- Home

- »

- Water & Sludge Treatment

- »

-

Membrane Cleaning Chemicals Market, Industry Report 2030GVR Report cover

![Membrane Cleaning Chemicals Market Size, Share & Trends Report]()

Membrane Cleaning Chemicals Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Acidic Cleaners, Alkaline Cleaners), By Application (Reverse Osmosis Systems, Ultrafiltration Systems), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-486-5

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

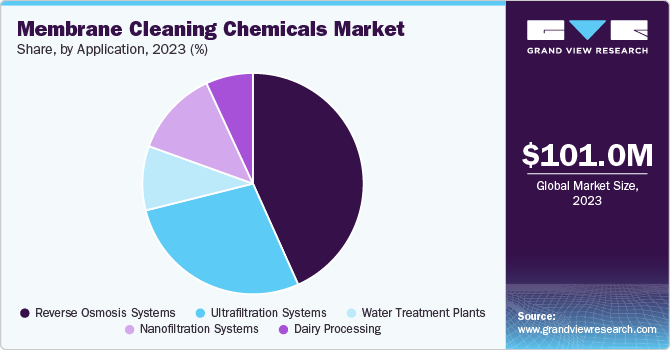

The global membrane cleaning chemicals market size was estimated at USD 101.00 million in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. Membrane cleaning chemicals play a crucial role in the maintenance and efficiency of membrane systems, such as reverse osmosis, ultrafiltration, and microfiltration. These chemicals are designed to remove fouling agents, which can include organic matter, inorganic scales, and biofilms that accumulate on the membrane surfaces. By effectively addressing these issues, cleaning agents help restore product permeability, ensuring that the system operates at optimal performance levels.

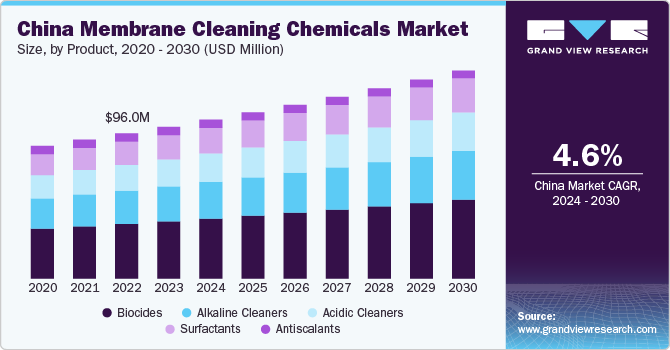

Chinese companies are focusing on creating specialized formulations that address the unique fouling conditions prevalent in the region. This includes the development of multi-functional cleaning agents that can tackle both organic and inorganic fouling effectively. Research and development efforts are increasingly being directed toward improving the efficiency and safety of these chemicals, ensuring compliance with environmental regulations. The use of local raw materials also enables manufacturers to reduce costs while maintaining high cleaning performance, making them competitive in both domestic and international markets.

The implementation of advanced products is significantly enhancing industrial efficiency in China. By reducing membrane fouling and extending the lifespan of membrane systems, these chemicals contribute to lower operational costs and improved reliability. In addition, the focus on sustainable practices, such as the use of biodegradable cleaning agents and environmentally friendly formulations, reflects China's commitment to greener industrial practices. Overall, the development and application of products in China not only support industrial growth but also promote sustainable water management solutions.

Product Insights

Biocides membrane cleaning chemicals type dominated the market with a revenue share of 38.17% in 2023. Biocides are essential chemicals used in product to control and prevent biological fouling, which can significantly impair the performance of membrane systems such as reverse osmosis (RO). These compounds are effective against a range of microorganisms, including bacteria, fungi, and algae, which can accumulate within the membrane system and lead to reduced efficiency and increased operational costs. For instance, products like BioGuard ISO are specifically designed for non-potable water systems, providing a slow kill effect over several hours, making them ideal for continuous feeding applications.

Biocides used in the market can be categorized into two main types: oxidizing and non-oxidizing biocides. Oxidizing biocides, such as chlorine and bromine compounds, work by disrupting the cellular processes of microorganisms, while non-oxidizing biocides, like quaternary ammonium compounds, offer a different mechanism of action and are often used in situations where oxidizing agents may cause damage to the membrane material. These biocides can be applied either as part of a cleaning regimen or as an online treatment to maintain integrity and performance.

Alkaline cleaners are specialized chemicals used in product systems, particularly in reverse osmosis (RO), ultrafiltration (UF), and microfiltration (MF) applications. These cleaners are formulated to effectively remove organic fouling, such as oils, fats, and proteins, which can accumulate on membrane surfaces and hinder performance. By maintaining a high pH, alkaline cleaners help to break down these contaminants, restoring membrane efficiency and prolonging the lifespan of the system.

Acidic cleaners are vital in the maintenance of product systems, particularly for reverse osmosis (RO), ultrafiltration (UF), and microfiltration (MF) applications. These cleaners are specifically formulated to tackle inorganic fouling, such as scale deposits from minerals like calcium carbonate and silica. By lowering the pH, acidic cleaners effectively dissolve these deposits, restoring membrane performance and preventing damage that can occur from prolonged fouling. Companies like Applied Membranes have developed proprietary acidic cleaning solutions that have been refined over decades to optimize cleaning efficiency and effectiveness.

Application Insights

The reverse osmosis systems dominated the market with a revenue share of 43.3% in 2023 owing to the cleaning chemicals that are essential for maintaining the efficiency and longevity of reverse osmosis (RO) systems. Over time, membranes can become fouled by various contaminants, including organic matter, inorganic scales, and microorganisms. Regular cleaning with appropriate chemicals helps to remove these foulants, restoring membrane performance and ensuring that the system operates effectively. Companies like Applied Membranes have developed proprietary cleaning solutions specifically designed for RO membranes, which have been refined over decades to optimize cleaning efficiency and effectiveness.

Cleaning chemicals play a crucial role in maintaining the efficiency and longevity of ultrafiltration (UF) systems, which are widely used in water and wastewater treatment. Over time, UF membranes can become fouled by organic matter, inorganic scales, and microbial growth, leading to reduced permeate flow and increased operational costs. Regular cleaning with appropriate chemicals is essential to remove these foulants, restore membrane performance, and ensure the sustainable operation of the system. Effective cleaning not only enhances the lifespan of the membranes but also improves overall water quality standards.

The cleaning process for UF membranes typically involves the use of alkaline and acidic cleaners, as well as biocides. Alkaline cleaners are effective against organic fouling, such as oils and proteins, while acidic cleaners target inorganic scales like calcium carbonate. Sodium hypochlorite is a commonly used biocide that addresses both organic and microbial fouling, although its use must be carefully managed to avoid potential damage to the membranes. The choice of cleaning agent depends on the specific fouling conditions, making it essential to assess the membrane's state before selecting a cleaning solution. Cleaning-in-place (CIP) procedures are often employed, allowing for effective cleaning without dismantling the system, which saves time and resources.

Regional Insights

Asia Pacific dominated the global market and accounted for the largest revenue share of 41.08% in 2023. The Asia Pacific membrane cleaning chemicals market is experiencing significant growth, driven by several key factors. As the demand for water treatment solutions increases, particularly in the context of urbanization and industrialization, the need for effective membrane cleaning solutions has become more pronounced.

The membrane cleaning chemicals market in China is experiencing significant growth, driven by increasing demand for water treatment solutions across various industries. As urbanization and industrialization continue to rise, the need for effective cleaning chemicals to maintain membrane performance in reverse osmosis (RO), ultrafiltration (UF), and microfiltration (MF) systems has become critical.

North America Membrane Cleaning Chemicals Market Trends

The North America membrane cleaning chemicals market is witnessing robust growth, driven by increasing demand for effective water treatment solutions across various sectors. This growth is influenced by several key trends that reflect the evolving landscape of water and wastewater treatment technologies.

Europe Membrane Cleaning Chemicals Market Trends

The membrane cleaning chemicals market in Europe is experiencing notable growth, driven by increasing demand for effective water treatment solutions and stringent regulatory requirements. This market is evolving rapidly, influenced by several key trends that reflect the changing landscape of water and wastewater treatment technologies.

Key Membrane Cleaning Chemicals Company Insights

Some of the key players operating in the market include Veolia Water Technologies, SUEZ Water Technologies & Solutions, Ecolab, Kemira, GE Water, Solenis, Koch Membrane Systems, BWA Water Additives, and Italmatch Chemicals.

-

Veolia Water Technologies is a leading provider of water treatment solutions, specializing in addressing complex water, wastewater, and process challenges across various industries. As a subsidiary of Veolia Environment, the company operates globally, leveraging advanced technologies and engineering services to deliver comprehensive water management solutions.

-

SUEZ Water Technologies & Solutions is a prominent player in the water treatment industry, specializing in providing innovative solutions for water and wastewater management. As part of the SUEZ Group, the company is dedicated to addressing the growing environmental challenges associated with water resources and waste management.

Key Membrane Cleaning Chemicals Companies:

The following are the leading companies in the membrane cleaning chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Veolia Water Technologies

- SUEZ Water Technologies & Solutions

- Ecolab

- Kemira

- GE Water

- Solenis

- Koch Membrane Systems

- BWA Water Additives

- Italmatch Chemicals

Recent Developments

-

In March 2024, Toray Industries, Inc. announced the development of a highly durable reverse osmosis (RO) membrane that promises significant advancements in water treatment technology. This innovative membrane is designed to enhance the efficiency and sustainability of water purification processes.

-

In September 2023, American Water Chemicals (AWC) announced the launch of its European division, named Amaya Solutions Europe, SL. This strategic move marks a significant milestone in AWC's global expansion efforts aimed at enhancing its presence in the European market.

Membrane Cleaning Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 104.0 million

Revenue forecast in 2030

USD 140.9 million

Growth rate

CAGR of 5.2% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

Veolia Water Technologies, SUEZ Water Technologies & Solutions, Ecolab, Kemira, GE Water, Solenis, Koch Membrane Systems, BWA Water Additives, Italmatch Chemicals.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Membrane Cleaning Chemicals Market Report Segmentation

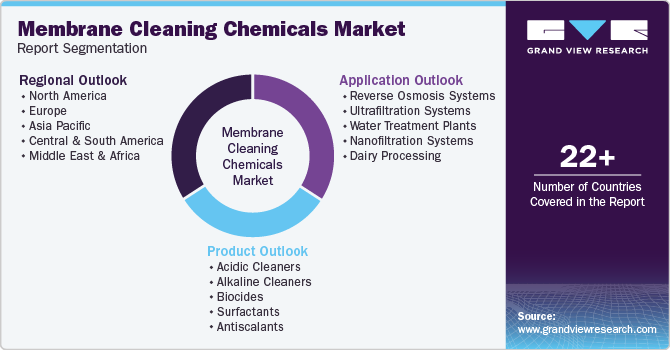

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global membrane cleaning chemicals market report based on product, application, & region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acidic Cleaners

-

Alkaline Cleaners

-

Biocides

-

Surfactants

-

Antiscalants

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Reverse Osmosis Systems

-

Ultrafiltration Systems

-

Water Treatment Plants

-

Nanofiltration Systems

-

Dairy Processing

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global membrane cleaning chemicals market was valued at USD 101.00 million in 2023 and is expected to reach USD 104.0 million in 2024.

b. The global membrane cleaning chemicals market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 140.9 million by 2030

b. The Asia Pacific membrane cleaning chemicals market is experiencing significant growth, driven by several key factors. As the demand for water treatment solutions increases, particularly in the context of urbanization and industrialization, the need for effective membrane cleaning solutions has become more pronounced.

b. Some of the key players operating in the market include Veolia Water Technologies, SUEZ Water Technologies & Solutions, Ecolab, Kemira, GE Water, Solenis, Koch Membrane Systems, BWA Water Additives, Italmatch Chemicals.

b. Key factors that are driving the market growth include as membrane cleaning chemicals play a crucial role in the maintenance and efficiency of membrane systems, such as reverse osmosis, ultrafiltration, and microfiltration.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.