- Home

- »

- Medical Devices

- »

-

Medical Simulation Market Size, Share, Growth Report, 2030GVR Report cover

![Medical Simulation Market Size, Share & Trends Report]()

Medical Simulation Market (2025 - 2030) Size, Share & Trends Analysis Report By Product & Services (Healthcare Simulation Software, Simulation Training Services), By Technology, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-582-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Simulation Market Summary

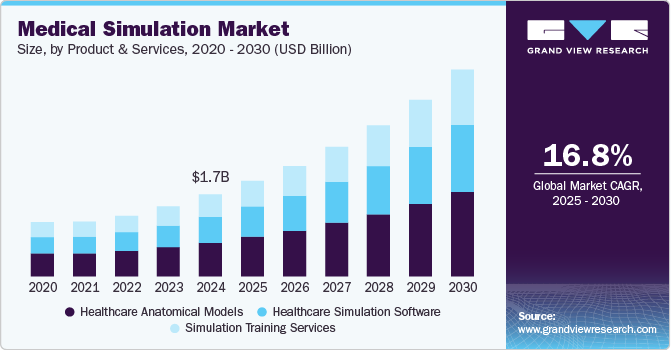

The global medical simulation market size was estimated at USD 1.65 billion in 2024 and is projected to reach USD 4.17 billion by 2030, growing at a CAGR of 16.80% from 2025 to 2030. The market's growth is driven by various factors, such as the rising awareness of medical simulation benefits in emerging economies, focus on patient safety, and the need for healthcare professionals to improve their skills in a safe environment, increasing the demand for simulation technologies.

Key Market Trends & Insights

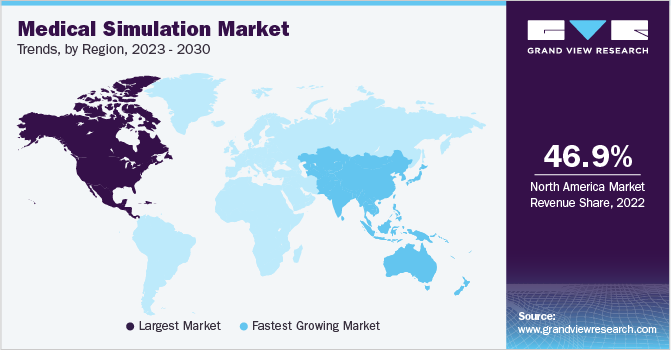

- North America dominated the medical simulation market, with the largest revenue share of 46.50% in 2024.

- The medical simulation market in the U.S. accounted for the largest share in North America in 2024.

- By product & services, the healthcare anatomical models segment dominated the market, with the largest revenue share of 41.58% in 2024.

- By technology, the 3D printing segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.65 Billion

- 2030 Projected Market Size: USD 4.17 Billion

- CAGR (2025-2030): 16.80%

- North America: Largest market in 2024

Furthermore, the growing significance of various health apps, medical visualization, and preventive medicine is increasing the penetration of advanced technologies in medical simulation. This, in turn, is likely to fuel the market growth.

Simulation-based training and certification for healthcare professionals can improve patient safety and outcomes, leading to a larger market than the current education-based market. According to a WHO report, unsafe care is a leading cause of death and disability worldwide, with up to 134 million adverse events occurring in hospitals in low- and middle-income countries, resulting in approximately 3 million deaths annually. One in 10 patients in high-income countries experiences an adverse event while receiving hospital care, emphasizing the need for safer healthcare practices worldwide.

Furthermore, according to the World Health Organization (WHO), 55 countries are experiencing a significant shortage of health workers, with a potential deficit of 10 million healthcare staff by 2030, particularly in low- and lower-middle-income countries. However, countries at all levels of socioeconomic development face challenges in the employment, deployment, education, retention, and performance of their healthcare workforce. The pandemic has heightened these challenges, which has further stretched the already inadequate supply of these valuable healthcare professionals.

Medical simulation has been found to enhance clinical competency, improve patient outcomes, and minimize medical errors. This growing body of evidence suggests that simulation-based training can help in mitigating the escalating healthcare costs. With the world becoming more aware of the benefits of healthcare simulation, this technology is expected to become even more relevant in the future. It helps save lives in both steady-state healthcare and during a crisis.

Moreover, Virtual Reality (VR) technology has made significant advancements in recent years, with increased availability and reduced hardware costs. As a result, many of the initial challenges in adopting VR have diminished. However, one of the commonly identified gaps in immersive VR training for medical education is the confidence in the long-term validity of the applications, particularly in training using Virtual Reality-Head Mounted Display (VR-HMD). Vantari VR, a medical virtual reality company, has found that virtual training reduces medical errors by an impressive 40%. The University of Wollongong (UOW) conducted tests in partnership with Vantari VR in June 2022 and found that the company's training software led to a 32% improvement in student clinicians' performance and a 39% increase in their adherence to safety & hygiene protocols. These results showcase the potential for virtual reality technology to revolutionize medical education & improve patient outcomes.

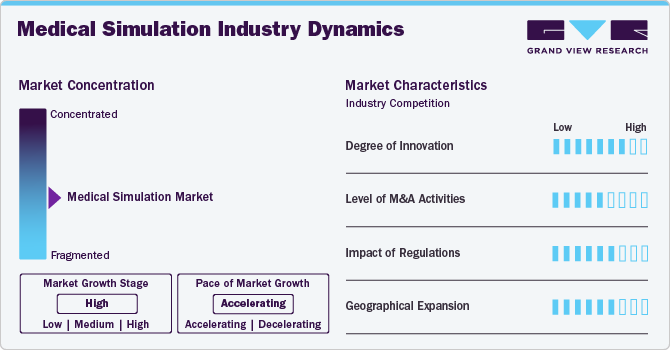

Market Concentration & Characteristics

The degree of innovation in the medical simulation industry is high. The innovation is due to increasing adoption of AI/ML, VR, and other technologies to advance the medical simulation devices. For instance, in December 2023, the Irish government launched a free VR learning system for nursing education developed by the University of Galway, Ireland. It is funded through the ERASMUS+ program and ViReTrain. The project is an innovative teaching strategy for faculty and academics working in nursing education.

Industry players implement various business strategies to increase revenues, promoting global growth of the medical simulation industry. The market players undertake partnerships, mergers & acquisitions, and product launches to expand their product portfolio, further contributing to the industry growth. For instance, in July 2023, Limbs & Things Ltdannounced the acquisition of eoSurgical, a software specialist and laparoscopic surgical trainer.

The medical simulation companies are mandated to abide by several regulations. Governments are introducing new frameworks to regulate the medical simulation industry. For instance, in November 2023, the FDA published final guidance titled Assessing the Credibility of Computational Modeling and Simulation in Medical Device Submissions. This guidance provides a framework for manufacturers to demonstrate the credibility of CM&S models used to support regulatory submissions for medical devices. The guidance specifically applies to physics-based or mechanistic CM&S models and excludes standalone machine learning or artificial intelligence-based models.

Companies within the medical simulation industry seek geographic expansion strategies to maintain their position in emerging markets, attracting customers from these regions. For instance, in October 2023, Operative Experience, Inc.opened a new office in Germany. This expansion was planned to increase its presence in the Middle East and Europe.

Product & Services Insights

The healthcare anatomical models segment dominated the market, with the largest revenue share of 41.58% in 2024. The growth of this segment can be attributed to the increasing focus on patient safety and effective treatment. Furthermore, 3D printing technology is gaining popularity in healthcare settings due to its wide range of applications, including diagnostics, surgical planning, and patient education with anatomical models.

Thus, collaborations between medical institutions, technology developers, and anatomical model manufacturers have developed more advanced and effective simulation tools. For instance, in May 2022, Ricoh USA and Stratasys partnered to offer point-of-care anatomical modeling services to healthcare facilities. Ricoh launched its Ricoh 3D for healthcare program in 2021, which utilizes Stratasys technology to provide medical providers and hospitals with access to 3D-printed, patient-specific anatomical models.

The healthcare simulation software segment is expected to grow at the fastest CAGR of 17.48% during the forecast period. The healthcare simulation software helps in recording audio & video of procedures, annotation, and debriefing. The software records feedback to help assess performance, specifically during training. The increasing recognition of simulation training as an effective healthcare education and skill development method has driven the demand for healthcare simulation software. For instance, in October 2023, Lumeto launched a conversational AI system for healthcare simulation that uses a Large Language Model (LLM) to generate more realistic and practical virtual human responses, animations, & interactions. The technology has been fully integrated into the Involve XR platform, and it has the potential to enhance healthcare simulation programs greatly.

Technology Insights

The 3D printing segment dominated the market with the largest revenue share in 2024. The insights gained from 3D printing simulation contribute to continuous improvement in the printing process. Users can learn from simulations, refine their approaches, and apply best practices to future printing projects. 3D printing simulation allows students and professionals to learn about the intricacies of the 3D printing process, experiment with different parameters, and understand how design choices impact the final product.

Moreover, companies are undertaking various strategic initiatives to sustain their position in the market, which also boosts market growth. For instance, in April 2023, 3D Systems and Clarkson College collaborated to create a 3D Printing and Training Center of Excellence for healthcare innovation, education, and patient care. The partnership aims to make 3D printing and visualization accessible to healthcare facilities in the Omaha region.

The virtual patient simulation segment is expected to grow at the fastest CAGR during the forecast period. This growth is driven by increasing focus on patient safety, growing demand for minimally invasive treatments, technological innovations, and increasing efforts by governments to offer high-quality patient care.

Moreover, advancements in medical simulation technology are also expanding its applications in healthcare training for professionals, further fueling the market growth. For instance, in May 2023, SimX Virtual Reality Platform released a sepsis scenario for medical simulation. SimX is a virtual reality medical simulation program that offers a range of cases to test learners' abilities to identify and manage medical emergencies while improving their communication & patient management skills.

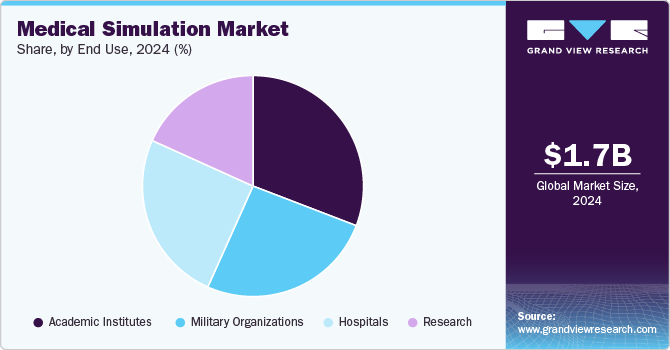

End Use Insights

The academic institutes segment dominated the market with the largest revenue share in 2024. Technological advancements and the need for better patient outcomes drive the requirement for and popularity of Simulation-Based Medical Education (SBME). Furthermore, introducing novel medical simulation models, such as simulation manikins, is expected to boost market growth.

Simulation manikins train students and medical practitioners in various medical scenarios. These training modalities aim to enhance medical practitioners' clinical skills and competence, making them better prepared to deliver high-quality patient care. For instance, in November 2023, CPS Mumbai launched a modern Simulation Lab to train medical professionals. Equipped with advanced resources and technology, the lab features simulation manikins for various medical disciplines, such as Ares, Lucina, and Arya.

The hospitals segment is expected to grow at the fastest CAGR during the forecast period. Various factors responsible for the growth include the gradual shift of focus to advanced learning, the advent of advanced simulation-based technologies, the full utilization of simulation models in medical surgeries, the rising focus on minimizing errors, and the cost-effectiveness of procedural training for physicians. For instance, in September 2023, The University of Limerick and UL Hospitals Group launched a simulation facility at University Hospital Limerick to train doctors, nurses, and allied health professionals for clinical procedure training.

Regional Insights

North America dominated the medical simulation market, with the largest revenue share of 46.50% in 2024. The growth is attributed to the regionwide presence of key players and their high investments in technology. Moreover, key regional hospitals and health systems are undertaking strategic initiatives, such as education and training programs, to provide students & professionals with the ability to develop skills in a realistic environment. For instance, in July 2023, the U.S. Department of Defense announced the launch of a new Healthcare Simulation and Bioskills Center at Naval Medical Center Camp Lejeune. This center aims to support medical professionals with operational and clinical education.

U.S. Medical Simulation Market Trends

The medical simulation market in the U.S. accounted for the largest share in North America in 2024 due to the introduction of several product & services, supportive government policies, increasing frequency of chronic conditions, technical improvements, and the presence of key companies. For instance, in September 2023, the Des Moines Fire Department (DMFD) and the Simulation in Motion-Iowa (SIM-IA), a simulation clinical learning program by the University of Iowa, launched a medical simulation training truck. This simulation truck featured an ambulance box, video recording for analysis & debriefing, four human patient simulators, and a simulated emergency bay to provide high-quality, evidence-based clinical education to hospital professionals & EMS across the state.

Europe Medical Simulation Apps Market Trends

The growth in the medical simulation market in Europe can be attributed to an advanced healthcare system in the European Union (EU). Factors contributing to this growth include continuous technological advancements, increasing concerns over patient safety, and the rising demand for minimally invasive treatments. Furthermore, private players largely provide medical simulation training services in Europe, further contributing to the regional market growth. For instance, in January 2024, EuroMedSim announced the launch of a book named To Err is Human, To Teach VR. Virtual Reality and Artificial Intelligence in Medical Education (Maxim Gorshkov - Stuttgart: EuroMedSim, 2024. - 272 p.). The book focuses on using virtual patients, trainers, simulators, and artificial intelligence (AI)-based systems in medical education.

The medical simulation market in Germany is expected to witness substantial growth owing to a strong national commitment to health IT, which involves strategy and adoption of simulation & models for training and learning purposes by healthcare professionals. In addition, the country's growth can be attributed to the presence of market players undertaking several initiatives. For instance, in August 2023, 3B Scientific, a medical simulation product and anatomical model manufacturer and marketers acquired Lifecast Body Simulation. This acquisition aims to strengthen the global distribution and manufacturing of medical and healthcare education.

The UK medical simulation market is experiencing growth due to increasing funding to upgrade healthcare infrastructure and the rising demand for medical simulation. This funding allows for the developing and implementing of advanced simulation technologies and training programs. For instance, in December 2023, The University of Reading opened a new clinical training facility to provide NHS staff and students with vital learning experiences in a simulated hospital environment. The new facility was built with funding of USD 2.8 million (£2.6m) granted by the office for students.

Asia Pacific Medical Simulation Market Trends

Medical simulation market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period due to the increasing demand for innovative technologies, minimally invasive treatments, and patient safety solutions. In addition, the market in the region is experiencing growth due to increasing focus on integrating advanced technology into medical personnel training, growing emphasis on patient safety, expanding infrastructure, large population bases, and rapid economic development in countries such as China, India, & South Korea.

The medical simulation market in China is expected to grow significantly during the forecast period. The growth is due to the government having established action plans for deploying new innovative technology related to healthcare services in China, including 3D printing and telehealth. Furthermore, several workshops and summits are undertaken by academic & research institutes for therapy simulations to educate healthcare professionals. For instance, the 7th China Neuromonitoring Workshop and the 7th Chinese Research Hospital Association Thyroid Disease Summit were held in March 2022 in Zhengzhou. One of the sessions was a virtual simulation on neuromonitoring technology hosted by professors from the China-Japan Alliance Hospital of Jilin University.

The Japan medical simulation market dominated Asia Pacific in 2024. Advancements in healthcare education, increased emphasis on patient safety, shortage of clinical training opportunities, and increasing healthcare expenditure are expected to boost the market growth in Japan over the forecast period. Moreover, the adoption of innovative technology, 3D printing, healthcare IT, and virtual reality in simulation for learning & training for healthcare professionals to reduce medical errors & improve patient outcomes is driving the market in Japan.

Key Medical Simulation Company Insights

The companies in the medical simulation market are actively involved in various strategic initiatives, such as partnerships, product launches, and acquisitions. Some of the strong players in the market are CAE, Inc.; Laerdal Medical; and 3D Systems, Inc. These companies offer a variety of medical simulation products to cater to diverse healthcare domains, such as training, emergency care, nursing and patient care, and catheterization, among others.

Key Medical Simulation Companies:

The following are the leading companies in the medical simulation market. These companies collectively hold the largest market share and dictate industry trends.

- CAE, Inc. (Madison Industries acquired CAE healthcare division in October 2023)

- Laerdal Medical

- 3D Systems, Inc.

- Simulab Corporation

- Limbs & Things Ltd

- Simulaids

- Kyoto Kagaku Co., Ltd

- Gaumard Scientific

- Mentice

- Surgical Science Sweden AB

- Intelligent Ultrasound

- Operative Experience, Inc.

- Cardionics, Inc.

- VirtaMed AG

- SYNBONE AG

- IngMar Medical

- TruCorp

- KaVo Dental

- Simendo

- Haag-Streit

- Symgery

- HRV Simulation

- Synaptive Medical

- Inovus Limited

Recent Developments

-

In January 2024, Laerdal Medical announced a global distribution partnership with SIMCharacters, an Austrian company specializing in neonatal simulation technology. The partnership aims to revolutionize medical training and enhance healthcare simulation.

-

In January 2024, CAE Inc.collaborated with SimHawk. This collaboration aims to combine SimHawk's didactic and motion-based learning with CAE Healthcare's manikin-based simulation, ultimately offering a more comprehensive and effective training experience.

-

In October 2023, Madison Industries acquired the healthcare division of CAE, Inc. This acquisition was expected to enhance the share of Madison Industries in the healthcare sector.

-

In June 2023, Wolters Kluwer Health announced collaborating with Laerdal Medical and the National League for Nursing (NLN) to launch vrClinicals for Nursing. This VR-based learning solution is designed to address the gaps in nursing education and prepare students for the real-world pressures of nursing practice.

-

In September 2020, CAE Inc. launched Airside, a novel digital platform for pilots. Airside delivers career and training tools to provision pilots amid the COVID-19 pandemic and during their professional careers.

Medical Simulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.92 billion

Revenue forecast in 2030

USD 4.17 billion

Growth rate

CAGR of 16.80% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product & services, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

CAE (Madison Industries acquired CAE healthcare division in October 2023), Inc.; Laerdal Medical; 3D Systems, Inc.; Simulab Corporation; Limbs & Things Ltd; Simulaids; Kyoto Kagaku Co., Ltd; Gaumard Scientific; Mentice; Surgical Science Sweden AB; Intelligent Ultrasound; Operative Experience, Inc.; Cardionics, Inc.; VirtaMed AG; SYNBONE AG; IngMar Medical; TruCorp; KaVo Dental; Simendo; Haag-Streit; Symgery; HRV Simulation; Synaptive Medical; Inovus Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Simulation Market Report Segmentation

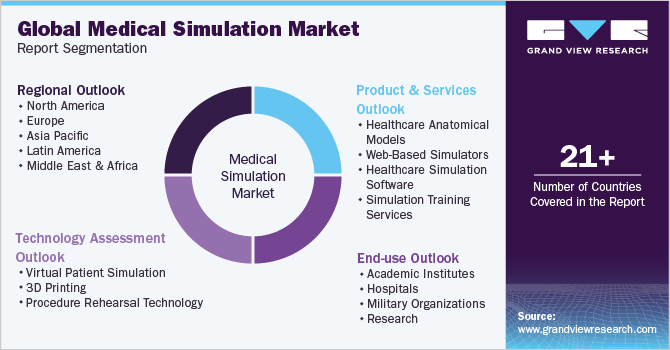

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global medical simulation market report based on product & services, technology, end use, and region:

-

Product & Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare Anatomical Models

-

Type 1

-

Patient Simulators

-

Adult

-

Pediatrics and Baby Care

-

-

Task Trainers

-

-

Fidelity

-

Low-fidelity

-

Medium-fidelity

-

High-fidelity

-

-

Type 2

-

Interventional/Surgical Simulators

-

Laparoscopic Surgical Simulators

-

Gynecology Simulators

-

Cardiovascular Simulators

-

Arthroscopic Surgical Simulators

-

Spine Surgical Simulators

-

Other Interventional/Surgical Simulators

-

-

Endovascular Simulators

-

Ultrasound Simulators

-

Dental Simulators

-

Eye Simulators

-

-

-

Healthcare Simulation Software

-

Simulation Training Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Virtual Patient Simulation

-

3D Printing

-

Procedure Rehearsal Technology

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Institutes

-

Hospitals

-

Military Organizations

-

Research

-

Medical Device Companies

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical simulation market size was estimated at USD 1.65 billion in 2024 and is expected to reach USD 1.92 billion in 2025.

b. The global medical simulation market is expected to grow at a compound annual growth rate of 16.80% from 2025 to 2030 to reach USD 4.17 billion by 2030.

b. North America dominated the medical simulation market with a share of 46.50% in 2024. This is attributable to rising medical training institutes and hospitals, which are mainly focusing on standardizing their teaching practices to enhance patient safety.

b. Some key players operating in the medical simulation market include CAE (Madison Industries acquired CAE healthcare division in October 2023), Inc.; Laerdal Medical; 3D Systems, Inc.; Simulab Corporation; Limbs & Things Ltd; Simulaids; Kyoto Kagaku Co., Ltd; Gaumard Scientific; Mentice; Surgical Science Sweden AB; Intelligent Ultrasound; Operative Experience, Inc.; Cardionics, Inc.; VirtaMed AG; SYNBONE AG; IngMar Medical; TruCorp; KaVo Dental; Simendo; Haag-Streit; Symgery; HRV Simulation; Synaptive Medical; and Inovus Limited.

b. Key factors that are driving the medical simulation market growth include growing technological advancements, rising demand for minimally invasive procedures, and increasing focus on patient safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.