- Home

- »

- Medical Imaging

- »

-

Medical X-ray Image Processor Market Size Report, 2030GVR Report cover

![Medical X-ray Image Processor Market Size, Share & Trends Report]()

Medical X-ray Image Processor Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Cassette, Flat Panel Detectors), By Application (Dental, Others), By End-use (Hospitals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-057-6

- Number of Report Pages: 97

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical X-ray Image Processor Market Summary

The global medical X-ray image processor market size was valued at USD 844.8 million in 2022 and is projected to reach USD 999.5 million by 2030, growing at a CAGR of 2.1% from 2023 to 2030. X-ray film processor is an efficient device that moves medical X-ray films from one solution to another without the requirement of inserting film or cassette by humans.

Key Market Trends & Insights

- North America dominated the medical X-ray image processor industry in 2022, with a market share of 32.5%.

- By product, the cassette segment dominated the market with a market share of 52.9% in 2022.

- By application, the orthopedic segment is expected to have a market share of 42.6% in 2022.

- By end-use, the hospitals segment dominated the market with a market share of 47.1% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 844.8 Million

- 2030 Projected Market Size: USD 999.5 Million

- CAGR (2023-2030): 2.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

Rising technological advancements in medical X-ray image processor, a rising number of chronic disorders requiring imaging technologies, and increasing usage of X-ray in several sectors such as dental, and orthopedic is expected to help the market grow over the forecast period.

The diagnosis and treatment of chronic illnesses, frequently involve the use of medical x-rays. Some examples of chronic disorders where medical x-rays are used include:

-

Osteoporosis: Medical X-ray imaging is used to measure bone density and assess the risk of fractures in patients with osteoporosis

-

Arthritis: X-ray imaging can be used to detect changes in the joints that occur with arthritis, such as joint space narrowing and bone spurs

-

Chronic obstructive pulmonary disease (COPD): X-ray imaging can be used to assess the severity of lung damage in patients with COPD

-

Cardiovascular disease: X-ray imaging can be used to diagnose and monitor a range of cardiovascular conditions, including coronary artery disease, heart failure, and arrhythmias

-

Kidney disease: X-ray imaging can be used to assess the size and function of the kidneys in patients with chronic kidney disease

Thus, with the rising number of above-mentioned chronic disorders, and use of X-ray imaging in its diagnosis may boost the need for medical X-ray image processor over the forecast period.

Moreover, increasing technological advancements in X-ray image processor and its use in various field such as dental is expected to further drive the market growth. For instance, the use of software programs designed to enhance and analyze digital X-ray images of teeth, gums, and other oral structures. This software & processor utilizes advanced algorithms and image processing techniques to improve the clarity, contrast, and quality of the images, which helps dentists and dental professionals to diagnose and treat dental conditions more accurately and effectively.

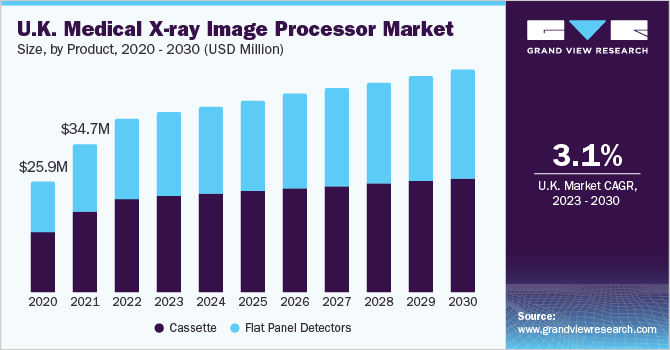

Product Insights

The cassette segment dominated the market with a market share of 52.9% in 2022. The dominance can be attributed to the presence of more traditional X-ray systems globally. Moreover, traditional X-ray systems are cost-effective and easily available. Additionally, the high cost of digital X-ray systems, is expected to limit its use in under-developed countries, where the use of traditional X-rays is anticipated to be more. Thus, as a result of the aforementioned factors, the cassette segment is expected to have a considerable growth rate over the forecast period.

However, flat panel detectors segment is projected to impel at the fastest CAGR of 2.8% over the forecast duration. The increasing adoption of digital X-ray systems in developing and developed countries is expected to boost the flat panel detector segment. Moreover, as these systems are more efficient, have high capability of rapid image viewing, and are more compact, the use of digital X-ray systems is expected to grow in near future. As digital X-ray systems use flat panel detectors, the segment is anticipated to witness lucrative growth over the forecast period.

Application Insights

The orthopedic segment is expected to have a market share of 42.6% in 2022. X-ray systems are used in many of the orthopedic practices such as diagnosis & treatment of bone & joint conditions. Some of the most common uses of X-ray systems in orthopedics include:

-

Fracture diagnosis: X-rays can be used to determine whether a bone is broken or not. This is important for diagnosing fractures and determining the severity of the fracture

-

Joint problems: X-rays can also be used to diagnose joint problems such as osteoarthritis, rheumatoid arthritis, and gout

-

Bone tumors: X-rays can help identify bone tumors and determine their location and size

-

Pre-operative planning: X-rays are also used in pre-operative planning to help surgeons visualize the bone and joint structures and plan the surgical approach

-

Post-operative evaluation: After a surgical procedure, X-rays are used to evaluate the success of the surgery and ensure that the bone is healing properly

Moreover, the increasing number of orthopedic surgical cases is expected to increase the usage of X-ray systems. For instance, as per Regenexx, around 7.0 million orthopedic surgeries are performed every year in the U.S. alone. This may help the segment's growth over the forecast period.

The dental segment is projected to witness a growth rate of 2.12% over the forecast period. The growth rate can be attributed to the increasing number of dental surgeries and rising dental cases globally. Below given are some examples where X-ray systems are used:

-

Detecting cavities: X-rays are used to detect cavities that are not visible to the naked eye, particularly in the early stages.

-

Evaluating the health of the tooth roots: X-rays allow dentists to see the roots of teeth and the bone surrounding them. This helps to identify any infections, abscesses, or bone loss.

-

Assessing the need for orthodontic treatment: X-rays are used to assess the position and development of teeth, jawbone, and soft tissue in the mouth. This helps dentists to determine if orthodontic treatment is necessary.

-

Planning dental implants: X-rays are used to determine the appropriate placement of dental implants, ensuring that they are inserted into the jawbone correctly.

As the number of people suffering from cavities is increasing the use of X-ray systems is expected to grow. For instance, according to CDC, among adults aged more than 20, 90% have at least one cavity. Similarly, as per WHO, in the U.S. around 26.0% of the population have an untreated dental cavity. Thus, as a result of the aforementioned factors, the segment is expected to witness significant growth over the forecast duration.

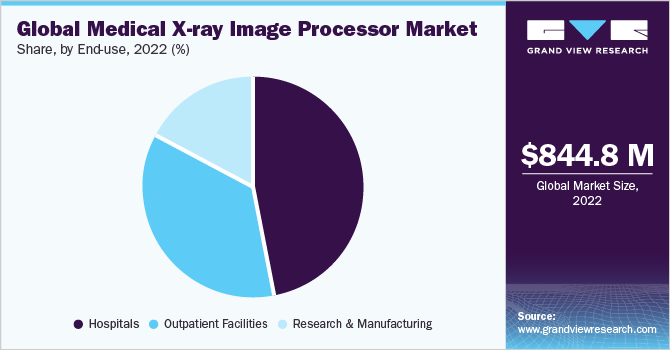

End-use Insights

The hospitals segment dominated the market with a market share of 47.1% in 2022. This can be attributed to the expanding hospital sector, increased orthopedic surgery rates, and an expanding patient base across all age categories. For instance, the India Brand Equity Foundation estimates that by 2023, India's hospital industry will account for around 80.0% of the country's total healthcare market, with a value of USD 132 billion. Moreover, there are more orthopedic surgery cases worldwide. This is expected to raise demand for medical X-ray image processors globally.

The outpatient facilities segment is projected to witness the fastest growth rate of 2.4% during the forecast years. Outpatient facilities segment consists of ambulatory surgery centers, specialized clinics like dental clinics, and diagnostic labs like pathology and imaging centers. Diagnostic labs provide a comprehensive range of diagnostic and preventative health services. Moreover, as per United Healthcare, hospital facilities charge up to 165% more than that of diagnostic imaging centers, as a result, more people are expected to visit outpatient facilities. Therefore, as a result of the aforementioned factors, the outpatient facilities segment is anticipated to witness a significant growth rate.

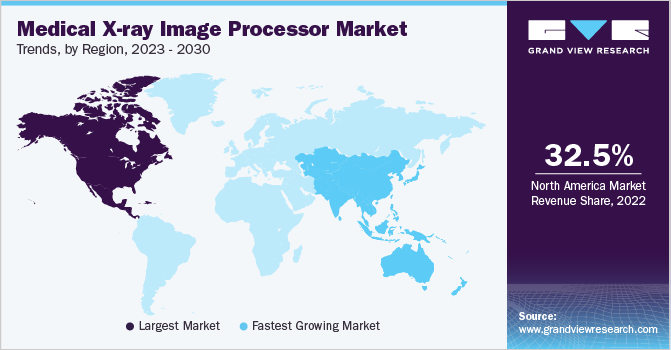

Regional Insights

North America dominated the medical X-ray image processor industry in 2022, with a market share of 32.5%. This can be credited to the rising number of surgical procedures, presence of major market players. This can be attributed to the presence of major service providers and the rising number of surgical procedures in the North America region. For instance, as per Canadian Medical Protective Association Similarly, every year around 1 million surgical procedures are performed in Canada, whereas, as per Canadian Institute for Health Information (CIHI), in 2019-2020, there were over 687,000 surgical and other therapeutic procedures performed on bones, joints and connective tissues in Canada. Such instances are expected to help the region dominate medical X-ray image processor market.

However, Asia Pacific is projected to witness the fastest growth rate of CAGR of 3.2% during the forecast period. The growth rate can be accredited to growing medical tourism, increasing demand for technologically advanced imaging devices, increasing surgical procedures, and the growing geriatric population. Additionally, many major players in this market are expanding their portfolio in this region, which is further expected to help the medical X-ray image processor industry impel across the Asia Pacific region.

Key Companies & Market Share Insights

Key players are involved in adopting strategies such as geographic expansion, partnerships to strengthen their foothold in the market for medical X-ray image processor. Some of the prominent players in the global medical X-ray image processor market include:

-

Zimed Healthcare Ltd

-

Euroteck

-

HEXAGON INTERNATIONAL(GB) LIMITED

-

AFP Manufacturing

-

Baker Hughes Company

-

PROTEC

-

Konica Minolta, Inc.

-

Agfa-Gevaert NV

-

Fujifilm Holdings Corporation

-

Carestream Health

Medical X-ray Image Processor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 864.5 million

Revenue forecast in 2030

USD 999.5 million

Growth rate

CAGR of 2.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA)

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Zimed Healthcare Ltd; Euroteck; HEXAGON INTERNATIONAL(GB) LIMITED; AFP Manufacturing; Baker Hughes Company; PROTEC; Konica Minolta, Inc.; Agfa-Gevaert NV; Fujifilm Holdings Corporation; Carestream Health

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

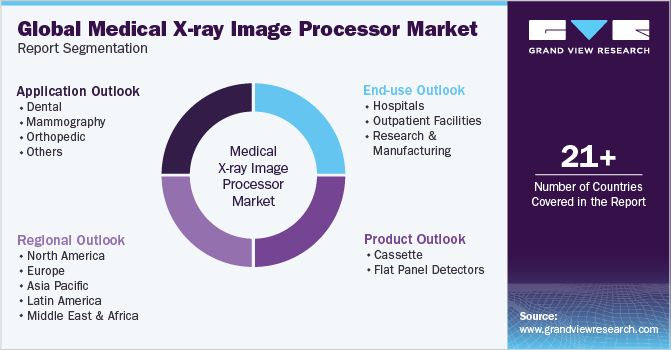

Global Medical X-ray Image Processor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical X-ray image processor market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cassette

-

Flat Panel Detectors

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental

-

Mammography

-

Orthopedic

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Research & Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

- Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical X-ray image processor market size was estimated at USD 844.84 million in 2022 and is expected to reach USD 864.5 million in 2023.

b. The global medical X-ray image processor market is expected to grow at a compound annual growth rate of 2.1% from 2023 to 2030 to reach USD 999.5 million by 2030.

b. North America dominated the medical X-ray image processor market with a share of 32.51% in 2022. This is attributable to the presence of major service providers, and the rising number of surgical procedures in the North American region.

b. Some key players operating in the medical X-ray image processor market include Zimed Healthcare Ltd, Euroteck, HEXAGON INTERNATIONAL(GB) LIMITED, AFP Manufacturing, Baker Hughes Company, PROTEC, Konica Minolta, Inc., Agfa-Gevaert NV, Fujifilm Holdings Corporation, Carestream Health.

b. Key factors that are driving the market growth include rising technological advancements in medical x-ray image processors, a rising number of chronic disorders requiring imaging technologies, and increasing usage of x-ray in several sectors such as dental, orthopedic is expected to help the medical x-ray image processor market grow over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.