- Home

- »

- Medical Devices

- »

-

Medical Suction Devices Market Size, Industry Report, 2030GVR Report cover

![Medical Suction Devices Market Size, Share & Trends Report]()

Medical Suction Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Portability, By Vacuum Systems (Manual, Electrically Powered, Venturi), By End-use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-927-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Suction Devices Market Summary

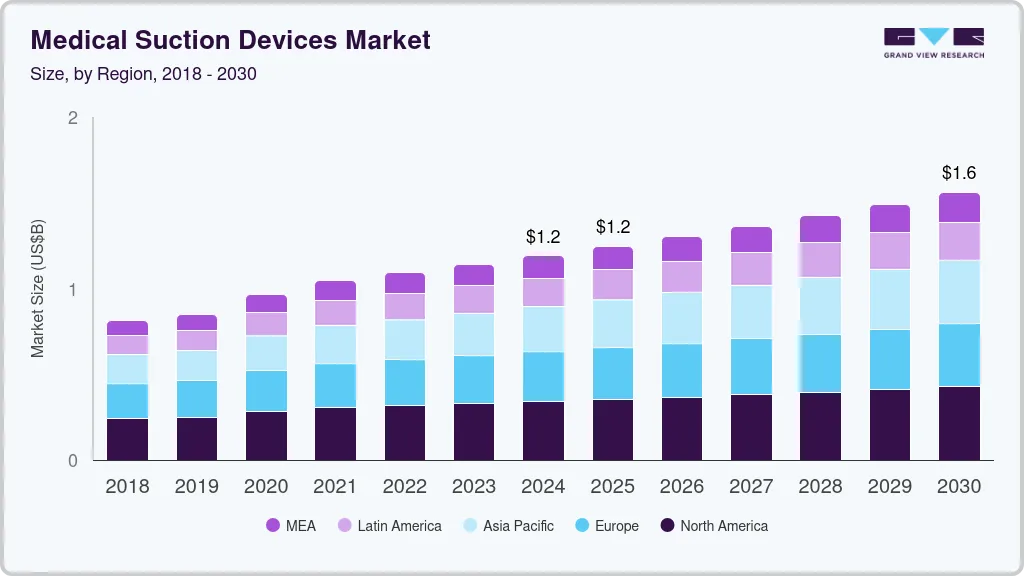

The global medical suction devices market size was estimated at USD 1.19 billion in 2024 and is projected to reach USD 1.56 billion by 2030, growing at a CAGR of 4.6% from 2025 to 2030. The prevalence of chronic respiratory diseases, such as Chronic Obstructive Pulmonary Disease (COPD) and asthma, was a major driver for the demand for medical suction devices.

Key Market Trends & Insights

- North America medical suction devices market dominated the global market with a revenue share of 28.5% in 2024.

- The U.S. dominated the North America medical suction devices market with a revenue share of 84.4% in 2024.

- In terms of portability, Non-portable devices dominated the market and accounted for a share of 68.4% in 2024.

- In terms of vacuum systems, Electrically powered vacuum systems led the market with a revenue share of 47.9% in 2024.

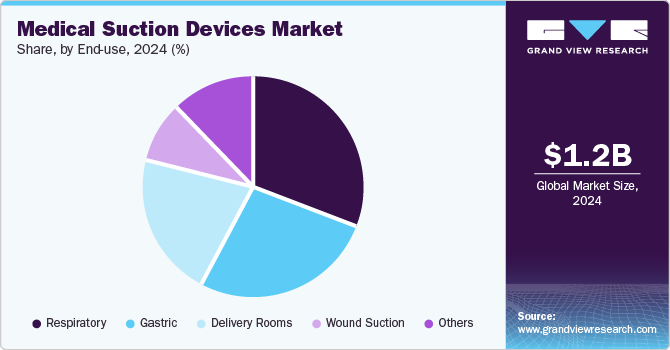

- In terms of end use, Respiratory end uses held the largest market share of 31.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.19 Billion

- 2030 Projected Market Size: USD 1.56 Billion

- CAGR (2025 - 2030): 4.6%

- North America: Largest market in 2024

As of 2023, approximately 4.3% of U.S. adults reported being diagnosed with COPD, highlighting the need for effective management of airway clearance and respiratory health. This demographic trend has contributed significantly to the growth of the market, as medical suction devices are essential for managing these conditions.The aging population has also played a crucial role in driving the demand for medical suction devices. The apparent shift in healthcare needs due to aging population has led to a growing need for healthcare solutions, including medical suction devices, to cater to the rising elderly population. Furthermore, the trend towards home healthcare solutions has also driven the demand for portable and compact suction devices.

The market has also been driven by technological advancements and decreasing prices. In Japan, as of 2023, approximately 70% of hospitals had adopted advanced medical technologies, including suction devices, to improve patient care and operational efficiency. Moreover, in Mexico, healthcare providers reported a 15% decrease in the average cost of medical devices, including suction devices, from 2023 to 2024, making them more accessible to a wider range of customers. These factors have enhanced the adoption of medical suction devices across various healthcare settings, contributing to the growth of the market.

The number of weight-loss surgeries has been on the rise, with nearly 580,000 people undergoing bariatric surgery annually worldwide, according to the International Federation for the Surgery of Obesity and Metabolic Disorders. Medical suction devices play a crucial role in these surgical procedures, and with the increasing number of surgeries, the demand for these devices is likely to continue growing in the coming years.

Portability Insights

Non-portable devices dominated the market and accounted for a share of 68.4% in 2024. The high cost of non-portable equipment is the main cause of its higher revenue share. The surge in the number of clinics & hospitals is further propelling the demand for non-portable aspirators. These devices are typically employed in hospitals, dentist offices, and other healthcare facilities where patients are unlikely to require transportation. Over the upcoming years, demand for non-portable suction devices is anticipated to rise along with the number of emergency cases and surgical procedures. As a result, the increase in hospitals and clinics in developed and developing countries is also anticipated to boost market growth in the near future.

Portable devices are expected to grow at the fastest CAGR of 4.7% over the forecast period due to increasing use in home healthcare services. Home healthcare is an affordable choice for the long-term care of the disabled, chronic illnesses, and surgical procedures. According to the U.S. Bureau of Labor Statistics, 13.0 million more home health and personal care assistants were employed in 2020 than in 2010 (a 70.0% increase). This rise is also aiding the expansion of the portable devices market in ambulatory and emergency care services. Moreover, the convenient, portable designs have benefits such as point-of-care use and do not need trained professionals to operate them. Therefore, such factors fuel the segment growth in the portable suction devices industry.

Vacuum Systems Insights

Electrically powered vacuum systems led the market with a revenue share of 47.9% in 2024. The availability of a wide variety of these devices suitable for various applications coupled with the ease of use with powerful suction is contributing to the segment growth. Moreover, the widespread awareness regarding electrically powered aspirators coupled with the growing number of prehospital and emergency care settings worldwide resulted in a large revenue share.

Venturi systems are expected to register significant growth over the forecast period as they provide immediate vacuum generation, ensuring rapid aspiration during procedures, which is vital in surgical environments. Their design enhances safety by allowing precise control over vacuum levels, thereby minimizing the risk of complications. Moreover, venturi systems feature a compact and lightweight design, facilitating easy integration into various medical settings and reducing the need for extensive tubing. With low maintenance requirements and cost-effectiveness stemming from efficient compressed air usage, these systems offer a reliable solution, driving their adoption among healthcare providers.

End-use Insights

Respiratory end uses held the largest market share of 31.0% in 2024. The demand for suction devices used to clean the airway passage is driven by the rapidly increasing prevalence rate of chronic respiratory disorders such as asthma, COPD, and bronchitis. The WHO has ranked COPD as the third largest cause of death worldwide. The American Lung Association also estimates that more than 11.7 million Americans are diagnosed with COPD annually. Therefore, it is predicted that an increase in COPD cases is anticipated to increase product acceptance and accelerate the segment’s growth.

The gastric segment is projected to grow at the fastest CAGR of 5.0% over the forecast period. Using these devices for gastric suction to remove poisons, dangerous substances, or overdosed medications from the stomach is likely to increase to relieve pressure from clogged intestines. The number of hospital admissions and escalating technological breakthroughs will continue to fuel market expansion.

Regional Insights

North America medical suction devices market dominated the global market with a revenue share of 28.5% in 2024. The presence of well-established healthcare facilities and the availability of advanced technologies as well as the high usage of suction devices in the treatment of chronic respiratory conditions and other surgical procedures are expected to boost the market growth.

U.S. Medical Suction Devices Market Trends

The medical suction devices market in the U.S. dominated the North America medical suction devices market with a revenue share of 84.4% in 2024. The country has witnessed an increase in emergency department visits and hospital admissions in recent years, as a result of the high occurrence of chronic medical conditions and fatal injuries. In addition, the higher adoption rate of these devices observed in the home care services sector and the increasing number of healthcare facilities are augmenting industry growth in the U.S.

Europe Medical Suction Devices Market Trends

Europe medical suction devices market held substantial market share in 2024, driven by the rising prevalence of chronic respiratory diseases and an aging population requiring effective respiratory management. By 2023, approximately 20% of the European population was projected to be over 65 years old, necessitating advanced medical devices to improve patient care. Furthermore, enhancements in healthcare infrastructure and favorable reimbursement policies across European nations supported market expansion, making suction devices critical for hospitals and clinics to ensure patient safety during surgical and emergency procedures.

The medical suction devices market in the UK is expected to grow lucratively over the forecast period. By 2024, it was projected that 18% of the UK population would be over 65 years old, increasing healthcare demands. Moreveor, the UK’s commitment to enhancing healthcare services and infrastructure bolstered the demand for effective medical solutions. The National Health Service (NHS) invested in advanced suction technologies, further contributing to improvements in patient outcomes and streamlined surgical processes.

Asia Pacific Medical Suction Devices Market Trends

Asia Pacific medical suction devices market is expected to register the fastest CAGR of 5.8% in the forecast period, owing to rapid urbanization, rising healthcare investments, and more prevalent chronic diseases. In 2023, healthcare expenditure in the region was expected to rise by approximately 7%, fueled by government initiatives aimed at enhancing healthcare access and quality. Moreover, technological advancements in medical devices facilitated increased adoption across hospitals and home care settings, further propelling market growth. This development is critical in addressing the healthcare needs of the region’s large population.

The medical suction devices market in India is projected to register the fastest growth of 7.0% between 2025 and 2030. By 2024, approximately 10% of India’s population was expected to be over 60 years old, amplifying the demand for healthcare services. The Indian government’s emphasis on expanding healthcare access and improving facilities has supported the need for efficient suction devices. Furthermore, the rise in surgical procedures and emergency care requirements has driven the adoption of these devices in hospitals and clinics nationwide.

Key Medical Suction Devices Company Insights

Some key companies operating in the market include Allied Medical LLC (A Flexicare Company); Precision Medical, Inc.; DRIVE MEDICAL GMBH & CO. KG; among others. The market is evolving through technological advancements and strategic collaborations among key companies. Market players prioritize research, regulatory compliance, and portable solutions to enhance product efficiency and safety.

-

Drive Medical specializes in manufacturing advanced medical devices, including heavy-duty suction machines that offer effective airway management. Their products feature advanced vacuum control, portability, and safety measures such as overflow protection for diverse applications in hospitals and home care settings.

-

ZOLL Medical Corporation is dedicated to developing innovative medical devices and software solutions for critical care and emergency medicine. Their advanced defibrillators and resuscitation devices aim to enhance patient outcomes during cardiac emergencies while improving clinical efficiency and safety.

Key Medical Suction Devices Companies:

The following are the leading companies in the medical suction devices market. These companies collectively hold the largest market share and dictate industry trends.

- Allied Medical LLC (A Flexicare Company)

- Precision Medical, Inc.

- DRIVE MEDICAL GMBH & CO. KG

- Medicop

- ATMOS MedizinTechnik GmbH & Co. KG

- ZOLL Medical Corporation

- Laerdal Medical

- Amsino International, Inc.

- Olympus

- Zimed Healthcare Inc.

Recent Developments

-

In September 2024, Baxter International Inc. launched The Vest Advanced Pulmonary Experience System, enhancing airway clearance with improved comfort, user-friendly features, and design options developed through clinician and patient collaboration.

-

In May 2024, Olympus launched two advanced bronchoscopes compatible with the EVIS X1 Endoscopy System, featuring improved suction, flexibility, and high-definition imaging, enhancing diagnostic and therapeutic procedures for healthcare professionals.t

-

In April 2024, Dynarex Corporation expanded its Dynarex Resp-O2 line, introducing portable respiratory solutions that enhanced patient mobility and provided caregivers with flexible options for delivering respiratory care outside traditional settings.

-

In March 2024, Asahi Kasei Medical and AW Technologies established an exclusive distribution agreement for the TrachFlush device in Japan, aimed at improving patient comfort and reducing healthcare professional workload.

Medical Suction Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.25 billion

Revenue forecast in 2030

USD 1.56 billion

Growth rate

CAGR of 4.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Portability, vacuum systems, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Allied Medical LLC (A Flexicare Company); Precision Medical, Inc.; DRIVE MEDICAL GMBH & CO. KG; Medicop; ATMOS MedizinTechnik GmbH & Co. KG; ZOLL Medical Corporation; Laerdal Medical; Amsino International, Inc.; Olympus; Zimed Healthcare Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Suction Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical suction devices market report based on portability, vacuum systems, end-use, and region:

-

Portability Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable

-

Non-portable

-

-

Vacuum Systems Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual

-

Electrically Powered

-

Venturi

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory

-

Gastric

-

Wound Suction

-

Delivery Rooms

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.