- Home

- »

- Plastics, Polymers & Resins

- »

-

Medical Device Packaging Market Size, Industry Report, 2030GVR Report cover

![Medical Device Packaging Market Size, Share & Trends Report]()

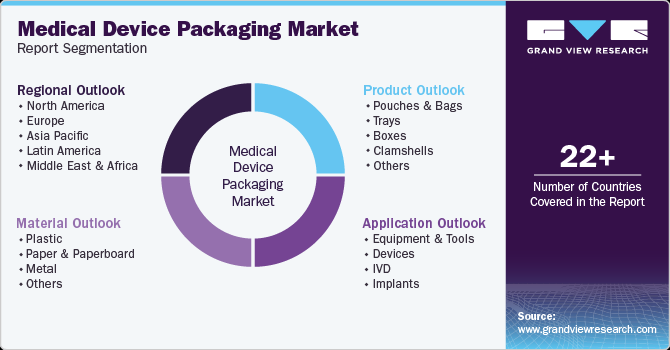

Medical Device Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Metal, Paper & Paperboard), By Product (Pouches & Bags, Trays, Boxes, Clamshells), By Application (Devices, IVD, Implants), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-308-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Device Packaging Market Summary

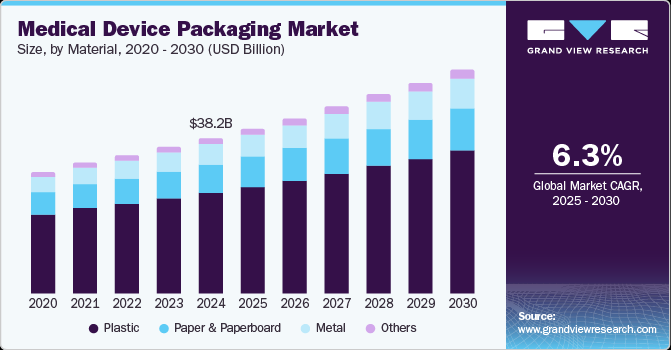

The global medical device packaging market size was estimated at USD 38.2 billion in 2024 and is projected to reach USD 55.1 billion by 2030, growing at a CAGR of 6.3% from 2025 to 2030. The growing demand for medical devices, including surgical implants and instruments, medical supplies, in-vitro diagnostic tools, electro-medical equipment, reagents, dental products, and irradiation devices, has been fueling the need for medical device packaging solutions.

Key Market Trends & Insights

- The Europe medical device packaging market dominated the global market and accounted for the largest revenue share of 31.9% in 2024.

- The medical device packaging market in Germany led the Europe market with the highest revenue share in 2024.

- Based on material, the plastic medical device packaging dominated the market and accounted for a revenue share of 64.7% in 2024.

- Based on product, the pouches and bags led the medical device packaging market and accounted for a revenue share of 35.9% in 2024.

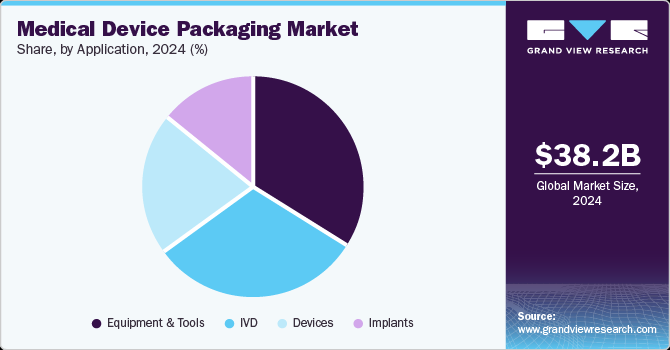

- Based on application, the equipment and tools sector dominated the medical device packaging market, accounting for a revenue share of 34.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 38.2 Billion

- 2030 Projected Market Size: USD 55.1 Billion

- CAGR (2025-2030): 6.3%

- Europe: Largest Market in 2024

- Asia Pacific: Fastest growing market

Unhealthy lifestyles have led to a rise in chronic diseases such as heart disease, cancer, diabetes, stroke, and arthritis, especially in developed countries. These conditions require advanced medical devices for diagnosis and treatment, driving growth in the medical device market. Manufacturers are introducing products with technologies such as peel/seal and counterfeit prevention features. Solutions such as 2-D barcodes, UV codes, holograms, and hidden text using security ink help protect against product counterfeiting and ensure product authenticity.

The medical device packaging market is growing due to the increasing complexity of packaging design and the need to meet evolving global regulatory standards. Manufacturers must ensure product safety, efficacy, and compliance through strict quality control, labeling, and traceability. As the healthcare sector expands, there’s greater demand for packaging solutions that protect product integrity, optimize transportation and meet sterilization requirements. Additionally, proactive collaboration with regulatory bodies ensures manufacturers stay ahead of changes, maintaining market relevance and consumer trust.

Material Insights

Plastic medical device packaging dominated the market and accounted for a revenue share of 64.7% in 2024. Plastic materials are safe, hygienic, versatile, and durable, offering aesthetic flexibility from opaque to clear. Their lightweight, cost-effective nature makes them an ideal choice for medical device packaging. Plastic packaging maintains the sterility and integrity of medical devices and diagnostic equipment. Formats such as blister packs, vials, and pouches provide protective layers for delicate products, improving handling and administration. Common recyclable healthcare plastics include semi-rigid, flexible, or rigid sterile barrier packaging, such as pouches, header bags, vented bags, blister packs, and film bags.

The metal segment in the medical device packaging market is expected to grow at the fastest CAGR of 7.1% over the forecast period. The growth of the medical device packaging market is driven by metal packaging’s safety, sustainability, and versatility. With customizable sizes, shapes, and designs, it enhances brand appeal and offers superior shelf presence. Its stackability optimizes storage and transportation efficiency, while its unbreakable nature prevents damage. Additionally, its eco-friendly supply chain, reduced CO2 emissions, and cost-effectiveness contribute to its growing demand in the medical packaging sector.

Product Insights

Pouches and bags led the medical device packaging market and accounted for a revenue share of 35.9% in 2024. Pouches and bags efficiently pack medical devices of all sizes, offering easy storage and handling. Made from materials such as LLDPE and PET, they protect devices from light, moisture, and gases, ensuring product safety. Pouches and bags withstand various sterilization methods such as steam, ETO, and gamma irradiation, offering flexibility in medical workflows. Their puncture-resistant design ensures durability through sterilization, distribution, storage, and use, maintaining device integrity. Additionally, their stackable design optimizes storage and transportation, reducing spoilage and costs and further enhancing the efficiency of the packaging process.

The medical device packaging boxes market is expected to grow at the fastest CAGR of 7.4% over the forecast period. Boxes can be customized in size, shape, and design to fit specific medical devices, improving brand competitiveness securely. Their stackable nature enables efficient storage and transportation, minimizing spoilage and costs. Built to comply with stringent industry regulations, including tamper-evident seals and sterilization compatibility, these boxes ensure medical devices stay sterile and safe for use. Made from recyclable materials such as corrugated cardboard, boxes reduce environmental impact by promoting reuse and recycling. Their sturdy design minimizes waste, ensuring efficient use of space in storage and transportation, further decreasing carbon footprints.

Application Insights

The equipment and tools sector dominated the medical device packaging market, accounting for a revenue share of 34.2% in 2024. Medical tools require flexible packaging that ensures a high level of sterilization. Most of these tools are packaged in flexible materials such as plastic pouches, trays, bags, and clamshells. Additionally, the equipment segment needs packaging solutions for large diagnostic devices, such as CT scanners, X-ray machines, MRI machines, and ultrasound scanners. These sizable devices require structured packaging to protect them, as hospitals and healthcare facilities typically purchase them.

The medical device packaging market for IVD (in-vitro diagnostic) is expected to grow at the fastest CAGR of 7.6% over the forecast period. As IVD tests become more widespread for disease detection and monitoring in healthcare, there is a rising need for advanced, reliable packaging solutions. A greater public understanding of the benefits of preventative healthcare is driving demand for IVD testing. With a growing elderly population, the need for regular monitoring of chronic conditions such as diabetes, heart disease, and cancer through IVD tests is increasing. Therefore, medical device packaging ensures the safety, sterility, and integrity of sensitive diagnostic components, giving rise to the market demand.

Regional Insights

The North America medical device packaging market held a substantial market share in 2024. The growing number of surgeries in North America, driven by both elective and non-elective procedures, is increasing demand for medical device packaging, especially for ensuring sterility and safety. Major cities in the region, such as Mexico, focus on innovative, high-quality technologies that deliver strong healthcare outcomes, with high demand in areas such as preventative care, diagnostics, and orthopedics. With established brands, investments, and technological advancements, the region has seen a surge in the medical device packaging industry.

U.S. Medical Device Packaging Market Trends

The U.S. medical device packaging market dominated the North America market, with the highest revenue share of % in 2024. The U.S. holds a competitive advantage in terms of instrumentation, technology, software development, and high investments in the R&D field, resulting in high production volumes of medical devices. The US medical device industry is the largest in the world, with many companies developing advanced medical technologies to improve healthcare. Furthermore, compliance with rigorous regulations to ensure patient safety and product efficacy is driving demand for high-quality packaging materials and designs.

Europe Medical Device Packaging Market Trends

The Europe medical device packaging market dominated the global market and accounted for the largest revenue share of 31.9% in 2024. The region is characterized by the presence of several well-established device manufacturing companies operating locally as well as in the international market. The U.K. is known as the key exporter of medical devices globally and is at the forefront of innovation and developments in medical technology. Furthermore, investment in advanced packaging technologies, such as recyclable materials and sustainable designs, is also driving growth, as companies aim to meet both regulatory standards and environmental sustainability goals.

The medical device packaging market in Germany led the Europe market with the highest revenue share in 2024. The growth is driven by significant investment in capacity and technology. In May 2024, Coveris Group invested approximately USD 8.4 million to improve its medical device packaging production capabilities, adding new pouch lines and a header bag line at Rohrdorf and Halle sites in Germany. Furthermore, the rise in home-based medical diagnostics and devices, such as test kits for diabetes or infection, has increased demand for packaging that ensures product integrity, portability, and user-friendliness.

Asia Pacific Medical Device Packaging Market Trends

The Asia Pacific medical device packaging market is expected to grow at the fastest CAGR of 7.9% over the forecast period. The rising healthcare sector in the region is giving rise to the medical device packaging industry. The Asia-Pacific healthcare market is growing rapidly, driven by changing demographics, rising disposable incomes, and increasing healthcare demands. The senior population in China is expanding by 10 million annually, while the middle class is expected to reach 3.49 billion by 2030. Furthermore, the region has become a global hub for medical tourism, particularly in countries such as Thailand, India, and Singapore, where affordable and high-quality medical treatments attract international patients.

The medical device packaging market in China dominated the Asia Pacific market with the highest revenue share in 2024. Government initiatives such as China's Healthy China 2030, which aims to double the health service industry by 2030, have given rise to the medical device packaging industry. China's medical device market is the second-largest globally after the U.S. The increasing need for long-term healthcare and high-quality medical services, fueled by higher incomes and expanding middle-class expectations, pushes demand for advanced medical equipment packaging across major cities and smaller regions, further giving rise to the medical device packaging market.

Key Medical Device Packaging Company Insights

Key companies in the global medical device packaging market include Amcor plc, DuPont, SteriPack, and Wipak Walothen GmbH, among others. These companies invest in innovative technologies, ensure compliance with global regulatory standards, and prioritize sustainability. They also focus on research and development to offer customized packaging solutions, optimize sterilization processes, and enhance supply chain efficiency. Strategic partnerships and acquisitions further help them expand their market reach and maintain leadership.

-

Amcor plc offers a wide range of products, such as sterile barrier systems, thermoformed trays and blisters, pouches and bags, medical packaging films, custom packaging solutions, and eco-friendly packaging. It is headquartered in Zurich, Switzerland. It also operates in various regions, including North America, Europe, Asia, and Latin America.

-

DuPont offers packaging solutions for the medical device industry, including Tyvek, nylon films, medical-grade adhesives, and specialty films, ensure sterility, integrity, and safety. DuPont’s packaging meets regulatory standards, supports various sterilization methods and focuses on sustainability, helping manufacturers maintain product protection and patient safety while reducing environmental impact.

Key Medical Device Packaging Companies:

The following are the leading companies in the medical device packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor PLC

- DuPont

- SteriPack

- Wipak Walothen GmbH

- Sonoco Products Company

- Sealed Air

- Tekni-Plex, Inc.

- Nelipak

- Oliver

- Berry Global Inc.

Recent Developments

-

In February 2024, Spectrum Plastics Group, a DuPont Business, announced the expansion of its Heredia, Costa Rica manufacturing facility. Expanding from 36,000 to 52,000 square feet, the facility is expected to increase capacity for medical packaging tubing, pouches, and sterile packaging. The expansion included additional extrusion equipment and production lines. As a DuPont Tyvek Authorized Converter, Spectrum is expected to be adhering to ISO 13485:2016 and ISO 9001:2015 standards, providing high-quality medical packaging with a 24/7 production schedule to meet growing demand.

-

In January 2024, Sanner Group, a healthcare packaging company, and CDMO acquired Springboard, a medical device design and development specialist for regulated markets. This acquisition aligned with Sanner's goal to expand its drug delivery, diagnostics, and medtech services. Springboard's expertise enhanced Sanner's in-house capabilities, creating a new Design Center of Excellence in the UK. The partnership strengthened Sanner's ability to support clients across various medical device sectors and the entire product lifecycle, from concept to manufacturing.

Medical Device Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 40.5 billion

Revenue forecast in 2030

USD 55.1 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; Brazil; Saudi Arabia

Key companies profiled

Amcor PLC; DuPont; SteriPack; Wipak Walothen GmbH; Sonoco Products Company; Sealed Air; Tekni-Plex, Inc.; Nelipak; Oliver; Berry Global Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Device Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global medical device packaging market report based on material, product, application, and region.

-

Material Outlook (Revenue, USD Million; 2018 - 2030)

-

Plastic

-

Paper & Paperboard

-

Metal

-

Others

-

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Pouches & Bags

-

Trays

-

Boxes

-

Clamshells

-

Others

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Equipment & Tools

-

Devices

-

IVD

-

Implants

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.