- Home

- »

- Medical Devices

- »

-

Medical Telepresence Robots Market Size, Share Report 2030GVR Report cover

![Medical Telepresence Robots Market Size, Share & Trends Report]()

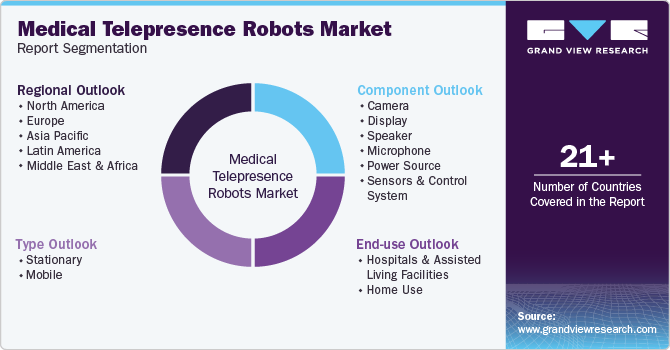

Medical Telepresence Robots Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Stationary, Mobile), By Component (Camera, Display), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-393-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Telepresence Robots Market Trends

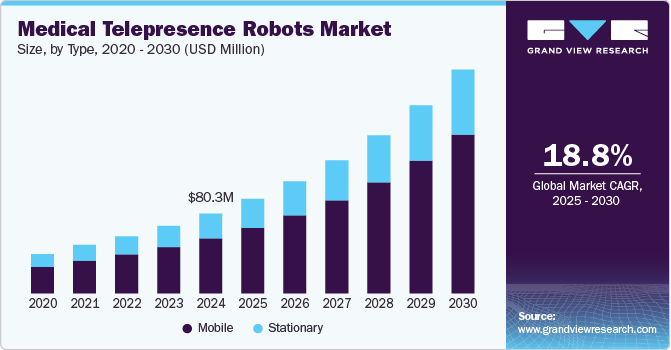

The global medical telepresence robots market size was estimated at USD 80.3 million in 2024 and is projected to grow at a CAGR of 18.8% from 2025 to 2030. Factors boosting the market growth include growing investments, increased demand for robots in the healthcare sector for essential tasks, such as online physician consultation & online patient surveillance, and their expanding use in the industry for patient data collection, bedside nursing, and lab automated support. For instance, in January 2022, Blue Ocean Robotics, a robotic company, raised more than USD 51 million from A.P. Møller Holding. This investment will help the company roll out its robots globally.

The increasing prevalence of chronic disease and the growing geriatric population further fuel the market growth for telepresence robots. These robots can be used for consultation and regular monitoring from remote locations. For instance, according to America’s Health Rankings 2023 Annual Report, in the U.S., over 29 million adults are registered for three or more chronic conditions in 2022. Telepresence robots can help the geriatric population stay at home and connect to healthcare professionals for their checkups, thereby reducing the burden on healthcare institutions. Such factors boost market growth.

Moreover, the growing adoption and popularity of telepresence robots in the healthcare sector are further driving market growth. Following are the hospitals and associations equipped with telepresence robots,

-

University Hospital Center of Lyon Sud & Liv & Lumière Association

-

IHOPe - Institute of Hematology and Pediatric Oncology of the Léon Bérard Center & APPEL Association (VIK-e)

-

University Hospital Center of Caen & Arche et Cassandra Associations

-

University Hospital Center of Nantes & LEAF Association

-

Regional University Hospital of Tour - Clocheville Pediatric Hospital & Rotary Club of Loches

-

Regional University Hospital of Strasbourg & ARAME Association

-

CHRU Strasbourg & Association ARAME

-

FLO Association

-

Coup d’Pouce Association

-

University Hospital Center of Clermont Ferrand & Acte Auvergne Association

-

Arche Association

-

“Ligue nationale contre le cancer”

-

Cassandra Association

-

Imagine for Margo Association

The features of telepresence robots include quick and efficient two-way communication, the ability to remotely connect from any location for patient monitoring and consultation, self-guiding navigation, and healthcare-related features such as screen body temperature, integrated stethoscope, and fever warning are further fueling the adoption of medical telepresence robots.

The favorable government initiatives and increasing investment support for R&D in AI and robotics in developing countries are fueling innovations and attracting new players in the market for medical telepresence robots, further influencing the expansion of the market. For instance, in July 2024, AIRS Medical, an AI and robotics provider for healthcare applications, received USD 20 million through a Series C funding round from seven institutional investors in Korea. The investment, led by Shinyoung Securities and BSK Investment, is to revolutionize preventive healthcare through technological innovation.

The expansion of robot usage in healthcare environments and advancements in communication technologies such as 4G and 5G are attracting fresh investments into the sector. The varying customer requirements and consumer demands with rapidly changing technologies are spurring companies in the industry to strengthen their efforts in R&D to offer breakthrough solutions. Furthermore, the rising number of companies offering cutting-edge products and solutions featuring the latest upgrades is driving the market growth.

Market Concentration & Characteristics

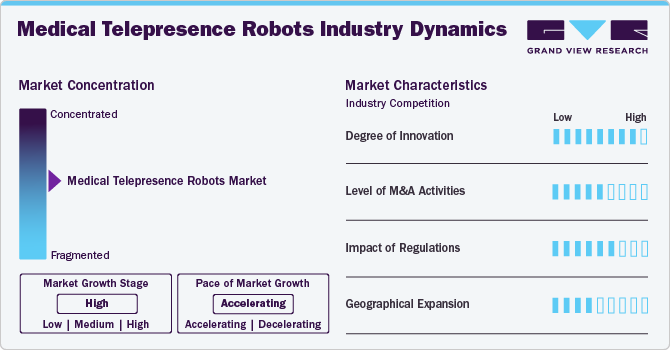

The medical telepresence robots industry is characterized by a high degree of innovation due to technological advancements in the robotics industry, which led to a rise in the adoption of telepresence robots in the healthcare sector. For example, the Sanbot Elf telepresence robot (Sanbot S1) offers a physical, remote presence, enabling patients to visit co-workers, family, physicians, and others efficiently and instantly.

The market is characterized by a medium level of merger and acquisition (M&A) activity. These mergers and acquisitions facilitate access to expertise, complementary technologies, and distribution channels, enabling companies to accelerate product development and capture a larger market share. For instance, in August 2019, Blue Ocean Robotics, a Denmark-based robotics company, acquired Suitable Technologies, Inc., a U.S.-based provider of telepresence products.

Medical telepresence robots require FDA clearance to ensure they meet safety and efficacy standards for active patient monitoring. They must comply with HIPAA (Health Insurance Portability and Accountability Act) regulations to protect patient privacy. This ensures that communication between patients and healthcare providers remains safe and confidential. These regulations are essential for safeguarding patient health and promoting innovation.

Several market players are expanding their business by entering new business geographies to strengthen their market position and expand their product portfolio. For instance, in 2021, OhmniLabs, a robotic company in California, provided telepresence robots to the Eastern Kentucky Advanced Manufacturing Institute (eKAMI) for healthcare, manufacturing, and education.

Type Insights

The mobile segment dominated the market in 2024 and is expected to witness the fastest growth at a CAGR of 19.4% over the forecast period. Features such as obstacle avoidance, adjustable height, and head motion provide efficient and smooth service delivery, autonomous navigation, and virtual monitoring, enabling effective teleconsultation. This fuels the market for medical telepresence robots. Furthermore, the growing adoption of mobile telepresence robots in healthcare settings boosts market growth. For instance, in August 2021, Hill-Rom Services Inc., a medical technology provider, expanded its sales and educational processes reach by using telepresence robots from Ava Robotics Inc. at its product showrooms in Calif., Irvine, and Batesville, Ind.

The stationary segment is expected to grow at a lucrative CAGR over the forecast period. It is growing considerably and cost-effectiveness is one of the major factors supporting its growth. Stationary robots are more affordable than mobile robots, leading to the rise in adoption of stationary telepresence robots. These robots are simply put in function and have a screen that users can control, enabling them to view their surroundings.

Component Insights

The camera segment dominated the market in 2024 and held the largest revenue share of 22.3%. The camera enhances remote communication through features such as clarity and visualization. These robots are monitored autonomously and consist of motorized stands connected to the monitor. Incorporating advanced cameras in these robots enables clear and live video communication between healthcare providers and patients, which is essential for precise diagnosis and efficient monitoring. The need for high-definition cameras equipped with zoom, pan, and tilt functions is growing as they improve the ability of healthcare specialists to conduct remote examinations.

The sensors and control systems segment in the market is anticipated to witness the fastest CAGR over the forecast period, owing to growing investment in IoT and AI. For instance, in January 2023, the European Commission and national funding agencies invested USD 65.1 million in the Testing and Experimentation Facility for Health AI and Robotics (TEF-Health) to promote and accelerate the validation and certification of robotics and AI in medical devices.

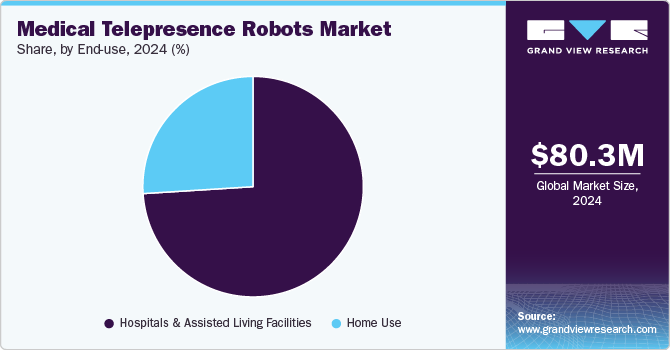

End-use Insights

The hospitals & assisted living facilities segment dominated the market in 2024. The expansion of healthcare infrastructure and the deployment of technologically advanced telepresence robots in hospitals that enable effective teleconsultation and monitoring through two-way communication from any location are key drivers behind boosting segment growth. In addition, these robots facilitate medication management, social interaction, and regular health check-ups, which are necessary for the well-being of elderly residents. By enabling remote monitoring and virtual visits, telepresence robots help address the challenges posed by staff shortages and ensure that residents receive immediate medical attention when needed; such factors boost the market growth.

The home use segment in the market is anticipated to register the fastest CAGR of 19.7% over the forecast period. Factors such as the increasing geriatric population and the rising prevalence of chronic diseases increase the demand for telepresence robots for regular monitoring. One of the major drivers is the rising demand for remote healthcare solutions, which enable patients to receive medical attention and monitor their health without leaving their homes. This is particularly beneficial for individuals with chronic illnesses and mobility issues.

Regional Insights

North America medical telepresence robots market dominated globally in 2024 with the largest revenue share of 40.2%. This large share is attributed to the presence of favorable government initiatives and highly developed healthcare infrastructure. In addition, rising disposable incomes, increasing adoption of robotic technologies, including service robots in healthcare institutions, and product launches in the market are some of the factors anticipated to support regional market growth.

U.S. Medical Telepresence Robots Market Trends

The U.S. medical telepresence robots market held the largest market share in 2024. Growing government initiatives, rising investments, and the presence of key market players drive market growth in the country. For example, Vecna Healthcare, a U.S.-based provider of telepresence robotics solutions, offers the VGo telepresence robot, which provides real-time audio and video communication, allowing users to interact remotely as if they were physically present. It is designed for use in hospitals, long-term care facilities, and educational settings.

Canada medical telepresence robots market is anticipated to register the fastest CAGR during the forecast period. The country's aging population and increasing prevalence of chronic disorders contribute to increasing demand for medical telepresence robots. For instance, according to a Springer Nature article, the proportion of seniors (aged 65+) in Canada was projected to increase from 16.3% in 2016 to 25.4% by 2060. These aging populations are more susceptible to chronic diseases, supporting market growth.

Europe Medical Telepresence Robots Market Trends

Europe medical telepresence robots market is anticipated to register a considerable CAGR during the forecast period. Ongoing research on robotics in the region is anticipated to drive market growth over the forecast period. In addition, EU-funded research studies are promoting the development of innovative technologies in robotics, which are helpful for the healthcare sector. For instance, according to the International Federation of Robotics, the European Commission funded USD 198.5 million for the robotics-related work program 2021-2022.

The medical telepresence robots market in Germany is anticipated to register a considerable CAGR during the forecast period. Rising investments by governments and private organizations boost the country's market growth. For instance, according to the International Federation of Robotics, the German government will provide around USD 69 million annually for Germany's High-Tech Strategy 2025 (HTS), a German R&D and innovation program that includes human-robot collaboration, data glasses, and exoskeletons.

The medical telepresence robots market in the UK is anticipated to register a considerable growth rate during the forecast period. Factors such as favorable government initiatives and high revenue share include a well-established healthcare system, the National Health Service (NHS) in the country that supports the utilization of robots, and ongoing market competition. For instance, in September 2021, The National Robotarium, hosted by Heriot-Watt University, presented its advanced sensing and telepresence robotics technology to a UK Government Minister.

Asia Pacific Medical Telepresence Robots Market Trends

The medical telepresence robots market in the Asia Pacific region is anticipated to witness the fastest CAGR globally over the forecast period. This growth is due to the rising government initiatives regarding robotics and AI and the increasing adoption of robotics in the healthcare sector. Furthermore, this growth is driven by the emergence of new robotics technology startups that are revolutionizing healthcare by developing innovative medical technologies that enhance healthcare delivery, optimize patient care, and reduce costs.

Japan medical telepresence robots market dominated the Asia Pacific region in 2024.Technologically advanced healthcare systems, with a strong focus on innovation and technological advancements, and potential investments by government and private companies are boosting market growth. For instance, according to the International Federation of Robotics, the Japanese government invested over USD 930.5 million in 2022 for the “New Robot Strategy,” which aims to establish the country as the leading hub for robot innovation globally.

The China medical telepresence robots market is anticipated to register the fastest CAGR during the forecast period. Rapidly expanding healthcare infrastructure and a growing elderly population present a significant growth driver for the market. For instance, according to government statistics released by China, its population of 60 and older was approximately 297 million in 2023, accounting for 21.1% of the total population.

Latin America Medical Telepresence Robots Market Trends

Latin America medical telepresence robots market is witnessing steady growth due to the growing awareness among patients and healthcare professionals regarding their availability and benefits. The growing prevalence of chronic diseases, the easy availability of newer technologies & robots, and the increasing demand for remote patient monitoring in the region boost market growth.

Brazil medical telepresence robots market is anticipated to register considerable growth during the forecast period. Growing disposable incomes, increasing access of private healthcare companies to a large population pool, increasing government medical expenditure, and rapid expansion of healthcare R&D are key factors expected to drive the market for technologically advanced robotic solutions.

Middle East Medical Telepresence Robots Market Trends

The medical telepresence robots market in the Middle East and Africa are anticipated to experience lucrative growth over the forecast period. Associated benefits and ongoing research activities about developing innovative technologies are anticipated to boost the usage rate of telepresence robots in the healthcare sector.

The UAE medical telepresence robots market is anticipated to register a considerable growth rate during the forecast period. The increasing number of key players entering the UAE market is one key factor signifying growing demand and awareness for robotics technologies. Furthermore, new product launches in the country drive market growth. For instance, in April 2020, RoboAds Inc., a UAE-based robotics startup, developed RoboAds, a new generation of telepresence robots to assist security and healthcare staff on Covid 19 virus frontlines.

Key Medical Telepresence Robots Company Insights

Key participants in the market for medical telepresence robots are focusing on developing innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Medical Telepresence Robots Companies:

The following are the leading companies in the medical telepresence robots market. These companies collectively hold the largest market share and dictate industry trends.

- Ava Robotics Inc.

- Amy Robotics

- Guangzhou Yingbo Intelligent Technology Co., Ltd.

- Axyn Robotics

- Blue Ocean Robotics

- Teladoc Health, Inc. (InTouch Health)

- OhmniLabs, Inc.

- VGo Communications, Inc.

- Rbot

- Xandex Inc.

Recent Developments

-

In April 2022, OhmniLabs collaborated with Lovell Government Services, a Service-Disabled Veteran-Owned Small Business (SDVOSB), to add Ohmni Telepresence and OhmniClean Robot to government contract vehicles.

-

In February 2021, the U.S. government launched the National Robotics Initiative (NRI) for fundamental robotics R&D. The government funded 14 million USD for this project in 2021.

Medical Telepresence Robots Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 95.1 million

Revenue forecast in 2030

USD 224.9 million

Growth rate

CAGR of 18.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, Norway, Denmark, Sweden, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Ava Robotics Inc., Amy Robotics, Guangzhou Yingbo Intelligent Technology Co., Ltd., Axyn Robotics, Blue Ocean Robotics, Teladoc Health, Inc. (InTouch Health), OhmniLabs, Inc., VGo Communications, Inc. , Rbot, Xandex Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Medical Telepresence Robots Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global medical telepresence robots market report based on type, component, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stationary

-

Mobile

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Camera

-

Display

-

Speaker

-

Microphone

-

Power Source

-

Sensors & Control System

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Assisted Living Facilities

-

Home Use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical telepresence robots market size was valued at USD 80.3 million in 2024 and is expected to reach USD 95.1 million in 2025.

b. The global medical telepresence robots market is expected to grow at a compound annual growth rate of 18.8% from 2025 to 2030 to reach USD 224.9 million by 2030.

b. In 2023, the mobile segment dominated the medical telepresence robots market with a revenue share of over 68.9% and is expected to witness the fastest growth over the forecast period.

b. Some of the key market players operating in the medical telepresence robots market are Amy Robotics, Ava Robotics Inc., AXYN Robotics, Blue Ocean Robotics, Guangzhou Yingbo Intelligent Technology Co., Ltd., InTouch Health, OhmniLabs, Inc., Rbot, VGo Communications Inc., and Xandex Inc.

b. The rising prevalence of chronic diseases and the increasing geriatric population propels the demand for telepresence robots for regular monitoring and consultation from remote location.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.