- Home

- »

- Medical Devices

- »

-

Medical Equipment Third Party Calibration Services Market Report, 2030GVR Report cover

![Medical Equipment Third Party Calibration Services Market Size, Share & Trends Report]()

Medical Equipment Third Party Calibration Services Market Size, Share & Trends Analysis Report By End-use (Hospitals, Clinical Laboratories, Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-463-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

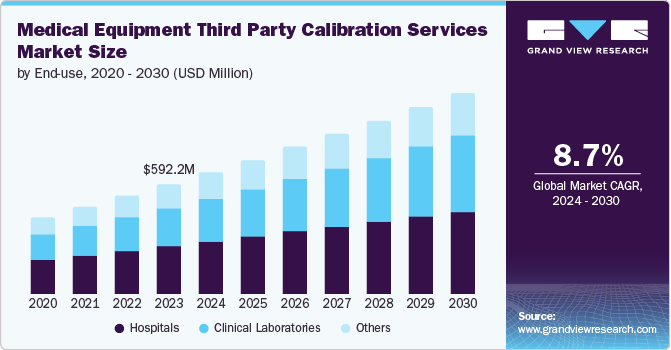

The global medical equipment third party calibration services market size was estimated at USD 592.2 million in 2023 and is projected to grow at a CAGR of 8.7% from 2024 to 2030. The factors contributing to the market growth include rising demand for healthcare services, advancements in the medical device sector, stringent regulations, and increasing awareness about preventive medical equipment maintenance.

The rising demand for calibration services is a factor driving the market growth. Medical equipment such as ECG machines, nebulizers and oxygen concentrators, anesthesia machines, and ventilators require timely calibration for the appropriateness and accuracy of the medical device. Various third-party calibration service providers recognize this need to improve accuracy and offer medical equipment calibration services.

The demand for refurbished medical equipment is rising due to increased medical expenditures and medical services in remote areas with cost sensitivity. Refurbished medical equipment needs calibration services to increase its accuracy for improved treatment. Companies recognize this need and provide calibration services for medical apparatus. For instance, Biomedix offers calibration services, repair services, and preventive maintenance. The increased usage of used devices and equipment has led to the emergence of third-party calibration service companies.

Market Concentration & Characteristics

The impact of COVID-19 increased the demand for telemedicine and remote patient monitoring, and improved healthcare services are characterized by an increased degree of innovation in this field. With the technological developments in artificial intelligence (AI), cloud computing, and IoT (Internet of Things), remote calibration services have become accessible. For instance, according to the National Center for Biotechnology Information data published in January 2022, remote calibration incorporates edge intelligence technology to enable calibration with limited human intervention. Such developments in the technological field enable remote calibration of medical equipment and enhance market growth.

The market is characterized by a moderate-to-high merger and acquisition (M&A) activity. Various factors attributing to this growth are the high demand for healthcare services in remote areas, increased demand for remote patient monitoring, and company expansion to fulfill the growing demand. For instance, Transcat, Inc. acquired Alliance Calibration in June 2022 to expand its calibration services. Such instances are expected to drive the market growth for third-party calibration services.

The third-party calibration services sector is subjected to increased regulatory scrutiny. These service companies provide calibration of critical healthcare equipment, which, if not properly regulated, may prove fatal to a patient's life. Therefore, companies entering the market space are required to comply with the stringent regulations. For instance, India's National Accreditation Board for Testing and Calibration Laboratories (NABL) offers accreditation services involving third-party vendor assessment, including medical and calibration laboratories provided in NABL 100B Accreditation Process and Procedures issued in November 2022. Such strict regulations and guidelines ensure safety and quality, instilling trust in calibration services offered by third-party vendors, hence helping the market growth.

The increased demand for refurbished medical equipment has created a need to calibrate it for enhanced performance. Companies recognize this need and are looking forward to expanding these services. For instance, Transact, Inc. acquired Tangent Labs in January 2022, aiming to expand the service business as part of its expansion strategy. Such service expansions in the third-party calibration service market boost growth.

The medical equipment third-party calibration services offer a lucrative market with rising demand for healthcare services, technological advancements, and stringent regulatory requirements in place to ensure the quality, safety, and high efficacy of the medical equipment in use. This involves an increased number of companies offering third-party calibration services, such as NicolScales, Transcat, Inc., and Trescal. These companies are also acquiring calibration service laboratories to expand their presence in the market. For instance, Transcat, Inc. acquired an e2b calibration service company in September 2022, enabling Transcat, Inc. to establish its presence in Ireland.

End-use Insights

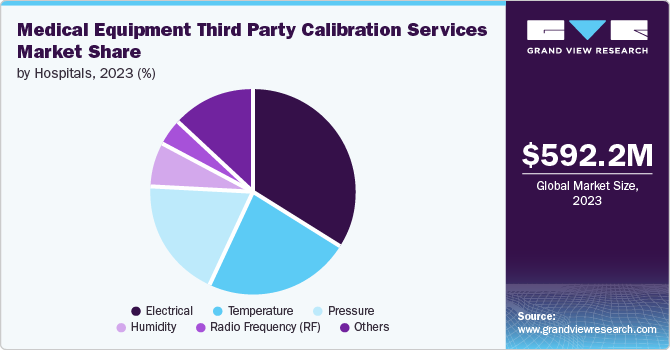

The hospitals segment dominated the market in 2023. The driving factors of the segment growth include increased usage of refurbished medical apparatus, requirement of standardized equipment offering efficiency, and compliance with health and safety standards. Various hospitals installed refurbished medical equipment during emergencies such as the COVID-19 pandemic and required calibration services for improved performance and safety of the patient.

The hospitals rely on third-party calibration service laboratories as they offer quality assurance, reduced chances of error, and cost-effective auditing. Third-party calibration service companies such as Transcat, Inc. provide hospital calibration services for tools and instruments, including ESU analyzers, patient simulators, oscilloscopes, and defibrillator analyzers. Most of the equipment used in hospitals offers integrated healthcare under one roof, which boosts the segment growth.

The clinical laboratories are projected to grow at the fastest CAGR over the forecast period. Clinical laboratories need third-party calibration services to maintain the quality and accuracy of their testing equipment. This testing equipment plays a crucial role in diagnoses and requires it to be serviced frequently. The in-house calibration process is expensive, requires extensive training for the staff, and needs a longer turnaround time. Third-party service providers eliminate delays and extra costs by providing faster turnaround time, are less expensive, and eliminate the need to train the clinic staff for the process, saving time and enabling speedier functionality. Such instances drive the segment growth.

Regional Insights

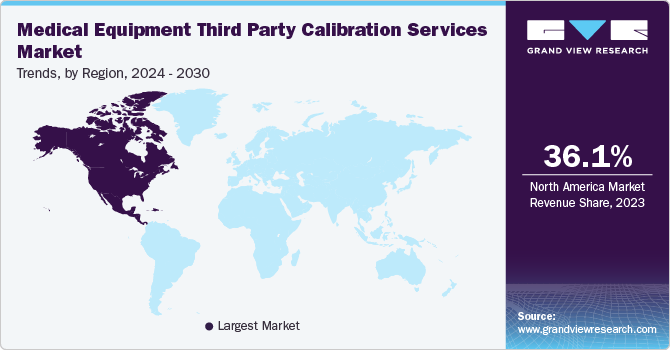

North America medical equipment third party calibration services market dominated globally with a revenue share of 36.1% in 2023. The driving factors of the market growth include increased demand for healthcare services, advancements in technology, and the number of third-party vendors offering calibration services. Stringent regulations ensure the quality of instruments for improved efficacy of results in healthcare facilities. Such quality assurance practices enable better results and hence drive market growth.

U.S. Medical Equipment Third Party Calibration Services Market Trends

The U.S. medical equipment third party calibration services market dominated the North America region in 2023 due to increased third-party vendors offering calibration services for medical equipment, technological advancements in the healthcare sector, and increased refurbished medical equipment usage. Companies recognize the need to calibrate medical equipment, such as Allometrics Inc., which offers services for various medical equipment. Such increased third-party vendors in the nation are expected to drive market growth.

Europe Medical Equipment Third Party Calibration Services Market Trends

The medical equipment third-party calibration services market in Europe was identified as a lucrative region in 2023, driven by factors including technological advancements, increased usage of refurbished medical equipment, and regulations. Such rising demand for refurbished medical apparatus requires device maintenance and calibration, leading to the growing demand for third-party calibration services and boosting market growth.

The UK medical equipment third party calibration services market is expected to grow rapidly over the forecast period. According to the National Center for Biotechnology Information data published in May 2021, the nation is lagging on health outcomes coupled with the growing burden of mental illness. The growing geriatric population increased the demand for healthcare services. Refurbished medical equipment usage has increased to adapt to changing needs, requiring timely calibration to ensure efficacy. The government has established guidelines under the Medicines and Healthcare Products Regulatory Agency (MHRA) for laboratories and manufacturers to conduct maintenance and calibration requiring third-party assistance during the COVID-19 pandemic to ensure safety, quality, and efficacy. Such instances in the nation are expected to boost market growth.

Medical equipment third party calibration services market in Germany held a substantial market share in 2023 owing to factors including a rise in the geriatric population, increased chronic diseases and their diagnosis, and the use of refurbished medical equipment to meet the increased healthcare demand. Companies such as esz AG calibration and metrology offer calibration services to ensure the efficacy of the outcome.

Asia Pacific Medical Equipment Third Party Calibration Services Market Trends

The Asia Pacific medical equipment third-party calibration services market is anticipated to witness significant growth in the coming years owing to factors such as a rise in chronic diseases, an increased geriatric population, expensive healthcare solutions, and increasing demand for refurbished medical equipment. For instance, Mobile Test ‘n’ Cal High Voltage Inspection Testing & Calibration, based in Australia, offers calibration services for various instruments such as temperature, electrical, and pressure gauges. Such instances are expected to boost market growth.

The India medical equipment third-party calibration services market is expected to grow rapidly in the coming years due to the increased rate of chronic diseases, rise in healthcare services, and rise in refurbished medical equipment. The rising demand for healthcare has led the Standardisation Testing and Quality Certificate Directorate (STQC) to establish third-party testing laboratories that offer calibration services and testing services. In addition, various companies offer calibration services, such as MATRIX LAB and NorthLab (India) Pvt. Ltd.

Key Medical Equipment Third Party Calibration Services Company Insights

Some key companies in the medical equipment third-party calibration services market include Applus+ and NorthLab (India) Pvt. Ltd, TÜV SÜD's calibration laboratory, Al Borg Diagnostics, and Allometrics Inc. These companies are involved in strategic initiatives such as innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

NorthLab (India) Pvt. Ltd is a third-party calibration service provider based in India. The NABL-accredited laboratory offers calibration services for medical devices such as anesthesia machines and ventilators, radiant warmers (Pressure, Temperature, and humidity), defibrillators, and suction pumps. In addition to medical calibration, the company also offers calibration services, including electrotechnical calibration, thermal and mechanical calibration, fluid flow, and chemical and gas calibration.

-

Transcat, Inc. provides calibration services through various mediums such as in-house instrument calibration, onsite calibration, and new instrument calibration. The company is an accredited calibration company and is actively involved in acquisition activity to expand its presence.

Key Medical Equipment Third Party Calibration Services Companies:

The following are the leading companies in the medical equipment third party calibration services market. These companies collectively hold the largest market share and dictate industry trends.

- NorthLab (India) Pvt.Ltd

- TÜV SÜD's calibration laboratory

- Al Borg Diagnostics

- Abdulminam Ibrahim Al Mohaisin Contracting

- Allometrics Inc.

- The Calibration Company

- Copper Mountain Technologies

- LotusWorks

- ACS-Calibration

- NicolScales

- Aries e-Solutions

- Applus+

Recent Developments

-

In April 2024, IIT Madras, India, launched a medical devices calibration facility on wheels. This newly launched facility aims to reduce the cost of calibration and transportation time, which can lead to affordable, scalable, and quality healthcare.

-

In January 2023, Al Borg Diagnostics signed a partnership with International SOS Medical Complex that was expected to allow the company to operate its laboratories for five additional years.

Medical Equipment Third Party Calibration Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 656.3 million

Revenue forecast in 2030

USD 1.08 billion

Growth rate

CAGR of 8.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Japan; China; India; Thailand; Singapore; Brazil; Mexico; Argentina; Columbia; South Africa; Saudi Arabia; UAE

Key companies profiled

NorthLab (India) Pvt.Ltd; TÜV SÜD's calibration laboratory; Al Borg Diagnostics; Abdulminam Ibrahim Al Mohaisin Contracting; Allometrics Inc.; The Calibration Company; Copper Mountain Technologies; LotusWorks; ACS-Calibration; NicolScales; Aries e-Solutions; Applus+

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

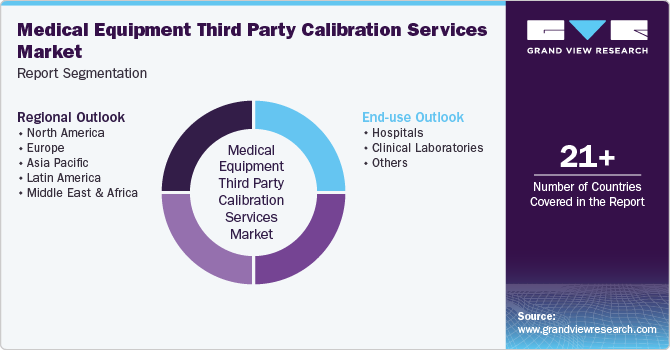

Global Medical Equipment Third Party Calibration Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical equipment third-party calibration services market report based on end-use and region.

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Electrical

-

Radio Frequency (RF)

-

Temperature

-

Humidity

-

Pressure

-

Others

-

-

Clinical Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Columbia

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global medical equipment third party calibration services market size was valued at USD 592.2 million in 2023 and is projected to reach USD 656.3 million in 2024.

b. The global medical equipment third party calibration services market is projected to grow at a compound annual growth rate (CAGR) of 8.7% from 2024 to 2030 to reach USD 1.08 billion by 2030.

b. The hospitals segment dominated the market in 2023. The driving factors of the segment growth include increased usage of refurbished medical apparatus, requirement of standardized equipment offering efficiency, and compliance with health and safety standards.

b. Some of the key players operating in this market include NorthLab (India) Pvt.Ltd, TÜV SÜD's calibration laboratory, Al Borg Diagnostics, Abdulminam Ibrahim Al Mohaisin Contracting, Allometrics Inc., The Calibration Company, Copper Mountain Technologies, LotusWorks, ACS-Calibration, NicolScales, Aries e-Solutions, Applus+.

b. The factors contributing to market growth include rising demand for healthcare services, advancements in the medical device sector, stringent regulations, and increasing awareness about preventive medical equipment maintenance.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."