- Home

- »

- Medical Devices

- »

-

Medical Radiation Shielding Market Size, Share Report, 2030GVR Report cover

![Medical Radiation Shielding Market Size, Share & Trends Report]()

Medical Radiation Shielding Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (X-ray Shields, MRI Shields), By Material (Lead-based Shielding, Hybrid Shielding), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-335-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Radiation Shielding Market Summary

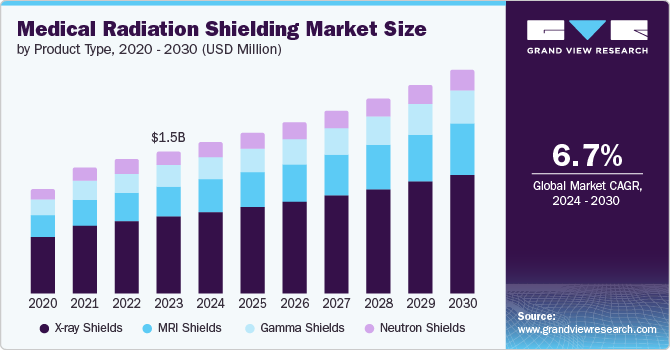

The global medical radiation shielding market size was estimated at USD 1.47 billion in 2023 and is expected to reach USD 2.30 billion by 2030, growing at a CAGR of 6.69% from 2024 to 2030. This growth can be attributed to the rising incidence of chronic diseases and growing diagnostic imaging procedures.

Key Market Trends & Insights

- The North America medical radiation shielding market accounted for a 37.09% share in 2023.

- By product type, the X-ray shields segment dominated the market and accounted for a share of 53.93% in 2023.

- By material, the lead-based shielding segment held the largest share of 52.96% in 2023.

- By application, the diagnostics segment held the largest share of 52.78% in 2023.

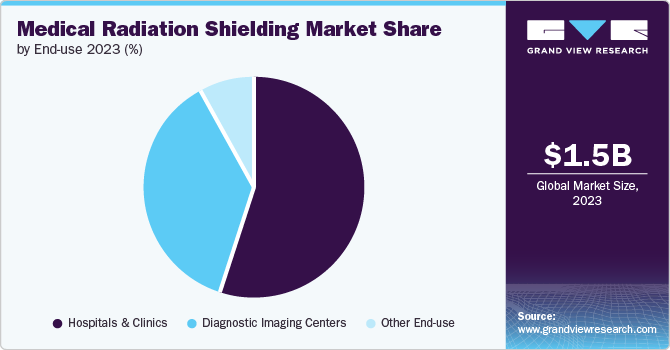

- By end-use, the hospitals & clinics held the largest share of 55.14% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.47 Billion

- 2030 Projected Market Size: USD 2.30 Billion

- CAGR (2024-2030): 6.69%

- North America: Largest market in 2023

As the demand for radiotherapy and diagnostic imaging in treating cancer and other conditions grows, the need for effective radiation shielding solutions is also expected to increase to protect patients & healthcare workers from harmful radiation exposure. For instance, according to WHO, in 2022, there were around 20 million new cases of cancer and approximately 9.7 million deaths due to the disease. It is reported that about one in five people will develop cancer during their lifetime. Furthermore, technological advancements in imaging equipment and radiotherapy devices contribute to market expansion, as newer machines often require more sophisticated shielding materials. In addition, stringent government regulations and safety standards related to radiation protection propel the adoption of advanced shielding solutions.

Governments and healthcare regulatory agencies are implementing stricter guidelines and mandates for radiation safety in medical facilities. These regulations require adequate shielding measures to minimize radiation exposure during diagnostic and treatment procedures. For instance, the U.S. Nuclear Regulatory Commission (NRC) implemented regulations mandating the application of materials that shield against radiation during diagnostic imaging processes. This is to safeguard patients and healthcare workers from the adverse effects of radiation exposure. Technological advancements in medical radiation shielding materials and equipment are significantly driving the market. Innovative, nontoxic, and lead-free shielding alternatives have been developed that offer improved properties compared to traditional lead-based solutions.

For instance, an article published in Science Reports in December 2022 state that a new type of lightweight radiation protection has been developed through the use of electrospinning, which generates nanofibers from a blend of polymer and tungsten, creating a multilayered thin film similar in structure to the wings of a morpho butterfly. This innovative shield, fashioned into a flexible form similar to paper, measures just 0.1 mm thick. The market is also driven by expanding healthcare infrastructure, especially in developing regions. The growth of healthcare infrastructure in these regions creates a need for radiation-shielding solutions in newly established medical facilities. In addition, developing innovative shielding materials and equipment optimized for advanced treatment modalities, such as proton therapy & stereotactic radiosurgery, presents a promising opportunity for market growth.

Product Type Insights

The X-ray shields segment dominated the market and accounted for a share of 53.93% in 2023. This segment includes lead sheets & plates, lead bricks, lead curtains, lead glass, and lead aprons. With the rising adoption of diagnostic imaging procedures such as X-rays in healthcare settings, there is a growing need for effective radiation protection measures. Ongoing advancements in materials science and manufacturing technologies have led to the development of more efficient & innovative X-ray shielding solutions. These technological improvements enhance the performance, durability, and usability of X-ray shields, making them more attractive to end users across various industries. Increasing awareness among healthcare professionals and patients about the potential health risks associated with ionizing radiation has increased the demand for reliable radiation protection products such as X-ray shields.

The MRI shields segment is projected to grow at a significant rate over the forecast period. This segment includes Radiofrequency (RF) shielding systems and magnetic shielding systems. This growth is driven by the increasing demand for advanced MRI technologies in healthcare facilities worldwide. MRI shielding systems are crucial in ensuring the safety and efficacy of MRI machines by containing electromagnetic interference and maintaining a controlled environment for accurate imaging. For instance, in November 2023, ETS-Lindgren, a prominent player in Electromagnetic Compatibility (EMC) and RF testing, reaffirmed its dedication to designing and manufacturing innovative products & services for MRI shielding. The company showcased its latest advancements in MRI shielding technology at the Healthcare Design (HCD) Expo & Conference held in New Orleans, Louisiana. By focusing on R&D, ETS-Lindgren aims to address the evolving needs of the healthcare industry and contribute to enhancing patient care through cutting-edge MRI shielding solutions.

Material Insights

The lead-based shielding segment held the largest share of 52.96% in 2023. Lead is an exceptionally effective material for radiation shielding due to its high density, which efficiently attenuates ionizing radiation, such as X-rays and gamma rays. Lead has a long history of use in radiation shielding, and its reliability and proven performance have established it as the standard material for protection against ionizing radiation in various applications, including medical facilities, industrial radiography, nuclear power plants, and research laboratories. The widespread use of X-rays, CT scanners, & radiation therapy devices in the healthcare sector, which rely on electromagnetic radiation for diagnostic & treatment purposes, is a major factor driving the growth of the lead shielding segment in the market.

Non-lead shielding segment is anticipated to grow at the fastest rate during the forecast period. This growth is driven by increasing concerns regarding the potential toxicity and environmental impact of traditional lead-based shielding materials. Governments and healthcare organizations are promoting the adoption of lead-free alternatives to reduce occupational exposure risks and minimize waste disposal challenges. Emerging materials, such as tungsten and tantalum-containing composites, are being developed & characterized as effective replacements for lead in radiation shielding applications.

Application Insights

The diagnostics segment held the largest share of 52.78% in 2023. This segment includes radiography (X-ray), Computed Tomography (CT), fluoroscopy, mammography, and dental imaging. The growth can be attributed to the increasing prevalence of chronic diseases such as cancer and the growing geriatric population. Diagnostic imaging procedures such as X-rays, CT scans, MRI, and PET scans are widely used for early detection, accurate diagnosis, and monitoring of various health conditions. As per the United Nations, the proportion of the global population aged 65 and older is projected to increase from 10% in 2022 to 16% by 2050, contributing to the rising need for diagnostic imaging to manage age-related health issues. The widespread adoption of advanced imaging technologies, such as 3D mammography, PET/CT, and 3T MRI systems, further propels the growth of the diagnostic segment.

The therapeutics segment is anticipated to witness significant growth over the forecast period. The increasing adoption of advanced radiation therapy techniques such as radiotherapy, brachytherapy, and proton therapy drives this growth. These techniques offer more precise targeting of tumors, reduced damage to surrounding healthy tissues, and improved patient treatment outcomes. Furthermore, integrating artificial intelligence and machine learning algorithms in radiation therapy planning & delivery drives the growth of the therapeutics segment by enhancing treatment accuracy and efficiency. For instance, in May 2022, Elekta introduced a groundbreaking advancement in radiosurgery with the launch of Elekta Esprit. This advanced system represents a significant leap forward in the field, offering a range of benefits that elevate the standard of care for patients undergoing radiotherapy treatments.

End-use Insights

The hospitals & clinics held the largest share of 55.14% in 2023. Hospitals and clinics play a significant role in the market due to their high demand for radiation protection products. These facilities are subject to stringent regulations regarding radiation safety, and compliance with these regulations necessitates implementing effective radiation shielding measures to protect patients, staff, & visitors. The rising healthcare expenditure globally has led to the expansion of hospital infrastructure and diagnostic imaging capabilities. As hospitals invest in advanced imaging equipment, the demand for radiation shielding solutions also increases.

The diagnostic imaging centers segment is projected to grow at a significant rate over the forecast period. Diagnostic imaging centers are increasingly adopting advanced imaging modalities such as MRI, PET-CT, and nuclear medicine scans. These technologies require specialized radiation shielding solutions to maintain safety standards. The emphasis on early disease detection and preventive healthcare has increased the number of diagnostic imaging centers offering screening services. This expansion fuels the demand for radiation protection products in these facilities. Owing to cost-effectiveness and efficiency, many healthcare providers outsource their imaging services to specialized diagnostic imaging centers. This trend boosts the demand for radiation shielding solutions in standalone imaging facilities.

Regional Insights

TheNorth America medical radiation shielding market accounted for a 37.09% share in 2023. The market is driven by the increasing adoption of advanced cancer therapies and the growing burden of chronic diseases in the region. According to the Society of Nuclear Medicine, the U.S., in particular, has observed a rise in the number of nuclear medicine procedures, with nearly 20 million procedures performed annually to detect and treat various conditions. In addition, the market in Canada has benefited from the country's leadership in nuclear imaging technology, which is widely used in cardiology, oncology, neurology, and other medical fields.

U.S. Medical Radiation Shielding Market Trends

The medical radiation shielding market in the U.S. held the largest share in North America in 2023. The U.S. market has been strengthened by increased R&D activities in medical devices & biotechnology industries, growing expenditure on hospital setups, and government initiatives to raise awareness about healthcare resources to prevent risks associated with radiation therapies. The country's well-developed healthcare system and high rate of diagnosis & treatment adoption have further contributed to market growth.

Europe Medical Radiation Shielding Market Trends

The medical radiation shielding market in Europe is expected to grow at a lucrative rate. This can be attributed to the presence of key players and an opportunistic approach to new investments in the field. The region has also observed rising investments in R&D, boosting the potential for new-age innovation in radiation shielding. The European Alliance for Medical Radiation Protection Research (EURAMED) has launched initiatives to optimize radiation protection for patients, such as conducting European Diagnostic Reference Level (DRL) surveys and specifying up-to-date clinical DRLs from a radiation protection perspective.

Asia Pacific Medical Radiation Shielding Market Trends

The medical radiation shielding market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. This can be attributed to the increasing prevalence of chronic diseases, especially cancer, in the region. According to NIH, in India, the incidence of cancer is projected to rise by 12.8% in 2025 compared to 2020. Governments in countries such as China and India have been investing in healthcare infrastructure and promoting the use of radiation-based therapies, further driving the demand for medical radiation shielding solutions.

Key Medical Radiation Shielding Company Insights

Some of the key players operating in the market are NELCO, MarShield, Amray Group, and Gaven Industries. These companies are leading the medical radiation shielding market through their innovative products, strategic partnerships, and focus on technological advancements.

Key Medical Radiation Shielding Companies:

The following are the leading companies in the medical radiation shielding market. These companies collectively hold the largest market share and dictate industry trends.

- Amray Group

- ETS-Lindgren

- Gaven Industries

- MarShield

- MAVIG GmbH

- NELCO

- Nuclear Shields B.V.

- Radiation Protection Products, Inc.

- VacuTec Meßtechnik GmbH

- Veritas Medical Solutions

Recent Developments

-

In March 2022, Radiaction Medical Ltd., a leading medical technology company, achieved a significant milestone by receiving FDA clearance for its innovative radiation protection system. This clearance allowed the company to launch its state-of-the-art technology in the U.S. market, marking a significant step forward in the field of radiation protection in healthcare settings.

-

In March 2022, Trivitron Healthcare expanded its operations in the U.S. by acquiring The Kennedy Company, a company specializing in manufacturing acoustic barrier products and radiation protection X-ray shielding materials. This strategic move enhanced Trivitron’s manufacturing presence in the U.S., enabling the company to broaden its manufacturing capabilities and pave the way for establishing an advanced technology park in Scottsboro, Alabama.

Medical Radiation Shielding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.55 billion

Revenue forecast in 2030

USD 2.30 billion

Growth rate

CAGR of 6.69% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024–2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, material, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Amray Group; ETS-Lindgren; Gaven Industries; MarShield; MAVIG GmbH; NELCO; Nuclear Shields B.V.; Radiation Protection Products, Inc.; VacuTec Meßtechnik GmbH; Veritas Medical Solutions

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country or regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Radiation Shielding Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the medical radiation shielding market report based on product type, material, application, end-use, and region

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray Shields

-

Lead Sheets and Plates

-

Lead Bricks

-

Lead Curtains

-

Lead Glass

-

Lead Aprons

-

-

MRI Shields

-

RF Shielding Systems

-

Magnetic Shielding Systems

-

-

Gamma Shields

-

Gamma Camera Shields

-

Positron Emission Tomography (PET) Shields

-

-

Neutron Shields

-

Neutron Absorbers

-

Neutron Reflectors

-

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Lead-based Shielding

-

Non-lead Shielding

-

Hybrid Shielding

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics

-

Radiography (X-ray)

-

Computed Tomography (CT)

-

Fluoroscopy

-

Mammography

-

Dental Imaging

-

-

Therapeutics

-

Radiotherapy

-

Brachytherapy

-

Proton Therapy

-

-

Nuclear Medicine

-

SPECT (Single Photon Emission Computed Tomography)

-

Positron Emission Tomography (PET)

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Imaging Centers

-

Other End-use

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global medical radiation shielding market size was estimated at USD 1.47 billion in 2023 and is expected to reach USD 1.55 billion in 2024.

b. The global medical radiation shielding market is expected to grow at a compound annual growth rate of 6.69% from 2024 to 2030 to reach USD 2.30 billion by 2030.

b. North America medical radiation shielding market accounted for 37.09% share in 2023. The market is driven by the increasing adoption of advanced cancer therapies and the growing burden of chronic diseases in the region.

b. Some key players operating in the medical radiation shielding market include Amray Group; ETS-Lindgren; Gaven Industries; MarShield; MAVIG GmbH; NELCO ; Nuclear Shields B.V.; Radiation Protection Products, Inc. ; VacuTec Meßtechnik GmbH; Veritas Medical Solutions.

b. Key factors that are driving the market growth include rising incidence of chronic diseases and the consequent rise in diagnostic imaging procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.