- Home

- »

- Healthcare IT

- »

-

Medical Speech Recognition Software Market Report, 2030GVR Report cover

![Medical Speech Recognition Software Market Size, Share & Trends Report]()

Medical Speech Recognition Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Deployment (Cloud-based Services), By Functionality, By End Use (Doctors & Physicians, Radiologists, Medical Transcriptionist), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-450-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Speech Recognition Software Market Summary

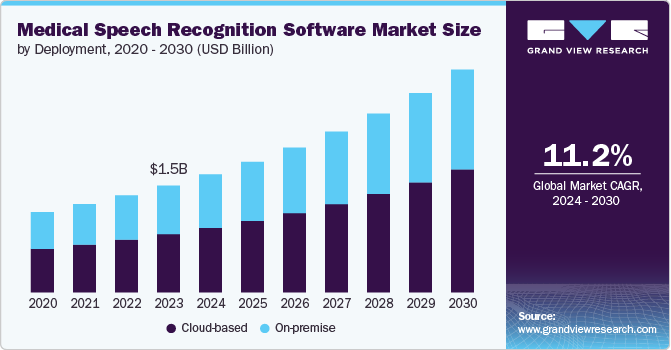

The global medical speech recognition software market size was estimated at USD 1,520.3 million in 2023 and is projected to reach USD 3,167.5 million by 2030, growing at a CAGR of 11.16% from 2024 to 2030. Medical speech recognition software converts voice input from physicians or patients into standardized written reports, appointment summaries, treatment plans, mood journal entries, symptom summaries, and more.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- In terms of segment, cloud based accounted for a revenue of USD 1,520.3 million in 2023.

- Cloud Based is the most lucrative deployment segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1,520.3 Million

- 2030 Projected Market Size: USD 3,167.5 Million

- CAGR (2024-2030): 11.16%

- North America: Largest market in 2023

The advancements in technology and increasing demand for efficiency in healthcare documentation are the major factors driving the market growth.

The incorporation of AI and NLP technologies into speech recognition systems has led to improved recognition accuracy. These technologies enable the systems to understand context better and reduce errors associated with complex medical language. With continued improvements in deep learning techniques, the latest ASR models can reach over 90% accuracy on medical dictation tasks.

Speech recognition solutions are increasingly being integrated with EHR systems, allowing Radiologist to dictate patient information directly into the records. This integration reduces manual data entry and streamlines the documentation process, facilitating real-time updates during patient encounters.

A notable example of this integration is the use of Nuance's Dragon Medical One, a cloud-based speech recognition solution that integrates seamlessly with various EHR systems. Many hospitals and clinics have adopted Dragon Medical One to allow physicians to dictate notes directly into their EHRs. As per a study published in June 2022 by NCBI, physicians using Dragon Medical One were able to complete their documentation 30-50% faster than those relying on traditional typing methods. This efficiency not only improved clinician satisfaction but also enhanced the overall patient experience by reducing wait times and increasing the time available for patient interactions.

Furthermore, increasing focus on patient engagement is driving the market. Speech recognition technology enhances patient engagement by allowing patients to use voice commands for scheduling appointments, accessing medical records, and communicating with Radiologist. This capability contributes to a more inclusive healthcare environment, especially for individuals with disabilities.

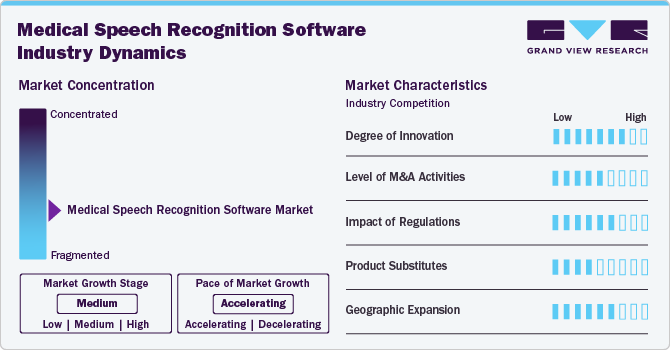

Market Characteristics & Concentration

The degree of innovation in the market is high, driven by several cutting-edge advancements. Innovations in AI and NLP have significantly enhanced the accuracy and context-awareness of medical speech recognition software. These technologies enable the software to understand and process complex medical terminology, abbreviations, and even contextual nuances, leading to more precise transcriptions.

The level of M&A (Mergers and Acquisitions) activity in the medical speech recognition software market has been notably high in recent years. Companies are acquiring to integrate advanced AI, machine learning, and NLP technologies into their existing speech recognition platforms. Major tech firms are acquiring AI startups to bolster the capabilities of their speech recognition solutions, making them more accurate and context-aware.

Regulation has a significant impact on the market, influencing product development, market adoption, and operational practices. Regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. and the General Data Protection Regulation (GDPR) in Europe impose strict requirements on the handling, storage, and transmission of patient data. Medical speech recognition software must ensure that all voice data is securely encrypted and stored and that any transcriptions comply with these data protection standards.

Geographical expansion in the market is a key strategy for companies aiming to tap into new growth opportunities and increase their global presence. Companies are forming strategic alliances with regional healthcare technology firms, hospitals, and government bodies to facilitate market entry and expansion. These partnerships help in navigating regulatory requirements and establishing a customer base.

Case Study

Revolutionizing Radiology Reporting with Augnito’s AI-Powered Voice Recognition Software Overview:

Dr. Rupesh, a seasoned radiologist with 15 years of experience, specializes in MRI and CT imaging at Bhawani Diagnostics. Over the years, he recognized the critical importance of accurate and efficient radiology reporting in delivering high-quality patient care. However, the manual processes he relied on were time-consuming and often prone to errors, significantly affecting his workflow and the consistency of his reports.

Challenges Faced

-

Time-Consuming Manual Reporting: The manual nature of traditional reporting methods led to delays and inefficiencies. Reports often took 15-20 minutes to complete, limiting the number of patients he could see in a day.

-

Inconsistent Transcriptions: Relying on transcriptionists introduced inconsistencies in report quality, as each typist required extensive training to align with his unique reporting style. Despite this, errors were frequent, leading to additional time spent on corrections.

-

Software Limitations: The transcription software previously used lacked essential features like macros and was incompatible with Mac systems, further hindering his ability to streamline his reporting process.

Solution

Augnito Spectra, an AI-powered medical voice recognition software specifically designed for radiologists. Augnito addressed the challenges through several key features:

-

Advanced Speech Recognition: Augnito Spectra offers precise speech recognition with 99% accuracy right out of the box, eliminating the need for voice training. This feature allows to dictate and auto-transcribe medical notes effortlessly, significantly reducing reliance on human typists.

-

Time-Saving Features: The inclusion of templates and macros streamlines the report creation process, reducing the time spent on each report from 15-20 minutes to just 3-5 minutes. This efficiency enables to produce 60 reports in the same time it previously took to create 35.

-

Seamless Integration: Augnito’s compatibility with Mac systems and its ability to integrate seamlessly into a multiple monitor setup allows to navigate documents without interrupting the dictation, further enhancing his productivity.

Outcome

The implementation of Augnito Spectra transformed Dr. Rupesh’s radiology reporting process, leading to significant improvements in both efficiency and accuracy:

-

Increased Productivity: Dr. Rupesh experienced a 70% reduction in the time spent on report creation, allowing him to see more patients and generate reports faster.

-

Enhanced Accuracy: The advanced AI-powered speech recognition eliminated transcription errors, ensuring consistent and accurate reporting, which is crucial in the field of medical imaging.

-

Streamlined Workflow: The ability to use templates and macros tailored to his specific needs allowed Dr. Rupesh to focus more on patient care rather than administrative tasks, resulting in a more streamlined workflow.

Conclusion

The adoption of Augnito Spectra highlights the transformative impact of AI-driven voice recognition technology in the field of radiology. By addressing the inefficiencies and inaccuracies of manual reporting, Augnito has become an indispensable tool for radiologists, enabling them to optimize their practice and deliver enhanced patient care.

“Augnito has truly revolutionized my radiology reporting process. The time savings and accuracy it offers are remarkable. The challenges I faced with previous transcription software were frustrating, but Augnito’s innovative features, such as templates and macros, have rectified these issues and streamlined my reporting process. Augnito has exceeded my expectations. I am confident that the collaboration between radiologists and AI technologies, as exemplified by Augnito, will lead to remarkable advancements in the field.”

- Dr. Rupesh

Deployment Insights

The cloud-based segment held the largest market share of 54.5% in 2023. The increasing demand for improved clinical efficiency, cost-effectiveness & scalability, and growing emphasis on data accessibility and collaboration is driving the segment for cloud-based software. Cloud-based speech recognition software enables faster documentation, reduces errors, and allows Radiologist to spend more time on patient care. By automating documentation tasks, these solutions help reduce physician burnout and improve overall productivity in healthcare settings.

Moreover, cloud-based solutions offer a more cost-effective alternative to on-premises systems by eliminating the need for extensive IT infrastructure and maintenance. They also provide scalability, allowing healthcare organizations to easily adjust their usage based on demand. Furthermore, governments and healthcare regulators are increasingly mandating the use of electronic health records (EHRs) and digital documentation, which in turn drives the adoption of cloud-based speech recognition software. Also, the continuous advancements in cloud computing technology, including improvements in data storage, processing power, and security, are driving the adoption of cloud-based speech recognition solutions.

On-premise software are installed locally on a healthcare facility's servers. They provide greater control over data security and customization but may require more significant upfront investment and maintenance. With increasing concerns over data privacy and compliance with regulations like HIPAA, healthcare organizations are opting for on-premises solutions to maintain greater control over their sensitive patient data. On-premises systems allow facilities to implement their own security protocols, reducing the risks associated with cloud-based solutions. While on-premises solutions often require a higher initial investment for software and hardware, they can lead to long-term savings by reducing reliance on outsourced transcription services and minimizing operational costs associated with cloud subscriptions.

Functionality Insights

Based on functionality, the market is segmented into front-end speech recognition, back-end speech recognition and voice command and control. In 2023, front-end speech recognition held the largest market share of 50.0%. Front-End Speech Recognition software provides real-time transcription of spoken words into text as they are spoken. This capability is crucial for Radiologist who need to document patient interactions, notes, and other clinical information immediately during patient consultations or procedures.

Also, these solutions are often integrated with Electronic Health Record (her) systems, allowing seamless documentation directly into patient records. This integration enhances workflow efficiency and reduces the time spent on administrative tasks. Moreover, it offers advanced features such as context-aware recognition and specialized medical vocabularies, which enhance transcription accuracy. This reduces the need for manual corrections and increases the overall efficiency of documentation processes.

The back-end speech recognition segment is anticipated to witness significant growth. Demand for post-consultation transcription is driving the demand for back-end speech recognition software. Moreover, in high-volume environments like radiology departments, where large numbers of reports are generated, Back-End Speech Recognition provides an efficient means to handle and transcribe these reports in bulk. This helps manage and process large amounts of data efficiently, reducing the manual transcription workload. Also, Back-End solutions can be integrated with existing transcription workflows and systems, including those that use legacy software or hardware. This allows for continuity in operations without the need for a complete system overhaul. It enables organizations to leverage existing infrastructure while enhancing transcription accuracy and efficiency.

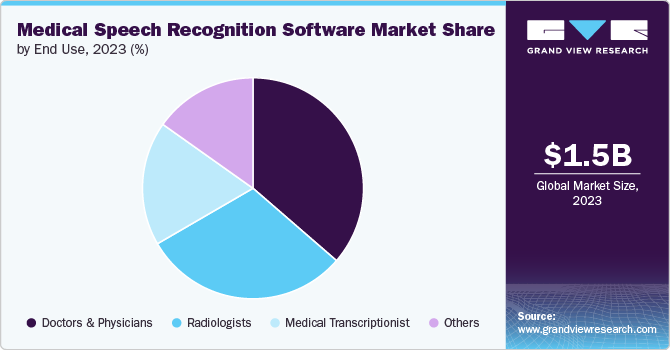

End Use Insights

Based on the end use, the market is segmented into doctors & physicians, radiologists, medical transcriptionist and others. In 2023, doctors & physicians held the largest market share of 36.4%.

Doctors and physicians are increasingly adopting medical speech recognition software to enhance efficiency and accuracy in their documentation processes. The software allows for direct dictation into Electronic Health Records (EHRs), streamlining documentation and reducing manual data entry time. Key benefits include seamleherEHR integration, which speeds up report generation and minimizes errors in medical records.

Furthermore, the shift towards real-time updates allows doctors to keep patient records current during consultations or procedures, improving care quality and team coordination. With rising patient volumes and healthcare demands, the software helps physicians manage their workload more effectively, enabling them to focus on patient care rather than administrative tasks. Moreover, the software’s user-friendly nature and minimal training requirements further support its widespread adoption. As healthcare continues to embrace digital solutions, medical speech recognition software is becoming essential for modern medical practice.

The radiologist segment is expected to experience the fastest growth over the forecast period, driven by the increasing adoption of medical speech recognition software. Radiologists require efficiency, accuracy, and seamless integration within their specialized workflows, as they generate detailed reports for imaging studies such as X-rays, MRIs, and CT scans. The high demand for documentation has made speech recognition software indispensable, enabling quick and accurate transcription of complex medical terminology without manual entry.

The software's precision ensures the quality and reliability of radiology reports, which are crucial for accurate diagnosis and treatment planning. Integration with key radiology systems like Picture Archiving and Communication Systems (PACS) and Radiology Information Systems (RIS) further streamlines the reporting process, allowing real-time report generation immediately after image review. This shift towards real-time reporting has significantly improved turnaround times, especially in emergency and acute care settings where rapid diagnosis is essential. Additionally, the software reduces dependence on traditional transcription services, resulting in cost savings and faster report generation.

Regional Insights

North America dominated the market with a revenue share of 51.3% in 2023. The medical speech recognition software market in North America is experiencing robust growth due to rapid advancements in AI and NLP, growing adoption of cloud-based solutions, and a focus on real-time reporting and data security. The trend towards integrating these technologies into diverse healthcare settings underscores their growing importance in enhancing documentation efficiency and improving patient care.

Major players such as Nuance Communications, Amazon Web Services (AWS), and Cerner Corporation are leading the market with innovative solutions tailored to the evolving needs of Radiologist. AWS HealthLake, for example, integrates speech recognition to streamline the processing and analysis of healthcare data. It is gaining notable traction in North America due to its advanced data management capabilities. Health systems like Johns Hopkins Medicine are adopting AWS HealthLake to centralize and analyze their data, enhancing workflow efficiency and clinical decision-making. This trend is anticipated to drive significant market growth over the forecast period.

U.S. Medical Speech Recognition Software Market Trends

The adoption of medical speech recognition software in the U.S. is expanding rapidly, driven by advancements in technology, increased healthcare demands, and the need for efficient clinical documentation. Many healthcare facilities are integrating speech recognition software with EHR systems to streamline documentation processes. This integration allows Radiologist to dictate clinical notes directly into patient records, reducing manual data entry. For example, Mayo Clinic has implemented Nuance’s Dragon Medical One within its EHR system. This integration allows physicians to dictate clinical notes directly into patient records, significantly reducing manual data entry and improving documentation efficiency across its multiple locations. Moreover, there is a growing emphasis on real-time documentation capabilities to improve the speed and accuracy of clinical records. This is expected to drive the market over a forecast period.

Europe Medical Speech Recognition Software Market Trends

European healthcare facilities are increasingly adopting speech recognition software to streamline clinical documentation processes. For instance, NHS Trusts in the UK have implemented Nuance's Dragon Medical software to facilitate faster and more accurate reporting. This adoption has improved workflow efficiency and allowed healthcare professionals to focus more on patient care. Moreover, the integration of speech recognition software with EHR systems is becoming common in Europe as this seamless integration supports real-time documentation and enhances the accuracy of patient records. For instance,Amsterdam UMC in the Netherlands has adopted 3M’s M*Modal Fluency Direct, integrating it with their EHR system to improve the speed and accuracy of clinical documentation. Furthermore, advancement in AI and NLP, increasing adoption of telemedicine, etc. is driving the market for medical speech recognition software.

Asia Pacific Medical Speech Recognition Software Market Trends

With the rising number of patients and expanding healthcare services in the APAC region, there is a growing need for efficient documentation solutions. This has raised the adoption of medical speech recognition software among the Radiologist. For instance, Apollo Hospitals in India has adopted Nuance's Dragon Medical software to improve documentation efficiency across its facilities. Moreover, the incorporation of AI and NLP technologies into speech recognition software is advancing in the APAC region, providing improved transcription accuracy and handling of complex medical terminology. For example, Samsung Medical Center in South Korea utilizes AI-powered speech recognition tools to enhance the accuracy of clinical documentation. These advanced tools are enabling more precise and efficient patient record management. Furthermore, the rapid advancements in telemedicine, increasing multilingual support, and a focus on data security and compliance is driving the adoption of these software in the region.

Key Medical Speech Recognition Software Company Insights

Market players are utilizing innovative product development strategies, partnerships, and mergers and acquisitions to expand their presence

Key Medical Speech Recognition Software Companies:

The following are the leading companies in the medical speech recognition software market. These companies collectively hold the largest market share and dictate industry trends.

- Nuance Communications, Inc.

- Amazon Web Services (AWS)

- 3M Health Information Systems

- IBM Watson Health

- Microsoft Corporation

- DeepScribe

- Augnito

- Deepgram

- ScienceSoft

- PrognoCIS

- WebChartMD

- The FTW Transcriber

- Dolbey

- Lexacom

- SpeechWrite

- S10.AI

Recent Developments

-

In August 2024, Nuance Communications, a Microsoft company, announced that Northwestern Medicine has chosen Dragon Ambient eXperience Copilot, integrated with Epic, as its ambient voice solution. Powered by Microsoft Cloud for Healthcare, DAX Copilot helps Northwestern Medicine physicians convert patient conversations into a productivity tool, reducing documentation burdens and enhancing patient experiences.

-

In August 2023, Dolbey and Company, Inc. has entered into a strategic partnership with SOAP Health, a prominent innovator in AI-driven medical practices. This collaboration combines Dolbey’s advanced speech recognition technology, Fusion Narrate powered by nVoq, with SOAP Health’s AI expertise in medical encounters. The partnership aims to transform interactions between healthcare professionals and patients, enhancing productivity, revenue, early disease detection, diagnosis, and overall patient outcomes.

-

In September 2021, Augmedix, Inc. a leading provider of virtual medical documentation and live clinical support, partnered with Google Cloud. This collaboration aimed to enhance and integrate automated speech recognition (ASR) technology for application in real-world clinical environments.

“This is a significant leap forward for Augmedix’s technology evolution. With Google Cloud Speech-to-Text, we believe we can improve the accuracy of our NLP models, improve our unit economics, and accelerate our ability to scale to new clinicians. Crucially, Google Cloud's models perform well in real-time, which is necessary for us, because unlike other solutions in the market, our clinician customers frequently expect note delivery to occur in real-time.

--Ian Shakil, Founder of Augmedix.

Medical Speech Recognition Software Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 1.68 billion

The revenue forecast in 2030

USD 3.17 billion

Growth Rate

CAGR of 11.16% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, functionality, end use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Spain; Italy; Norway; Sweden; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Nuance Communications, Inc.; Amazon Web Services (AWS); 3M Health Information Systems; IBM Watson Health; Microsoft Corporation; DeepScribe; Augnito; Deepgram; ScienceSoft; PrognoCIS; WebChartMD; The FTW Transcriber

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

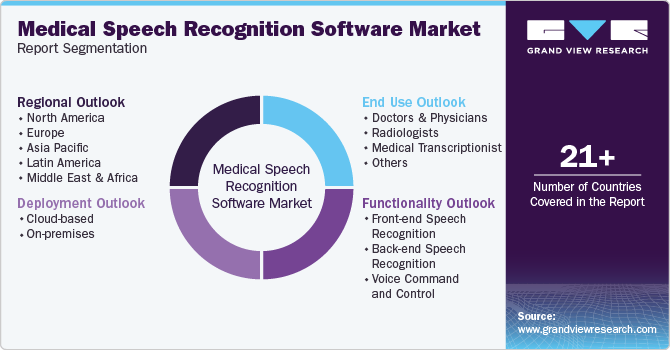

Global Medical Speech Recognition Software Market Report Segmentation

This report forecasts revenue growth at the global, regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the medical speech recognition software market on the basis of deployment, functionality, end use and region:

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud-based

-

On-premises

-

-

Functionality Outlook (Revenue, USD Billion, 2018 - 2030)

-

Front-end Speech Recognition

-

Back-end Speech Recognition

-

Voice Command and Control.

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Doctors & Physicians

-

Radiologists

-

Medical Transcriptionist

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical speech recognition software market size was estimated at USD 1.52 billion in 2023 and is expected to reach USD 1.68 billion in 2024.

b. The global medical speech recognition software market is expected to grow at a compound annual growth rate of 11.16% from 2024 to 2030 to reach USD 3.17 billion by 2030.

b. North America dominated the medical speech recognition software market with a share of 51.3% in 2023. The medical speech recognition software market in North America is experiencing robust growth due to rapid advancements in AI and NLP, growing adoption of cloud-based solutions, and a focus on real-time reporting and data security. The trend towards integrating these technologies into diverse healthcare settings underscores their growing importance in enhancing documentation efficiency and improving patient care.

b. Some key players operating in the medical speech recognition software market include Nuance Communications, Inc., Amazon Web Services (AWS), 3M Health Information Systems, IBM Watson Health, Microsoft Corporation, DeepScribe, Augnito, Deepgram, ScienceSoft, PrognoCIS, WebChartMD, The FTW Transcriber

b. Key factors that are driving the market growth include advancements in technology and increasing demand for efficiency in healthcare documentation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.