- Home

- »

- Medical Devices

- »

-

Medical Office Buildings Market Size And Share Report, 2030GVR Report cover

![Medical Office Buildings Market Size, Share & Trends Report]()

Medical Office Buildings Market Size, Share & Trends Analysis Report By Type (Physician Offices, ASCs, Wellness Centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-292-1

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Medical Office Buildings Market Trends

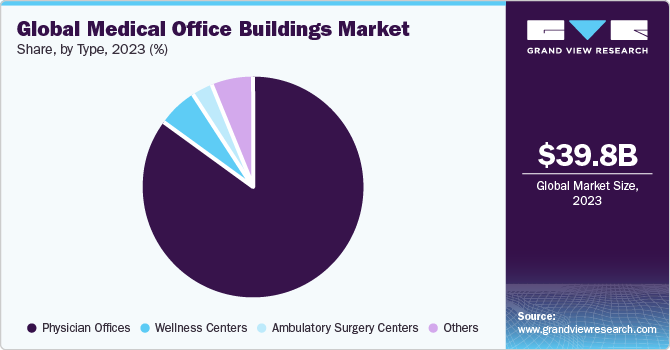

The global medical office buildings market size was estimated at USD 39.79 billion in 2023 and is projected to grow at a CAGR of 6.64% from 2024 to 2030. The growth can be attributed to the rising demand for medical offices owing to increased burdens on hospitals and favorable demographic trends, such as the growing aging population and increasing prevalence of chronic diseases. Moreover, the demand for these healthcare spaces is growing owing to low tenant turnover and growing developments by Real Estate Investment Trusts (REITs) & institutional investors, due to the tenant-driven nature. In addition, the growing demand for outpatient services is expected to shift to the construction of outpatient facilities.

Many players provide retail healthcare services by adding medical or diagnostic facilities in the same buildings. With globalization and advancements in healthcare, patients are increasingly seeking medical treatment in countries with specialized facilities contributing to the rise in medical tourism. This is expected to boost demand for high-quality office spaces equipped to cater to international patients, providing a range of services from consultations to specialized procedures. For instance, Dubai Healthcare City in the UAE is witnessing development of medical complexes that integrate clinics, hospitals, and research facilities, attracting patients and healthcare professionals globally.

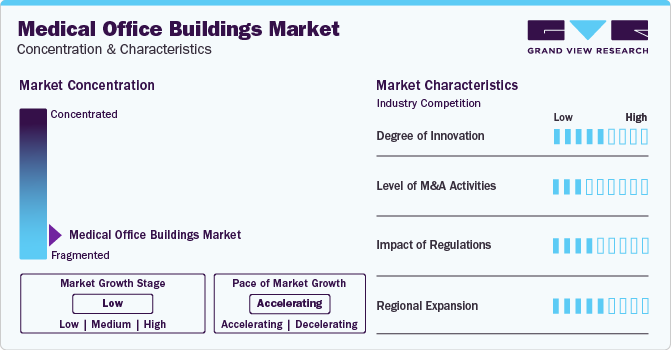

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, level of mergers & acquisition activities, impact of regulations, and regional expansion.

The medical office buildings (MOBs) are experiencing moderate innovation, majorly driven by the increasing demand for better customer experiences and community-based healthcare. Property Technology (PropTech) investments are growing for MOBs to meet the evolving needs of patients and healthcare providers. Integrating technology, such as intelligent building digital signage, wall displays, or interactive kiosks, enhances the patient experience, provides valuable information, and creates an environment for patients, visitors, and caregivers.

The level of M&A activities in the industry is expected to remain high over the forecast period. These activities are consolidating market presence and shifting the trends towards multispecialty healthcare, and patient-centric care. According to the statistics published by Irving Levin Associates LLC in April 2023, in the U.S., the M&A activities in the MOB industry increased by 13.7% in the first quarter of 2023 and reported an increase of 5% compared to the first quarter of 2022.

Regulations have a significant impact on the MOBs, influencing rents, sales prices, and the landscape of the market. The regulatory environment impacts factors, such as compliance with healthcare laws, building codes, zoning regulations, and accessibility standards. Regulations increase the costs for property owners, especially when meeting specific healthcare standards for clinical support, structural requirements, and safety measures such as HIPAA and OSHA guidelines in the U.S.

Regional expansion is low in the industry. However, with the shift toward suburban areas and Tier-II cities, due to changing demographics, easy access to technology, and the need for modern healthcare infrastructure, the industry is expected to witness a high degree of geographical expansion. Healthcare providers focus on creating a wider geographic footprint to reach new patients and cater to emerging opportunities in different regions.

Type Insights

The physician offices type segment accounted for the largest revenue share of 85.18% in 2023. This can be attributed to the growing demand from physicians to build successful physician practices. Physician practices have longer occupancy duration and lower frequency of relocation than general office tenants, leading to more stable occupancy and revenue streams for property owners. Moreover, the increasing competition for new patients is driving health service providers to shift towards off-campus locations, including community retail settings, leading to the development of smaller suburban MOBs.

The Ambulatory Surgery Centers (ASCs) segment is expected to witness the fastest growth rate from 2024 to 2030. The demand for MOBs with ASCs is increasing globally owing to the growing trend of ambulatory care centers and outpatient procedures, and the high growth potential of ASCs. Many MOBs are setting up ASCs in the facilities to cater to the growing ASC industry, contributing to market growth. For instance, in June 2023, Remedy Medical Properties and Medical Facilities Holdings (MFH) completed the building of an MOB of 59,741 sq. ft. with a new ASC for Physician Surgical Network Affiliates (PSN) in Westover Hills, U.S.

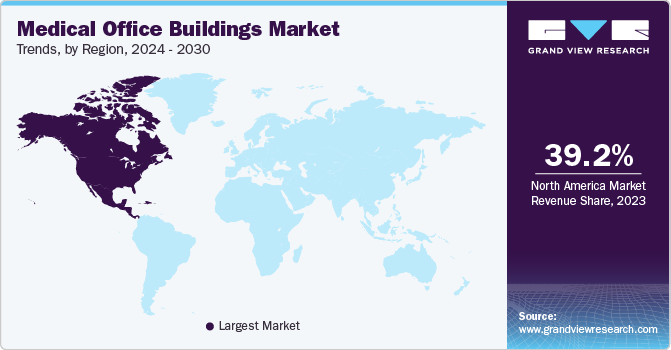

Regional Insights

The North America medical office buildings market dominated the global market with the largest revenue share of 39.16% in 2023. This is due to well-established healthcare infrastructure, high demand for healthcare services, and the need for efficient management & maintenance of healthcare facilities in the region. In addition, rising demand for better healthcare services and the need to reduce operational costs are expected to contribute to regional market growth.

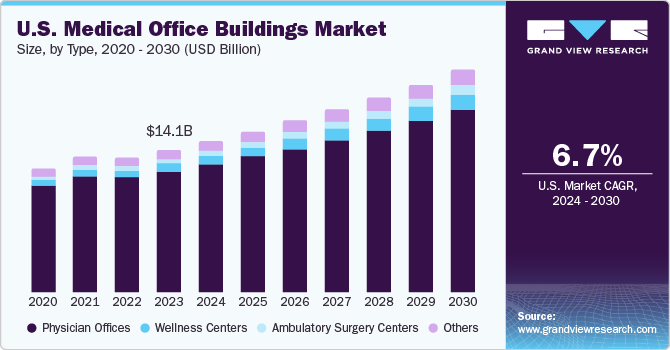

U.S. Medical Office Buildings Market Trends

The medical office buildings market in the U.S. held a significant share in 2023 owing to longer tenant tenure, specific buildout directives for tenants, and increasing trend of healthcare providers moving to off-campus sites such as community retail locations.

Europe Medical Office Buildings Market Trends

The Europe medical office buildings market is expected to witness significant growth in the coming years, owing to increasing demand for healthcare services and the need for modern healthcare infrastructure. The region has a strong presence of leading manufacturers of modular healthcare construction, which focus on innovative green building module activities to enhance construction and promote isolated modules in remote locations. This is expected to boost industry growth and support the development of MOBs.

The medical office buildings market in the UK is expected to witness significant growth owing to the increasing demand for medical office space on account of the aging population and advances in healthcare technology. The market typically has a low vacancy rate, with stable tenants occupying the properties for long periods, making it an attractive investment opportunity for investors.

The Germany medical office buildings market is expected to witness considerable growth over the forecast period due to the growing shift towards ambulatory care. Moreover, the use of portable and re-locatable modules, with the implementation of intelligent design services and clinic designs is contributing to market growth.

Asia Pacific Medical Office Buildings Market Trends

The medical office buildings market in Asia Pacificis shifting towards modern and technologically advanced facilities, focusing on patient-centric care. Telemedicine and digital health technologies is expected to drive the demand for MOBs equipped with advanced IT infrastructure.

The India medical office buildings market is expected to witness significant growth in the coming years owing to the rising patient burden on hospitals and demand for healthcare space to cater to the growing population.

The medical office buildings market in Australia is expected to register a moderate growth rate from 2024 to 2030 owing to low volatility, long leases, and strong demographic tailwinds, making it attractive for private and institutional investors.

Latin America Medical Office Buildings Market Trends

The Latin America medical office buildings market growth is expected to be driven by rising healthcare expenditure and government initiatives to improve access to quality care services. Rapid urbanization and rising population are increasing the demand for medical facilities, leading to investments in new construction and refurbishment of existing properties.

The medical office buildings market in Brazil is witnessing demographic shifts, including an aging population and changing healthcare needs, contributing to the demand for facilities offering comprehensive medical services.

Middle East & Africa Medical Office Buildings Market Trends

The medical office buildings market in Middle East & Africa is expected to witness significant growth over the forecast period. Rapid population growth and urbanization in cities, such as Dubai and Riyadh, are driving demand for modern healthcare infrastructure, leading to the development of state-of-the-art MOBs in the region.

The Saudi Arabia medical office buildings market held a significant share of the MEA market in 2023 owing to the government's encouragement of Public-Private Partnerships (PPP) models in healthcare infrastructure development, attracting private investors and developers to participate in the construction and management of MOBs.

Key Medical Office Buildings Company Insights

The medical office buildings market is a growing and competitive sector. The competition is increasing, with traditional offices being converted to medical offices in areas where demand is especially high. The market is witnessing an increase in investment in infrastructure, particularly in developing countries, such as Africa and Middle East, where the construction and infrastructure sectors are on the rise.

Key Medical Office Buildings Companies:

The following are the leading companies in the medical office buildings (MOBs) market. These companies collectively hold the largest market share and dictate industry trends.

- PCL Construction Enterprises

- Swinerton

- Skanska

- Clark Group

- Hensel Phelps

- James G. Davis Construction

- Andersen Construction

- Adolfson & Peterson Construction

- Pepper Construction

- HKS Inc

- DPR Construction

- McCarthy Building Companies, Inc.

Recent Developments

-

In August 2023, Skanska completed the Samaritan Court Ambulatory Care and Surgery Center of Sutter Health. The facility is 69,000 sq. ft. MOB, offering affordable, convenient, and connected care in the U.S.

-

In August 2022, Hensel Phelps completed Kaiser Permanente Springfield Replacement MOB. The new facility includes a retail pharmacy, outpatient clinic, clinical laboratory, nurse clinic, physical therapy, and imaging area

Medical Office Buildings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 42.28 billion

Revenue forecast in 2030

USD 62.18 billion

Growth rate

CAGR of 6.64% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

PCL Construction Enterprises; Swinerton; Skanska; Clark Group; Hensel Phelps; James G. Davis Construction; Andersen Construction; Adolfson & Peterson Construction; Pepper Construction; HKS Inc.; DPR Construction; McCarthy Building Companies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Office Buildings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global medical office buildings market report on the basis of type, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Physician Offices

-

Ambulatory Surgery Centers

-

Wellness Centers

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical office buildings market size was estimated at USD 39.79 billion in 2023 and is expected to reach USD 42.28 billion in 2024.

b. The global medical office buildings market is expected to grow at a compound annual growth rate of 6.64% from 2024 to 2030 to reach USD 62.18 billion by 2030.

b. The physician offices segment dominated the medical office building market with a share of 85.18% in 2023. This can be attributed to the growing demand from physician’s to build successful physician practices.

b. Some key players operating in the medical office buildings market include PCL Construction Enterprises, Swinerton, Skanska, Clark Group, Hensel Phelps, James G. Davis Construction, Andersen Construction, Adolfson & Peterson Construction, Pepper Construction, HKS Inc, DPR Construction, and McCarthy Building Companies, Inc.

b. Key factors that are driving the medical office building market growth include increasing demand for healthcare services globally. With growing populations and aging demographics, the need for accessible and modern healthcare facilities is increasing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."