- Home

- »

- Medical Devices

- »

-

Medical Thawing System Market Size & Share Report, 2030GVR Report cover

![Medical Thawing System Market Size, Share & Trends Report]()

Medical Thawing System Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Manual, Automated), By Sample (Blood, Embryo, Ovum, Semen), By End-use (Hospitals, Tissue Banks), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-192-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Thawing System Market Trends

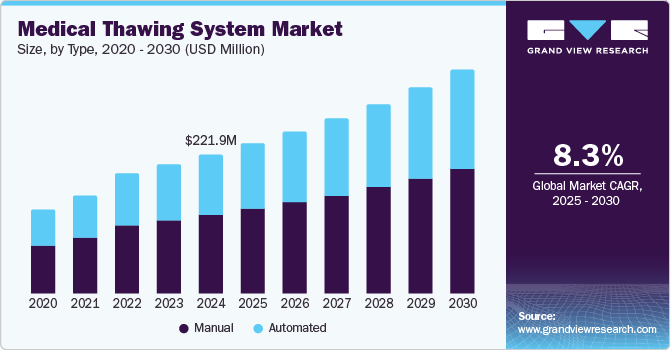

The global medical thawing system market size was estimated at USD 221.9 million in 2024 and is projected to grow at a CAGR of 8.3% from 2025 to 2030. As awareness regarding blood donation rises, there has been a notable increase in blood donors, thereby amplifying the demand for thawing systems integral to blood banks and transfusion centers. The urgency to have thawed blood products rapidly available, particularly for managing hemorrhagic cases, has catalyzed the advancement of thawing technologies that ensure a swift and safe thawing process while maintaining the integrity of critical biological materials.

Technological advancements significantly drive market growth, as the emergence of automated thawing systems has revolutionized conventional practices, improving both efficiency and safety throughout the thawing process. These systems facilitate controlled temperature management and agitation, significantly reducing thaw times while ensuring the efficacy of plasma and other cellular products. The Organ Procurement and Transplantation Network 2023 report highlights a significant evolution in organ transplantation, with approximately 46,632 procedures performed-a notable 8.7% increase from the previous year-underscoring the growing necessity for dependable thawing solutions to ensure optimal preparation of tissues and organs prior to transplantation.

Furthermore, the shift toward portable thawing devices reflects broader trends in decentralized healthcare delivery models. The ability to thaw blood products and tissues at point-of-care locations, including ambulances and emergency rooms, is critical, particularly in trauma cases where time is of the essence. This flexibility ultimately enhances patient outcomes and expands the applicability of thawing technologies across various medical settings, aligning well with the growing emphasis on accessible healthcare solutions.

As research and clinical applications in this sector gain traction, the demand for cutting-edge thawing technologies that facilitate the preparation of living cells and tissues is likely to rise. Coupled with sustained government initiatives and positive reimbursement cycles for plasma donation, the market growth highlights the critical intersection between technology, healthcare, and patient care.

Type Insights

Manual thawing systems led the market with a revenue share of 56.6% in 2024, owing to their cost-effectiveness and extensive product variety. Manual thawing systems are particularly appealing to budget-constrained healthcare facilities, largely because of their straightforwardness and adaptability in thawing protocols, which maintain their popularity even amidst advancements in automated systems.

Automated systems are expected to grow at the fastest CAGR of 8.6% over the forecast period. Automated thawing systems offer consistent and precise temperature control, significantly reducing the risk of damage to biological materials. By minimizing human error associated with manual methods and achieving rapid thawing in under three minutes, these systems are essential for time-sensitive medical procedures, including organ transplantation, while also adhering to stringent regulatory standards.

Sample Insights

The blood segment dominated the market and accounted for a share of 52.6% in 2024. The demand for rapid thawing of blood products in emergency and surgical settings is escalating, driven by the increasing volume of surgical procedures and the critical need for thawed blood in hemorrhage cases. Technological advancements in safe thawing processes, alongside greater awareness and a growing donor base, further enhance this requirement.

The embryo segment is expected to register the fastest CAGR of 9.0% over the forecast period. The growing adoption of in vitro fertilization (IVF) has led to a substantial increase in embryo transfers and a rising demand for reliable thawing solutions. In 2023, India performed approximately 160,000 IVF cycles, reflecting a trend fueled by advancements in reproductive technology and heightened awareness among couples facing infertility challenges.

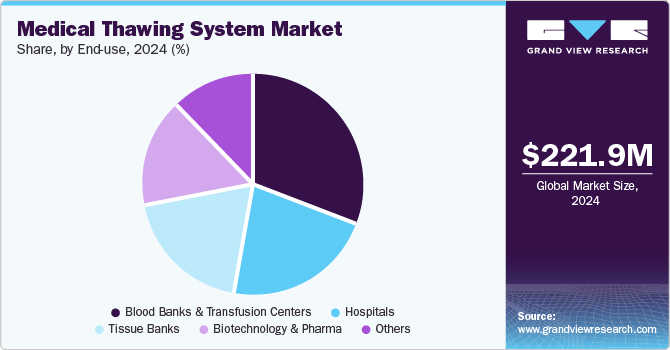

End-use Insights

Blood banks & transfusion centers held the largest share of 31.4% in 2024. The demand for rapid thawing of blood products, especially fresh frozen plasma and red blood cells for emergency transfusions, is increasing. As surgical procedures and trauma cases rise, the need for efficient thawing solutions becomes critical. Advancements in thawing technology further enhance safety and reduce thawing time, ensuring effective patient care.

Tissue banks are projected to grow at the fastest CAGR of 8.5% over the forecast period. The demand for efficient thawing solutions for stored human tissues, such as skin, bone, and corneas, is rising due to the recovery and storage efforts of tissue banks. Advancements in regenerative medicine and an emphasis on tissue transplantation underscore the necessity for specialized thawing technologies that preserve tissue integrity.

Regional Insights

North America medical thawing system market dominated the global market with a revenue share of 47.3% in 2024. North America experiences a high prevalence of chronic diseases, driving demand for efficient thawing solutions for blood and plasma products. The region’s robust healthcare infrastructure and leading manufacturers enhance access to innovative thawing technologies. Furthermore, rising awareness of blood and plasma donation, alongside government initiatives, significantly supports market growth and adoption.

U.S. Medical Thawing System Market Trends

The U.S. medical thawing system market dominated the North America medical thawing system market with a revenue share of 81.9% in 2024. The presence of over 14 million active blood donors underscores the critical need for efficient thawing solutions to facilitate timely transfusions. Supportive government initiatives and heightened awareness of blood donation are driving market growth. Leading companies such as GE Healthcare and Helmer Scientific promote innovation and product availability to meet rising demands.

Europe Medical Thawing System Market Trends

Europe medical thawing system market held substantial market share in 2024. The growing prevalence of chronic diseases demands efficient thawing solutions for blood and tissue products. Europe’s stringent regulatory standards enhance confidence in quality medical devices. Moreover, increasing awareness of organ donation and advancements in regenerative medicine are driving demand for reliable thawing systems in hospitals and tissue banks.

The medical thawing system market in UK is expected to grow in the forecast period. The National Health Service underscores the critical role of efficient thawing systems for timely access to blood products in emergencies. Moreover, increasing awareness of organ donation and advancements in reproductive technologies enhance the demand for reliable thawing solutions in fertility clinics, positioning the UK as a significant player in the European market.

Asia Pacific Medical Thawing System Market Trends

Asia Pacific medical thawing system market is expected to register the fastest CAGR of 6.1% in the forecast period. Rapid urbanization and advancements in healthcare infrastructure are enhancing access to cutting-edge medical technologies, including thawing systems. Moreover, growing awareness of semen and ovum cryopreservation is driving demand in reproductive health sectors. Government initiatives to improve healthcare services further bolster market growth, fostering a favorable environment for innovation and development.

The medical thawing system market in China dominated the Asia Pacific medical thawing system market in 2024. The growing demand for blood and plasma products, fueled by the rise in chronic diseases, significantly impacts market growth. Government initiatives promoting plasma donation and advancements in thawing technologies enhance efficiency and safety. The expansion of the pharmaceutical sector in China attracts manufacturers aiming to capitalize on this lucrative market opportunity.

Key Medical Thawing System Company Insights

Some key companies operating in the market include Helmer Scientific Inc.; SARSTEDT AG & Co. KG; Azenta US, Inc.; GE HealthCare; among others. Companies are prioritizing product innovation, strategic partnerships, and mergers while investing in technological advancements and expanding offerings to address the growing demand for efficient thawing solutions.

-

Helmer Scientific Inc. specializes in manufacturing medical thawing systems that ensure precise temperature control for thawing blood and plasma products. Their advanced technology enhances safety and efficiency in blood banks and laboratories, addressing the increasing demand for thawed biological materials.

-

SARSTEDT AG & Co. KG provides a comprehensive array of medical thawing solutions tailored for laboratories and healthcare facilities. Their systems effectively thaw diverse biological samples, ensuring optimal temperature control and user-friendly operation, while emphasizing innovation and quality in medical technologies.

Key Medical Thawing System Companies:

The following are the leading companies in the medical thawing system market. These companies collectively hold the largest market share and dictate industry trends.

- Helmer Scientific Inc.

- SARSTEDT AG & Co. KG

- Azenta US, Inc.

- GE HealthCare

- Boekel Scientific

- Barkey

- Cardinal Health

- Thermo Fisher Scientific Inc.

- Cytotherm

Recent Developments

-

In March 2023, Barkey launched the Vialguard Pro, an automated solution designed to thaw multiple small volume vials vertically, building on their expertise in fluid warming for the cell and gene therapy sector.

Medical Thawing System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 239.0 million

Revenue forecast in 2030

USD 355.9 million

Growth rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, sample, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Helmer Scientific Inc.; SARSTEDT AG & Co. KG; Azenta US, Inc.; GE HealthCare; Boekel Scientific; Barkey; Cardinal Health; Thermo Fisher Scientific Inc.; Cytotherm

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Thawing System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical thawing system market report based on type, sample, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Automated

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood

-

Embryo

-

Ovum

-

Semen

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Banks & Transfusion Centers

-

Hospitals

-

Tissue Banks

-

Biotechnology & Pharma

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.