- Home

- »

- Healthcare IT

- »

-

Medical Spa Management Software Market Size Report 2030GVR Report cover

![Medical Spa Management Software Market Size, Share, & Trends Report]()

Medical Spa Management Software Market Size, Share, & Trends Analysis Report By Type (On-premise, Web & Cloud-based), By Application (Appointment Management, Customer Relationship Management), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-250-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

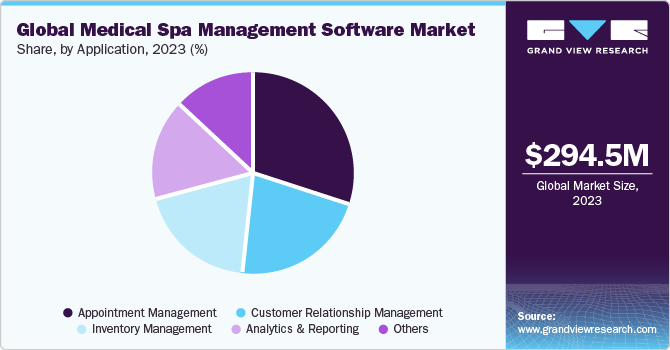

The global medical spa management software market size was estimated at USD 294.46 million in 2023 and is expected to grow at a CAGR of 13.74% from 2024 to 2030. The market is expected to grow significantly, driven by a rise in the popularity of spa services, the availability of spas and wellness centers, and the high adoption of technology. The primary factor driving the growth is the rapid rise of wellness tourism across several countries. According to the Global Wellness Economy Monitor 2023, the report shows that there are over 181,000 spas, which earned a revenue of USD 105 billion, and demand for the spa is growing in several countries, such as the U.S., Germany, China, France, and Japan. These factors are expected to boost the demand for spa services, thereby driving the need for medical spa management software.

The wellness tourism sector is experiencing rapid expansion, and this growth is driving the demand for medical spa management services. Integration of business areas like travel, hospitality, cosmetics, and fitness with wellness tourism is expected to further drive the market. This factor is expected to create a demand for developing new and innovative management solutions to cater to the growing demand for medical spa treatments.

The market is witnessing a surge in innovation and integration of new technologies, including cloud computing and artificial intelligence (AI). Automation of processes enables customers to access various management solutions. For instance, in October 2023, Aesthetix CRM LLC, a medical aesthetics practices software provider launched AI Chat Assistant, a tool particularly engineered to streamline communications for med spas and plastic surgeons. This assistant is designed to streamline processes and save time and costs that redirect toward improving patient care. Additionally, the tool is capable of supervising incoming messages from various platforms Facebook, web chat, Google, and Instagram.

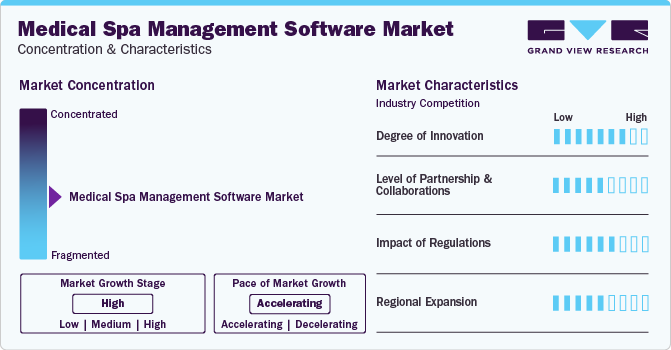

Market Concentration & Characteristics

The market is experiencing significant innovation as numerous players introduce new products and enhance existing solutions to boost their industry presence. In January 2024, Nextech Systems, LLC introduced photo management functionality to its med spa software that will showcase transformation and better client experience through vivid imagery. The tool helps improve the consultation experience and patient knowledge with simplified charting and robust management features.

The level of partnerships & collaborations in the market is moderate due to several mature players and local players involved in partnerships & collaboration activities to expand their market presence. For instance, in January 2024, VIO Franchise Group, LLC. announced a partnership with GoSaga, Inc., which specializes in elevating brands through a centralized operating platform. This partnership aims to expand its medical spa services in the state of Connecticut with the support of GoSaga, Inc., to offer better medical aesthetics experiences.

Regulations have a moderate impact on the medical spa management software industry. However, the market is anticipated to grow due to supportive government policies and laws that ensure the safety and effectiveness of medical spa management services data. Medical spas handle sensitive patient information, and regulations like the Health Insurance Portability and Accountability Act (HIPAA) handle data safety. The software ensures compliance with HIPAA guidelines for privacy and health information disclosure.

The level of regional expansion is moderate due to the rapid expansion of the wellness tourism sector in regions such as North America and Asia-Pacific, which are experiencing significant growth in the market. For instance, in January 2024, VIO Franchise Group, LLC. expanded its presence by opening medical spas in over 60 locations in new states, including Indiana, Tennessee, North Carolina, Missouri, and New Jersey, that offer a range of services.

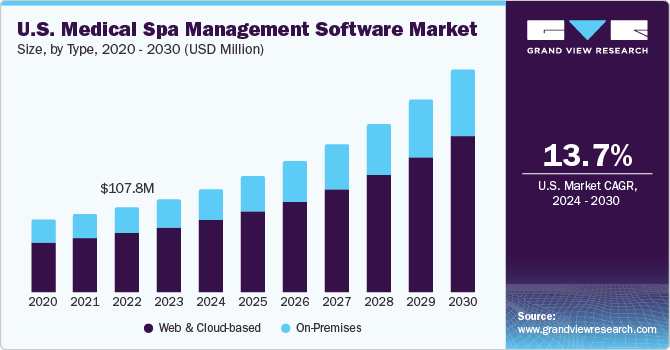

Type Insights

The web & cloud-based segment dominated the market with a revenue share of over 68% in 2023 and is expected to grow at the fastest CAGR during the forecast period. The growth is attributed to its increased easy accessibility to data from anywhere, unrestricted storage space, quick updates, and low cost. The rise in adoption of management software in medical spas for appointment scheduling, inventory management, organizing rebooking, and managing employee schedules quickly and easily is expected to boost segment growth.

The growth of this segment is anticipated to be fueled by the introduction of new software, mergers, and collaborations among major players, with a focus on delivering web and cloud-based solutions to their customers. For instance, in March 2022, Zenoti, a cloud-based wellness and beauty platform provider, partnered with PR at PARTNERS. The purpose of this partnership is to enhance guest satisfaction and offer comprehensive access to essential business functions, including marketing, booking, and reporting capabilities, all in one place.

Application Insights

The appointment management segment dominated the market with a revenue share of 30% in 2023. The growing popularity of medical spas worldwide is increasing the demand for efficient service management software to handle the rising customer base. Moreover, technological advancements, such as mobile applications and automated marketing tools, are also driving the need for software solutions to enhance service management and customer experience.

The customer relationship management segment is expected to grow at the fastest CAGR during the forecast period. The need for personalized customer experiences is a key growth driver. Client management applications enable medical spas to capture and manage client information, track preferences, and provide tailored services, enhancing overall customer satisfaction and loyalty. Moreover, effective marketing and customer engagement capabilities are driving the adoption of client management applications. These key advantages are driving the increasing demand for client management adoption in the market.

Regional Insights

North America held the largest revenue share of over 44% in 2023. This can be attributed to the increase in demand for healthy and standardized lifestyles, both individuals and professionals in salons and spas are swiftly embracing medical spa services and products in the early stages of adoption.

U.S. Medical Spa Management Software Market Trends

The U.S. market held the largest revenue share in 2023. Owing to a robust economy and growing consumer expenditure on wellness-related products and services, the region experienced numerous partnerships, mergers, and acquisitions among vendors in the U.S.

Europe Medical Spa Management Software Market Trends

The medical spa management software market in Europe is anticipated to grow significantly over the forecast period. The growing wellness tourism in countries like the UK and France and the increasing spending capacity of the people on premium personal care services, including spa treatment, and the rise of non-invasive cosmetic procedures are the primary growth drivers.

The medical spa management software market in the UK is expected to grow significantly over the forecast period. This can be attributed to a rise in the number of service providers.

The Germany medical spa management software market held the largest revenue share in 2023, owing to the population's increasing focus on self-care, anti-aging services, and overall well-being contributions.

Asia Pacific Medical Spa Management Software Market Trends

Asia Pacific is expected to witness the fastest growth over the forecast period. The rising demand for medical spas in countries such as China & India is expected to be driven by a large client pool and rising interest in aesthetic treatments.

The medical spa management software market in Japan held the largest share in 2023, owing to the rise in popularity of aesthetic procedures, and easy availability of various spa facilities.

The India medical spa management software market is expected to grow during the forecast period, due to the increasing investments by global players and a growing penetration of healthcare IT infrastructure.

Latin America Medical Spa Management Software Market Trends

The medical spa management software market in Latin America is anticipated to grow significantly due to the high demand for aesthetic treatment in Brazil, Mexico, Argentina, and Colombia.

Middle East & Africa Medical Spa Management Software Market Trends

The medical spa management software market in Middle East & Africa is anticipated to grow significantly over the forecast period, due to the growing westernization and aesthetic procedures & treatments gaining popularity among people aged 30 and above.

Key Medical Spa Management Software Company Insights

The market is highly fragmented, with the presence of many country-level players. To stay ahead of the competition, companies are adopting various strategies such as acquisitions, collaborations, partnerships, and launching new products.

Key Medical Spa Management Software Companies:

The following are the leading companies in the medical spa management software market. These companies collectively hold the largest market share and dictate industry trends.

- Acuity Scheduling - A Squarespace Company

- AestheticsPro

- Book4Time Inc.

- GlamPlus

- Meditab

- Milano

- Millennium Systems International

- MINDBODY, Inc.

- Miosalon (Waffor Inc.)

- PatientNow

- Reservio

- SimpleSpa by Lasyk Networks, Inc.

- Vagaro, Inc.

- Zenoti

Recent Developments

-

In January 2024, PatientNow launched a new product, PatientNow Essentials. The purpose of this product is to meet the distinctive requirements of small to midsize medspas and wellness clinics; this product offers a comprehensive solution. It optimizes operations and elevates patient and client experiences.

-

In October 2023, Millennium Systems International extended its strategic partnership with Tippy with Revolutionary MeevoTips Integration. This integration aims to improve the tipping and checkout process for guests while maximizing employee tips.

-

In July 2023, MINDBODY, Inc. entered a strategic alliance with Shoot 360, the premier immersive basketball training experience globally. With Shoot 360's expansion and the addition of new locations, Mindbody's technology enhances operational efficiency and prioritizes customer experience.

Medical Spa Management Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 327.27 million

Revenue forecast in 2030

USD 708.39 million

Growth rate

CAGR of 13.74% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Acuity Scheduling - A Squarespace Company; AestheticsPro; Book4Time Inc.; GlamPlus; Meditab; Milano; Millennium Systems International; MINDBODY, Inc.; Miosalon (Waffor Inc.); PatientNow; Reservio; SimpleSpa by Lasyk Networks, Inc.; Vagaro, Inc.; Zenoti

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Spa Management Software Market Report Segmentation

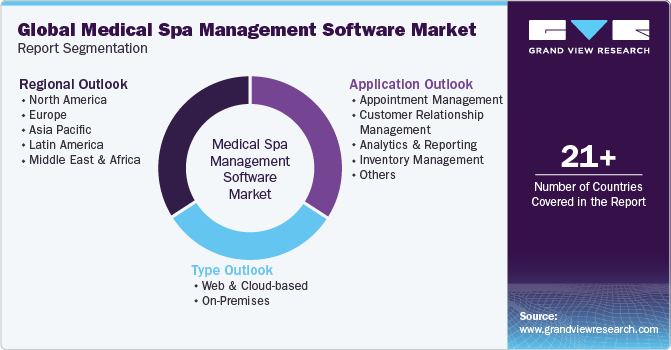

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical spa management software market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Web & Cloud-based

-

On-Premises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Appointment Management

-

Customer Relationship Management

-

Analytics & Reporting

-

Inventory Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the medical spa management software market growth include a rise in the popularity of spa services, the growing number of spas and wellness centers, and an increase in the adoption of technology.

b. The global medical spa management software market size was estimated at USD 294.46 million in 2023 and is expected to reach USD 327.27 million in 2024.

b. The global medical spa management software market is expected to grow at a compound annual growth rate of 13.74% from 2024 to 2030 to reach USD 708.39 million.

b. North America dominated the market with a share of 44.46% in 2023. This is attributable to the increase in demand for healthy and standardized lifestyles, both individuals and professionals in salons and spas are swiftly embracing medical spa services and products in the early stages of adoption, high disposable income, and a large geriatric population.

b. Some key players operating in the medical spa management software market include Acuity Scheduling - A Squarespace Company, AestheticsPro, Book4Time Inc., GlamPlus, Meditab, Milano, Millennium Systems International, MINDBODY, Inc., Miosalon (Waffor Inc.), PatientNow, Reservio, SimpleSpa by Lasyk Networks, Inc., Vagaro, Inc., and Zenoti

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."