- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Medical Coatings for Implants Market Size Report, 2030GVR Report cover

![Medical Coatings For Implants Market Size, Share & Trends Report]()

Medical Coatings For Implants Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (PVD, Plasma Spray), By Product (Hydroxyapatite, Nanoparticle), By Application (Cardiovascular Implants, Dental Implants), And Segment Forecasts

- Report ID: GVR-4-68039-949-2

- Number of Report Pages: 112

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Coatings For Implants Market Trends

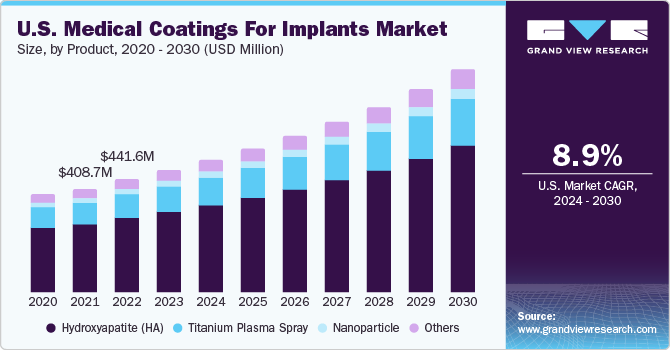

The global medical coatings for implants market size was estimated at USD 1.50 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 9.3% from 2024 to 2030. The rising product demand is fueled by an increase in the number of various medical implant procedures, such as cardiovascular, orthopedic, and dental implants. A steady rise in the utilization of implants for cases such as bone fracture and bone dislocation, mostly in the elderly, is expected to boost product demand in the coming years. A fast-rising healthcare expenditure is another major factor enabling market expansion. As per the Centers for Medicare & Medicaid Services, healthcare spending accounted for approximately 19.7% of the U.S. GDP in 2020.

As per the same source, healthcare spending in the country is projected to witness an average growth rate of 5.4% from 2019 to 2028 and reach USD 6.2 trillion by 2028. The strong growth is expected to be driven by a rapidly rising need for healthcare services for the country's aging population (of and above 65 years of age), an extensive prevalence of chronic diseases & disorders, and technological developments. The growing prevalence of cardiovascular diseases is enabling the global demand for cardiovascular implants. Cardiac implants are considered a great asset for heart patients as they help monitor patient’s heartbeat and detect irregularities in the cardiac rhythms.

Implantable Cardioverter-defibrillator (ICD) is one such cardiac implant that supports cardiac patients with programs, such as high-energy shock and low-energy pacing. Thus, the increasing prevalence of cardiovascular diseases, coupled with advancements in surgical techniques, and rising awareness about preventive care are expected to create significant demand for cardiovascular implants, which, in turn, is projected to fuel demand for medical coatings. The titanium prices are affected by the high cost of the aforementioned extraction process and the presence of several stringent government regulations pertaining to the metals and mining sector. This further impacts the overall cost of titanium alloy.

This, in turn, is expected to act as a market restraint. Several import tariffs imposed by the U.S. government due to the current trade war between the country and China are expected to further result in raw material price volatility. These factors are poised to slow down industry growth substantially. Rising consumption of junk foods and improper eating habits are causing tooth decay, creating demand for solutions, such as dental implants. In addition, the increasing geriatric population along with the burden of dental diseases, and a rising demand for cosmetic dentistry are further propelling the need for dental implants. This, in turn, will positively influence industry growth.

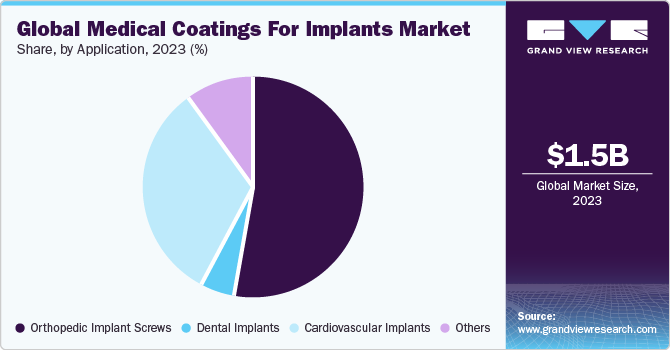

Application Insights

Orthopedic implant screws led the industry with a revenue share of 53.0% in 2023. Orthopedic implant screws are essential in the process of orthopedic fixation. Pedicle screws are a type of orthopedic screws, which are primarily used in spine fusion surgeries to correct deformities and treat trauma. They are inserted to hold the vertebrae together and keep the spine stable. Pedicle screws are made of titanium alloy and are often associated with risks involving breaking, loosening, and/or falling of screws. To remedy that, these implants are sprayed with titanium plasma-sprayed (TPS) coatings, which provide good corrosion resistance, adhesion, wear strength, and reduce allergic reactions.

Improper weight lifting techniques in material handling and also while working out in gyms often lead to spine disorders, which is expected to drive the market for pedicle screws and influence the consumption of medical coatings in implants. Demand for dental implants has been increasing, owing to the rising prominence of the American promotion company, Ultimate Fighting Championship (UFC), which has boosted the popularity of Mixed Martial Arts (MMA).

MMA has become one of the fastest-growing sports globally and is anticipated to increase in popularity further due to extensive investments pouring into it. For instance, in December 2021, One Championship, the Asian MMA company, closed a USD 150 million equity financing round led by Qatar Investment Authority and Guggenheim Investments. Since injuries are frequently associated with MMA, the developing MMA sector is expected to drive the market for dental implants and positively impact market expansion.

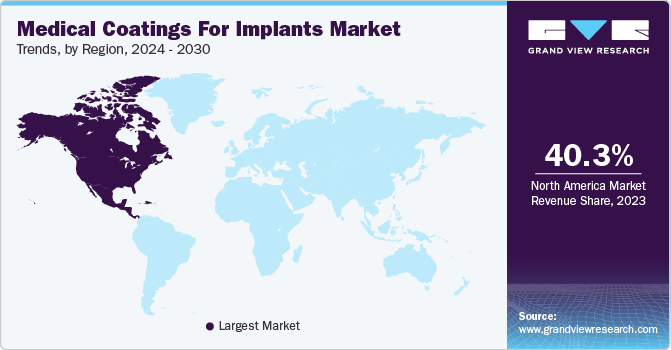

Regional Insights

North America held a dominant revenue share of 40.3% in 2023. Cosmetic surgeries are gaining popularity due to rapid urbanization, changing lifestyles, and rising image consciousness among consumers in the region, due to the growing usage of social media platforms. According to the American Society of Plastic Surgeons (ASPS), the popularity of cosmetic surgery among men is increasing due to the introduction of non-surgical procedures, such as soft tissue fillers, which provide quicker recovery time. Hydroxyapatite is used as a soft tissue filler for facial wrinkles. It lasts for a relatively long period.

Since the social stigma associated with men undergoing cosmetic surgeries has been steadily fading away, it is expected to result in high demand for soft tissue fillers, which will directly propel market growth in similar applications. Asia Pacific is expected to witness significant gains from 2024 to 2030 on account of rising demand for medical coatings in various countries, including India, China, and Japan. The increasing volume of body implant surgeries is anticipated to boost product demand further in this region.

Market Dynamics

Medical coatings are extensively utilized by medical device manufacturers on various devices, including cardiac arrest devices, feeding tubes, guide wires, and others. As per the Centers for Medicare & Medicaid Services (CMS), healthcare spending in the United States saw an increase of 2.7%, reaching USD 4.3 trillion or USD 12,914 per person in 2021. Moreover, as per the same source, healthcare spending in the country is projected to witness an average growth rate of 5.4% from 2019 to 2028, reaching USD 6.2 trillion by 2028. The projected demand growth for healthcare services among the elderly population, along with a high prevalence of chronic disorders and technological advancements, is projected to fuel the need for medical implants and, consequently, boost the demand for medical coatings.

Moreover, the increasing consumption of unhealthy food and growth in unhealthy eating practices have increased the instances of tooth decay, which is driving the need for dental solutions such as dental implants. Furthermore, the rising elderly population and increasing prevalence of dental diseases, along with a high demand for cosmetic dentistry, are further fueling industry growth for dental implants.

Product Insights

Hydroxyapatite (HA) product segment accounted for a revenue share of 64.8% in 2023. Hydroxyapatites are widely consumed in implants, such as dental and orthopedics for bone adjustments. These coatings present prominent applications in the integration of medical implants within the human body. Though metallic implants offer required mechanical strength, they need a good osteophilic surface for bonding to the skeleton. This is provided by hydroxyapatite coatings, which help natural bones affix to implants. These coatings are normally used for low load-bearing dental and orthopedic implants owing to their low fatigue strength.

Biofilm formation, infection risks, and microbial colonization are the major complications encountered by medical implants. These are also some of the predominant factors causing implant failures, leading product manufacturers to develop antimicrobial nanoparticles for use in implant coatings. Nanoparticle composites, such as silver nanoparticles, are incorporated with hydroxyapatite into implants to inhibit bacterial growth in them. This assures that implants have enhanced integration possibilities with the body of patients.

Technology Insights

Plasma spray technology segment accounted for the highest revenue share of 55.2% in 2023. Plasma spraying produces thick-layered coatings, from a few tens to a few hundred microns on ceramic or metal implants. It is usually used to spray titanium (Ti) coatings, Hydroxyapatite (HA) coatings, and Ti/HA dual coatings on implants used in orthopedic, trauma, dental, and other applications. Plasma-sprayed coatings are applied on the bone-contacting surface for biological fixation of implants, surface roughness, and maintaining the similarity of chemical composition to bone minerals. Vacuum spray technology offers prominent applications for implants.

During fracture healing, when an implant is inserted, the bone, in order to grow, has to offer the trabaculae an excellent surface to adhere to it. Trabeculae are small rods inserted inside the bone to provide support during bone healing. This requires the implant to provide a porous surface while still being able to withstand enormous loads. Vacuum plasma spray coating provides them with a suitable adhesive property and smooth surface to bond well with the substrate and is used in bone-in growth applications.

Key Companies & Market Share Insights

Key manufacturers are striving to adapt to changes in terms of technologies and new product developments to offer the best medical coatings solution and gain a competitive edge over others.

Key Medical Coatings For Implants Companies:

- Himed

- Hydromer

- DOT GmbH

- Lincotek Group S.p.A.

- Medicoat AG

- CAM Bioceramics B.V.

- APS Materials, Inc.

Medical Coatings For Implants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.64 billion

Revenue forecast in 2030

USD 2.83 billion

Growth rate

CAGR of 9.3 % from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report Updated

November 2023

Quantitative units

Volume in Tons, Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Himed; Hydromer; DOT GmbH; Lincotek Group S.p.A.; Medicoat AG; CAM Bioceramics B.V.; APS Materials, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

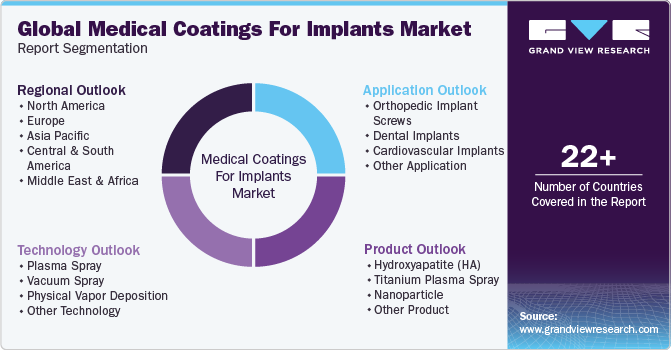

Global Medical Coatings For Implants Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the medical coatings for implants market report on the basis of product, technology, application, and region:

-

Product Outlook (Volume, Tons, Revenue, USD Million, 2018 - 2030)

-

Hydroxyapatite (HA)

-

Titanium Plasma Spray

-

Nanoparticle

-

Other Product

-

-

Technology Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Plasma Spray

-

Vacuum Spray

-

Physical Vapor Deposition

-

Other Technology

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Orthopedic Implant Screws

-

Pedicle Screws

-

Sacroiliac SI Joint Screws

-

Other Orthopedic Implant Screws

-

-

Dental Implants

-

Cardiovascular Implants

-

Other Application

-

-

Regional Outlook (Volume, Tons, Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global medical coatings for implants market size was estimated at USD 1.50 billion in 2023 and is expected to reach USD 1.64 billion in 2024

b. The global medical coatings for implants market is expected to grow at a compound annual growth rate of 9.3% from 2024 to 2030 to reach USD 2.83 billion by 2030

b. The hydroxyapatite (HA) based coatings under product segment dominated the medical coatings for implants market with a share of 64.8% in 2023. This is attributable to the wide use of hydroxyapatite-based coatings in bone repair and bone regrowth applications.

b. Some key players operating in the medical coatings for implants market include Himed, Hydromer, DOT GmbH, and Lincotek Group S.p.A.

b. Key factors that are driving the medical coatings for implants market growth include the increasing prevalence of orthopedic and cardiovascular diseases and rise in global healthcare expenditure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.