- Home

- »

- Advanced Interior Materials

- »

-

Medical Injection Molding Market Size & Share Report, 2030GVR Report cover

![Medical Injection Molding Market Size, Share & Trends Report]()

Medical Injection Molding Market (2024 - 2030) Size, Share & Trends Analysis Report By System (Hot Runner, Cold Runner), By Material (Plastics, Metal), By Product (Patient Aids, Dental Products), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-756-8

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Injection Molding Market Summary

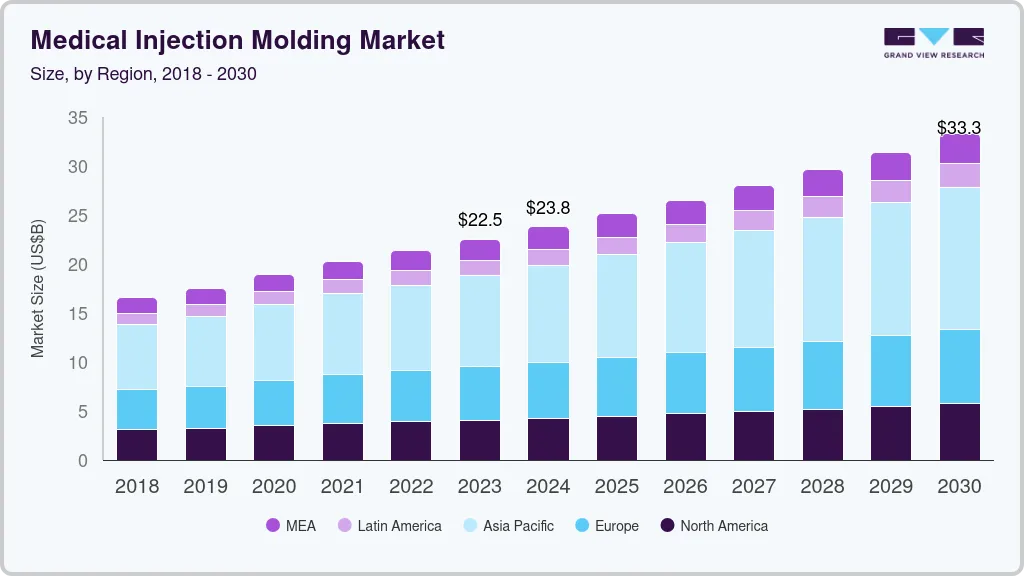

The global medical injection molding market size was estimated at USD 22.54 billion in 2023 and is projected to reach USD 33.28 billion by 2030, growing at a CAGR of 5.8% from 2024 to 2030. Increasing consumption of plastics in healthcare applications, technological advancements, and rising demand for medical disposable products are the major factors driving the growth of the market.

Key Market Trends & Insights

- Asia Pacific region dominated the market with a 41.2% share in 2023.

- The availability of skilled labor and advancements in injection molding technologies in countries like China and India are fueling the region's prominence as a manufacturing hub for medical devices.

- By material, plastics segment led the market with a revenue share of 97.6% in 2023.

- By product, medical equipment components segment led the market's global revenue in 2023.

- By system, hot runner system segment led the market in 2023 in terms of revenue share.

Market Size & Forecast

- 2023 Market Size: USD 22.54 Billion

- 2030 Projected Market Size: USD 33.28 Billion

- CAGR (2024-2030): 5.8%

- Asia Pacific: Largest market in 2023

Moreover, factors driving the growth of the market include a surge in the incidence of cardiovascular and respiratory diseases, growing awareness about the medical injection molding process, and improving healthcare infrastructure in emerging economies. In addition, supportive government policies and laws of the countries are boosting the growth of the market.The medical industry's increasing reliance on plastic components for various devices and equipment has propelled the demand for injection molding processes. This surge is particularly evident in the production of medical devices such as syringes, IV components, diagnostic equipment, and surgical instruments, where the versatility and cost-effectiveness of plastic injection molding play a crucial role.

One significant driver is the ongoing trend toward miniaturization and the demand for intricate, complex designs in medical devices. Plastic injection molding allows for the precise manufacturing of small, detailed components that are vital for the functionality and efficiency of modern medical equipment. The ability to produce high-precision parts with tight tolerances makes plastic injection molding an ideal choice for meeting the stringent requirements of the medical industry.

The versatility of plastic materials used in injection molding is a key factor contributing to its widespread adoption in the medical sector. The availability of medical-grade plastics with superior biocompatibility, sterilization capabilities, and chemical resistance ensures that the final components meet the stringent safety and regulatory standards set by health authorities. These materials also offer the advantage of being lightweight, which is crucial for applications like wearable medical devices and portable equipment.

The demand for personalized and patient-specific medical solutions is on the rise. Injection molding facilitates the production of customized components, enabling manufacturers to create devices tailored to individual patient needs. For instance, prosthetics, orthopedic implants, and dental appliances often require bespoke components, and injection molding provides the necessary flexibility and precision to meet these specific requirements. These aforementioned factors are expected to augment the market demand over the forecast period.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. Medical devices often require intricate and complex components to ensure their functionality and reliability. Injection molding processes excel in delivering precise, repeatable results, making them well-suited for meeting the stringent specifications and quality standards of the medical sector. Material versatility is another defining feature of the market. Medical injection molding allows for the use of diverse range of materials, including various medical-grade plastics and biocompatible polymers. This flexibility in material selection is crucial for addressing the specific requirements of different medical applications, ensuring that the final components are not only functional but also safe for use in a healthcare setting.

The market also reflects a growing demand for miniaturization in medical devices. As technology advances, there is an increasing need for smaller, lighter components that can be integrated into compact and portable medical devices. Injection molding's capability to produce intricate, small-scale parts with high precision, positions it as a key manufacturing process to meet this demand for miniaturization. Moreover, cost-effectiveness is a significant characteristic of the medical injection molding industry. The ability to produce components in large quantities with minimal material waste and reduced production cycles makes injection molding an economically viable option for medical device manufacturers. This efficiency is essential for meeting the cost containment pressures faced by the healthcare industry.

Furthermore, regulatory compliance such as U.S. FDA is a critical aspect shaping the market. The medical sector is subject to stringent regulations and standards to ensure the safety and efficacy of devices. Medical injection molding processes and materials must adhere to these regulatory requirements, making it imperative for manufacturers to invest in processes that guarantee compliance.

Product Insights

Medical equipment components led the market's global revenue in 2023. The rising demand for medical injection molding in the manufacturing of medical equipment is propelled by various crucial factors. As the healthcare sector advances, there is an increasing requirement for cutting-edge and intricate medical devices, and injection molding provides an exceptionally efficient and accurate production process to fulfill these requirements. The capability of injection molding to create detailed and complex components is essential for the innovation of diverse medical equipment, spanning from diagnostic devices and surgical instruments to wearable technologies. Moreover, the adaptability of materials employed in injection molding, particularly medical-grade plastics, and biocompatible polymers, guarantees that the produced components adhere to strict safety and regulatory standards.

Patient aids, encompassing a wide range of devices such as prosthetics, orthopedic supports, and mobility aids, require intricate, customized components that can be efficiently and precisely manufactured. Medical injection molding allows for the production of complex geometries and tailored designs, contributing to the development of patient aids that are both functional and comfortable for individual needs. The versatility of materials used in injection molding, including specialized polymers and biocompatible materials, ensures that the final products meet the necessary safety and regulatory standards for prolonged patient use. In addition, the cost-effectiveness and scalability of injection molding enable the efficient production of patient aids on a large scale, addressing the increasing demand for personalized and high-quality medical solutions. As patient-centric care becomes a focal point in healthcare, medical injection molding plays a crucial role in providing innovative and effective patient aids that enhance the quality of life for individuals with various healthcare needs.

Regional Insights

Asia Pacific region dominated the market with a 41.2% share in 2023. The region's expanding population, coupled with rising healthcare needs, is driving the demand for advanced medical devices and components, spurring the adoption of injection molding technologies. The increasing prevalence of chronic diseases and the necessity for cost-effective and precise manufacturing processes in the healthcare sector further contribute to the market's growth. In addition, the availability of skilled labor and advancements in injection molding technologies in countries like China and India are fueling the region's prominence as a manufacturing hub for medical devices.

The increasing number of plastic medical injection molding manufacturers in the U.S., rising demand for medical devices, and growing healthcare expenditures are some of the factors driving the regional market. For instance, EG Industries manufactures plastic injection molds for drug delivery and other medical applications. To strengthen medical device safety and performance requirements, the regulatory framework for the medical device industry in Europe is being modified. As a result, the demand for recyclable, novel, high-quality, and biocompatible plastics in medical devices is anticipated to rise over the forecast period, thereby supporting market growth. For instance, PureLab Plastics offers customized medical products, such as micro-syringes, connection components, and capillary pistons to healthcare providers as per their requirements.

Material Insights

Plastics material led the market with a revenue share of 97.6% in 2023. Achieving unique designs for medical-grade products, parts, equipment, and tools necessitates a fabrication process that adheres to stringent medical cleanliness standards while also accommodating complex designs. Plastic injection molding emerges as a viable technique for producing intricate designs in medical products. The demand for medical-grade injection-molded products is on the rise due to their durability, inherent resistance to contaminants and chemicals, and the economic advantages they provide to large-scale manufacturing firms.

Plastic medical injection molding has become integral to the healthcare industry, driven by its unparalleled precision, versatility, and cost-effectiveness in producing a wide range of medical devices and components. This manufacturing process allows for the creation of intricate and complex plastic parts used in applications such as syringes, diagnostic equipment, and surgical instruments. The ability to use medical-grade plastics with superior biocompatibility, sterilization capabilities, and chemical resistance ensures compliance with stringent safety standards. Moreover, the scalability and efficiency of plastic injection molding contribute to cost-effective mass production, meeting the growing demand for high-quality, customized medical solutions while adhering to the industry's rigorous regulatory requirements.

Metal medical injection molding, a sophisticated manufacturing process, is gaining prominence in the healthcare sector for its ability to produce intricate and high-precision metal components used in various medical devices. Leveraging a combination of powder metallurgy and plastic injection molding techniques, this method allows for the production of complex geometries and small-sized parts, crucial for applications such as orthopedic implants, surgical instruments, and dental prosthetics. The versatility of using biocompatible metal alloys, including stainless steel and titanium, ensures compliance with stringent safety and regulatory standards in the medical industry.

System Insights

Hot runner system led the market in 2023 in terms of revenue share. The growth is attributed to a number of system benefits, including shorter cycle times and lower pressure requirements to force the molten mixture into the mold cavity, waste elimination due to the removal of runners, the housing of larger parts with higher production volumes, and improvements in part uniformity and quality. The demand for hot runner systems is increasing owing to several benefits such as quicker cycle time & lower pressure requirement to push the molten mixture into the mold cavity as well as the elimination of waste due to the absence of runners, accommodation of larger parts with a higher volume of production, and improvement in consistency & quality of parts. Thus, these factors are anticipated to drive segment growth.

The adoption of cold runner systems is driven by their advantageous features, characterized by ease of maintenance, cost-effectiveness, and compatibility with a diverse range of polymers. This method stands out for its ability to produce high-quality parts, making it a preferred choice in various applications. The rapid expansion of the utilization of cold runner systems is attributed to their lower initial investments compared to alternative systems. The attractiveness of these systems lies in their flexibility in design options, capacity to handle a variety of engineered thermoplastics, and the ease of changing or upgrading gate locations.

Key Companies & Market Share Insights

Some of the key players operating in the market include Arburg GmbH + Co KG, Engel Austria GmbH, and Milacron.

-

Arburg GmbH + Co. KG designs and manufactures injection molding machines and their spare parts for use in plastic processing applications. The company also provides engineering and consulting services, as well as offers individual project support for installing and maintaining injection molding machines. It offers a wide range of products and services such as hydraulic machines, hybrid machines, electric machines, cube machines, vertical machines, and accessories. It offers its products and services to automotive, electronics, packaging, medical, robotic, and consumer goods end-use industries. It provides a wide range of consulting services such as turnkey consulting, applications technology, and production efficiency and management. The company operates in 36 locations and maintains trading partnerships in over 100 countries.

-

Milacron, LLC offers a full-line product portfolio comprising injection molding machines, extrusion & blow molding equipment, and hot runner systems. Apart from these products, it also offers mold bases & components, process control systems, and MRO supplies for fluid technology and plastic processing equipment. The company provides a variety of products encompassing servo-hydraulic, all-electric, or low-pressure injection systems, offering a comprehensive range of plastics-processing technologies such as multi-component and co-injection. With clamp capacities ranging from 17 to 7,650 tons, the company's machines manufacture a wide spectrum of products, from precise medical components to large structural plastic items. Furthermore, in 2019, Hillenbrand completed the acquisition of Milacron, ushering in a new era for the company and strengthening its capacity to serve customers and pioneer innovative technologies.

-

C&J Industries, HTI Plastics, and Currier Plastics, Inc. are some of the emerging market participants in the market.

-

C&J INDUSTRIES was established in 1962 and is headquartered in Pennsylvania, U.S. The company is involved in plastic injection molding and contract manufacturing. It specializes in high precision injection molded components and assemblies. The company uses the latest technologies in both specialized disciplines. It is a vertically integrated plastic contract manufacturer. The company provides various services such as plastic contract manufacturing, medical contract manufacturing, plastic injection molding, medical injection molding, plastic product design & development, injection mold & spare tooling services, and tooling gauges & fixtures. It also offers long-term security such as a 10-year mold warranty on production tools built by them.

-

HTI Plastics was established in 1985 and is headquartered in Nebraska, U.S. It manufactures quality injection molded products. The company was acquired by PCE, Inc. to expand its plastics division. Its advanced technology consists of injection molding processes, robotic technology, and machines. The company also offers on-site design ensuring satisfaction. It has over 30 injection molding machines in its manufacturing facility. This company has been involved in medical device manufacturing business for more than 30 years. It manufactures numerous injection molded products for a wide range of industries including medical, healthcare, packaging, agriculture, and consumer goods.

Key Medical Injection Molding Companies:

- C&J Industries

- All-Plastics

- Biomerics

- HTI Plastics

- The Rodon Group

- EVCO Plastics

- Majors Plastics, Inc.

- Proto Labs, Inc.

- Tessy Plastics

- Currier Plastics, Inc.

- Formplast GmbH

- H&K Müller GmbH & Co. KG

- Hehnke GmbH & Co KG

- TR Plast Group

- D&M Plastics, LLC.

Recent Developments

-

In October 2023, C&J Industries, a manufacturer specializing in custom injection molding and medical devices, revealed the acquisition of a 53,000-square-foot building and its corresponding property in Meadville, PA.

-

In September 2023, Milacron, a prominent player in the global plastics technology and processing industry, provided the injection molding machine to its longstanding customer, 20/20 Custom Molded Plastics, LLC, located in Holiday City, Ohio.

-

In August 2021, HTI Plastics acquired a new 420-Ton Engel injection molding press featuring an integrated Engel Viper 20 robot. This versatile press, with the ability to manufacture products across various applications, will enhance HTI's already impressive lineup of injection molding machines, ensuring the company remains at the forefront of technological advancements. The addition of this press will enable HTI to broaden its services across different areas, ultimately benefiting HTI's customers.

Medical Injection Molding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.78 billion

Revenue forecast in 2030

USD 33.28 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2023

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, system, product, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

C&J INDUSTRIES; All-Plastics; Biomerics; HTI Plastics; The Rodon Group; EVCO Plastics; Majors Plastics, Inc.; Proto Labs, Inc.; Tessy Plastics; Currier Plastics, Inc.; Formplast GmbH; H&K Müller GmbH & Co. KG; Hehnke GmbH & Co KG; TR Plast Group; D&M Plastics, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Injection Molding Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical injection molding market report based on product, system, material, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medical Equipment Components

-

Consumables

-

Patient Aids

-

Orthopedics Instruments

-

Dental Products

-

Others

-

-

System Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hot Runner

-

Cold Runner

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plastics

-

Metals

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global medical injection molding market size was estimated at USD 22.54 billion in 2023 and is expected to be USD 23.78 billion in 2024.

b. Asia Pacific region dominated the market and accounted for 41.2% share in 2023. he region's expanding population, coupled with rising healthcare needs, is driving the demand for advanced medical devices and components, spurring the adoption of injection molding technologies. The increasing prevalence of chronic diseases and the necessity for cost-effective and precise manufacturing processes in the healthcare sector further contribute to the market's growth.

b. Some of the key players operating in the medical injection molding market include C&J INDUSTRIES; All-Plastics; Biomerics; HTI Plastics; The Rodon Group; EVCO Plastics; Majors Plastics, Inc.; Proto Labs, Inc.; Tessy Plastics; Currier Plastics, Inc.; Formplast GmbH; H&K Müller GmbH & Co. KG; Hehnke GmbH & Co KG; TR Plast Group; D&M Plastics, LLC.

b. The global medical injection molding market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 33.28 billion by 2030.

b. Increasing consumption of plastics in healthcare applications, technological advancements and rising demand for medical disposable products are the major factors driving the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.