- Home

- »

- Pharmaceuticals

- »

-

Medical Foods Market Size, Share & Trends Report, 2030GVR Report cover

![Medical Foods Market Size, Share & Trends Report]()

Medical Foods Market Size, Share & Trends Analysis Report By Route of Administration, By Product (Powder, Pills, Liquid, Other), By Application, By Sales Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-419-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Medical Foods Market Size & Trends

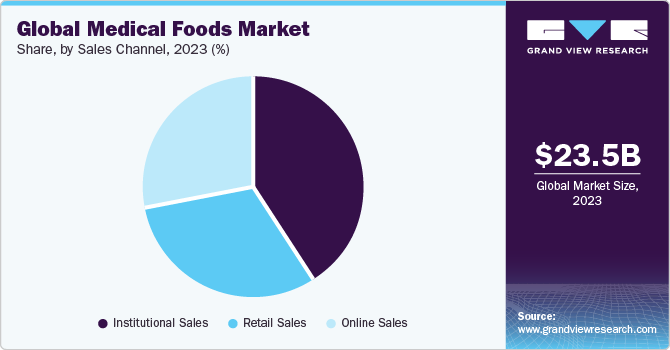

The global medical foods market size was valued at USD 23.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.1% 2024 to 2030. The market growth is driven by the rising prevalence of chronic diseases like Alzheimer's, ADHD, osteoporosis, osteoarthritis, and central nervous system disorders. Noncommunicable diseases, causing 74% of annual deaths (41 million), prompt global action. The UN's 2030 Agenda aims to reduce noncommunicable disease-related deaths by one-third between ages 30 and 70. Amino acid-based enteral nutrition is applied for conditions like sleep disorders, depression, osteoporosis, fibromyalgia, and PTSD. It's tailored for patients with impaired digestive capacity or specific nutrient needs.

Furthermore, the rise in consuming disease-specific formulas is set to boost the market, driven by increasing incidence of targeted diseases and advancements in drug development. Clinical nutrition is increasingly used for personalized treatment, especially in diseases like cancer and cystic fibrosis, where special nutrition is vital to prevent drug interactions. For example, in cystic fibrosis cases, unique digestive enzyme capsules are administered, varying among individuals. Notable companies like Nestlé specialize in personalized clinical nutrition products, offering solutions like Deplin for depression and Metanx for diabetes.

Growing product launches and constant innovations by manufacturers are key factors expected to drive product demand. The need for new food to address inherited metabolic disorders and manage incurable conditions is on the rise. For instance, In July 2022, Danone, as stated in the press release, launched the first-ever dairy and plants blend baby formula in response to parents’ demand for vegetarian & flexitarian options for their babies. The consumption of plant-based products is experiencing significant growth, with over one-third (37%) of EU consumers opting for a vegan, vegetarian, or flexitarian diet. In addition, almost 70% (69%) of parents now prefer their children to consume more plant-based foods.

Industry experts provide insights on the significance of this product launch:

“At Danone, we recognize many parents want to introduce plant-based, vegetarian, and flexitarian options into their baby’s diet, while still meeting their baby’s specific nutritional requirements. Our new Dairy & Plants Blend baby formula has been developed with these needs top of mind.”

-Manuela Borella, Vice President, Global Plant Based Strategy & Business Acceleration, Nutricia's parent company Danone

In October 2020, Nestle Health Science introduced a protein-based ready-to-drink nutritional food in China for special medical purposes, featuring galactomannan to improve gastrointestinal intolerance.

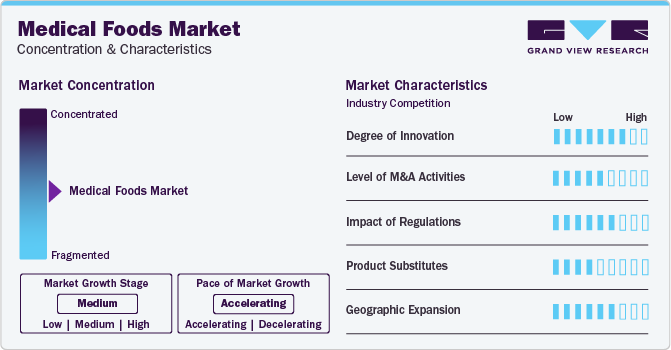

Market Concentration & Characteristics

Market growth is at a high stage, accelerating in pace. The medical foods market, driven by a surge in chronic diseases, exhibits significant innovation. Key players are engaging in industry consolidation through acquisitions, mergers, and partnerships to expand product reach. For example, ByHeart's acquisition of the Allerton facility from DairiConcepts (a DFA subsidiary) in January 2023 tripled supply capacity and fortified formula production in the U.S. The additional domestic infant formula manufacturing facility, along with ByHeart's existing facilities, positions the company to achieve its annual goal of feeding 500,000 babies.

Industry expert insights-

"Infant formula is one of the most value added dairy products in the world. We at Dairy Farmers of America are committed to producing high-quality milk and dairy ingredients in a sustainable way while building relationships that leverage the value of dairy nutrition for infant formula.

We look forward to continuing to work with ByHeart, which we believe has the potential to unlock significant opportunity for our 11,500 family farmers across the country.”

- Martin Bates, President, Dairy Farmers of America (DFA) Ingredient Solutions

The medical foods market is subject to increasing regulatory scrutiny. According to Federal Food, Drug, and Cosmetic Act, for a product to be classified as medical food, it must be labeled for dietary management of a specific disease condition with discrete nutritional requirements and must be intended for oral or tube feeding. In addition, the product must be intended for use under specific medical supervision.

Threat of substitute product is expected to be low in medical foods market over the forecast period. Medical food are partial or complimentary meal replacement, and these products effectively enhance the chronic disease management.

Growing geriatric population along with the increasing number of chronic diseases would offer growth opportunities for the market over the forecast period. Medical foods products are highly adopted by the geriatric population who are dealing with chronic conditions for proper intake of nourishment and, thus, fueling the market growth.

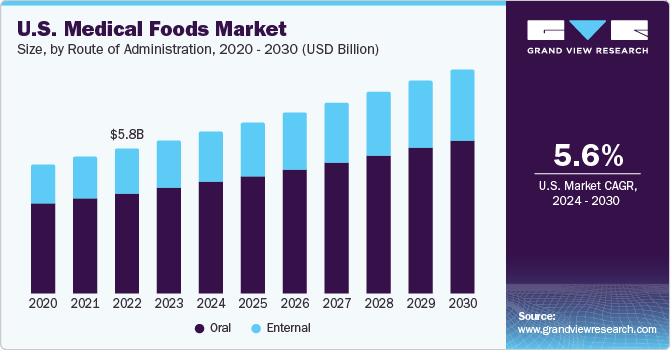

Route of Administration Insights

Oral segment led the market and accounted for 70.0% of the global revenue in 2023. Increased preference for orally administered products, commercial viability, and supportive initiatives are key factors driving the demand for orally administered medical foods. Furthermore, the growing manufacturing of oral products in the form of prethickened products, powders, and pills is anticipated to fuel the segment. For instance, in January 2023, Nutricia launched its Fortimel PlantBased Energy, a plant-based oral nutritional supplement designed to address the nutritional requirements of individuals facing malnutrition or those at risk due to illness. This addition to the Fortimel portfolio leverages Nutricia's parent company, Danone's proficiency in plant nutrition. It further extends the range of Fortimel products, which are clinically proven medical nutrition solutions specifically developed to cater to the daily needs of patients.

Enteral route of the administration segment is expected to witness the fastest growth over the forecast years. The growing prevalence of cardiovascular and chronic diseases resulting from several metabolic disorders leads to difficulty in oral food consumption and increases the preference for medical food feeding through enteral mode. Moreover, the growing focus of the manufacturers to develop technologically advanced enteral feeding devices is positively impacting the segment growth.

Product Insights

Powder segment accounted for the largest market revenue share in 2023. Medical foods are most widely available in powder form, which can be administered through the oral route or enteral route by mixing with milk or water, as advised by the physician. Medical foods in the powdered formula are suitable for patients of all age groups, especially in the oral route. Owing to a high preference for powdered formulations due to ease of consumption, manufacturers are developing product categories in line with consumer preferences. For instance, in January 2022, Danone launched Souvenaid, a powder version of a medical nutrition drink to support memory function in the early stages of Alzheimer's disease.

The liquid segment is anticipated to grow at the fastest rate during the forecast period owing to the rising adoption of liquid formulations in the pediatric and geriatric population, where the intake of solid formulations is limited or impossible and in case of clinically diagnosed dysphagia or when oral physiology is limited. In addition, the ease of administration of liquid-based medical foods and the commercial viability of these products will drive the segment. Increasing functional gastrointestinal disorders and the recommendation of doctors to intake liquid formulated medical food who suffer from these illnesses before or after surgeries support the segment growth. Moreover, the increasing benefits of taking liquid formulated food to maintain sufficient hydration and electrolyte balance favor the segment growth.

Application Insights

The cancer application segment dominated the market in 2023. According to the Pan America Health Organization, North America saw approximately 4 million new cancer diagnoses in 2020, resulting in 1.4 million deaths. Notably, 57% of new cases and 47% of related deaths affected individuals aged 69 or younger. Globally, 2020 recorded an estimated 20 million new cancer cases and 10 million deaths. Projections indicate a 60% increase in the cancer burden over the next two decades, reaching approximately 30 million new cases by 2040, with significant rises in low- and middle-income countries. These statistics underscore the increasing for comprehensive strategies to address the growing cancer burden and support affected populations worldwide.

Cancer weakens immunity, leading to malnutrition in 40% to 80% of cases. Medical food administration is an effective option for restoring nutritional balance in malnourished patients. Consequently, the demand for medical foods in cancer treatments is expected to rise over the forecast period.

Sales Channel Insights

Institutional sales channel held the largest market share in 2023. The growing number of patient visits to the hospitals and other healthcare facilities for the diagnosis and treatment of several chronic and dietary disorders is driving the segment. Medical foods are prescribed by doctors for particular disease management. In addition, the increasing preference among the patients to consult a doctor in the hospitals for their chronic disease management will drive the segment. Moreover, the growing number of private and public healthcare institutions and the increasing chronic disease patient population across the globe will support the segment growth.

The online sales segment is anticipated to expand at the fastest rate over the forecast period. Preference for the online purchase of medical foods is rising owing to the convenience offered by this sales channel. Although medical foods are mainly consumed under medical surveillance, these are intended for long-term nutrition management, which is resulting in surging sales through e-commerce. Thus, with the e-commerce penetration, there is a shift from traditional methods of purchase to online purchase of medical foods, thereby offering various market growth opportunities.

Regional Insights

North America dominated the market and accounted for 29.7% share in 2023. Growth in the market can be attributed to the increasing geriatric population, which is more susceptible to chronic diseases, such as gastrointestinal disorders, metabolic disorders, and neurological disorders. According to the United Health Foundation, in 2022, about 17.3% of the population in the U.S. was aged 65 and above. Furthermore, around 56 million elderly people are expected to depend on medical foods to fulfill their nutritional needs in the U.S. by 2030. Moreover, the growing number of premature infants in critical care is a major factor driving market growth. For instance, in 2022, CDC reported that approximately 10% of infants born in the U.S. were affected by preterm birth. In addition, the preterm birth rate decreased by 1% in 2022, after a 4% increase from 2020 to 2021. These aforementioned factors are anticipated to fuel market growth over the forecast period.

The Asia Pacific region is anticipated to be the fastest-growing regional market over the forecast period owing to the increasing rate of cancer and diabetic patients, along with several government initiatives in the healthcare segment. In addition, the local presence of key players and untapped opportunities provided by the region are among the major factors propelling the regional market growth.

Key Companies & Market Share Insights

Some of the key players operating in the market include Danone, Nestlé, Fresenius Kabi AG and Abbott. Furthermore, Key innovators in the market are utilizing strategies like new product launches to enhance their market presence.

For instance:

-

Lanfam LLC

-

In March 2022, the company launched a new medical food Proleeva for chronic pain relief conditions such as inflammatory disorders including fibromyalgia, osteoporosis, diabetic neuropathy, and rheumatoid arthritism. The company also offering customized solutions for specific condition which help the company recognize as an innovator in the market)

-

-

SFI Health

-

In December 2021, the company introduced two new medical foods, EQUAZEN PRO and Ther-Biotic PRO IBS Relief, for treating Irritable Bowel Syndrome (IBS) and supporting dietary nutrition. These innovations have contributed to the company's market position as key innovators.)

-

Notable Product-Level Data for Key Companies at the Application Level

Companies

Top Notable Products/Brands

Available Product Form

Application

Market Presence

Danone

Aptamil

Powder/Liquid

Constipation Relief

High

Nutrison

Liquid/Semi-elemental

Malabsorption

High to Medium

Alzheimer's

Cancer

Cerebral Plasy

Diabetes

Dysphagia

Gastrointestinal Disease

Wound Care

Parkinson's Disease

Multiple Food Allergy

Eosinophilic Esophagatis

Short Bowel Sydrome

Malabsorption

Abbott

Ensure

Powder

Diabetes

High

Glucerna

Shakes/Bars/Powder

Diabetes

High

Similac

Powder/Liquid

Nutritional Deficiency

High to Medium

Key Medical Foods Companies:

- Danone

- Nestlé

- Abbott

- Targeted Medical Pharma Inc. (Physician Therapeutics LLC, a division of the company)

- Primus Pharmaceuticals Inc.

- Fresenius Kabi AG

- Mead Johnson & Company, LLC

Recent Developments

-

In November 2023, Danone launched its first medical nutrition product, Fortimel, for adults in China, categorized under foods for special medical purposes. This launch is a crucial component of Danone's strategy in China, aimed at utilizing its scientific expertise across all life stages and promoting growth of the adult medical nutrition segment.

-

In September 2023, Danone announced a €50 million (USD 53.78 million) line expansion of its production facility at Opole, Poland, to meet the increasing demand for medical nutrition worldwide. This move aims to enhance its position in the adult medical nutrition market, with the growing rate of chronic diseases and aging population. The expansion is anticipated to enable Danone to serve patients across the globe, as many people are expected to require medical nutrition at some point in their lives due to diseases such as cancer and stroke, which can result in malnutrition.

-

In March 2023, Danone acquired ProMedica, a Poland-based company that specializes in providing care services for patients in their homes. This acquisition is part of Danone's lucrative specialized nutrition market expansion strategy, to strengthen its presence in Poland.

-

In February 2023, Neslte and EraCal Therapeutics entered into a research collaboration to identify novel nutraceuticals relevant to controlling food intake.

Medical Foods Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.7 billion

Revenue forecast in 2030

USD 33.4 billion

Growth Rate

CAGR of 5.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Route of administration, product, application, sales channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, U.K., France, Italy, Spain, Sweden, Denmark, Norway, China, Japan, India, South Korea, Australia, Brazil Mexico, Argentina, Saudi Arabia, UAE, Kuwait, Qatar and South Africa

Key companies profiled

Danone, Nestlé, Abbott, Targeted Medical Pharma Inc. (Physician Therapeutics LLC, a division of the company), Primus Pharmaceuticals Inc., Fresenius Kabi AG, Mead Johnson & Company, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Foods Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical foods market report based on route of administration, product, application, sales channel, and region.

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Enteral

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Pills

-

Liquid

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Kidney Disease

-

Minimal Hepatic Encephalopathy

-

Chemotherapy Induced Diarrhoea

-

Pathogen Related Infections

-

Diabetic Neuropathy

-

ADHD

-

Depression

-

Alzheimer's Disease

-

Nutritional Deficiency

-

Orphan Diseases

-

Tyrosinemia

-

Eosinophilic Esophagitis

-

FPIES

-

Phenylketonuria

-

MSUD

-

Homocystinuria

-

Others

-

-

Wound Healing

-

Chronic Diarrhea

-

Constipation Relief

-

Protein Booster

-

Dysphagia

-

Pain Management

-

Parkinson's Disease

-

Epilepsy

-

Other Cancer related treatments

-

Severe Protein Allergy

-

Cancer

-

Cachexia

-

Other

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Sales

-

Retail Sales

-

Institutional Sales

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

Qatar

-

-

Frequently Asked Questions About This Report

b. Some of the key market players include Danone, Targeted Medical Pharma Inc. (Physicians Therapeutics), Nestlé, Abbott, Primus Pharmaceuticals Inc., Fresenius Kabi AG, Mead Johnson & Company LLC (Reckitt Benckiser Group PLC).

b. The global medical foods market size was valued at USD 23.5 billion in 2023 and is expected to reach USD 24.7 billion in 2024.

b. The global medical foods market is anticipated to reach USD 33.4 billion by 2030 and is anticipated to expand at a CAGR of 5.1% from 2024 to 2030 to reach USD 33.4 billion by 2030.

b. The oral route of administration segment dominated the medical foods market with a share of 70.0% in 2023 and is expected to grow at a compounded annual growth rate (CAGR) of 5.0% from 2024 to 2030.

b. North America dominated the global medical foods market with a revenue share of 29.7% in 2023. The region's highest revenue share is attributed to key market players and their substantial revenue generation in the region.

Table of Contents

Chapter 1 Medical Foods Market: Methodology and Scope

1.1 Market segmentation and scope

1.2 Market definition

1.3 Research methodology

1.3.1 Information procurement

1.3.2 Purchased database

1.3.3 GVR's internal database

1.3.4 Primary research

1.3.5 Research methodology

1.3.6 Research scope and assumptions

1.3.7 List of secondary sources

1.3.8 List of primary sources

Chapter 2 Medical Foods Market: Executive Summary

2.1 Market outlook

2.1.1 Medical foods market snapshot

2.1.2 Medical foods market: Segment snapshot (Part 1)

2.1.3 Medical foods market: Segment snapshot (Part 2)

2.1.4 Medical foods market: Market dynamics

Chapter 3 Medical Foods Market: Medical Foods Market Variables, Trends & Scope

3.1 Market lineage outlook

3.1.1 Parent market outlook

3.1.1.1 Nutritional supplements market

3.1.2 Ancillary market outlook

3.1.2.1 Parenteral nutrition market:

3.1.2.2 Enteral feeding devices market

3.2 Pricing analysis

3.3 Industry analysis

3.3.1 User perspective analysis

3.3.1.1 Consumer behavior analysis

3.3.1.2 Market influencer analysis

3.3.2 Key end users

3.4 Technology outlook

3.4.1 Technology timeline

3.5 Regulatory framework

3.5.1 Reimbursement framework

3.5.1.1 North America

3.5.1.2 Europe

3.5.1.3 Asia Pacific

3.5.2 Standards, compliance & safety

3.6 Market Dynamics

3.6.1 Market Driver Analysis

3.6.1.1 Rising geriatric population

3.6.1.2 Growing prevalence of chronic diseases

3.6.1.3 Shifting trend toward the consumption of disease-specific formulas

3.6.1.4 Growing demand for neonatal and preterm enteral feeding

3.6.1.5 Rising organizational strategic initiatives To bolster market presence

3.6.2 Market Restraint Analysis

3.6.2.1 Lack of awareness in the medical community

3.6.2.2 Improper categorization of medical foods

3.6.3 Industry Challenges and Opportunity

3.6.3.1 Complications associated with small-bore connectors

3.6.3.2 Risks associated with enteral feeding

3.6.4 Industry Opportunity Overview

3.7 Medical Foods Market Analysis Tools

3.7.1 Medical Foods Market - PESTLE Analysis

3.7.2 Industry Analysis - Porter’s

3.8 Major Deals & Strategic Alliances Analysis

3.8.1 Mergers & Acquisitions

3.8.2 Market Entry Strategies

3.8.3 Product Recalls

3.9 Impact of COVID-19 on Medical Foods Market

Chapter 4 Medical Foods Market: Route of Administration Estimates & Trend Analysis

4.1 Medical Foods Market: Route of Administration Movement Analysis, 2023 & 2030 (USD Million)

4.2 Oral

4.2.1 Oral Medical foods market estimates and Forecasts, 2018 - 2030 (USD Million)

4.3 Enteral

4.3.1 Enteral Medical foods market estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5 Medical Foods Market: Product Estimates & Trend Analysis

5.1 Medical Foods Market: Product Movement Analysis, 2023 & 2030 (USD Million)

5.2 Overview and Guidelines about Packaging of Different Products

5.3 Pills

5.3.1 Medical foods market estimates and forecasts for pills formulation, 2018 - 2030 (USD Million)

5.4 Powder

5.4.1 Medical foods market estimates and forecasts for powder formulation, 2018 - 2030 (USD Million)

5.5 Liquid

5.5.1 Medical foods market estimates and forecasts for liquid formulation, 2018 - 2030 (USD Million)

5.6 Others

5.6.1 Medical foods market estimates and forecasts for other formulations, 2018 - 2030 (USD Million)

Chapter 6 Medical Foods Market: Application Estimates & Trend Analysis

6.1 Medical Foods Market: Application Movement Analysis, 2023 & 2030 (USD Million)

6.2 Chronic Kidney Diseases

6.2.1 Medical foods market estimates and forecasts for chronic kidney diseases, 2018 - 2030 (USD Million)

6.3 Minimal Hepatic Encephalopathy

6.3.1 Medical foods market estimates and forecasts for minimal hepatic encephalopathy, 2018 - 2030 (USD Million)

6.4 Chemotherapy Induced Diarrhea

6.4.1 Medical foods market estimates and forecasts for chemotherapy induced diarrhea, 2018 - 2030 (USD Million)

6.5 Pathogen Related Infection

6.5.1 Medical foods market estimates and forecasts for pathogen related infections, 2018 - 2030 (USD Million)

6.6 Diabetic Neuropathy

6.6.1 Medical foods market estimates and forecasts for diabetic neuropathy, 2018 - 2030 (USD Million)

6.7 ADHD

6.7.1 Medical foods market estimates and forecasts for ADHD, 2018 - 2030 (USD Million)

6.8 Depression

6.8.1 Medical foods market estimates and forecasts for depression, 2018 - 2030 (USD Million)

6.9 Alzheimer's Disease

6.9.1 Medical foods market estimates and forecasts for Alzheimer's disease, 2018 - 2030 (USD Million)

6.10 Nutritional Deficiency

6.10.1 Medical Foods Market Estimates and Forecasts for nutritional deficiency, 2018 - 2030 (USD Million)

6.11 Orphan Diseases

6.11.1 Medical Foods Market Estimates and Forecasts for orphan diseases, 2018 - 2030 (USD Million)

6.11.2 Phenylketonuria

6.11.2.1 Medical foods market estimates and forecasts for phenylketonuria, 2018 - 2030 (USD Million)

6.11.3 Eosinophilic Esophagitis

6.11.3.1 Medical foods market estimates and forecasts for eosinophilic esophagitis, 2018 - 2030 (USD Million)

6.11.4 Food protein-induced enterocolitis syndrome

6.11.4.1 Medical foods market estimates and forecasts for FPIES, 2018 - 2030 (USD Million)

6.11.5 TYROSINEMIA

6.11.5.1 Medical foods market estimates and forecasts for tyrosinemia, 2018 - 2030 (USD Million)

6.11.6 Maple Syrup Urine Disease

6.11.6.1 Medical foods market estimates and forecasts for MSUD, 2018 - 2030 (USD Million)

6.11.7 HOMOCYSTINURIA

6.11.7.1 Medical foods market estimates and forecasts for homocystinuria, 2018 - 2030 (USD Million)

6.11.8 Other Orphan Diseases

6.11.8.1 Medical foods market estimates and forecasts for other orphan diseases, 2018 - 2030 (USD Million)

6.12 Wound Healing

6.12.1 Medical foods market estimates and forecasts for wound healing, 2018 - 2030 (USD Million)

6.13 Chronic Diarrhea

6.13.1 Medical foods market estimates and forecasts for chronic diarrhea, 2018 - 2030 (USD Million)

6.14 Constipation Relief

6.14.1 Medical foods market estimates and forecasts for constipation relief, 2018 - 2030 (USD Million)

6.15 Protein Booster

6.15.1 Medical foods market estimates and forecasts for protein booster, 2018 - 2030 (USD Million)

6.16 Dysphagia

6.16.1 Medical foods market estimates and forecasts for dysphagia, 2018 - 2030 (USD Million)

6.17 Pain Management

6.17.1 Medical foods market estimates and forecasts for pain management, 2018 - 2030 (USD Million)

6.18 Parkinson's Disease

6.18.1 Medical foods market estimates and forecasts for Parkinson's disease, 2018 - 2030 (USD Million)

6.19 Epilepsy

6.19.1 Medical foods market estimates and forecasts for epilepsy, 2018 - 2030 (USD Million)

6.20 Cancer

6.20.1 Medical foods market estimates and forecasts for cancer, 2018 - 2030 (USD Million)

6.21 Cachexia

6.21.1 Medical foods market estimates and forecasts for Cachexia, 2018 - 2030 (USD Million)

6.22 Severe Protein Allergy

6.22.1 Medical foods market estimates and forecasts for severe protein allergy, 2018 - 2030 (USD Million)

6.23 Other Diseases

6.23.1 Medical foods market estimates and forecasts for other diseases, 2018 - 2030 (USD Million)

Chapter 7 Medical Foods Market: Sales Channel Estimates & Trend Analysis

7.1 Medical Foods Market: Sales Channel Movement Analysis, 2023 & 2030 (USD Million)

7.2 Online Sales

7.2.1 Medical foods market estimates and forecasts for online sales channel, 2018 - 2030 (USD Million)

7.3 Retail Sales

7.3.1 Medical foods market estimates and forecasts for retail sales channel, 2018 - 2030 (USD Million)

7.4 Institutional Sales

7.4.1 Medical foods market estimates and forecasts for institutional sales channel, 2018 - 2030 (USD Million)

Chapter 8 Medical Foods Market: Regional Estimates and Trend Analysis

8.1 Medical Foods Market: Regional Movement Analysis, 2023 & 2030 (USD Million)

8.2 North America

8.2.1 North America Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.2.2 U.S.

8.2.2.1 Regulatory Scenario

8.2.2.2 Country Dynamics

8.2.2.3 U.S. Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.2.3 Canada

8.2.3.1 Regulatory Scenario

8.2.3.2 Country Dynamics

8.2.3.3 Canada Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3 Europe

8.3.1 Regulatory Framework

8.3.2 Europe Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.3 UK

8.3.3.1 Regulatory Scenario

8.3.3.2 Country Dynamics

8.3.3.3 UK Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.4 Germany

8.3.4.1 Regulatory Scenario

8.3.4.2 Country Dynamics

8.3.4.3 Germany Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.5 France

8.3.5.1 Regulatory Scenario

8.3.5.2 Country Dynamics

8.3.5.3 France Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.6 Spain

8.3.6.1 Regulatory Scenario

8.3.6.2 Country Dynamics

8.3.6.3 Spain Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.7 Italy

8.3.7.1 Regulatory Scenario

8.3.7.2 Country Dynamics

8.3.7.3 Italy Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.8 Sweden

8.3.8.1 Regulatory Scenario

8.3.8.2 Country Dynamics

8.3.8.3 Sweden Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.9 Denmark

8.3.9.1 Regulatory Scenario

8.3.9.2 Country Dynamics

8.3.9.3 Denmark Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.3.10 Norway

8.3.10.1 Regulatory Scenario

8.3.10.2 Country Dynamics

8.3.10.3 Norway Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4 Asia Pacific

8.4.1 Asia Pacific Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.2 Japan

8.4.2.1 Regulatory Scenario

8.4.2.2 Country Dynamics

8.4.2.3 Japan Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.3 China

8.4.3.1 Regulatory Scenario

8.4.3.2 Country Dynamics

8.4.3.3 China Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.4 Australia

8.4.4.1 Regulatory Scenario

8.4.4.2 Country Dynamics

8.4.4.3 Australia Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.5 India

8.4.5.1 Regulatory Scenario

8.4.5.2 Country Dynamics

8.4.5.3 India Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.4.6 South Korea

8.4.6.1 Regulatory Scenario

8.4.6.2 Country Dynamics

8.4.6.3 South Korea Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5 Latin America

8.5.1 Latin America Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.2 Brazil

8.5.2.1 Regulatory Scenario

8.5.2.2 Country Dynamics

8.5.2.3 Brazil Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.3 Mexico

8.5.3.1 Regulatory Scenario

8.5.3.2 Country Dynamics

8.5.3.3 Mexico Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.5.4 Argentina

8.5.4.1 Regulatory Scenario

8.5.4.2 Country Dynamics

8.5.4.3 Argentina Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6 Middle East & Africa (MEA)

8.6.1 MEA Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.2 South Africa

8.6.2.1 Regulatory Scenario

8.6.2.2 Country Dynamics

8.6.2.3 South Africa Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.3 Saudi Arabia

8.6.3.1 Country Dynamics

8.6.3.2 Saudi Arabia Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.4 The United Arab Emirates (UAE)

8.6.4.1 Country Dynamics

8.6.4.2 UAE Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.5 Kuwait

8.6.5.1 Country Dynamics

8.6.5.2 Kuwait Medical Foods Market Estimates and Forecasts, 2018 - 2030 (USD Million)

8.6.6 Qatar

8.6.6.1 Country Dynamics

8.6.6.2 Qatar Medical Foods Market estimates and forecasts, 2018 - 2030 (USD Million)

8.6.7 Middle East Regulatory Scenario

Chapter 9 Competitive Analysis

9.1 Recent Developments & Impact Analysis, by Key Market Participants

9.2 Company/Competition Categorization (Key Innovators, Market Leaders, Emerging Players)

9.3 Vendor Landscape

9.3.1 Key Customers

9.3.2 List Of Key Distributors and Channel Partners

9.3.3 Key Company Market Share Analysis, 2023

9.4 Public Companies

9.4.1 Company Market Position Analysis

9.4.2 Company Market Ranking By Region

9.5 Key Company Insights

9.5.1 Abbott

9.5.2 Nestle

9.5.3 Danone

9.6 Notable Product-Level Data for Key Companies at the Application Level

9.6.1 Key Analyst Highlights On The Table's Products

Chapter 10 Competitive Landscape

10.1 Company Profiles

10.1.1 Participants’ Overview

10.1.1.1 Danone S.A.

10.1.1.1.1 Participant’s Overview

10.1.1.1.2 Financial Performance

10.1.1.1.3 Product Benchmarking

10.1.1.1.4 Recent Developments

10.1.1.2 Nestlé S.A.

10.1.1.2.1 Participant’s Overview

10.1.1.2.2 Financial Performance

10.1.1.2.3 Product Benchmarking

10.1.1.2.4 Recent Developments

10.1.1.3 Abbott

10.1.1.3.1 Participant’s Overview

10.1.1.3.2 Financial Performance

10.1.1.3.3 Product Benchmarking

10.1.1.3.4 Recent Developments

10.1.1.4 Targeted Medical Pharma Inc. (Physician Therapeutics LLC, a division of the company)

10.1.1.4.1 Participant’s Overview

10.1.1.4.2 Financial Performance

10.1.1.4.3 Product Benchmarking

10.1.1.4.4 Recent Developments

10.1.1.5 Primus Pharmaceuticals Inc.

10.1.1.5.1 Participant’s Overview

10.1.1.5.2 Financial Performance

10.1.1.5.3 Product Benchmarking

10.1.1.5.4 Recent Developments

10.1.1.6 Fresenius Kabi AG

10.1.1.6.1 Participant’s Overview

10.1.1.6.2 Financial Performance

10.1.1.6.3 Product Benchmarking

10.1.1.6.4 Recent Developments

10.1.1.7 Mead Johnson & Company, LLC

10.1.1.7.1 Participant’s Overview

10.1.1.7.2 Financial Performance

10.1.1.7.3 Product Benchmarking

10.1.1.7.4 Recent Developments

10.1.2 Financial Performance

10.1.2.1 Public Market Players

10.1.2.2 Private Market Players

10.2 Product Benchmarking

10.3 Strategy Mapping

10.3.1 Acquisition

10.3.2 Collaboration

10.3.3 Expansions

10.3.4 Partnership

10.3.5 Product Launch

10.3.6 Others

10.4 List of Other Companies Providing Medical Foods

10.5 Sales Revenue by Online Sales Channel and Retail Sales Channel for Key Companies

10.5.1 Nestlé S.A

10.5.1.1 Online Sales Channel Insights

10.5.1.2 Retail Sales Channel Insights

10.5.2 Danone S.A.

10.5.2.1 Online Sales Channel Insights

10.5.2.2 Retail Sales Channel Insights

10.5.3 Abbott

10.5.3.1 Online Sales Channel Insights

10.5.3.2 Retail Sales Channel Insights

List of Tables

Table 1 List of key distributors and channel partners

Table 2 List of key emerging companies /technology disruptors/innovators

Table 3 Supplier ranking

Table 4 Few examples of the medical foods in the oral form

Table 5 Few examples of the products available in powder form:

Table 6 Few examples of medical foods in the other formulations

Table 7 Oral medical foods market revenue estimates and forecasts, by products, 2018 - 2030 (USD Million)

Table 8 Enteral medical foods market revenue estimates and forecasts, by products, 2018 - 2030 (USD Million)

Table 9 List of key players, by region

Table 10 North America medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 11 North America medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 12 North America medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 13 North America orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 14 North America medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 15 U.S. medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 16 U.S. medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 17 U.S. medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 18 U.S. orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 19 U.S. medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 20 Canada medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 21 Canada medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 22 Canada medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 23 Canada orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 24 Canada medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 25 Europe medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 26 Europe medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 27 Europe medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 28 Europe orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 29 Europe medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 30 UK medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 31 UK medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 32 UK medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 33 UK orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 34 UK medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 35 Germany medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 36 Germany medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 37 Germany medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 38 Germany orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 39 Germany medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 40 France medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 41 France medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 42 France medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 43 France orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 44 France medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 45 Spain medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 46 Spain medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 47 Spain medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 48 Spain orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 49 Spain medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 50 Italy medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 51 Italy medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 52 Italy medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 53 Italy orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 54 Italy medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 55 Denmark medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 56 Denmark medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 57 Denmark medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 58 Denmark orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 59 Denmark medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 60 Norway medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 61 Norway medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 62 Norway medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 63 Norway orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 64 Norway medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 65 Sweden medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 66 Sweden medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 67 Sweden medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 68 Sweden orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 69 Sweden medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 70 Asia Pacific medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 71 Asia Pacific medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 72 Asia Pacific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 73 Asia Pacific orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 74 Asia Pacific medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 75 Japan medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 76 Japan medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 77 Japan medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 78 Japan orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 79 Japan medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 80 China medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 81 China medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 82 China medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 83 China orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 84 China medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 85 Australia medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 86 Australia medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 87 Australia medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 88 Australia orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 89 Australia medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 90 India medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 91 India medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 92 India orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 93 India medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 94 South Korea medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 95 South Korea medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 96 South Korea medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 97 South Korea orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 98 South Korea medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 99 Latin America medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 100 Latin America medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 101 Latin America medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 102 Latin America orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 103 Latin America medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 104 Brazil medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 105 Brazil medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 106 Brazil medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 107 Brazil orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 108 Brazil medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 109 Mexico medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 110 Mexico medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 111 Mexico medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 112 Mexico orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 113 Mexico medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 114 Argentina medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 115 Argentina medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 116 Argentina medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 117 Argentina orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 118 Argentina medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 119 MEA medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 120 MEA medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 121 MEA medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 122 MEA orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 123 MEA medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 124 South Africa medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 125 South Africa medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 126 South Africa medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 127 South Africa orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 128 South Africa medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 129 Saudi Arabia medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 130 Saudi Arabia medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 131 Saudi Arabia medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 132 Saudi Arabia orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 133 Saudi Arabia medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 134 UAE medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 135 UAE medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 136 UAE medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 137 UAE orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 138 UAE medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 139 Kuwait medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 140 Kuwait medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 141 Kuwait medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 142 Kuwait orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 143 Kuwait medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 144 Qatar medical foods market revenue estimates and forecasts, by route of administration, 2018 - 2030 (USD Million)

Table 145 Qatar medical foods market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 146 Qatar medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 147 Qatar orphan disease specific medical foods market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 148 Qatar medical foods market revenue estimates and forecasts, by sales channel, 2018 - 2030 (USD Million)

Table 149 List of other players

Table 150 Participant’s overview

Table 151 Financial performance

Table 152 Key companies undergoing expansions

Table 153 Key companies undergoing acquisitions

Table 154 Key companies undergoing collaborations

Table 155 Key companies launching new components/services

Table 156 Key companies undergoing partnerships

Table 157 Key companies undertaking other strategies

List of Figures

Fig. 1 Medical foods market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Enteral feeding formulas market: Research methodology

Fig. 6 Medical foods market snapshot, 2023, (USD Billion)

Fig. 7 Medical foods market: Segment snapshot, 2023, (USD Billion) (Part 1)

Fig. 8 Medical foods market: Segment snapshot, 2023, (USD Billion) (Part 2)

Fig. 9 Medical foods market: Market dynamics

Fig. 10 Medical foods market trends & outlook

Fig. 11 Parent market analysis, 2023

Fig. 12 Timeline for new ENFit Connectors

Fig. 13 Consumer decision-making process

Fig. 14 Evolution of medical foods

Fig. 15 Market driver analysis (Current & future impact)

Fig. 16 Global population, aged 65 years and above, 2018 - 2023 (Million)

Fig. 17 Increase in the number of people with chronic conditions in the U.S., 1995-2030 (in million)

Fig. 18 Market restraint analysis (current & future impact)

Fig. 19 Medical foods market - PESTLE analysis

Fig. 20 Industry analysis - Porter’s

Fig. 21 Medical foods market, route of administration outlook: Key takeaways, USD Million

Fig. 22 Medical foods market: route of administration movement analysis, 2023 & 2030 (USD Million)

Fig. 23 Oral medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 24 Enteral medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 25 Medical foods market, product outlook: Key takeaways, USD Million

Fig. 26 Medical foods market: Product movement analysis, 2023 & 2030 (USD Million)

Fig. 27 Medical foods market estimates and forecasts for pills formulation, 2018 - 2030 (USD Million)

Fig. 28 Medical foods market estimates and forecasts for powder formulation, 2018 - 2030 (USD Million)

Fig. 29 Medical foods market estimates and forecasts for liquid formulation, 2018 - 2030 (USD Million)

Fig. 30 Medical foods market estimates and forecasts for other formulations, 2018 - 2030 (USD Million)

Fig. 31 Medical foods market, application outlook: Key takeaways, USD Million

Fig. 32 Medical foods market: application movement analysis, 2023 & 2030 (USD Million)

Fig. 33 Medical foods market estimates and forecasts for chronic kidney diseases, 2018 - 2030 (USD Million)

Fig. 34 Medical foods market estimates and forecasts for minimal hepatic encephalopathy, 2018 - 2030 (USD Million)

Fig. 35 Medical foods market estimates and forecasts for chemotherapy induced diarrhea, 2018 - 2030 (USD Million)

Fig. 36 Medical foods market estimates and forecasts for pathogen related infections, 2018 - 2030 (USD Million)

Fig. 37 Medical foods market estimates and forecasts for diabetic neuropathy, 2018 - 2030 (USD Million)

Fig. 38 Medical foods market estimates and forecasts for ADHD, 2018 - 2030 (USD Million)

Fig. 39 Medical foods market estimates and forecasts for depression, 2018 - 2030 (USD Million)

Fig. 40 Medical foods market estimates and forecasts for Alzheimer's disease, 2018 - 2030 (USD Million)

Fig. 41 Medical foods market estimates and forecasts for nutritional deficiency, 2018 - 2030 (USD Million)

Fig. 42 Medical foods market estimates and forecasts for orphan diseases, 2018 - 2030 (USD Million)

Fig. 43 Medical foods market estimates and forecasts for phenylketonuria, 2018 - 2030 (USD Million)

Fig. 44 Medical foods market estimates and forecasts for eosinophilic esophagitis, 2018 - 2030 (USD Million)

Fig. 45 Medical foods market estimates and forecasts for FPIES, 2018 - 2030 (USD Million)

Fig. 46 Medical foods market estimates and forecasts for tyrosinemia, 2018 - 2030 (USD Million)

Fig. 47 Medical foods market estimates and forecasts for MSUD, 2018 - 2030 (USD Million)

Fig. 48 Medical foods market estimates and forecasts for homocystinuria, 2018 - 2030 (USD Million)

Fig. 49 Medical foods market estimates and forecasts for other orphan diseases, 2018 - 2030 (USD Million)

Fig. 50 Medical foods market estimates and forecasts for wound healing, 2018 - 2030 (USD Million)

Fig. 51 Medical foods market estimates and forecasts for chronic diarrhea, 2018 - 2030 (USD Million)

Fig. 52 Medical foods market estimates and forecasts for constipation relief, 2018 - 2030 (USD Million)

Fig. 53 Medical foods market estimates and forecasts for protein booster, 2018 - 2030 (USD Million)

Fig. 54 Medical foods market estimates and forecasts for dysphagia, 2018 - 2030 (USD Million)

Fig. 55 Medical foods market estimates and forecasts for pain management, 2018 - 2030 (USD Million)

Fig. 56 Medical foods market estimates and forecasts for Parkinson's disease, 2018 - 2030 (USD Million)

Fig. 57 Medical foods market estimates and forecasts for epilepsy, 2018 - 2030 (USD Million)

Fig. 58 Medical foods market estimates and forecasts for cancer, 2018 - 2030 (USD Million)

Fig. 59 Medical foods market estimates and forecasts for Cachexia , 2018 - 2030 (USD Million)

Fig. 60 Medical foods market estimates and forecasts for severe protein allergy, 2018 - 2030 (USD Million)

Fig. 61 Medical foods market estimates and forecasts for other diseases, 2018 - 2030 (USD Million)

Fig. 62 Medical foods market, sales channel outlook: Key takeaways, USD Million

Fig. 63 Medical foods market: Sales channel movement analysis, 2023 & 2030 (USD Million)

Fig. 64 Medical foods market estimates and forecasts for online sales channel, 2018 - 2030 (USD Million)

Fig. 65 Medical foods market estimates and forecasts for retail sales channel, 2018 - 2030 (USD Million)

Fig. 66 Medical foods market estimates and forecasts for institutional sales channel, 2018 - 2030 (USD Million)

Fig. 67 Regional marketplace: Key takeaways

Fig. 68 Medical foods market: Regional movement analysis, 2023 & 2030 (USD Million)

Fig. 69 North America medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 70 U.S country dynamics

Fig. 71 U.S. medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 72 Canada country dynamics

Fig. 73 Canada medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 74 Europe medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 75 UK country dynamics

Fig. 76 UK medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 77 Germany country dynamics

Fig. 78 Germany medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 79 France country dynamics

Fig. 80 France medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 81 Spain country dynamics

Fig. 82 Spain medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 83 Italy country dynamics

Fig. 84 Italy medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 85 Sweden country dynamics

Fig. 86 Sweden medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 87 Denmark country dynamics

Fig. 88 Denmark medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 89 Norway country dynamics

Fig. 90 Norway medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 91 Asia Pacific medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 92 Japan country dynamics

Fig. 93 Japan medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 94 China country dynamics

Fig. 95 China medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 96 Australia country dynamics

Fig. 97 Australia medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 98 India country dynamics

Fig. 99 India medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 100 South Korea country dynamics

Fig. 101 South Korea medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 102 Latin America medical foods market estimates and forecasts, 2018 - 2030 (USD Million

Fig. 103 Brazil country dynamics

Fig. 104 Brazil medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 105 Mexico country d

Fig. 106 Mexico medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 107 Argentina country dynamics

Fig. 108 Argentina medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 109 MEA medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 110 South Africa country dynamics

Fig. 111 South Africa medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 112 Saudi Arabia country dynamics

Fig. 113 Saudi Arabia medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 114 UAE country dynamics

Fig. 115 UAE medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 116 Kuwait country dynamics

Fig. 117 Kuwait medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 118 Qatar: Country Dynamics

Fig. 119 Qatar medical foods market estimates and forecasts, 2018 - 2030 (USD Million)

Fig. 120 Key company categorization

Fig. 121 Medical foods company market share analysis, 2023

Fig. 122 Company market position analysis

Fig. 123 Company market ranking, by region based on number of countries served in each region

Fig. 124 Abbott: Key Insights

Fig. 125 Abbott: Key Insights

Fig. 126 Nestle: Key Insights

Fig. 127 Nestle: Key Insights

Fig. 128 Danone: Key Insights

Fig. 129 Danone: Key Insights

Fig. 130 Sales Revenue By Online Sales Channel And Retail Sales Channel For Key CompaniesWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Medical Foods Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

- Oral

- Enteral

- Medical Foods Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Powder

- Pills

- Liquid

- Other

- Medical Foods Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Chronic Kidney Disease

- Minimal Hepatic Encephalopathy

- Chemotherapy Induced Diarrhea

- Pathogen Related Infections

- Diabetic Neuropathy

- ADHD

- Depression

- Alzheimer's Disease

- Nutritional Deficiency

- Orphan Diseases

- Tyrosinemia

- Eosinophilic Esophagitis

- FPIES

- Phenylketonuria

- MSUD

- Homocystinuria

- Others

- Wound Healing

- Chronic Diarrhea

- Constipation Relief

- Protein Booster

- Dysphagia

- Pain Management

- Parkinson's Disease

- Epilepsy

- Other Cancer related treatments

- Severe Protein Allergy

- Cancer

- Cachexia

- Other

- Medical Foods Sales Channel Outlook (Revenue, USD Billion, 2018 - 2030)

- Online Sales

- Retail Sales

- Institutional Sales

- Medical Foods Regional Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America Medical Foods Market, By Route of Administration

- Oral

- Enteral

- North America Medical Foods Market, By Product

- Powder

- Pills

- Liquid

- Other

- North America Medical Foods Market, By Application

- Chronic Kidney Disease

- Minimal Hepatic Encephalopathy

- Chemotherapy Induced Diarrhea

- Pathogen Related Infections

- Diabetic Neuropathy

- ADHD

- Depression

- Alzheimer's Disease

- Nutritional Deficiency

- Orphan Diseases

- Tyrosinemia

- Eosinophilic Esophagitis

- FPIES

- Phenylketonuria

- MSUD

- Homocystinuria

- Others

- Wound Healing

- Chronic Diarrhea

- Constipation Relief

- Protein Booster

- Dysphagia

- Pain Management

- Parkinson's Disease

- Epilepsy

- Other Cancer related treatments

- Severe Protein Allergy

- Cancer

- Cachexia

- Other

- North America Medical Foods Market, By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

- U.S.

- U.S. Medical Foods Market, By Route of Administration

- Oral

- Enteral

- U.S. Medical Foods Market, By Product

- Powder

- Pills

- Liquid

- Other

- U.S. Medical Foods Market, By Application

- Chronic Kidney Disease

- Minimal Hepatic Encephalopathy

- Chemotherapy Induced Diarrhea

- Pathogen Related Infections

- Diabetic Neuropathy

- ADHD

- Depression

- Alzheimer's Disease

- Nutritional Deficiency

- Orphan Diseases

- Tyrosinemia

- Eosinophilic Esophagitis

- FPIES

- Phenylketonuria

- MSUD

- Homocystinuria

- Others

- Wound Healing

- Chronic Diarrhea

- Constipation Relief

- Protein Booster

- Dysphagia

- Pain Management

- Parkinson's Disease

- Epilepsy

- Other Cancer related treatments

- Severe Protein Allergy

- Cancer

- Cachexia

- Other

- U.S. Medical Foods Market, By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

- U.S. Medical Foods Market, By Route of Administration

- Canada

- Canada Medical Foods Market, By Route of Administration

- Oral

- Enteral

- Canada Medical Foods Market, By Product

- Powder

- Pills

- Liquid

- Other

- Canada Medical Foods Market, By Application

- Chronic Kidney Disease

- Minimal Hepatic Encephalopathy

- Chemotherapy Induced Diarrhea

- Pathogen Related Infections

- Diabetic Neuropathy

- ADHD

- Depression

- Alzheimer's Disease

- Nutritional Deficiency

- Orphan Diseases

- Tyrosinemia

- Eosinophilic Esophagitis

- FPIES

- Phenylketonuria

- MSUD

- Homocystinuria

- Others

- Wound Healing

- Chronic Diarrhea

- Constipation Relief

- Protein Booster

- Dysphagia

- Pain Management

- Parkinson's Disease

- Epilepsy

- Other Cancer related treatments

- Severe Protein Allergy

- Cancer

- Cachexia

- Other

- Canada Medical Foods Market, By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

- Canada Medical Foods Market, By Route of Administration

- North America Medical Foods Market, By Route of Administration

- Europe

- Europe Medical Foods Market, By Route of Administration

- Oral

- Enteral

- Europe Medical Foods Market, By Product

- Powder

- Pills

- Liquid

- Other

- Europe Medical Foods Market, By Application

- Chronic Kidney Disease

- Minimal Hepatic Encephalopathy

- Chemotherapy Induced Diarrhea

- Pathogen Related Infections

- Diabetic Neuropathy

- ADHD

- Depression

- Alzheimer's Disease

- Nutritional Deficiency

- Orphan Diseases

- Tyrosinemia

- Eosinophilic Esophagitis

- FPIES

- Phenylketonuria

- MSUD

- Homocystinuria

- Others

- Wound Healing

- Chronic Diarrhea

- Constipation Relief

- Protein Booster

- Dysphagia

- Pain Management

- Parkinson's Disease

- Epilepsy

- Other Cancer related treatments

- Severe Protein Allergy

- Cancer

- Cachexia

- Other

- Europe Medical Foods Market, By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

- Germany

- Germany Medical Foods Market, By Route of Administration

- Oral

- Enteral

- Germany Medical Foods Market, By Product

- Powder

- Pills

- Liquid

- Other

- Germany Medical Foods Market, By Application

- Chronic Kidney Disease

- Minimal Hepatic Encephalopathy

- Chemotherapy Induced Diarrhea

- Pathogen Related Infections

- Diabetic Neuropathy

- ADHD

- Depression

- Alzheimer's Disease

- Nutritional Deficiency

- Orphan Diseases

- Tyrosinemia

- Eosinophilic Esophagitis

- FPIES

- Phenylketonuria

- MSUD

- Homocystinuria

- Others

- Wound Healing

- Chronic Diarrhea

- Constipation Relief

- Protein Booster

- Dysphagia

- Pain Management

- Parkinson's Disease

- Epilepsy

- Other Cancer related treatments

- Severe Protein Allergy

- Cancer

- Cachexia

- Other

- Germany Medical Foods Market, By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

- Germany Medical Foods Market, By Route of Administration

- UK

- UK Medical Foods Market, By Route of Administration

- Oral

- Enteral

- UK Medical Foods Market, By Product

- Powder

- Pills

- Liquid

- Other

- UK Medical Foods Market, By Application

- Chronic Kidney Disease

- Minimal Hepatic Encephalopathy

- Chemotherapy Induced Diarrhea

- Pathogen Related Infections

- Diabetic Neuropathy

- ADHD

- Depression

- Alzheimer's Disease

- Nutritional Deficiency

- Orphan Diseases

- Tyrosinemia

- Eosinophilic Esophagitis

- FPIES

- Phenylketonuria

- MSUD

- Homocystinuria

- Others

- Wound Healing

- Chronic Diarrhea

- Constipation Relief

- Protein Booster

- Dysphagia

- Pain Management

- Parkinson's Disease

- Epilepsy

- Other Cancer related treatments

- Severe Protein Allergy

- Cancer

- Cachexia

- Other

- UK Medical Foods Market, By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

- UK Medical Foods Market, By Route of Administration

- France

- France Medical Foods Market, By Route of Administration

- Oral

- Enteral

- France Medical Foods Market, By Product

- Powder

- Pills

- Liquid

- Other

- France Medical Foods Market, By Application

- Chronic Kidney Disease

- Minimal Hepatic Encephalopathy

- Chemotherapy Induced Diarrhea

- Pathogen Related Infections

- Diabetic Neuropathy

- ADHD

- Depression

- Alzheimer's Disease

- Nutritional Deficiency

- Orphan Diseases

- Tyrosinemia

- Eosinophilic Esophagitis

- FPIES

- Phenylketonuria

- MSUD

- Homocystinuria

- Others

- Wound Healing

- Chronic Diarrhea

- Constipation Relief

- Protein Booster

- Dysphagia

- Pain Management

- Parkinson's Disease

- Epilepsy

- Other Cancer related treatments

- Severe Protein Allergy

- Cancer

- Cachexia

- Other

- France Medical Foods Market, By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

- France Medical Foods Market, By Route of Administration

- Italy

- Italy Medical Foods Market, By Route of Administration

- Oral

- Enteral

- Italy Medical Foods Market, By Product

- Powder

- Pills

- Liquid

- Other

- Italy Medical Foods Market, By Application

- Chronic Kidney Disease

- Minimal Hepatic Encephalopathy

- Chemotherapy Induced Diarrhea

- Pathogen Related Infections

- Diabetic Neuropathy

- ADHD

- Depression

- Alzheimer's Disease

- Nutritional Deficiency

- Orphan Diseases

- Tyrosinemia

- Eosinophilic Esophagitis

- FPIES

- Phenylketonuria

- MSUD

- Homocystinuria

- Others

- Wound Healing

- Chronic Diarrhea

- Constipation Relief

- Protein Booster

- Dysphagia

- Pain Management

- Parkinson's Disease

- Epilepsy

- Other Cancer related treatments

- Severe Protein Allergy

- Cancer

- Cachexia

- Other

- Italy Medical Foods Market, By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

- Italy Medical Foods Market, By Route of Administration

- Spain

- Spain Medical Foods Market, By Route of Administration

- Oral

- Enteral

- Spain Medical Foods Market, By Product

- Powder

- Pills

- Liquid

- Other

- Spain Medical Foods Market, By Application

- Chronic Kidney Disease

- Minimal Hepatic Encephalopathy

- Chemotherapy Induced Diarrhea

- Pathogen Related Infections

- Diabetic Neuropathy

- ADHD

- Depression

- Alzheimer's Disease

- Nutritional Deficiency

- Orphan Diseases

- Tyrosinemia

- Eosinophilic Esophagitis

- FPIES

- Phenylketonuria

- MSUD

- Homocystinuria

- Others

- Wound Healing

- Chronic Diarrhea

- Constipation Relief

- Protein Booster

- Dysphagia

- Pain Management

- Parkinson's Disease

- Epilepsy

- Other Cancer related treatments

- Severe Protein Allergy

- Cancer

- Cachexia

- Other

- Spain Medical Foods Market, By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

- Spain Medical Foods Market, By Route of Administration

- Sweden

- Sweden Medical Foods Market, By Route of Administration

- Oral

- Enteral

- Sweden Medical Foods Market, By Product

- Powder

- Pills

- Liquid

- Other

- Sweden Medical Foods Market, By Application

- Chronic Kidney Disease

- Minimal Hepatic Encephalopathy

- Chemotherapy Induced Diarrhea

- Pathogen Related Infections

- Diabetic Neuropathy

- ADHD

- Depression

- Alzheimer's Disease

- Nutritional Deficiency

- Orphan Diseases

- Tyrosinemia

- Eosinophilic Esophagitis

- FPIES

- Phenylketonuria

- MSUD

- Homocystinuria

- Others

- Wound Healing

- Chronic Diarrhea

- Constipation Relief

- Protein Booster

- Dysphagia

- Pain Management

- Parkinson's Disease

- Epilepsy

- Other Cancer related treatments

- Severe Protein Allergy

- Cancer

- Cachexia

- Other

- Sweden Medical Foods Market, By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

- Sweden Medical Foods Market, By Route of Administration

- Denmark

- Denmark Medical Foods Market, By Route of Administration

- Oral