Membrane Oxygenators Market Size, Share & Trends Analysis Report By Type (Hollow Fiber, Flat Sheet), By Application (Cardiac, Respiratory, ECPR), By Age Group (Neonates, Adults), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-390-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Membrane Oxygenators Market Trends

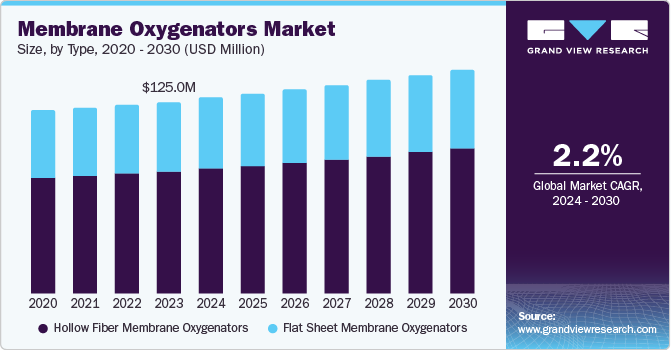

The global membrane oxygenators market size was valued at USD 125.0 million in 2023 and is expected to grow at a CAGR of 2.2% from 2024 to 2030. The increasing prevalence of cardiopulmonary disorders is expected to increase the demand for membrane oxygenators during the forecast period. Membrane oxygenators are used in the treatment of patients suffering from chronic respiratory and heart diseases. They have a wide range of uses and are used to treat newborns, pediatric patients, and adults. In addition, membrane oxygenators in extracorporeal membrane oxygenation (ECMO) devices provide extracorporeal life support for patients suffering from severe cardiopulmonary disease.

According to the World Health Organization (WHO), in June 2023, about 620 million people worldwide are living with heart conditions and suffer from circulatory diseases. The main causes of cardiopulmonary diseases include unhealthy diet, lack of physical activity, and smoking. This rising prevalence of cardiovascular diseases is expected to increase the demand for membrane oxygenators in pediatric, adult, and elderly patients.

Chronic obstructive pulmonary disease (COPD) is considered the third largest cause of death in the U.S. after cancer and heart disease. According to the American Lung Association, over 11 million people in the U.S. are diagnosed with COPD each year. Thus, the rise in respiratory diseases is estimated to stimulate the adoption of membrane oxygenators. In addition, membrane oxygenators in extracorporeal membrane oxygenation devices deliver extracorporeal life support for patients with severe cardiopulmonary disease. The membrane oxygenators has several advantages over the traditional bubble oxygenators. This provides better platelet function, higher platelet counts, and lower hemolysis compared to bubble oxygenator perfusion.

Type Insights

The hollow fiber membrane oxygenators segment dominated the market and accounted for the largest revenue share of 64.0% in 2023 as they have a large number of fibers with semi porous walls and holes in the center which allow water to pass through. The small structure of these fibers also allows proteins, mostly plasma proteins, to cover the gaps and form a semi-permeable membrane or thin film to support gas exchange. Hollow fiber membrane oxygenators have holes to allow gas release and rapid air removal from the fibers. Therefore, this type of oxygenator is integrated into some ECLS circuits to support the Rapid Response System for cardiac shock or cardiac arrest, which promotes segmental growth.

The flat plate membrane oxygenators segment is expected to witness a CAGR of 1.8% over the forecast period. These membrane oxygenators lack holes in the membrane wall and rely on the permeability of the plastic material to allow gas to pass through the membranes. Plate membrane oxygenators require flushing the extra-membrane air with a soluble gas, including carbon dioxide, to prevent air entrapment in the pooled blood. In addition, flat membrane oxygenators have a longer service life and are allowed up to 14 days compared to hollow fiber oxygenators, which in most cases need to be replaced within 6 to 12 hours. This is expected to increase their adoption during the forecast period.

Age Group Insights

The pediatrics segment dominated the market and accounted for the largest revenue share of 28.4% in 2023 attributed to the critical advanced respiratory support for neonatal and pediatric patients. Premature births and congenital respiratory distress often require immediate and effective intervention, making membrane oxygenation devices an invaluable technology in neonatal intensive care units (NICUs) and pediatric intensive care units (PICUs).

The increased susceptibility of infants and children to respiratory complications of pneumonia, bronchitis, and acute respiratory distress syndrome (ARDS) has increased the need for membrane oxygenators in the patients. Development of specialized pediatric membrane oxygenators designed to meet the unique physiological needs of infants and children has contributed to segment control, ensuring optimal care and better outcomes for these vulnerable patients.

The neonate segment is anticipated to exhibit considerable CAGR over the forecast period. A membrane oxygenator is commonly used to manage neonates with respiratory and cardiac failure. The increasing number of neonates is expected to augment the demand for membrane oxygenators. However, the total number of neonates treated with membrane oxygenators is dropping significantly over time in large measure due to the recent development of minimally invasive modes of therapy for neonatal respiratory failure, limiting segment growth.

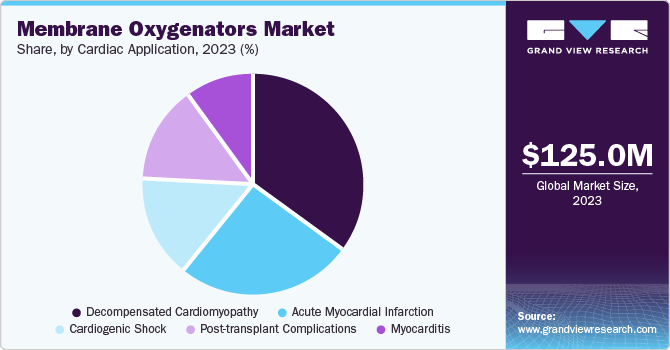

Application Insights

The decompensated cardiomyopathy segment dominated the membrane oxygenators market and accounted for the largest revenue share of 35.1% in 2023. According to a report by the American Heart Association, in the year 2022, approximately 6.2 million adults in the U.S. were estimated to suffer from heart failure, and decompensated cardiomyopathy was estimated to be the major cause.

The extracorporeal cardiopulmonary resuscitation is expected to witness the fastest CAGR over the forecast period. The extracorporeal membrane oxygenation (ECMO) machine provides support that resembles the cardiopulmonary bypass using a centrifugal pump and a membrane oxygenator with a drainage and return cannula. Venoarterial ECMO benefits in maintaining an optimal cardiac output, before or after coronary revascularization, enabling lower doses of vasoactive drugs. In addition, advances in ECMO technology, such as the development of smaller and more efficient membrane oxygenation devices, have facilitated their wider adoption in cardiac settings, contributing to the segment's dominance.

Regional Insights

The North America membrane oxygenators market dominated the global market and accounted for the largest revenue share of 42.5% in 2023. The market is expected to continue its dominant position during the forecast period. The availability of well-developed primary, secondary, and tertiary hospitals is expected to support market growth in the region. In addition, a well-developed reimbursement network, government funding and increasing awareness of membrane oxygenation machines are increasing their adoption in hospitals. Moreover, the development of membrane oxide technology supports the market growth.

U.S. Membrane Oxygenators Market Trends

The U.S. membrane oxygenators market dominated North America and accounted for the largest revenue share of 85.9%, owing to the considerable healthcare spending, advantageous reimbursement schemes, and the presence of key membrane oxygenator manufacturers have all contributed to the widespread adoption of these critical medical devices. Moreover, the rising awareness among healthcare providers regarding the advantages of extracorporeal membrane oxygenation (ECMO) and the increasing elderly population, who are more prone to respiratory and cardiovascular issues, has further stimulated the demand for membrane oxygenators in the U.S., propelling market growth in North America.

Europe Membrane Oxygenators Market Trends

The Europe membrane oxygenators market is experiencing consistent expansion fueled by factors like the rising incidence of respiratory and cardiovascular ailments, and the uptake of cutting-edge medical technologies. This growth can be attributed to the rising awareness among healthcare professionals and the implementation of extracorporeal membrane oxygenation (ECMO) procedures in critical care settings.

Asia Pacific Membrane Oxygenators Market Trends

The Asia Pacific membrane oxygenators market is projected to exhibit the fastest CAGR of 2.7% over the forecast period. The growing prevalence of chronic diseases such as cardiopulmonary diseases due to unhealthy eating habits, excess tobacco consumption, and rising awareness about membrane oxygenators have led to a rise in its adoption rate in hospitals.

The China membrane oxygenators market plays a significant role in Asia Pacific driven by the rapid growth of its healthcare industry, rising investments in medical technology, and the increasing utilization of advanced medical techniques such as ECMO.

Key Membrane Oxygenators Company Insights

Product launches, strategic acquisitions and innovations are important strategies to retain market participants.

-

Medtronic is a global company in medical technology, services, and solutions. The company develops and manufactures a broad range of medical devices and therapies to treat various conditions, including cardiovascular diseases, diabetes, and neurological disorders. Medtronic offers advanced extracorporeal life support (ECLS) systems, including the Affinity Fusion Oxygenation System. Medtronic has been focusing on enhancing its ECLS portfolio to improve patient outcomes and reduce complications associated with extracorporeal membrane oxygenation (ECMO) therapy.

-

MicroPort Scientific Corporation is a global medical device company, with a focus on innovating and manufacturing high-quality medical devices for a variety of therapeutic areas. MicroPort has also established a presence in the membrane oxygenators market through its cardiopulmonary business segment. The company offers advanced membrane oxygenators as part of its extracorporeal life support (ECLS) systems, designed for use in cardiopulmonary bypass procedures and extracorporeal membrane oxygenation (ECMO) therapy.

Key Membrane Oxygenators Companies:

The following are the leading companies in the membrane oxygenators market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Fresenius SE & Co. KGaA

- Getinge AB

- TERUMO CORPORATION

- MicroPort Scientific Corporation

- Nipro Medical Corporation

- Kewei Medical

- Braile Biomedica

- Livanova Plc

- Chalice Medical Ltd

Recent Developments

-

In May 2023, Inspira Technologies announced development of VORTX Blood Oxygenator, a technology expected to help in saturating blood with oxygen and removing carbon dioxide.

-

In February 2022, Getinge announced the acquisition of U.S.-based Talis Clinical, engaged in the manufacturing and supply of high-acuity IT software applications for critical care, including extracorporeal membrane oxygenation (ECMO). The acquisition is expected to help it expand in the ECMO and perfusion digital solutions.

Membrane Oxygenators Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 127.3 million |

|

Revenue forecast in 2030 |

USD 145.5 million |

|

Growth Rate |

CAGR of 2.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, age group, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy ; Spain; Norway; Sweden; Denmark; China; Japan; India; South Korea; Australia; South Korea; Thailand; Brazil; Mexico; UAE; South Africa |

|

Key companies profiled |

Medtronic; Fresenius SE & Co KGaA; Getinge AB; Terumo Medical Corporation; MicroPort Scientific Corporation; Nipro Medical Corporation; Kewei Medical; Braile Biomedica; Livanova Plc; Chalice Medical Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Membrane Oxygenators Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020-2030. For the purpose of this study, Grand View Research has segmented the global membrane oxygenators market report based on type, application, age group, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hollow Fiber Membrane Oxygenators

-

Flat Sheet Membrane Oxygenators

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory

-

Respiratory failure

-

Pulmonary embolism

-

Acute respiratory distress syndrome

-

Pneumonia

-

COVID-19

-

-

Cardiac

-

Acute myocardial infarction

-

Myocarditis

-

Post-transplant complications

-

Decompensated cardiomyopathy

-

Cardiogenic shock

-

-

Extra Corporeal Cardiopulmonary Resuscitation

-

-

Age group Outlook (Revenue, USD Million, 2018 - 2030)

-

Neonates

-

Pediatrics

-

Adults

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."