driver, highlighting the continued significance and demand for mercury over the forecast period.

Product Insights

Based on the product, the mercury market is segmented into metals, alloys, and compounds. The metal segment held the largest market share in 2022 owing to its wide applications across various end-use industries. With its unique physical properties, including liquidity at room temperature and high conductivity, mercury metal is extensively used in electronics manufacturing for switches and relays. Additionally, it plays a crucial role in the dental industry for amalgam fillings and in various chemical processes as a catalyst. Its prevalence in fluorescent lamps and bulbs further contributes to the majority of segment dominance in the largest market share.

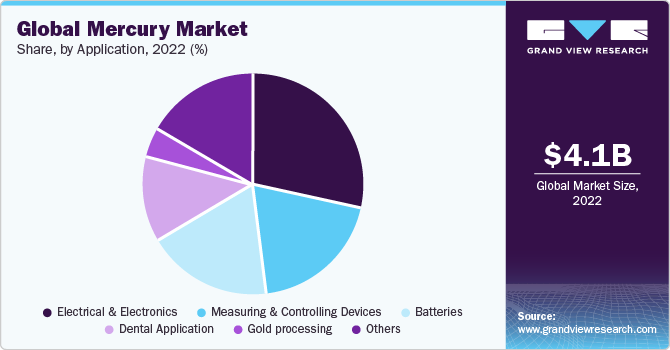

Application Insights

Based on application, the mercury market is segmented into batteries, electrical & electronics, measuring & controlling devices, dental applications, and gold processing. The electrical & electronics segment is expected to grow at the fastest CAGR over the forecast period. The rising population and growing urbanization have led to an increase in the application of electrical & electronic devices across the globe. Mercury is a vital component utilized in battery production to enhance the performance and longevity of the product. Despite environmental concerns, its application in batteries, especially in specific medical devices and aerospace equipment, drives demand within the mercury market.

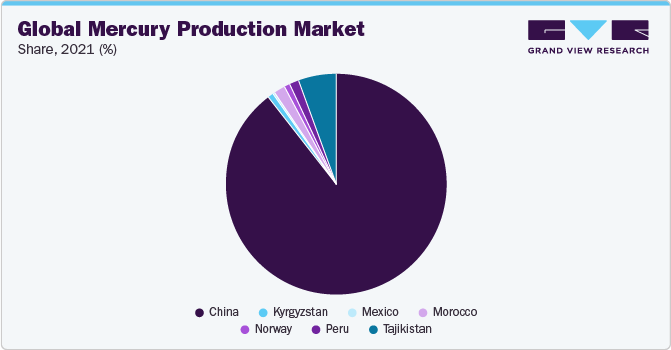

Regional Insights

Asia Pacific dominated the market in 2022 owing to the presence of China. The dominance is primarily attributed to China's substantial industrial and manufacturing activities, including electronics, where mercury is critical. The region’s rapid economic growth has increased demand for electronic devices. China's significant presence in industries like healthcare, where mercury is utilized in dental applications, further contributes to its leading position in mercury consumption. While environmental concerns and regulatory pressures may influence future trends, Asia Pacific’s robust industrial sector and diverse applications for mercury have positioned it as a dominant player in the global mercury consumption market.

Key Companies & Market Share Insights

Key players operating in the market are Avantor, Inc., Merck KGaA, Wake Group, China Jin Run Industrial Co., Ltd., AHSA, Aldrett Hermanos SA de CV, and NOAH Technologies Corporation. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain market avenues. The following are some instances of strategic initiatives:

-

In January 2023, Merck Group acquired Mecaro, a South Korea-based chemical company, to expand its business portfolio and global capabilities. The acquisition of the chemical company is a part of Merck’s growth program to expand its electronics business portfolio. It is expected to propel the growth of semiconductors and electronics, thereby boosting the consumption of mercury metal, which is a key application in the electronics segment.

-

In December 2022, Albemarle Corporation unveiled an innovative technology, MercLok™, to extract mercury from mining waste and soil and help prevent mercury from entering the food chain. The technology is a mercury remediation that captures the mercury content in the ground and groundwater by identifying the neurotoxins and benefitting various industries and the mercury industry at large in the long term.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."