Medical Washer Disinfector Market Size, Share & Trends Analysis Report By Type (Floor Standing, Benchtop), By Modality (Automatic, Semi-Automatic, Manual), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-122-9

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Medical Washer Disinfector Market Trends

The global medical washer disinfector market size was estimated at USD 2,005.88 million in 2024 and is projected to grow at a CAGR of 6.11% from 2025 to 2030. Preserving proper cleanliness is crucial, specifically in dental and medical practice. Here, medical washer disinfectors play a vital role. In recent years, there has been a uniform rise in the adoption of washer disinfectors for cleaning & disinfecting medical instruments in many healthcare settings before they go for sterilization. Thus, the development and launch of new medical washer disinfector devices are anticipated to drive market growth over the coming years.

Furthermore, infection control is due to the rising threat of seasonal illnesses during the colder months. Thus, infection control must remain a top priority. Here, medical washer disinfectors are crucial in providing next-level protection to instruments from contamination and offer safety to medical practitioners and hospital staff from hospital-acquired infections. The U.S. FDA has long recommended classifying the general use of medical washer disinfectors into Class II to clean, disinfect, and dry surgical instruments, including anesthesia equipment and other medical devices. Thus, supportive regulatory policies are anticipated to boost the market for medical washer disinfectors over the forecast period.

Rising awareness regarding innovations in medical washer devices and their benefits among healthcare settings such as hospitals and dental facilities are expected to contribute to market growth positively. For instance, in June 2022, Innova announced a new presentation for the company’s glassware washer and water purification system in Mexico. This presentation was aimed at improving awareness about the company’s products in the scientific community and establishing supplier partnerships with Mexican market players, thereby driving market growth.

The rising number of surgical procedures globally is a significant driver for the medical washer disinfector market. With an increasing demand for surgeries due to a higher incidence of chronic diseases, trauma cases, and an aging population, there is a corresponding need for more efficient, reliable, and high-capacity washer disinfectors. These devices are critical for ensuring the sterilization of surgical instruments, reducing the risk of infection for patients and healthcare staff. According to the data published by the National Library Of Medicine in September 2020, approximately 310 million major surgeries are conducted annually across the globe. Of these, around 40 to 50 million surgical procedures are performed in the U.S and 20 million in Europe. Thus, the large number of surgical procedures conducted worldwide is expected to drive the demand for medical washer disinfector, resulting in market growth in the coming years.

Hospitals and surgical centers face stringent infection control protocols, making washer disinfectors indispensable for handling large volumes of surgical tools while meeting hygiene standards. In addition, as surgical procedures become more complex, the demand for sophisticated instruments requiring thorough decontamination also rises, driving healthcare facilities to invest in advanced washer disinfector systems with enhanced automation, efficiency, and user-friendly interfaces.

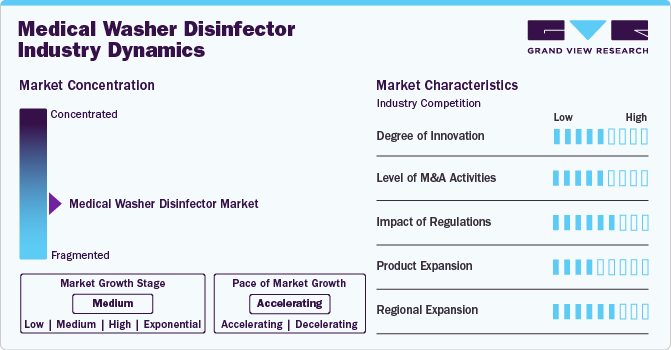

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The medical washer disinfector market is characterized by a high degree of growth owing to the rising number of surgical procedures, and the advancements in medical washer disinfector.

Modern washer disinfectors incorporate automation features, allowing for streamlined workflows with minimal manual handling. IoT and cloud connectivity enable remote monitoring, predictive maintenance, and real-time performance tracking, which enhances operational efficiency and reduces downtime.

The medical washer disinfector market has seen steady mergers and acquisitions (M&A) activity, primarily driven by key factors: the need for advanced technology, regulatory compliance, and market expansion. Established players acquire smaller companies with specialized automated cleaning and disinfection systems technologies to enhance their product offerings and strengthen their market position. For instance, innovations in automation, data integration for tracking sterilization processes, and eco-friendly disinfection solutions have become attractive areas for acquisition, allowing larger firms to keep up with technological advances without starting development from scratch.

Regulation plays a critical role in shaping the medical washer disinfector market, primarily through stringent standards to safeguard patient health and infection control. Agencies such as the FDA (U.S.), EMA (Europe), and other regional health authorities mandate strict compliance with safety, efficacy, and sterilization protocols for devices used in medical cleaning processes. These regulations affect various aspects, from design and manufacturing to validation, installation, and ongoing maintenance of washer disinfectors.

Product expansion in the medical washer disinfector market is primarily driven by the need to accommodate diverse healthcare settings, evolving infection control standards, and the increasing complexity of medical instruments. Manufacturers are innovating to offer a broader range of models, tailored features, and new technologies to meet these demands and tap into growing segments within the market. Product expansion involves introducing various washer disinfector models with different capacities, sizes, and automation levels. Smaller, compact models are marketed for clinics and outpatient centers with limited space, while larger, high-capacity models with rapid cycle times are targeted at hospitals with high patient throughput.

Regional medical washer disinfector market expansion is driven by rising healthcare infrastructure investments, increasing surgical procedure volumes, and evolving infection control regulations across different regions. Each region presents unique opportunities and challenges for market growth, often influenced by healthcare priorities, government policies, and economic conditions. As manufacturers look to expand regionally, they usually adapt their products to meet each region's specific regulatory, economic, and healthcare infrastructure needs. In December 2022, Olympus announced the expansion of its partnership with EndoClot Plus, Inc. in Europe, the Middle East, and Africa as a strategic move to enhance its presence in the market for advanced medical technologies. This partnership focuses on hemostatic solutions. The resulting shifts in surgical practices, infection control awareness, and regulatory requirements are expected to stimulate growth in the medical washer disinfector market as healthcare providers seek to enhance their infection prevention strategies.

Type Insights

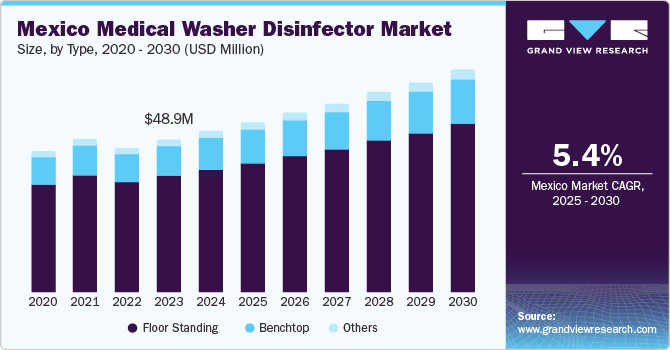

Based on type, the market has been segmented into floor standing, benchtop, and others. The floor-standing segment accounted for the largest market share of 75.74% in 2024. This can be attributed to the availability of a wide range of floor-standing washer disinfector products and a strong global manufacturer presence. Market players such as Steris plc, Skytron, and others offer durable and easy-to-handle heated medical washer disinfector devices. Notable floor medical washer disinfectors include AMSCO 7053HP, AMSCO 5052, RELIANCE VISION, STERLING P1000, and others. The development and introduction of innovative, technologically advanced floor-standing medical washer disinfectors play a significant role in fostering growth in this segment.

The benchtop segment is expected to register fastest growth with a CAGR of 6.43% during the forecast period. Smaller healthcare providers, such as outpatient clinics, dental offices, and private practices, require sterilization equipment as infection control standards become more rigorous. Benchtop washer disinfectors offer these facilities a practical and affordable solution for cleaning medical instruments without needing the space or budget required for larger, more industrial units. As infection prevention standards are strict globally, even smaller healthcare facilities and clinics must meet stringent hygiene regulations. Benchtop washer disinfectors help these facilities maintain compliance by providing effective decontamination within a small footprint, thus driving demand in this segment.

Modality Insights

The automatic segment dominated the market in 2024. Automatic washer disinfectors simplify decontamination by automating complex cleaning and disinfection cycles. This reduces the time and labor required for manual handling, freeing up staff for other essential tasks and allowing healthcare facilities to process a higher volume of instruments in less time. Automatic washer disinfectors have higher initial costs than manual or semi-automatic alternatives. Their efficiency in terms of labor and cleaning effectiveness translates to lower operational costs over time. By reducing the need for manual labor and minimizing the potential for costly contamination incidents, automatic washer disinfectors offer long-term cost savings, making them attractive to healthcare facilities.

Semi-automatic is expected to register significant growth during the forecast period. Semi-automatic washer disinfectors allow healthcare staff more control over specific steps in the cleaning process, which can be beneficial in facilities with varied decontamination needs. For instance, operators can intervene in the cleaning cycle to adjust parameters based on specific instrument requirements, allowing flexibility in handling delicate or specialty tools that do not require fully automated processes. In emerging economies, the demand for effective but cost-sensitive medical equipment is high, mainly as healthcare systems expand to improve access to quality care. Semi-automatic washer disinfectors provide a more affordable alternative to fully automatic units, enabling facilities in these regions to strengthen their sterilization processes and reduce infection risks without high upfront investments.

End Use Insights

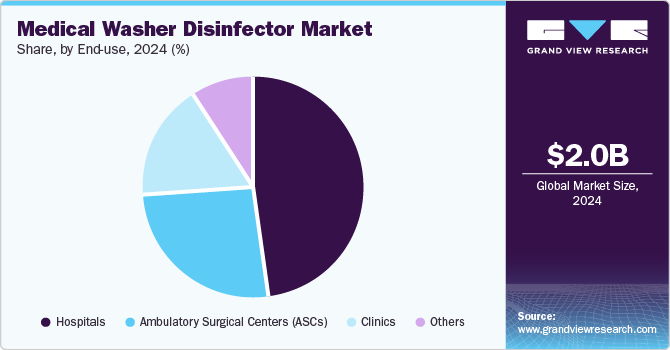

The hospital segment dominated the market in 2024. Driven by a growing patient population and an increasing focus on infection control measures. The rise in hospital-acquired infections (HAIs) highlights the need for stringent disinfection protocols, fueling the demand for efficient washer-disinfectors. According to data from the ECDC published in May 2024, approximately 4.3 million patients in EU/EEA hospitals acquire at least one healthcare-associated infection yearly. This rising prevalence of HAIs is expected to enhance the demand for washer-disinfectors in hospital settings. However, recent technological advancements, such as automated systems and improved cycle times, have made these machines more effective and user-friendly, further supporting segment growth during the forecast period.

The Ambulatory Surgical Centers (ASCs) segment is expected to grow fastest CAGR during the forecast period. ASCs are adopting medical washer disinfectors due to the growing trend of outpatient procedures and the need for efficient turnaround times. ASCs prioritize operational efficiency and infection prevention, driving the demand for compact, high-performance washing systems. Technological innovations, including touchless loading systems and enhanced user interfaces, cater to the unique needs of ASCs by minimizing manual handling and streamlining workflows. Moreover, the growing shift towards ambulatory surgery centers due to cost-effectiveness and shorter stays is anticipated to support the segment growth in the coming years.

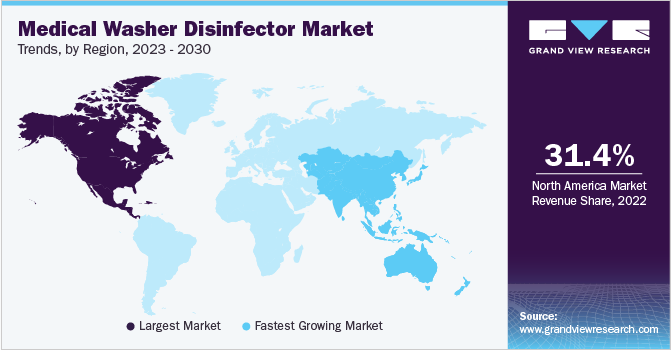

Regional Insights

North America held the largest share of 33.29% in the market in 2024 due to the rising prevalence of Hospital Acquired Infections (HAIs), increasing emphasis on infection control, and the rising number of surgical procedures. According to a study published by the National Institutes of Health (NIH), around 310 million surgeries are performed globally each year, with around 40 to 50 million of them being performed in the U.S. alone. Medical washer disinfectors are essential for cleaning and disinfecting reusable medical instruments, thereby reducing the risk of HAIs.

U.S. Medical Washer Disinfector Market Trends

The medical washer disinfector market in the U.S. is expected to dominate the North American market over the forecast period. Due to increasing demands for effective infection control and stringent regulatory standards within healthcare facilities. States and territories in the U.S. are enhancing infection prevention and control (IPC) policies to combat healthcare-associated infections (HAIs). For instance, in 2021, The American Rescue Plan Act allocated USD 2.1 billion for state health departments to invest in IPC efforts, including a USD 385 million program focused on HAIs and antimicrobial resistance.

Europe Medical Washer Disinfector Market Trends

Europe's medical washer disinfector market is anticipated to grow significantly in the coming years. The high prevalence of HAIs significantly drives the growth of the medical washer disinfector market in Europe. For instance, according to the European Centre for Disease Prevention and Control, in May 2024, around 4.3 million patients in the EU/EEA acquired hospital-associated infections each year. As HAIs pose serious health risks, healthcare facilities are prioritizing infection control measures to enhance patient safety, which is expected to drive the growth of the medical washer disinfector market in the region.

The medical washer disinfector market in the UK is expected to grow moderately over the forecast period. The UK government’s focus on maintaining patient safety has increased investments in public healthcare facilities, significantly increasing the demand for advanced washer disinfectors. Moreover, the growth is further driven by facilities such as NHS hospitals, where a high volume of reusable medical devices, including surgical instruments, are required to be sterilized efficiently and consistently.

France's medical washer disinfector market is expected to grow over the forecast period. France’s healthcare system, known for its emphasis on high-quality patient care, has prioritized automated disinfection processes to meet regulatory standards. Medical washer-disinfectors have become essential equipment for French hospitals, clinics, and specialty care centers, driven by efforts to reduce the prevalence of HAIs. Moreover, various organizations in the country, such as the French Ministry of Health, and regulatory bodies, such as the High Authority of Health (HAS), consistently emphasize the importance of sterilization and sanitation practices.

The medical washer disinfector market in Germany is experiencing steady growth due to rising demand from healthcare facilities to maintain stringent hygiene standards. German healthcare facilities are adopting washer-disinfectors to ensure comprehensive cleaning and sterilization of reusable medical instruments.

Asia Pacific Medical Washer Disinfector Market Trends

Asia Pacific region is anticipated to grow significantly over the forecast period. developing healthcare infrastructure in the region and increasing awareness about infection control in the healthcare facilities. Countries such as China, Japan, South Korea, and India are witnessing significant investments in their healthcare facilities to meet the increasing demand for healthcare services in the region.

The medical washer disinfector market in China is expected to grow over the forecast period owing to the growing awareness among Chinese healthcare providers about automated disinfection’s role in patient safety is accelerating adoption. With the increasing investments in the country’s developing healthcare sector, the medical washer disinfector market is expected to witness growth.

Japan's market for medical washer disinfector is projected to expand during the forecast period due to an aging population, which has led to higher demand for advanced medical equipment across healthcare facilities. According to an article published by the World Economic Forum, around 29.8% of Japan’s population was aged 65 years or above in 2021, with around 1 in every 10 people in the country aged 80 years or older. Japan’s elderly population has increased the need for procedures and devices that ensure sterility and hygiene in medical environments.

Middle East And Africa Medical Washer Disinfector Market Trends

The Middle East and Africa medical washer disinfector market is expected to witness significant growth in the coming years due to the rising focus on reducing the threat of hospital-acquired infections, which has prompted healthcare facilities to prioritize stringent infection control measures, increasing focus on patient safety and the developing healthcare infrastructure, allowing the adoption of advanced sterilization equipment in the region.

The medical washer disinfector market in Saudi Arabia is expected to grow over the forecast period. The government’s commitment to enhancing healthcare infrastructure and quality standards, the rising number of medical procedures, and increasing awareness about the importance of sterilization in healthcare facilities. The Saudi Arabian government is taking significant steps to improve the healthcare infrastructure and quality of care in the country. For instance, in January 2023, the Saudi Arabian government announced an investment of USD 50.4 billion in healthcare and social development—16.96% of its 2023 budget.

The medical washer disinfector market in Kuwait is expected to grow over the forecast period. The increasing awareness about HAI, growing focus on patient safety, developing healthcare infrastructure, and the growing demand for medical procedures in healthcare facilities are driving the growth of the Kuwait medical washer disinfector market.

Key Medical Washer Disinfector Company Insights

STERIS; MELAG Medizintechnik GmbH & Co. KG; Tuttnauer; Olympus Corporation; ECOLAB; SHINVA MEDICAL INSTRUMENT CO., LTD.; Getinge; Skytron, LLC; AT-OS S.r.l.; COLTENE Group; Map Industries; Spire Integrated Solutions; Steelco S.p.A.; Belimed; Smeg; TBT Medical; and DEKO MedTech Oy. are some of the major players in the medical washer disinfector market. Companies operating in the industry are seeking approvals for their novel products and expanding their manufacturing and production capacities to bolster their presence in the market. In addition, manufacturers are acquiring smaller players and emphasizing supplying their products globally.

Key Medical Washer Disinfector Companies:

The following are the leading companies in the medical washer disinfector market. These companies collectively hold the largest market share and dictate industry trends.

- STERIS

- MELAG Medizintechnik GmbH & Co. KG

- Tuttnauer

- Olympus Corporation

- ECOLAB

- SHINVA MEDICAL INSTRUMENT CO., LTD.

- Getinge

- Skytron, LLC

- AT-OS S.r.l.

- COLTENE Group

- Map Industries

- Spire Integrated Solutions

- Steelco S.p.A.

- Belimed

- Smeg

- TBT Medical

- DEKO MedTech Oy

Recent Developments

-

In April 2024, SHINVA Medical Instrument Co., Ltd. signed a Memorandum of Understanding (MOU) with Genoray, a South Korean company specializing in imaging systems, to expand its cooperation in the Chinese healthcare market. This MOU helps SHINVA establish a stronger foothold in healthcare facilities, positioning the company as a trusted partner for medical imaging and infection control solutions.

-

In March 2024, Getinge's launch of a new, intuitive, high-performance multi-chamber washer-disinfector is a significant development in the infection control sector, aimed at addressing the need for efficient, high-capacity cleaning in healthcare facilities. Multi-chamber washer disinfectors are particularly valuable in hospitals and large medical centers where large volumes of surgical instruments and medical equipment must be sterilized quickly and effectively.

-

In June 2023, Olympus's launch of the new ETD Endoscope Washer Disinfector represents an essential advancement in endoscope reprocessing technology. This new system is designed to meet the high standards of safety and efficiency required in endoscope disinfection, ensuring that flexible endoscopes are thoroughly cleaned and disinfected between uses.

Medical Washer Disinfector Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2,127.62 million |

|

Revenue forecast in 2030 |

USD 2,862.27 million |

|

Growth rate |

CAGR of 6.11% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis |

|

Segments covered |

Type, modality, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

STERIS; MELAG Medizintechnik GmbH & Co. KG; Tuttnauer; Olympus Corporation; ECOLAB; SHINVA MEDICAL INSTRUMENT CO., LTD.; Getinge; Skytron, LLC; AT-OS S.r.l.; COLTENE Group; Map Industries; Spire Integrated Solutions; Steelco S.p.A.; Belimed; Smeg; TBT Medical; DEKO MedTech Oy. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Medical Washer Disinfector Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the medical washer disinfector market report based on type, modality, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Floor Standing

-

Benchtop

-

Others

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Semi-Automatic

-

Manual

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical washer disinfector market size was estimated at USD 2,005.88 million in 2024 and is expected to reach USD 2,127.62 million in 2025.

b. The global medical washer disinfector market is expected to grow at a compound annual growth rate of 6.11% from 2025 to 2030 to reach USD 2,862.27 million 2030.

b. Floor-standing dominated the type segment of the medical washer disinfector market, with a share of 75.74% in 2024. This is attributable to the availability of a wide range of floor-standing washer disinfector products and the presence of their manufacturers worldwide.

b. Some key players operating in the medical washer disinfector market include STERIS; MELAG Medizintechnik GmbH & Co. KG; Tuttnauer; Olympus Corporation; ECOLAB; SHINVA MEDICAL INSTRUMENT CO., LTD.; Getinge; Skytron, LLC; AT-OS S.r.l.; COLTENE Group; Map Industries; Spire Integrated Solutions; Steelco S.p.A.; Belimed; Smeg; TBT Medical; and DEKO MedTech Oy.

b. Key factors driving the medical washer disinfector market growth include the growing incidence of hospital-acquired infections, technological advancement, and improvements in public and private hospital infrastructure.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."