Medical Coding Market Size, Share & Trends Analysis Report By Component (Outsourced, In-house), By Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-382-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Medical Coding Market Size & Trends

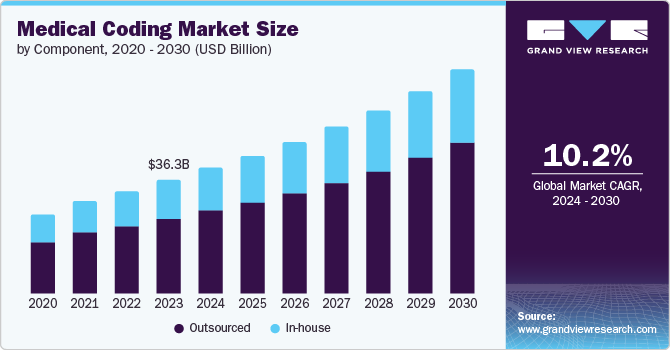

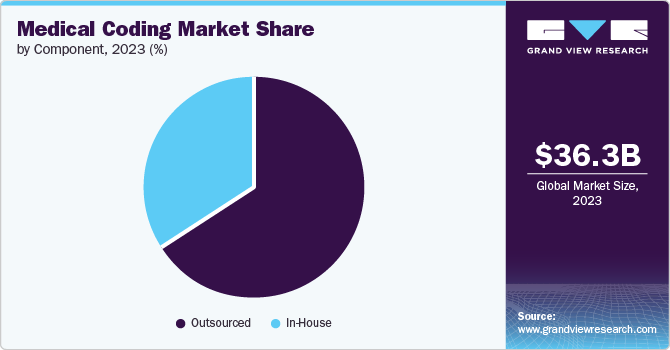

The global medical coding market size was estimated at USD 36.30 billion in 2023 and is expected to grow at a CAGR of 10.22% from 2024 to 2030. The rising need for coding services, a universal language to minimize fraudulent & erroneous insurance claims, and the pressure to improve hospital billing processes are expected to drive the market over the forecast period. Moreover, there is a growing trend for easier and more efficient coding & billing solutions that can simplify processes & improve convenience. This has led to an increased demand for skilled medical coding professionals.

The demand for coding services is significantly increasing due to the rise in hospital admissions. For instance, the American Hospital Association's 2024 report revealed that there were around 34 million hospital admissions in the U.S. The large number of hospital admissions is likely to boost the demand for skilled medical coders and billers to manage medical billings, driving the industry over the forecast period. The market is expected to grow due to a shift toward easier and more efficient coding & billing solutions. As healthcare needs rise, especially with the growing geriatric population, the demand for skilled medical coders is expected to increase. For instance, The Bureau of Labor Statistics expects an 8% growth in medical records and health information jobs from 2022 to 2032, highlighting the need for better healthcare solutions.

Furthermore, technological advancements in coding software are expected to propel the market over the forecast period. Innovations such as Artificial Intelligence (AI)-driven coding tools can help enhance the efficiency of handling large healthcare data volumes. For instance, in April 2024, XpertDox LLC partnered with Positive Results, LLC to introduce XpertCoding. This collaboration improves Positive Results’ operations using XpertDox’s advanced AI medical coding software. As a result, the rise of new clinical documentation technology that uses speech recognition and generative AI is expected to boost the industry in the coming years.

Market Concentration & Characteristics

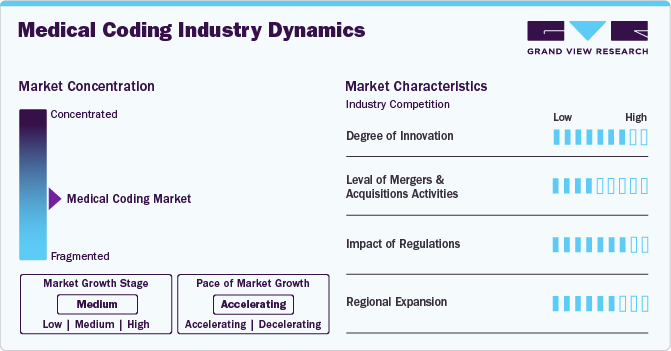

The industry growth stage is medium, and the pace of growth is accelerating. The chart below illustrates the relationship between market concentration, industry characteristics, and industry participants. The X-axis represents the level of industry concentration, ranging from low to high. The Y-axis represents various industry characteristics, including industry competition, level of mergers & acquisitions, degree of innovation, impact of regulations, and regional expansion. The market is fragmented, with the presence of several emerging service providers dominating key regions. The degree of innovation is high, and the level of mergers & acquisitions activities is moderate. The impact of regulations on the industry is high, and the rate of regional expansion in the industry is high.

The degree of innovation in the industry is high. As healthcare services expand and become more complex, there is a proportionate need for more intricate & exhaustive medical coding systems. This complexity requires innovative solutions to code new procedures, drugs, and diseases accurately. For instance, in June 2024, CluePoints launched two advanced deep learning technology solutions, Site Profile & Oversight Tool and Intelligent Medical Coding, at the DIA Global Annual Meeting 2024. The Intelligent Medical Coding solution is designed to streamline and enhance accuracy in clinical trial coding, reducing manual effort & ensuring consistency.

The industry's level of mergers and acquisitions is moderate. The industry is expected to exhibit significant growth, driven by a surge in mergers & acquisitions. This trend is influenced by regulatory complexities, the specialized nature of medical coding services, and the evolving landscape of healthcare technology. For instance, in October 2023, WellSky acquired Corridor, an end-to-end tech-enabled services platform designed for the postacute care industry. This strategic move aimed to expand WellSky's medical coding and revenue cycle management offerings, enabling care providers to increase efficiency & improve performance across clinical, financial, operational, & compliance areas.

The impact of regulations on the industry is high due to regulations that ensure medical coding solutions comply with healthcare standards, which require constant monitoring and updating of coding practices. Stringent compliance requirements compel companies to constantly update their systems to meet the latest healthcare protocols and patient privacy laws. In the U.S., this includes regulations set by CMS and NCHS, in addition to acts such as HIPAA.

The level of regional expansion in the industry is high due to the surge in healthcare services demand, globalization of clinical trials, the need for a universal language in medical documentation to ensure consistency & accuracy across healthcare facilities, and developments in information technology.

Component Insights

On the basis of component, the outsourced segment held the largest revenue share of 65.64% in 2023 and is anticipated to grow at the fastest rate over the forecast period. Segment growth can be attributed to the increasing volume of patient information & healthcare data, the emphasis on cost reduction & operational efficiency in healthcare organizations, and the need to ensure compliance with international coding standards & regulations. Outsourcing allows healthcare providers to access skilled coding professionals without the overhead associated with in-house teams. In addition, it enables professionals to focus on core healthcare provisions by offloading the intricate & time-consuming task of medical coding to external specialists. This model benefits from advancements in technology & communication, enabling secure and effective international collaboration.

The in-house segment is anticipated to grow significantly over the forecast period. Its growth can be attributed to the rising need for precise billing procedures, the accelerating increasing requirement for standardized patient data, and healthcare providers' growing emphasis on cost-cutting measures. The adoption of electronic health records and the increasing demand for specialized medical coders to navigate the complexities of various coding standards further contribute to the trend. Organizations are recognizing the value of having a dedicated, well-trained in-house team that ensures compliance, maximizes reimbursement, and reduces billing errors.

Regional Insights

The medical coding market in North America held the largest share of 60% in 2023. This can be attributed to the increasing need for a universal language to reduce instances of errors and discrepancies in healthcare documentation. Medical coding fulfills this need by converting healthcare diagnoses, procedures, medical services, and equipment into universal medical alphanumeric codes. The adoption of such coding practices is necessary for accurate billing and efficient healthcare management. Moreover, the evolution of healthcare IT solutions, including the integration of AI and Machine Learning (ML) in medical coding processes, is expected to propel the market.

U.S. Medical Coding Market Trends

The medical coding market in the U.S.held the largest share in 2023 due to the increasing number of healthcare facilities, such as hospitals, specialty clinics, ambulatory surgery centers, and cancer care centers. In addition, there is a significant need for coding by healthcare professionals to update patient records, accelerating market growth. For instance, the U.S. Bureau of Labor Statistics projected a 13% increase in employment for medical staff, including medical billing and coding specialists, between 2016 & 2026.

Europe Medical Coding Market Trends

The medical coding market in Europe is expected to be driven by the increasing need for standardized coding in medical records. Standardized coding can help reduce the risk of insurance fraud and misinterpretation of insurance claims, streamlining hospital billing procedures. In addition, technological advancements in the medical field, including the use of computer-aided coding systems and improvements in the healthcare infrastructure of several European countries, can contribute to this trend.

The medical coding market in the UK held the largest share in 2023, owing to the increasing number of training centers offering medical coding courses. Key players are increasing their efforts to spread awareness about the benefits of medical coding in the healthcare sector and provide information regarding training centers & career growth opportunities in this sector.

The Germany medical coding market held a significant share in 2023, owing to an increase in medical coding positions and the heightened use of digital technology in healthcare. Moreover, there is a growing demand to modernize hospital billing procedures due to the necessity for precise coding to assess treatment frequency and effectiveness in healthcare institutions.

Asia Pacific Medical Coding Market Trends

Themedical coding market in Asia Pacificis expected to witness the fastest growth over the forecast period owing to the increasing prevalence of chronic diseases, prompting healthcare providers to improve their infrastructure & services. Key advancements include efficient medical coding practices for proper billing and insurance claims. Furthermore, the growth in healthcare expenditure and government initiatives to improve healthcare services is likely to boost growth in the region.

The medical coding market in China is expected to be driven by the rapidly evolving healthcare infrastructure and the digitalization of patient health records. With more healthcare providers expanding their offerings to meet the demands of a growing population, there is an increasing need for standardized & efficient medical recordkeeping and billing practices. Therefore, medical coding practices can enable clearer, more consistent communication across healthcare providers and insurers.

The India medical coding market is expected to be driven by the cost-effectiveness of India-based medical coding service providers compared to the ones based in Western countries. In addition, the country’s market is likely to be driven by the growing demand for a standardized medical documentation language to ensure accurate billing & reimbursement, an increasing emphasis on healthcare IT solutions, the booming local healthcare industry, and the outsourcing of medical coding services.

Latin America Medical Coding Market Trends

The medical coding market in Latin America is expected to grow due to recent healthcare reforms, supportive regulatory initiatives, broad health insurance coverage, increase in adoption of healthcare IT systems, and rise in the prevalence of chronic conditions. Countries such as Argentina are witnessing a higher demand for medical coding services as private and public health insurance schemes continue to expand, necessitating accurate coding for efficient insurance claims processing & reimbursement. The increase in insurance coverage is boosting the need for complex and voluminous claims management, driving the adoption of sophisticated coding technologies.

The medical coding market in Brazil is anticipated to grow significantly due to the major reforms in healthcare regulation and increasing healthcare data. For instance, Brazil’s Unified Health System (SUS) is periodically refined to improve efficiency and coverage, necessitating the use of accurate coding to manage patient data, billing, & compliance with national health policies.

MEA Medical Coding Market Trends

Themedical coding market in MEA is expected to grow significantly due to the ongoing development of healthcare infrastructure. South Africa, the UAE, and other affluent MEA countries are adopting international coding standards, such as the ICD-10 system, to ensure consistency & accuracy in medical records. This regulatory shift has increased the demand for advanced medical coding systems and trained professionals who can navigate these complex standards, ensuring proper documentation & adherence to international norms.

The Saudi Arabia medical coding market is anticipated to grow significantly over the forecast period, owing to increased investment in healthcare services as part of the country's national development initiatives, such as Saudi Vision 2030. This emphasis on improving healthcare facilities and services has increased the demand for efficient medical coding systems to handle patient data, billing, & compliance. Therefore, such systems are essential for the efficient functioning of modern healthcare operations.

Key Medical Coding Company Insights

The medical coding market is fragmented. Several large and emerging players operating in this space are adopting various expansion strategies, such as collaborations, acquisitions, partnerships, and launch of new devices. Some of the emerging players in the market are RapidClaims; CodaMetrix; Fathom, Inc.; and Semantic Health.

Key Medical Coding Companies:

The following are the leading companies in the medical coding market. These companies collectively hold the largest market share and dictate industry trends.

- Aviacode, Inc.

- Dolbey Systems, Inc.

- GeBBS

- Maxim Healthcare Services

- Nuance Communications, Inc. (Microsoft)

- Optum, Inc.

- Oracle

- Paraxel International Corporation

- STARTEK

- The Coding Network, LLC

Recent Developments

-

In March 2024, CodaMetrix, a provider of AI-powered platforms for multispecialty medical coding, garnered USD 40 million in a Series B funding round. This funding would help advance the company’s AI-powered solutions to improve the quality of medical coding, generate complete clinical data sets, decrease the overall cost of care, and ease the administrative burden on providers.

-

In February 2024, RapidClaims announced its official launch with significant initial funding. The startup aims to transform the healthcare industry by leveraging AI to streamline the complex processes of medical coding and claim submission.

-

In February 2024, KAID Health, Inc., a provider of patient chart summarization and clinical analytics, launched the Patient Risk Identification & Data Extraction (PRIDE) application and formed the Coding Services Group. The newly formed organization and application are expected to enhance providers' coding accuracy, enabling them to offer better & more comprehensive patient care.

-

In January 2023, AQuity announced the launch of QCodeAI with early adopters of its QCode platform. This newly launched solution would leverage the latest developments in ML and natural language processing to automate coding processes, improve coder productivity & accuracy, and reduce turnaround times & labor costs.

Medical Coding Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 39.86 billion |

|

Revenue forecast in 2030 |

USD 71.47 billion |

|

Growth rate |

CAGR of 10.22% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

STARTEK; Oracle; Maxim Healthcare Services; Paraxel International Corporation; Aviacode Inc.; GeBBS; Nuance Communications Inc. (Microsoft); Optum, Inc.; The Coding Network, LLC.; Dolbey Systems, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country or regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Medical Coding Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the medical coding market report based on component and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Outsourced

-

In-house

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global medical coding market size was estimated at USD 36.31 billion in 2023 and is expected to reach USD 39.86 billion in 2024.

b. The global medical coding market is expected to grow at a compound annual growth rate of 10.22% from 2024 to 2030 to reach USD 71.47 billion by 2030.

b. North America dominated the market, with a share of over 60% in 2023. This is attributable to the region's increasing number of healthcare facilities, such as hospitals, specialty clinics, ambulatory surgical centers, and cancer care centers, which has led to a higher demand for medical coding services.

b. Some key players operating in the medical coding market include STARTEK; Oracle; Maxim Healthcare Services; Paraxel International Corporation; Aviacode Inc.; GeBBS; Nuance Communications Inc. (Microsoft); Optum, Inc.; The Coding Network, L.L.C.; Dolbey Systems, Inc.

b. Key factors that are driving the medical coding market growth include Key factors that are driving the medical coding market growth include rising demand for coding services, high demand to streamline hospital billing procedures, growing investment by private players to streamline the process

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."