- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Rubber Stopper Market Size, Industry Report, 2033GVR Report cover

![Medical Rubber Stopper Market Size, Share & Trends Report]()

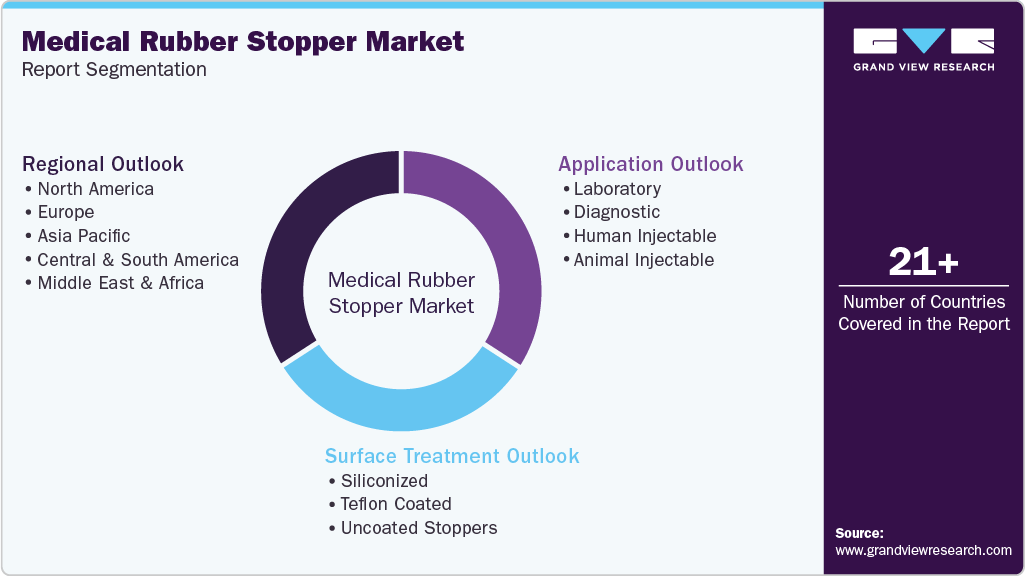

Medical Rubber Stopper Market (2025 - 2033) Size, Share & Trends Analysis Report By Surface Treatment (Siliconize, Teflon Coated, Uncoated Stoppers), By Application (Laboratory, Diagnostic, Human Injectable, Animal Injectable), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-135-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Rubber Stopper Market Summary

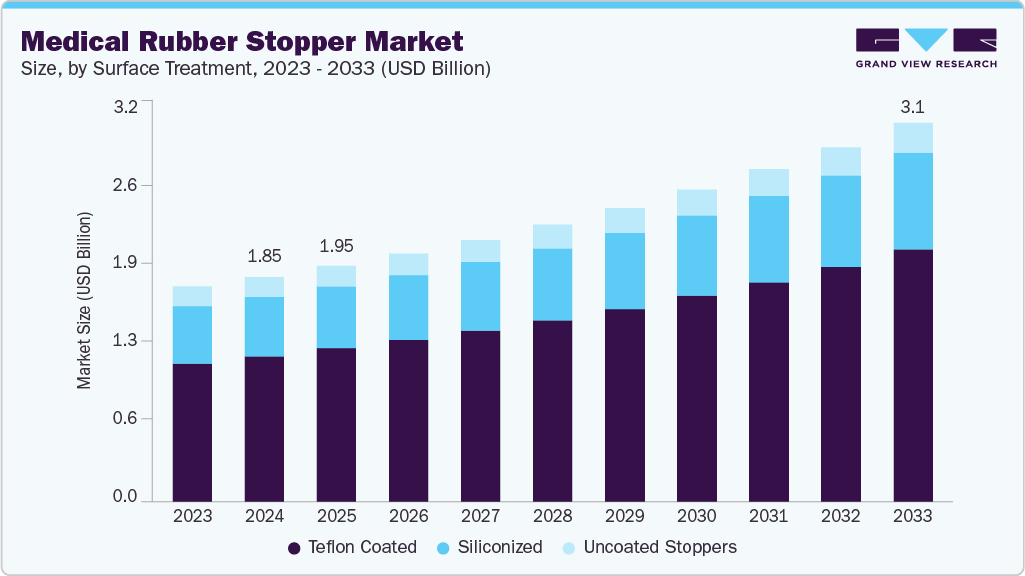

The global medical rubber stopper market size was estimated at USD 1.85 billion in 2024 and is projected to reach USD 3.13 billion by 2033, growing at a CAGR of 6.1% from 2025 to 2033. The expanding end use industries such as healthcare, pharmaceuticals, and biotechnology are expected to drive the demand for medical rubber stoppers over the forecast period.

Key Market Trends & Insights

- North America dominated the medical rubber stopper market with the largest revenue share of 37.88% in 2024.

- By surface treatment, the teflon coated segment dominated the market across the surface treatment segmentation in terms of revenue, accounting for a market share of 64.57% in 2024.

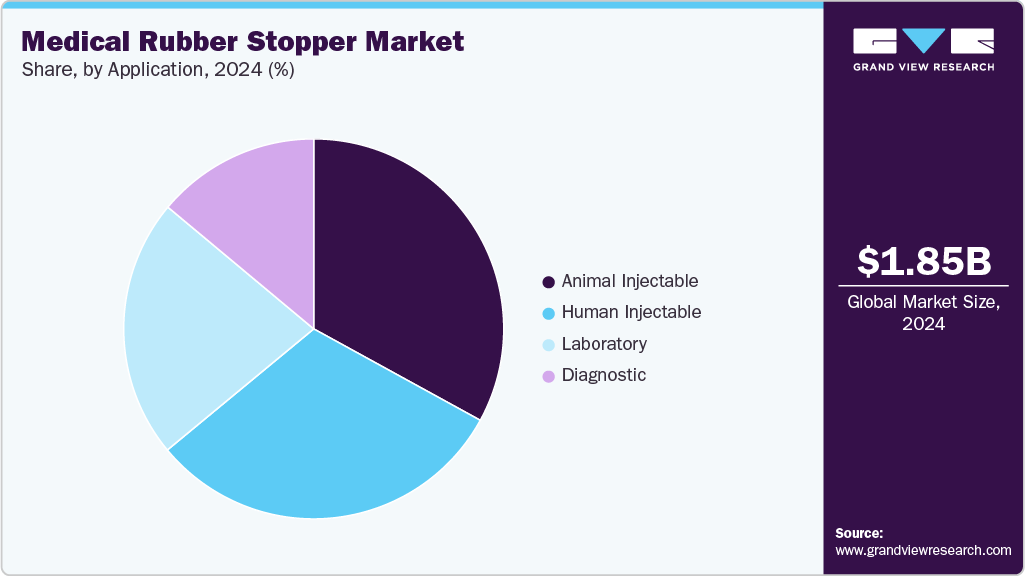

- By application, the animal injectable dominated the market across the application segmentation in terms of revenue, accounting for a market share of 32.99% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.85 Billion

- 2033 Projected Market Size: USD 3.13 Billion

- CAGR (2025-2033): 6.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the increasing focus on drug safety and efficacy is leading to more stringent regulations and standards for pharmaceutical packaging, which in turn is expected to stimulate market growth. The aging population and increasing childbirth rate worldwide are significant demographic trends that have a direct impact on the demand for stoppers in various industries, particularly healthcare, pharmaceutical, and infant care. This outlook directly leads to a higher demand for stoppers as pharmaceutical companies are seeking reliable packaging solutions to maintain the efficacy and safety of their products, such as vials, ampoules, and prefilled syringes.

Drivers, Opportunities & Restraints

The aging population is more susceptible to age-related diseases such as cancer, Alzheimer's disease, and Parkinson's disease. These diseases require specialized injectable treatments, including chemotherapy, immunotherapy, and neurodegenerative disease medications. Therefore, the aging demographic is expected to increase the demand for injectable medicine, which, in turn, is anticipated to trigger the market growth over the forecast period.

Furthermore, the global vaccination drive, accelerated by recent health crises, namely the COVID-19 pandemic, Ebola virus outbreaks, and yellow fever outbreaks, led to the production of billions of vaccine doses. Several vaccine doses, including those developed by Pfizer-BioNTech, Moderna, Johnson & Johnson, AstraZeneca, and others, were developed and distributed to control the spread of the virus.

Moreover, the biotechnology sector heavily emphasizes developing and manufacturing innovative vaccines, including mRNA vaccines. These cutting-edge vaccines often require specialized stoppers for their storage and administration. The mRNA vaccines, such as the Pfizer-BioNTech COVID-19 vaccine, require ultra-low temperature storage to maintain their stability. The Pfizer-BioNTech vaccine, for example, needs to be stored at around -70°C (-94°F). Specialized stoppers play a crucial role in sealing vials and containers used for storing these vaccines at such low temperatures.

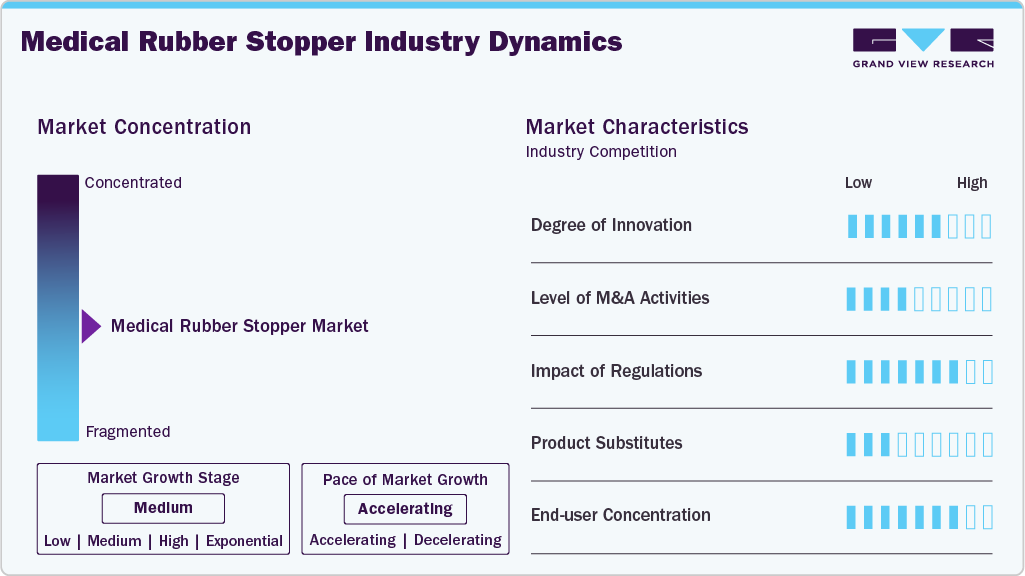

Market Concentration & Characteristics

The market growth stage of the market is medium, and the pace is accelerating. The market exhibits fragmentation, with key players dominating the industry landscape. Major companies such as AptarGroup, Inc., Dätwyler Holding Inc., West Pharmaceutical Services, Inc., and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

The medical rubber stopper industry faces growing substitution pressure from alternative closure formats-most notably prefilled syringes, polymer caps, and screw/flip-off closures-driven by manufacturers’ desires to simplify filling lines and improve patient convenience for certain biologics and vaccines. However, rubber (butyl, chlorobutyl, silicone, nitrile) retains a strong value proposition where puncture-seal reliability, low gas permeability, and chemical resistance are critical for long-term stability and lyophilized products; this preserves rubber’s share for high-value injectable formats.

Regulatory scrutiny, centered on container-closure integrity, biocompatibility, and extractables & leachables, has materially raised the bar for stopper qualification, forcing makers to invest in specialized formulations, clean manufacturing, and expanded testing regimes to secure market access. Recent FDA guidance on container-closure changes and evolving pharmacopeial updates (USP/ISO standards for elastomeric closures) require robust change control, comparability data, and sometimes advance notification for stopper modifications, increasing switching costs for drug sponsors and strengthening incumbent stopper suppliers.

Surface Treatment Insights

Teflon coated dominated the market across the surface treatment segmentation in terms of revenue, accounting for a market share of 64.57% in 2024, and is forecasted to grow at a 6.5% CAGR from 2025 to 2033. Teflon-coated stoppers are biocompatible and prevent reacting with or leaching harmful substances into the contents of vials, syringes, and ampoules, ensuring the safety of pharmaceuticals and medical devices. Hence, its biocompatibility is expected to increase product demand over the forecast period.

The siliconized segment is anticipated to grow at a substantial CAGR of 5.7% through the forecast period. Siliconized stoppers have a smooth and lubricated surface due to the silicone coating. This reduces friction during the insertion or removal of the stopper from a vial or ampoule, making it easier for pharmaceutical and medical device manufacturers to handle and assemble their products. Additionally, the enhanced sealing properties of siliconized stoppers contribute to a longer shelf life for pharmaceutical products, which is expected to increase the demand for siliconized stoppers over the forecast period.

Application Insights

Animal injectable dominated the market across the application segmentation in terms of revenue, accounting for a market share of 32.99% in 2024, and is forecasted to grow at a 6.1% CAGR from 2025 to 2033. This positive outlook is due to the growing veterinary pharmaceutical industry, rising pet ownership, and livestock farming and agriculture. Moreover, outbreaks of diseases affecting animals, such as canine distemper in dogs, feline panleukopenia in cats, and avian influenza in poultry, led to mass vaccination campaigns. These campaigns require large quantities of injectable vaccines and, consequently, are expected to drive the demand for medical rubber stoppers in the animal injectable segment.

The human injectable segment is expected to grow at a substantial CAGR of 6.7% through the forecast period. The prevalence of chronic diseases such as diabetes, cancer, and cardiovascular diseases is on the rise, increasing the demand for injectable medications for disease management. This, in turn, is expected to boost the demand for medical rubber stoppers over the forecast period. Furthermore, the ongoing development and distribution of vaccines, especially during global health crises such as pandemics, is anticipated to trigger the demand for medical rubber stoppers during the forecast period.

Regional Insights

North America medical rubber stoppers industry held the largest share of 37.88% in terms of global market revenue in 2024. Escalating demand for biologics, vaccines and complex parenteral products is the primary growth engine for medical rubber stoppers in North America; these modalities require high-integrity elastomeric closures with proven barrier and low-leach profiles, driving larger volume purchases from CDMOs and big pharma alike. Growth in vaccine and RNA platform manufacturing has also lifted demand for freeze-dried and sterile stoppers that meet rigorous aseptic standards, creating pull for pre-qualified, premium elastomer formulations. As manufacturers outsource more fill/finish and vaccine capacity to specialist CMOs, stopper suppliers integrated with CDMO supply chains capture disproportionate share gains.

The North America medical rubber stoppers industry is propelled by policy and supply-chain resilience initiatives that favour domestic sourcing and validated suppliers: regulatory focus on container-closure integrity and the U.S. push to onshore critical drug manufacturing raise the commercial value of locally qualified stopper vendors. Programs that streamline facility approvals and incentivize domestic capacity (regulatory engagement and funding for local manufacturing) shorten adoption cycles for pre-qualified materials and increase procurement from suppliers able to demonstrate rapid regulatory support and robust quality systems. This trend increases switching costs for import-only producers while expanding opportunities for regional manufacturers with validated portfolios.

U.S. Medical Rubber Stopper Market Trends

The medical rubber stopper industry in the U.S. is driven by the outsized R&D investment, a steady stream of injectable approvals, and the heightened FDA expectations on extractables & leachables that make regulatory compliance a revenue driver rather than just a cost: drug sponsors prefer stoppers that reduce regulatory friction and comparability risk. The FDA’s recent container-closure guidance and accelerated pre-engagement programs incentivize sponsors to standardize on pre-qualified elastomers, creating premium pricing power for suppliers with demonstrated E/L data packages and GMP supply chains. Consequently, U.S. demand tilts toward technically differentiated stoppers rather than commodity elastomers.

Europe Medical Rubber Stopper Market Trends

The medical rubber stoppers industry in Europe is witnessing demand due to a confluence of strict pharmacopeial/regulatory standards and sustainability requirements that push stopper makers to innovate on low-leach formulations and recyclable/mono-material designs for packaging systems. The rise of home-administered biologics and user-centric primary packaging increases requirements around usability and safety, while EU guidance on E/L and circularity is accelerating procurement preference for suppliers who can demonstrate both compliance and environmental credentials. This combination rewards suppliers offering validated, low-E/L elastomers plus transparent sustainability disclosures.

Asia Pacific Medical Rubber Stopper Market Trends

Asia Pacific medical rubber stoppers industry growth is fueled by the rapid expansion of vaccine and biologics manufacturing capacity across India and China, plus the maturation of regional CDMOs that provide cost-competitive fill/finish services to global clients, creating large, localized demand for sterile stoppers. Governments and industry (investment in biotech parks, large CRDMO expansions, and acquisition activity) are lowering barriers to scale, making the region the fastest-growing market for premium and high-volume stopper supply. Price sensitivity remains a factor, but rising technical capability among local suppliers is shifting procurement toward qualified elastomers rather than low-cost substitutes.

Key Medical Rubber Stopper Company Insights

The medical rubber stoppers industry is highly competitive, with several key players dominating the landscCo.e. Major companies include AptarGroup, Inc., Dätwyler Holding Inc., West Pharmaceutical Services, Inc., among others.. The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Medical Rubber Stopper Companies:

The following are the leading companies in the medical rubber stopper market. These companies collectively hold the largest market share and dictate industry trends.

- AptarGroup, Inc.

- Dätwyler Holding Inc.

- West Pharmaceutical Services, Inc.

- Hualan NPM

- Hubei Huaqiang High-Tech Co., Ltd.

- Samsung Medical Rubber Co., Ltd.

- Jiangsu Best New Medical Material Co, Ltd.

- Bharat Rubber Works Pvt. Ltd.

- Jiangyin Hongmeng Rubber Plastic Product Co., Ltd.

- SHRIJI Rubber Industries

- Jain Rubbers Pvt. Ltd.

- Universal Medicap Limited

- Lonstroff AG

- Bormioli Pharma S.p.A.

- APG Europe

- Sagar Rubber Products Pvt. Ltd.

- Shengzou Rubber & Plastics Co., Ltd.

Recent Developments

-

In August 2025, First Rubber announced its participation at INTERPHEX USA 2025 in New York City, inviting clients and potential partners to explore innovative solutions and collaboration opportunities. In addition, First Rubber emphasized the essential role of rubber in pharmaceutical packaging due to its durability and sealing capabilities. Their featured products included bromobutyl rubber stoppers for injections and vacuum blood collections, aluminum flip-off seals, and European-style lids for pharmaceutical packaging.

Medical Rubber Stopper Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.95 billion

Revenue forecast in 2033

USD 3.13 billion

Growth rate

CAGR of 6.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in million units and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Report Segmentation

Surface treatment, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

AptarGroup, Inc.; Dätwyler Holding Inc.; West Pharmaceutical Services, Inc.; Hualan NPM; Hubei Huaqiang High-Tech Co., Ltd.; Samsung Medical Rubber Co., Ltd.; Jiangsu Best New Medical Material Co., Ltd.; Bharat Rubber Works Pvt. Ltd.; Jiangyin Hongmeng Rubber Plastic Product Co., Ltd.; SHRIJI Rubber Industries; Jain Rubbers Pvt. Ltd.; Universal Medicap Limited; Lonstroff AG; Bormioli Pharma S.p.A.; APG Europe; Sagar Rubber Products Pvt. Ltd.; Shengzou Rubber & Plastics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Rubber Stopper Market Report Segmentation

This report forecasts revenue & volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global medical rubber stopper market report based on surface treatment, application, and region:

-

Surface Treatment Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Siliconized

-

Teflon Coated

-

Uncoated Stoppers

-

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

Laboratory

-

Diagnostic

-

Human Injectable

-

Animal Injectable

-

-

Regional Outlook (Volume, Million Units; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global medical rubber stopper market was estimated at around USD 1.85 billion in the year 2024 and is expected to reach around USD 1.95 billion in 2025.

b. The global medical rubber stopper market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2033 to reach around USD 3.13 billion by 2033.

b. Animal injectables emerged as a dominating application with a value share of around 32.99% in the year 2024 owing to the rising demand for veterinary pharmaceuticals, and the emphasis on preventive medicine in the animal health industry is fueling the demand for medical rubber stoppers.

b. The key market player in the medical rubber stopper market includes AptarGroup, Inc.; Dätwyler Holding Inc.; West Pharmaceutical Services, Inc.; Hualan NPM; Hubei Huaqiang High-Tech Co., Ltd.; Samsung Medical Rubber Co., Ltd.; Jiangsu Best New Medical Material Co, Ltd.; Bharat Rubber Works Pvt. Ltd.; Jiangyin Hongmeng Rubber Plastic Product Co., Ltd.; SHRIJI Rubber Industries; Jain Rubbers Pvt. Ltd.; Universal Medicap Limited; Lonstroff AG; Bormioli Pharma S.p.A.; APG Europe; Sagar Rubber Products Pvt. Ltd.; Shengzou Rubber & Plastics Co., Ltd.

b. Rise in aging population and the prevalence of age-related diseases are driving the demand for secure packaging and growing vaccination drive across the globe is expected to drive the medical rubber stoppers market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.