Medical Scheduling Software Market Size, Share & Trends Analysis Report By Product (Patient, Care Provider), By Deployment Model (Cloud-based, On-premise), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-267-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Medical Scheduling Software Market Trends

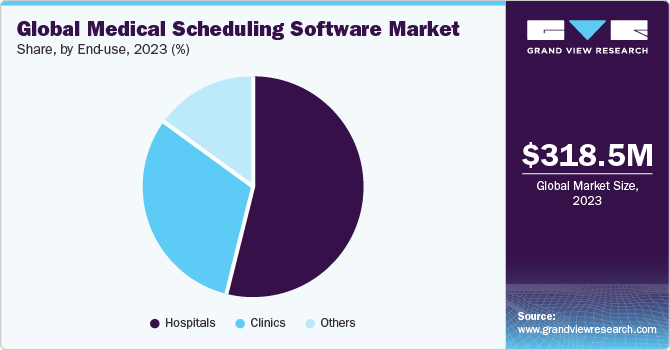

The global medical scheduling software market size was estimated at USD 318.47 million in 2023 and is anticipated to grow at a CAGR of 13.3% from 2024 to 2030. Growing demand for software to efficiently manage and optimize workflow and the rising adoption of patient-centric approaches are the major factors contributing to market growth. For instance, according to the "Essential Automation in Healthcare Statistics in 2023" study, 86% of healthcare providers believe that cloud-based automation will significantly impact the optimization of patient care. Patient-centric scheduling solutions offer patients online appointment arranging, timely reminders, and direct communication with medical providers. This results in a better patient experience and reduces administrative burden on healthcare organizations.

In addition, medical providers face multiple challenges with manual appointment arrangements, such as potential errors, time-consuming processes, limited accessibility, resource inefficiency, higher no-show rates, difficulty accommodating changes, and challenges in managing patient preferences. For instance, According to Sign In Solutions Inc. data from 2020, health clinics experience a 3% no-show rate, while practices that don't use scheduling software have a much higher rate of around 19%. In response to the limitations, healthcare settings are adopting digital scheduling software to improve efficiency and the patient experience.

Moreover, the market has grown due to the increasing prevalence of chronic diseases. For instance, according to the World Heart Day 2023 report, approximately 620 million people live with heart and circulatory diseases worldwide. Annually, 60 million people across the globe develop heart or circulatory disease. Similarly, as per the NIH report, in 2023, it is projected that there will be 1,958,310 new cases of cancer and 609,820 deaths in the U.S.With the rising demand for chronic disease management, healthcare organizations are turning to software solutions to improve patient care, accessibility, and operational efficiency. In addition, the shortage of medical professionals, such as doctors and nurses, further propels market growth. For instance, according to AAMC (Association of American Medical Colleges) data, the U.S. is projected to face a shortage of up to 124,000 physicians by 2034, with demand outpacing supply.

The market has witnessed significant technological advancements that have transformed the healthcare industry. These advancements have improved appointment management by making it more efficient and convenient. Integrating artificial intelligence (AI) and machine learning (ML) has enabled predictive scheduling, optimized resource allocation, and reduced patient wait times. Furthermore, the integration of telehealth has expanded healthcare access, and cloud-based solutions have enabled seamless appointment arranging across locations. Moreover, patient portals and mobile apps provide user-friendly tools to schedule and manage appointments, promoting greater engagement.

During the early phase of pandemic, the reduced number of in-person visits and elective procedures has negatively impacted the market growth. For instance, as per a U.S. Veterans Affairs 2020 report, due to the COVID-19 pandemic, the U.S. Veterans Health Administration canceled 11.4 million appointments between February 1 and May 1, 2020. However, the pandemic accelerated the demand for remote consultations and telemedicine, fostering market growth.According to the U.S. Veterans Health Administration, in 2020, 1.1 million canceled appointments were converted to video or phone appointments. Similarly, per the Centers for Disease Control and Prevention (CDC) report, during the first quarter of 2020, telehealth visits increased by 50%. Furthermore, growing government initiatives to surge the adoption of medical scheduling software have accelerated market growth. For instance, in August 2020, The VA Central Ohio Healthcare System launched a new scheduling tool to streamline appointments for Veterans and care providers.

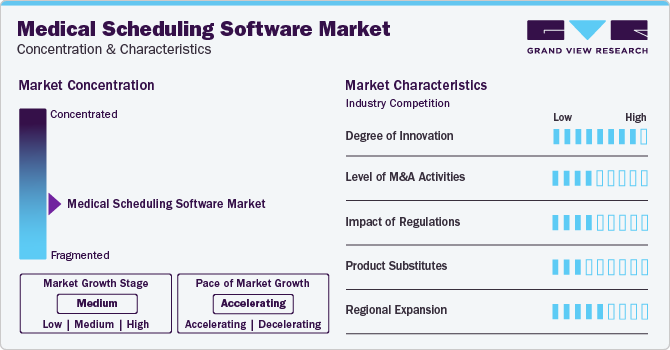

Market Concentration & Characteristics

The global medical scheduling software industry is characterized by a high degree of innovation. New advancements include AI-driven scheduling algorithms, seamless integration with electronic health records, and patient engagement features.

Market players are involved in various merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Compliance requirements such as HIPAA in the U.S. drive the development of secure and privacy-focused solutions. Furthermore, regulatory standards often require interoperability and data exchange standards, encouraging software development that seamlessly integrates with electronic health records (EHR) and other medical systems.

Traditional appointment scheduling methods, such as manual paper-based systems or essential electronic calendars, are potential substitutes for medical scheduling software. Key market players are adopting various strategies to capture emerging opportunities and meet the increasing demand for advanced scheduling solutions in healthcare.

Product Insights

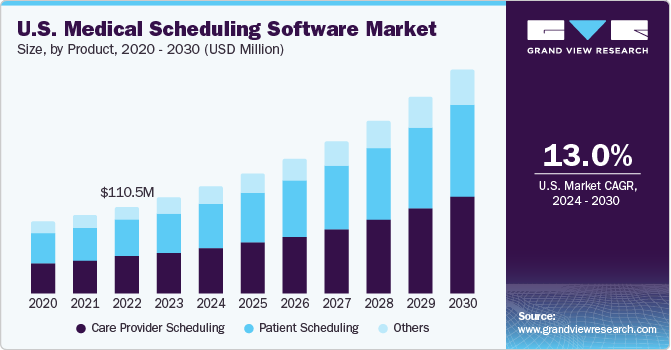

The patient scheduling segment accounted for the largest revenue share of 41.8% in 2023 due to the increasing demand for streamlined, patient-centric medical experiences. Moreover, patient scheduling software provides numerous benefits, such as easy appointment booking, automatic reminders to reduce no-show rates, and improved patient satisfaction through self-service options, fostering segmental growth. Furthermore, increasing funding from government and non-government organizations will supplement market growth. For instance, The VA awarded USD 3 million for improved patient scheduling software. Moreover, increasing adoption of mHealth will boost industry growth.

The care provider scheduling segment is predicted to grow substantially in the forecast period. Unhealthy and hectic lifestyles will increase the prevalence of lifestyle-related diseases such as lung cancer, cardiovascular diseases, and diabetes, among others. For instance, according to the Cleveland Clinic report, about 80% of chronic illnesses are caused by poor lifestyle choices, such as diet and lack of exercise.Expanding demand for affordable and technology-based medical solutions, coupled with an emphasis on patient safety and accuracy, will escalate market growth.

Deployment Model Insights

Cloud-based segment accounted for the largest revenue market share in 2023. Cloud-based software enables convenient access to appointment data from any location, facilitating virtual and remote medical services. Moreover, cloud-based solutions minimize healthcare expenses and complications by eliminating hardware and software upkeep. These associated benefits are expected to enhance the growth of this segment. Furthermore, the increasing adoption of cloud computing coupled with the rising number of strategic initiatives undertaken by the key market players will supplement the segmental growth. For instance, in November 2021, PerfectServe, a provider of cloud-based clinical collaboration and scheduling solutions, launched PerfectServe Unite. The company has used its experience in award-winning technology design to create a streamlined platform for healthcare scheduling and communication.

The installed segment is anticipated to witness significant growth in the market during the forecast period. Healthcare institutions may choose to use an installed deployment of scheduling software for various reasons, including concerns about data security and regulatory compliance. By hosting the software on their servers, these organizations can have more direct control over data management and security measures. This ensures that patient information remains in-house and meets strict compliance requirements. In addition, an installed deployment can offer more reliability and increased uptime for institutions with limited or unreliable internet connectivity. Such aforementioned factors are anticipated to boost segmental growth.

End-Use Insights

The hospitals segment dominated the market in 2023. Hospitals provide medical treatment for various specialties, such as pediatrics, cardiology, pulmonology, internal medicine, and psychiatry. As a result, hospitals are the primary destination for patients seeking diagnosis, treatment, and other medical services. Furthermore, rapid advancements in mobile applications and technologies, new opportunities for integrating mobile health into existing health services, and ongoing expansion of mobile cellular network coverage are among the major factors supporting the market growth.According to a report released in 2020 by Business of Apps, almost one-fifth, 19% of smartphone users, have installed a healthcare software application on their devices. This percentage has steadily increased as more individuals and companies have embraced mobile health technology.

The clinics segment is projected to experience significant growth during the forecast period due to itsability to provide cost-effective, convenient, and efficient patient care. In addition, the increasing demand for healthcare services and the growing awareness among people and professionals pertaining to the availability of various software developments in the healthcare sector are anticipated to boost the market growth.This software assists in the smooth management of resources and ensu res compliance with HIPAA regulations regarding patient data. Such factors promote a better work-life balance for all personnel involved.

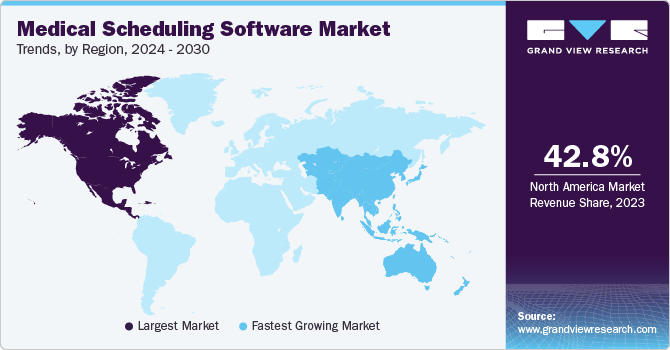

Regional Insights

North America dominated the market and accounted for a 42.8% share in 2023 due to several factors, including a growing elderly population, increasing incidence of chronic diseases, a well-established healthcare infrastructure, strong presence of industry players in the region, increasing healthcare expenditure, and technological advancement in healthcare IT. Furthermore, increasing adoption of inorganic and organic strategies by key market players is expected to drive market growth. For instance, in November 2022, Symplr, a leading provider of enterprise healthcare operations software and services, acquired SpinFusion, a provider of healthcare scheduling software. With this acquisition, SpinFusion became a part of Symplr's portfolio of workforce management solutions, which help healthcare organizations optimize their staff.

U.S. Medical Scheduling Software Market Trends

U.S. medical scheduling software market held the largest share in 2023 due to the presence of well-established healthcare IT sector, technological advancement, along with presence of notable market players such as Epic Systems Corporation, Oracle, AdvancedMD, Inc., and other players is expected to drive market growth.

Europe Medical Scheduling Software Market Trends

The market in Europe is anticipated to grow significantly due to the growing focus on patient engagement, increasing government policies and initiatives to promote healthcare IT adoption, and rising demand for efficient healthcare delivery systems along revenue cycle management is anticipated to drive the market growth.

The UK medical scheduling software market is expected to grow significantly over the forecast period. This can be attributed to the rising adoption of a patient-centric approach by healthcare providers, the surge in the use of smart devices for monitoring health among patients, and the increase in the prevalence of chronic diseases.

The medical scheduling software market in Germany held the largest share in 2023, owing to the government's increased reforms to reduce waiting time and the increasing adoption of software to assist in managing online support services. These factors can contribute to the growth of the pediatric hospital market in Germany.

Asia Pacific Medical Scheduling Software Market Trends

Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. Growing healthcare infrastructure, coupled with rapid adoption of digital technologies, will drive market growth. Furthermore, governments and healthcare providers across countries in the Asia Pacific are increasingly investing in modernizing healthcare systems.

The China medical scheduling software market held a significant share in 2023, owing to the increasing adoption of digital technologies in healthcare and the rise in government promotion of the use of digital health solutions to enhance the accessibility and quality of healthcare services.

The medical scheduling software market in India is driven by growing investment by healthcare providers and government in modernizing healthcare systems. For instance, in October 2022 Minister of State for Science and Technology announced at the Global Digital Health Summit, Expo & Innovations awards that India is expected to witness an 80% increase investment in digital healthcare tools over the next five years. In addition, the expanding population, especially in urban areas, amplifies the need for efficient patient management solutions.

Latin America Medical Scheduling Software Market Trends

The medical scheduling software market in Latin America is anticipated to grow significantly due to the growing healthcare spending, growing demand for healthcare IT solutions to optimize healthcare delivery systems and enhance patient outcomes, and investment in the healthcare infrastructure.

The Brazil medical scheduling software market is anticipated to grow significantly due to the increase in the prevalence of chronic diseases, the rise in the aging population, and the growing demand for technological advancement in the healthcare sector is also expected to grow the demand for the market.

Middle East & Africa Medical Scheduling Software Market Trends

The medical scheduling software market in the Middle East & Africa is anticipated to grow significantly owing to the increase in the development of healthcare facilities, the rising prevalence and incidence of chronic diseases, and the rise in government initiatives to provide better healthcare offerings.

The UAE medical scheduling software market is anticipated to grow significantly due to the growing demand for better patient management and automation of appointment scheduling in the healthcare system, along with an increase in investment in the healthcare IT sector is expected to growth market demand.

Key Medical Scheduling Software Company Insights

Oracle, NXGN Management, LLC., and AdvancedMD, Inc. are some of the dominant players These companies collectively hold the significant market share and dictate industry trends. SuperSaaS, PatientStudio, Kyruus, Sign In Solutions Inc. some of the emerging market players functioning in medical scheduling software market.

Key Medical Scheduling Software Companies:

The following are the leading companies in the medical scheduling software market. These companies collectively hold the largest market share and dictate industry trends.

- Kareo

- Oracle

- NXGN Management, LLC.

- American Medical Software

- Q-nomy Inc.

- Biosoftworld Medical Software

- Caspio

- SuperSaaS

- PatientStudio

- AdvancedMD, Inc.

- TIMIFY

- Sign In Solutions Inc

- Kyruus

Recent Developments

-

In January 2023, Sign In Solutions acquired 10to8 and SCR Tracker, leaders in appointment scheduling and cloud-based education compliance. This was the company's sixth and seventh acquisition in the past year and a half. This acquisition strategy will complement the company's primary visitor management platforms.

-

In August 2022, Kyruus collaborated with Christus Health, a non-profit healthcare system, to develop a state-of-the-art digital directory. The directory highlights the exceptional physicians and advanced practitioners in the network and improves the online find-care experience by providing comprehensive information that facilitates better patient-provider matching.

-

In March 2022, WellHive partnered with Kyruus to integrate systems and optimize care navigation for veterans. The two companies will offer a solution that makes it easier for veterans to find and schedule healthcare appointments with the Veterans Health Administration (VHA).

Medical Scheduling Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 355.09 million |

|

Revenue forecast in 2030 |

USD 749.87 million |

|

Growth rate |

CAGR of 13.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, deployment model, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Kareo; Oracle; NXGN Management, LLC.; American Medical Software; Q-nomy Inc.; Biosoftworld Medical Software; Caspio; SuperSaaS; PatientStudio; AdvancedMD, Inc.; TIMIFY; Sign In Solutions Inc; Kyruus. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Medical Scheduling Software Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 - 2030. For this study, Grand View Research has segmented global medical scheduling software market report based on product, deployment model, end use and region.

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Patient Scheduling

-

Care Provider Scheduling

-

Others

-

-

Deployment Model Outlook (Revenue in USD Million, 2018 - 2030)

-

Cloud-Based

-

On-Premise

-

-

End Use Outlook (Revenue in USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical scheduling software market size was estimated at USD 318.47 million in 2023 and is expected to reach USD 355.09 million in 2024.

b. The global medical scheduling software market is expected to grow at a compound annual growth rate of 13.3% from 2024 to 2030 to reach USD 749.87 million by 2030.

b. North America dominated the medical scheduling software market with a share of 42.8% in 2023. This is attributable to the growing elderly population, increasing incidence of chronic diseases, a well-established healthcare infrastructure, strong presence of industry players in the region, and technological advancement in healthcare IT.

b. Some key players operating in the medical scheduling software market are Kareo, Oracle, NXGN Management, LLC., American Medical Software, Q-nomy Inc., Biosoftworld Medical Software, Caspio, SuperSaaS, PatientStudio, AdvancedMD, Inc., TIMIFY, Sign In Solutions Inc, and Kyruus

b. Key factors that are driving the medical scheduling software market growth include growing demand for software to manage and optimize workflow efficiently and rising adoption of a patient-centric approach.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."