- Home

- »

- Healthcare IT

- »

-

Global Medical Terminology Software Market Size Report, 2030GVR Report cover

![Medical Terminology Software Market Size, Share & Trends Report]()

Medical Terminology Software Market (2024 - 2030) Size, Share & Trends Analysis Report By End Use (Healthcare Providers, Healthcare IT Vendors), By Application (Quality Reporting, Data Aggregation), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-985-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Terminology Software Market Summary

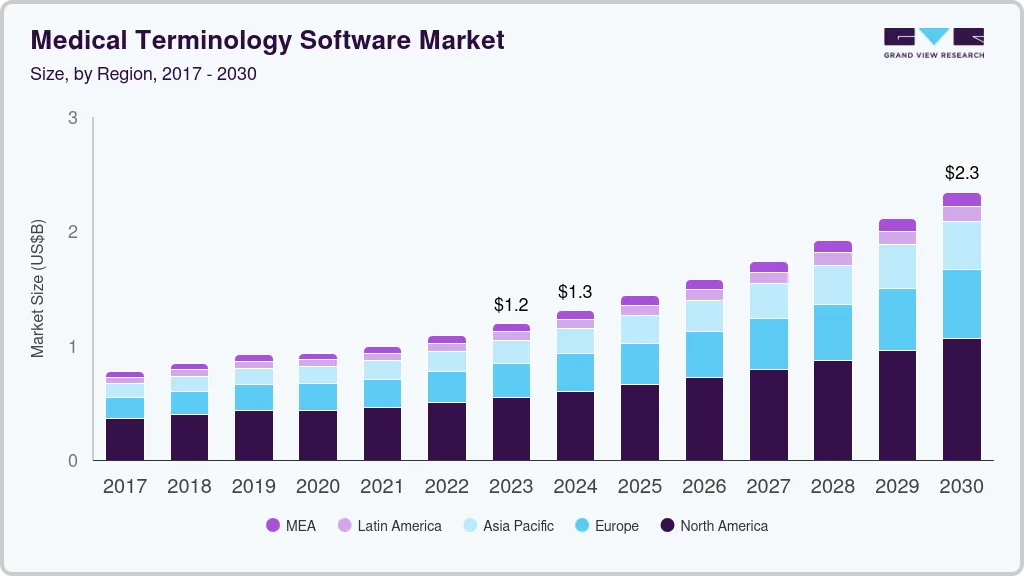

The global medical terminology software market size was valued at USD 1.19 billion in 2023 and is projected to reach USD 2.34 billion by 2030, growing at a CAGR of 10.1% from 2024 to 2030. The market growth is driven by factors, such as the increasing need to minimize clinical errors, increasing government initiatives to boost IT adoption among hospitals, and disparity within the clinical terminologies used by different healthcare organizations.

Key Market Trends & Insights

- North America dominated the global industry in 2021 and accounted for the maximum share of 46.6% of the overall revenue.

- Asia Pacific is anticipated to register the fastest growth rate during the forecast period.

- In terms of end-uses, the healthcare providers segment dominated the global industry in 2021.

- Based on applications, the quality reporting segment dominated the industry with a maximum revenue share of 21.6% in 2021.

Market Size & Forecast

- 2023 Market Size: USD 1.19 Billion

- 2030 Projected Market Size: USD 2.34 Billion

- CAGR (2024-2030): 10.1%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

Furthermore, the rising demand for interoperability between various hospital departments is propelling the industry's growth. Medical errors are one of the leading causes of death worldwide.

According to a John Hopkins study, in the U.S., more than 250,000 deaths are caused by clinical errors each year, making it the third leading cause of death after heart disease and cancer. Lack of standardized nomenclature is one of the major causes of medical errors. The growing focus on reducing clinical errors while maintaining standard patient information by the healthcare industry and hospitals are anticipated to fuel industry expansion. In recent years, the government has been taking proactive steps and measures to accelerate the implementation of Health Information Technologies (HITs) in healthcare settings.

For instance, in 2022, ONC announced funding opportunities in HIT under the Leading Edge Acceleration Projects (LEAP). The funding opportunity aims to expand health IT standards and solutions to improve the exchange and research on Social Determinants Of Health data (SDOH) and to develop tools for using EHR data for research. Many of the EHR vendors partner with medical terminology software providers for content or to add the clinical terminology feature to their EHR. For instance, in January 2021, Wolters Kluwer N.V. announced the integration of Henry Schein MicroMD, an EHR and practice management solution with Health Language Clinical Interface Terminology (CIT).

COVID-19 medical terminology market impact: 6.1% increase from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The industry witnessed an initial slowdown in growth during the pandemic due to a decrease in the number of EHR subscriptions. The negative impact was primarily offset by an increase in the number of hospitalizations and the introduction of new CPT codes and terms related to COVID-19, which increased the need for clinical terminology solutions

Post-pandemic the industry is likely to witness gradual growth owing to increasing steps toward interoperability and clinical terminology interfacing. Companies are also experiencing significant growth in their revenue. For instance, Wolters Kluwer N.V., the revenue of the clinical solutions segment grew by 7% in 2021

A significant increase in the number of claims submitted during the pandemic fueled the industry. For instance, as per the National Association of Insurance Commissioners (NAIC), Medicare and Medicaid reported an increase of 8.8% and 8.7%, respectively, in incurred claims in 2020

New product development is expected to give significant momentum to the industry. For instance, in April 2022, Clinical Architecture added new features and rebranded its software Nomad to Nomentys. The new feature assists healthcare providers in effortlessly complying with the 21st Century Cures Act through a practical, user-friendly SaaS strategy. Nomentys accepts patient data in a variety of formats, normalizes it to USCDI v2, improves the data for better quality, and finally converts it into standard output, such as FHIR

This will help in the quick mapping of clinical abbreviations, acronyms, and incomplete terms to standardized nomenclature. Thus, increasing the adoption of EHR. The growing number of new product launches, mergers, and acquisitions by industry participants is also promoting industry expansion. Many investors are focusing on entering the industry owing to the potential growth prospects and increasing traction. For instance, in April 2022, Thomas H.Lee Partners, L.P., a private equity firm announced the acquisition of Intelligent Medical Objects, Inc. The acquisition is anticipated to support the company’s product development and expand business relationships with hospitals and other care providers.

End-use Insights

In terms of end-uses, the healthcare providers segment dominated the global industry in 2021 and accounted for the maximum share of the overall revenue. The segment is anticipated to expand further at the fastest growth rate of 11.03% retaining its leading position throughout the forecast period. This growth can be attributed to the increasing deployment of EHR and clinical decision support systems in hospitals, increasing patient safety concerns, and rising demand for clinical interface terminologies in the healthcare system. In addition, compliance obligations imposed by governments for quality standards are contributing to segment growth.

Medical terminology software reduces inaccuracies caused by poor communication and paperwork, allowing professionals to quickly and accurately document patient histories, diagnoses, & treatment and identify potential health risks. It also helps in processing the natural language of doctors into a standard format for better understanding by other clinical staff. The healthcare IT vendors segment is also expected to have significant growth during the forecast period owing to partnerships between software providers. For instance, Intelligent Medical Objects, Inc. has partnerships with Epic, Cerner Corp., and Allscripts Healthcare. The others segment consists of CROs and medical/academic research institutes. A shift toward decentralized clinical trials is boosting the adoption of terminology software among CROs and academic research institutes.

Application Insights

Based on applications, the industry is further categorized into decision support, reimbursement, clinical trials, data aggregation, data integration, quality reporting, public health surveillance, and others. The quality reporting segment dominated the industry with a maximum revenue share of 21.6% in 2021. The segment is also projected to witness the fastest growth during the forecast period. This can be attributed to the increasing government steps to improve healthcare quality outcomes and develop standards for quality measurements.The reimbursement segment is expected to have lucrative growth during the forecast period.

An increasing number of hospitalizations and subsequent claim submissions are fueling the segment's growth. Correct codes and seamless medical billing are very important to ensure that healthcare providers get full reimbursement for care delivery. Discrepancies in the data collected from various sources for patient health surveillance results in incorrect data interpretation. Thus, clinical terminology solutions are widely used for standardization. An increase in investments in R&D, a rising number of clinical studies on novel drugs, and stringent government norms requiring proper documents for assessment and approvals are favoring the growth of the clinical trials segment.

Regional Insights

North America dominated the global industry in 2021 and accounted for the maximum share of 46.6% of the overall revenue. The growth of the region is attributed to the implementation of favorable government initiatives and support programs. The U.S. Centers for Medicare & Medicaid Services started Medicare Promoting Interoperability Program to encourage hospitals and professionals to adopt certified EHR technologies. The United States Core Data for Interoperability (USCDI) mandates the use of SONOMED CT and ICD-10-CM for documenting disease diagnoses, conditions, treatments, and health concerns. Hence, the service providers are focussing on launching new software for the same.

For example, in March 2022, Clinical Architecture, LLC announced the launch of SeekDx, which provides intelligent, doctor-friendly solutions that map the diagnosis to the appropriate ICD-10 CM code and SNOMED CT code, thus streamlining the documentation and saving physicians’ time. The Europe region is also estimated to register significant growth over the forecast period owing to the increasing investments by the government for the adoption of digital platforms in hospitals. Asia Pacific is anticipated to register the fastest growth rate during the forecast period. This can be attributed to the increasing focus of providers to expand their presence in emerging economies, the rising number of hospitals, and increasing investments in public health surveillance.

Key Companies & Market Share Insights

The industry is moderately fragmented with the presence of various domestic and international players. Partnerships with healthcare providers and IT vendors, new software launches, mergers, and acquisitions are some of the key strategies undertaken by manufacturers. For instance, Intelligent Medical Objects, Inc. serves nearly 4,000 hospitals and 400,000 physicians in the U.S. Some of the prominent players in the global medical terminology software market include:

-

Wolters Kluwer N.V.

-

3M

-

BT Clinical Computing

-

Intelligent Medical Objects, Inc.

-

Apelon, Inc

-

CareCom

-

Clinical Architecture, LLC

-

BiTAC

-

B2i Healthcare

-

HiveWorx

Medical Terminology Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.30 billion

The revenue forecast in 2030

USD 2.34 billion

Growth rate

CAGR of 10.1% from 2024 to 2030

The base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea, Brazil; Mexico, South Africa, Saudi Arabia, UAE.

Key companies profiled

Wolters Kluwer N.V.; 3M; BT Clinical Computing; Intelligent Medical Objects, Inc.; Apelon, Inc.; CareCom; Clinical Architecture, LLC; BiTAC; B2i Healthcare; HiveWorx

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Terminology Software Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global medical terminology software market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Quality Reporting

-

Reimbursement

-

Data Aggregation

-

Public Health Surveillance

-

Decision Support

-

Data Integration

-

Clinical Trials

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare Payers

-

Healthcare IT Vendors

-

Healthcare Providers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

South Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global medical terminology software market size was estimated at USD 991.8 million in 2021 and is expected to reach USD 1.08 billion in 2022.

b. The global medical terminology software market is expected to grow at a compound annual growth rate of 10.1% from 2022 to 2030 to reach USD 2.34 billion by 2030.

b. North America dominated the medical terminology software market with a share of 46.6% in 2021. The United States Core Data for Interoperability (USCDI) mandates the use of SONOMED CT and ICD-10-CM for documentation, thus favoring market growth.

b. Some key players operating in the medical terminology software market include Wolters Kluwer N.V.; 3M; BT Clinical Computing; Intelligent Medical Objects, Inc.; Apelon, Inc.; CareCom; Clinical Architecture, LLC; BiTAC; B2i Healthcare; and HiveWorx .

b. Key factors that are driving the market growth include a rising focus to reduce medical errors, rising adoption of EHR, and partnerships between EHR vendors and medical terminology solution providers,

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.