Medical Tapes And Bandages Market Size, Share & Trends Analysis Report By Product (Medical Tapes, Medical Bandages), By Application (Surgical Wound, Traumatic Wound), By End-use (Hospitals, Retail), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-259-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Medical Tapes & Bandages Market Trends

The global medical tapes and bandages market size was estimated at USD 7.79 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.4% from 2024 to 2030. The market growth is attributed to the increasing incidence of wound infections, number of road accidents, and patient safety concerns along with the rising burden of pressure ulcers & diabetic foot ulcers. For instance, according to ScienceDirect, diabetic foot ulcers may affect more than 25% of the diabetic population and may lead to the amputation of a foot in 20% of patients. Moreover, according to the American Diabetes Association, in 2018, an estimated 34.2 million people, i.e., 10.5% of the total U.S. population, had diabetes. Nearly 1.6 million U.S. residents have type 1 diabetes, which includes about 187,000 adolescents and children.

Moreover, according to a similar source, approximately 1.5 million people in the U.S. are diagnosed with diabetes each year. According to a study published by BMC Population Health Metrics, the number of people suffering from diabetes in the U.S. is projected to triple by 2060. Thus, with an increase in the number of individuals suffering from diabetes and a rise in the prevalence of diabetic foot ulcers, the demand for medical tapes and bandages is expected to increase during the forecast period. Sports injuries that can range in intensity from minor injuries, such as strains and sprains, to more serious wounds like fractures and dislocations, are frequent in various physical activities.

For instance, as per the data published by Johns Hopkins Medicine in 2023, approximately 30 million kids and teenagers participate in professional sports in the U.S., and each year, more than 3.5 million of them have injuries that restrict their ability to play. Sports-related injuries constitute nearly one-third of all juvenile injuries. Sprains and strains are among the most frequent injuries. Every year, over 775,000 children, aged 14 years & below, receive treatment for sports-related injuries in emergency departments at hospitals. Most injuries during disorganized or informal athletic events included falls, being hit by an object, collisions, and overexertion. The use of medical bandages and tapes is essential for the treatment, recovery, and prevention of these ailments. A common preventive taping technique used by athletes is ankle taping, which helps support joints and muscles prone to injury.

U.S. Diabetes Forecast, 2015 - 2030

|

|

2015 |

2020 |

2025 |

2030 |

|

Population |

321,363,000 |

333,896,000 |

346,407,000 |

358,471,000 |

|

Prediabetes |

90,644,000 |

97,284,000 |

103,950,000 |

107,713,000 |

|

Diagnosed diabetes |

26,019,000 |

32,021,000 |

37,349,000 |

41,733,000 |

|

Undiagnosed diabetes |

9,625,000 |

11,250,000 |

12,450,000 |

13,180,000 |

|

Total with diabetes |

35,644,000 |

43,271,000 |

49,799,000 |

54,913,000 |

Medical bandages and tapes can be applied to support and immobilize the injured region lowering the possibility of further injury. Thus, the increasing incidence of sports injuries among athletes drives market growth. A rise in the number of M&A activities is further aiding market expansion. Key players are adopting this strategy for the introduction of new products and technological developments that streamline processes to make them safer and more efficient. For instance, in June 2022, 3M agreed to a contract with Selic Corp Public Company Ltd. (Selic) to transfer Selic its ownership rights to the Neoplast and Neobun brands as well as associated property in Southeast Asian nations and Thailand, including the machinery used for manufacturing at its Ladlumkaew, Thailand site. Sports & medical tapes, medicated products, and bandages, for the medical field & end-user are all part of the product ranges of Neoplast and Neobun.

Market Concentration & Characteristics

The market growth stage is high, and the pace of its growth is accelerating. The market is characterized by a high degree of innovation owing to the new materials and technologies that have been developed to improve the effectiveness and comfort of medical tapes and bandages. For instance, some medical tapes and bandages now incorporate antimicrobial agents to help prevent infection. In contrast, others use advanced adhesives that provide strong holding power but are gentle on the skin

The market is also characterized by a high level of M&A activity by the leading players. Key players are acquiring small- and medium-sized manufacturers to expand their product portfolios and increase their industry share

The market has been experiencing growing regulatory scrutiny. Government bodies, such as the FDA and the European Medicines Agency, have set up strict regulations to ensure the safety and effectiveness of medical devices, including tapes and bandages. Adhering to these regulations can be a significant obstacle for manufacturers, resulting in higher production costs. However, compliance with these regulations can also help establish trust and credibility among consumers, potentially leading to an increase in market demand for their products

There are various substitutes for medical tapes & bandages in the market. Some of the commonly used alternatives include medical tapes and bandages, including self-adhesive elastic bandages, compression garments, and wound dressings. These products may provide similar benefits to medical tapes and bandages

The market is significantly affected by the concentration of end-users. The market has seen a growing demand from end-users, such as hospitals, clinics, and others. The increasing prevalence of chronic diseases and rising number of surgeries & accidents have led to a rise in product demand

Product Insights

In terms of product, the medical bandages segment dominated the market in 2023 and accounted for the largest share of 57.59%. Bandages are majorly used for wound dressings, supporting fractures & splints, and sports injuries. In cases of post-operation, the bandages are used to keep the overall body structure compressed by restricting the movement of the body parts. Bandages are generally made of a wide variety of materials, such as plastic, cloth, synthetic, or elastic. The bandages have an adhesive attached or an elastic structure to act as their support system. The segment is further fragmented into triangular bandages, elastic bandages, muslin bandage rolls, elastic plaster bandages, orthopedic bandages, and others.

Novel product launch by manufacturers boosts market growth. For instance, in May 2023, to cure and heal wounds gently and effectively, CURAD introduced CURAD Naturals, a range of adhesive bandages. The wound pad and bandage surface are directly infused with soothing properties of well-known substances like Vitamin E, Aloe Vera, and ARM & HAMMERTM Baking Soda to wrap and safeguard wounds as they recover. The medical tapes segment is anticipated to grow at the fastest CAGR from 2024 to 2030. The majority of medical tapes are used to dress up both acute and chronic wounds. Market growth drivers include wide usage of medical tapes and increased awareness of the use of medical adhesive products in sports injuries.

Furthermore, these products have several advantages, such as silicone-based tapes allow for consistent adhesion and are pleasant on the skin, which is expected to boost market growth. The medical tapes segment is further fragmented into plastic tape, paper tape, fabric tape, and other tapes. The other tapes include silicone, acrylic, and rubber tapes. In February 2023, 3M introduced 3M Medical Tape 4578, a new medical adhesive that can adhere to the skin for a maximum of 28 days and can be used with a variety of sensors for long-time healthcare wearables and health monitors. Before 2022, the duration of medical adhesives had a maximum wearing time of 14 days. To support the delivery of a more patient-centric form of care, 3M currently doubles that standard.

Application Insights

In terms of application, the surgical wound segment dominated the market in 2023 with the largest revenue share of 57.98%. The management of surgical wounds after surgery requires surgical wound dressings. In addition to sterile gauze dressings, non-adherent dressings and complex wound dressings like hydrocolloids and hydrogels are all accessible among dressings. The type and location of the wound determine the best form of dressing. Small wounds or incisions may require sticky bandages or tapes to be covered after surgery, which are intended to encourage wound healing and guard against infection. The demand for surgical wound care products is influenced by an increase in elective and non-elective surgical procedures. Self-adherent bandages and antimicrobial dressings, among other advances in wound dressing materials, have improved patient comfort and outcomes.

The ulcer segment is anticipated to grow at the fastest CAGR over the forecast period. The primary factors driving the segment's growth include the rising incidence of chronic diseases, particularly diabetes, and increasing geriatric population. For instance, as per the data published by the National Library of Medicine in August 2023, the occurrence of diabetic foot ulcers was between 9.1 and 26.1 million each year worldwide. In their lifetime, 15% to 25% of people with type 2 diabetes are at a higher risk of developing a diabetic foot ulcer. The incidence of diabetic foot ulcers is bound to increase, as more people are diagnosed with diabetes each year. Although diabetic foot ulcers can develop at any age, they are most common in people with type 2 diabetes aged over 45 years. The majority of Americans with foot ulcers are Latinos, Native Americans, and African Americans.

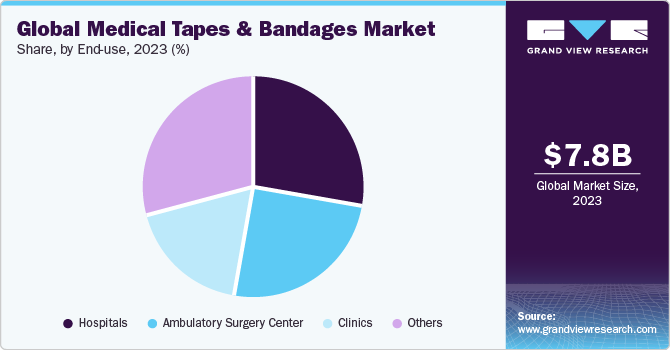

End-use Insights

The hospitals end-use segment captured the largest revenue share of over 28.22% in 2023. Dressings for surgical wound care and bone fractures are typically used in hospitals and should not be used at home. The segment's growth is being driven by an increase in surgical wounds due to more procedures being performed. Extended hospital stays and constant monitoring are required for the management of a surgical site infection. Furthermore, since medical tapes and bandages are frequently used in such circumstances, the rising prevalence of venous leg ulcers and diabetic foot ulcers is anticipated to drive market growth. Therefore, such factors are expected to boost segment growth.

The hospitals end-use segment is also anticipated to witness the fastest CAGR from 2024 to 2030. One of the primary drivers of the segment growth is the high prevalence of surgical wounds. Surgical wound dressings necessitate continual monitoring, which is driving up patient demand for clinics. Hospitals offer wound care services to patients who need them for post-surgical care, chronic wounds, trauma, or other reasons. Medical tapes and bandages help avoid contamination and infection at wound sites, which is a priority for hospitals when it comes to infection control. Therefore, such factors are likely to boost segment growth during the projection period.

Regional Insights

North America held the largest share of the global market and accounted for a share of 45.50% in 2023. This high share is attributed to the high incidence of sports injuries, road accidents, and presence of key players in the region. In addition, A rise in the number of surgical procedures/hospital visits, a well-established healthcare infrastructure, and favorable reimbursement & regulatory rules in the healthcare industry are anticipated to present significant growth opportunities for the regional market.

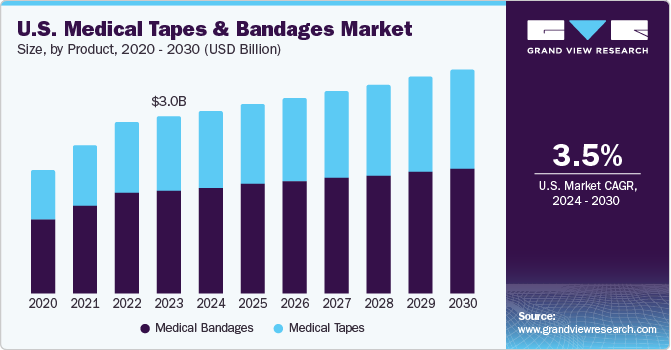

U.S. Medical Tapes And Bandages Market Trends

The U.S. medical tapes and bandages market held the largest share in the North America regional market in 2023. The increasing prevalence of chronic diseases and presence of key players in the country are some of the major factors fueling market growth. These factors are expected to drive product demand, thereby propelling segment growth over the forecast period.

Europe Medical Tapes And Bandages Market Trends

The growth of the medical tapes and bandages market in Europe is driven by factors, such as the high prevalence of chronic disorders and presence of well-established healthcare infrastructure. For instance, as per a report by the European Union (EU) population, in November 2023, more than 36.1% of people out of the total EU population reported having a chronic disorder in 2022.

The UK medical tapes and bandages market growth is driven by the rising healthcare expenditure and increasing geriatric population. These factors are expected to drive market growth over the forecast period.

The medical tapes and bandages market in France is anticipated to witness significant growth over the forecast period owing to factors, such as the presence of several key players in the country and high prevalence of chronic diseases.

The Germany medical tapes and bandages market growth is driven by factors, such as strategic partnerships, new product launches, and M&A activities by key players.

Asia Pacific Medical Tapes And Bandages Market Trends

The medical tapes and bandages market in Asia Pacific is anticipated to witness significant growth from 2024 to 2030. This is due to the presence of key players, such as Smith & Nephew PLC, Medtronic, 3M, and B. Braun Melsungen AG, which drives the industry growth. The presence of a large patient pool and growing need for technologically advanced & cost-efficient healthcare solutions are expected to present significant regional growth opportunities in the market.

The China medical tapes and bandages market accounted for the largest share of the Asia Pacific medical tapes and bandages market in 2023. Market growth is primarily driven by factors, such as the rising elderly population and high burden of chronic diseases.

The medical tapes and bandages market in Japan is moderately competitive, with the presence of some major companies offering wound care products. Major players are adopting several strategies, such as mergers & acquisitions and partnerships & collaborations, to stay competitive in the market.

Latin America Medical Tapes And Bandages Market Trends

The Latin America medical tapes and bandages market growth is driven by the rising healthcare expenditure and increasing volumes of surgical procedures, which is expected to drive product demand.

MEA Medical Tapes And Bandages Market Trends

The medical tapes and bandages market in MEA is expected to witness significant growth in the coming years due to factors, such as the increasing volume of surgical procedures being performed and increasing geriatric population in the region. The market in Saudi Arabia accounted for the largest share of the MEA market.

Key Medical Tapes And Bandages Company Insights

Top players are adapting the shift towards user comfort through technological advancements, and innovative products. These innovations help drive market growth.

Key Medical Tapes And Bandages Companies:

The following are the leading companies in the medical tapes and bandages market. These companies collectively hold the largest market share and dictate industry trends.

- Smith & Nephew PLC

- Mölnlycke Health Care AB

- 3M

- McKesson Corporation

- Ethicon Inc. (JOHNSON & JOHNSON)

- B. Braun Melsungen AG

- Paul Hartmann AG

- Coloplast

- Integra Lifesciences

- Medtronic Industries

Recent Developments

-

In January 2023, H.B. Fuller introduced Swift Melt 1515-I, marking its debut in the IMEA region (India, Middle East, and Africa) with a bio-compatible product. This innovative offering is specifically designed for medical tape applications, which cater to the needs of adhering to skin in challenging environmental conditions, such as the hot and humid climate prevalent in the Indian subcontinent

-

In May 2023, Medline's CURAD brand introduced CURAD Naturals, a new line of adhesive bandages that feature a blend of natural ingredients to help gently and effectively treat and safeguard wounds

-

In October 2022, Selic Corp Public Company Ltd. (Selic) acquired the rights to the Neoplast and Neobun brands, along with their related assets in Thailand and some Southeast Asian countries, from 3M. The Ladlumkaew manufacturing facility in Thailand was also included in the sale. Selic is a company that specializes in bonding innovation for various industries

Medical Tapes And Bandages Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.05 billion |

|

Revenue forecast in 2030 |

USD 9.86 billion |

|

Growth rate |

CAGR of 3.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

Smith & Nephew PLC; Mölnlycke Health Care AB; 3M; Ethicon Inc. (JOHNSON & JOHNSON); McKesson Corporation; B. Braun SE; Paul Hartmann AG; Coloplast; Integra Lifesciences; Medline Industries |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Medical Tapes And Bandages Market Report Segmentation

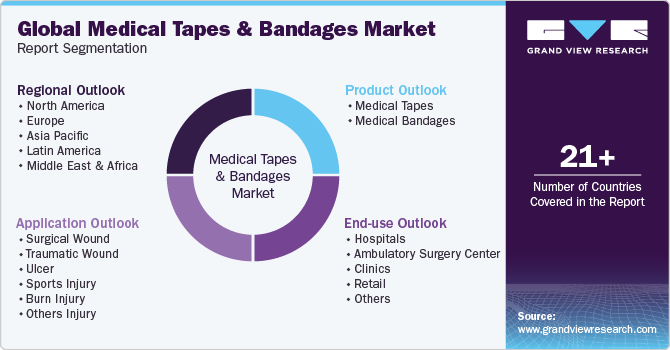

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the medical tapes and bandages market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Tapes

-

Fabric Tapes

-

Acetate

-

Viscose

-

Cotton

-

Silk

-

Polyester

-

Other Fabric Tape

-

-

Paper Tapes

-

Plastic Tapes

-

Propylene

-

Other Plastic Tapes

-

-

Other Tapes

-

-

Medical Bandages

-

Muslin Bandage Rolls

-

Elastic Bandage Rolls

-

Triangular Bandage Rolls

-

Orthopedic Bandage Rolls

-

Elastic Plaster Bandages

-

Other Bandages

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical Wound

-

Traumatic Wound

-

Ulcer

-

Sports Injury

-

Burn Injury

-

Others Injury

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgery Center

-

Clinics

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. he global medical tapes and bandages market size was estimated at USD 7.79 billion in 2023 and is expected to reach USD 8.05 billion in 2024.

b. The global medical tapes and bandages market is expected to grow at a compound annual growth rate of 3.4% from 2024 to 2030 to reach USD 9.86 billion by 2030.

b. Hospitals make up the majority in the end-use segment for the medical tapes & bandages market in 2023 with a market share of more than 28.0%.

b. Some key players operating in the medical tapes & bandages market include 3M, Medtronic, Derma Sciences Inc, Johnson & Johnson, Smith & Nephew PLC, B. Braun Melsungen AG, Medline Industries Inc., Paul Hartmann AG, Cardinal Health Inc., and Molnlycke Healthcare Inc.

b. Key factors that are driving the medical tapes & bandages market growth include increasing geriatric population is resulting in an increase in the incidence of chronic diseases and injuries, rising prevalence of ulcers, diabetes foot, and surgical procedures are the key factors that are driving the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."