- Home

- »

- Medical Devices

- »

-

Medical Carts Market Size And Share, Industry Report, 2030GVR Report cover

![Medical Carts Market Size, Share & Trends Report]()

Medical Carts Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Mobile Computing Carts, Wall-mounted Workstations), By Type (Anesthesia, Emergency, Procedure), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-269-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Medical Carts Market Summary

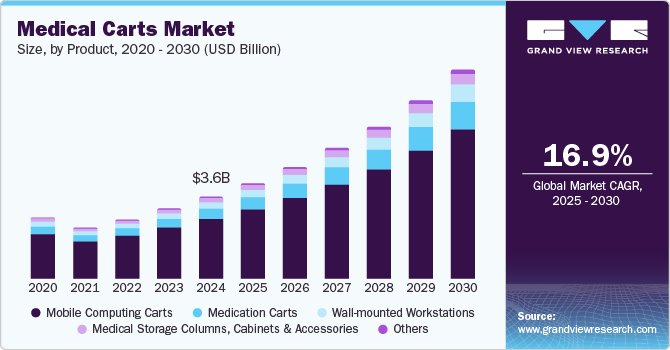

The global medical carts market size was estimated at USD 2.60 billion in 2024 and is projected to reach USD 6.63 billion by 2030, growing at a CAGR of 16.95% from 2025 to 2030. In 2023, approximately 90% of healthcare organizations reported the integration of digital medical records, leading to a heightened demand for medical carts equipped with electronic health record (EHR) capabilities.

Key Market Trends & Insights

- North America medical carts market dominated the global market with a revenue share of 40.87% in 2024.

- The U.S. dominated the North America medical carts market with a revenue share of 81.29% in 2024.

- By product, mobile computing carts segment dominated the market with a revenue share of 72.38% in 2024.

- By type, emergency carts segment led the market and accounted for a share of 40.53% in 2024.

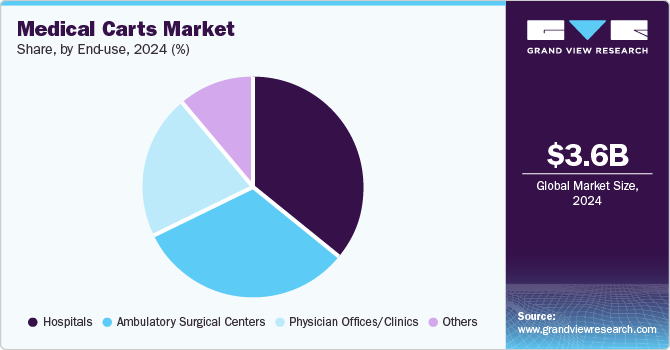

- By end use, hospitals segment held the largest revenue share of 35.94% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.60 billion

- 2030 Projected Market Size: USD 6.63 billion

- CAGR (2025-2030): 16.95%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Innovations such as RFID tracking and telemedicine functionalities are crucial in enhancing workflow efficiency and improving patient care outcomes. As healthcare facilities continue to adopt advanced technologies, the need for sophisticated medical carts is expected to increase, thereby fueling market growth.Concurrently, the rise of telehealth has emerged as a pivotal factor in shaping the medical carts market. A CDC report indicated that 37% of U.S. adults utilized telemedicine services in 2021, with adoption trends continuing to expand, particularly in rural areas where healthcare access has historically been limited. This increasing reliance on telehealth underscores the necessity for mobile solutions that facilitate remote patient monitoring and care delivery. Consequently, medical carts designed to support telehealth initiatives are becoming increasingly essential, further boosting market demand.

Another prominent driver is the focus on patient safety and operational efficiency, particularly through the implementation of barcode-labeled medication distribution systems (BCMA). These systems are recognized as vital in preventing medication errors, enhancing patient safety, and improving nursing efficiency. With many healthcare providers emphasizing the incorporation of secure mobile carts to safeguard patient information, this necessity contributes significantly to the growth of the medical carts market, as providers seek solutions that enhance both care quality and safety.

By 2024, it was projected that approximately 20% of the U.S. population will be over 65 years old, correlating with a higher prevalence of chronic health conditions that require frequent medical attention. As the demand for accessible medical solutions rises, healthcare facilities are increasingly investing in medical carts designed to provide easy access to essential supplies and equipment. Such investments are further supported by ongoing developments in healthcare infrastructure and rising global healthcare expenditures.

Product Insights

Mobile computing carts dominated the market with a revenue share of 72.38% in 2024. They facilitate healthcare professionals’ access to electronic medical records and patient data at the point of care, significantly enhancing workflow efficiency by minimizing time spent transitioning between patient rooms and workstations. Their mobility supports telehealth initiatives, enabling remote monitoring and virtual consultations. Furthermore, advanced features such as barcode scanning, RFID tracking, and data security measures ensure compliance with privacy regulations, making these carts indispensable in contemporary healthcare environments. For instance, in March 2024, Ultralife Corporation and Karta unveiled a new medical cart and power solution at HIMSS24, featuring a nestable cart with Ultralife’s X5 Power System.

Others segment is expected to grow at the fastest CAGR over the forecast period. This segment's growth is driven by the increasing demand for customized solutions in various medical settings and the rising number of surgical procedures. Furthermore, the increasing need for enhanced mobility and organization in critical care environments is anticipated to support the segment growth. In addition, advancements in cart design and infection control standards further contribute to the adoption of these carts across healthcare facilities.

Type Insights

Emergency carts led the market and accounted for a share of 40.53% in 2024. As the risk of infectious diseases is higher in emergency care units, demand for these products is expected to increase in the coming years. These products help in controlling infection in intensive care units as they are anticorrosive and durable for medical emergencies. These carts are stocked with drugs and medical equipment in the event of a medical emergency, such as cardiac arrest. Advancements in these products, such as mobile, lighter, and ergonomic designs, are expected to boost their adoption throughout the forecast period. The availability of handle & wheel mounts and smaller sizes of the batteries help in improving nursing staff safety, as they become easy to handle and avoid any occupational hazards to users. These benefits of emergency workstations are propelling segment growth.

Procedure carts are expected to register the fastest CAGR over the forecast period due to their consistent usage in many healthcare settings. These carts are very helpful in operating procedures, such as cardiology & endoscopy, and also provide access to essential therapeutics. They are of various types, including portable, adjustable, and powered. They are sanitary and movable storage solutions that support surgical procedures in operating rooms. These carts help in reducing the risk of cross-contamination by eliminating dust during the storage of supplies and instruments in small spaces. The types of surgeries performed in clean rooms that require specified procedure carts include cardiology, cystoscopy, laparoscopy, neurology, radiology, arthroscopy, urology, etc. The aforementioned benefits of these carts are anticipated to propel segment growth in the coming years.

End Use Insights

Hospitals held the largest revenue share of 35.94% in 2024, driven by technological advancements in medical mobile workstations. These advancements include the advent of adjustable, secure, and efficient systems for medication delivery. An increase in focus on patient engagement and promotion of EHR incentive programs in hospitals encourages patient involvement and can be attributed to the growing share of this segment. Furthermore, the growing adoption of BCMA to reduce medication errors, the emergence of technologically advanced solutions such as telehealth, focus on improving nursing efficiency, increasing need to curtail rising operational costs in hospitals, and ensuring easy access to critical medical supplies & equipment also contribute to segment growth worldwide.

Physician offices/clinics are projected to grow at the fastest rate over forecast period, fueled by the increase in awareness and demand for one-stop solutions that require less space and can be used for all kinds of medical requirements, as these carts include medicine, medical equipment, computers, & storage cabinets and are mobile. Hence, the rising adoption of mobile workstations by clinics is expected to propel segment growth. For instance, in December 2024, Medline announced a prime vendor agreement with Central Management Company, serving as the primary supplier for 22 skilled nursing facilities in Louisiana, enhancing care quality through specialized product solutions and training.

Regional Insights

North America medical carts market dominated the global market with a revenue share of 40.87% in 2024. Significant investments by governments for the development of innovative medical devices, the presence of key participants, and the existence of a favorable reimbursement scenario are the factors supplementing the growth of the market within the region. Due to the rising incidence of chronic kidney diseases (CKD), there is increasing demand for home dialysis. For instance, the CDC has reported that more than 37 million people are estimated to have CKD.

U.S. Medical Carts Market Trends

The medical carts market in the U.S. dominated the North America medical carts market with a revenue share of 81.29% in 2024. Market growth in the country is driven by the widespread adoption of EMR in healthcare facilities, which enhances workflow efficiency and patient care. The proliferation of hospitals and urgent care centers also contributes to increased demand for medical carts. Furthermore, advancements in technology and a strong focus on improving patient engagement and safety significantly propel market expansion, making medical carts integral to effective healthcare delivery in modern settings.

Europe Medical Carts Market Trends

Europe medical carts market held substantial market share in 2024 due to the region’s commitment to enhancing healthcare delivery systems and improving patient care. The expansion of healthcare facilities and the integration of advanced medical technologies are key growth drivers. Moreover, the heightened focus on infection control and efficient medication management within hospitals boosts the demand for medical carts, which enable better organization and accessibility to essential medical supplies.

The medical carts market in UK is expected to grow rapidly in the forecast period, aided by the increasing number of healthcare facilities and a rising elderly population that necessitates enhanced healthcare services. By 2024, approximately 18% of the UK population was projected to be over 65 years old, leading to heightened demand for efficient medical solutions. Furthermore, the UK government’s commitment to improving healthcare infrastructure supports the expansion of this market segment, facilitating the development of innovative medical cart solutions.

Asia Pacific Medical Carts Market Trends

Asia Pacific medical carts market is expected to register the fastest CAGR of 18.3% in the forecast period. The region is witnessing substantial investments in healthcare infrastructure and technology. Moreover, the demand for organized and effective healthcare delivery systems drives the adoption of medical carts across various healthcare environments, underscoring their role in meeting the growing needs of the population.

The medical carts market in China is expected to grow at the most lucrative rate between 2025 and 2030. Ongoing investments in healthcare infrastructure and technological advancements, coupled with the aging population, are propelling industry growth, as hospitals seek efficient solutions for improved patient care and management processes.

Key Medical Carts Company Insights

Some key companies operating in the market include Ergotron; iTD GmbH; Capsa Healthcare; TouchPoint Medical, Inc.; GCX Corporation; among others. Market players are adopting various strategies, such as acquisitions & mergers, partnerships, product launches, geographic expansion of manufacturing facilities, improvements and expansions in the distribution network, and innovations such as the introduction of medical care products, to strengthen their foothold in the market. For instance, in January 2023, Capsa Healthcare announced the acquisition of Tryten Technologies Inc., a designer and manufacturer of lightweight, easy to maneuver mobile cart solutions.

-

Capsa Healthcare specializes designing and manufacturing medical carts and technology solutions. The company offers a diverse portfolio, including medication management carts and pharmacy automation systems, aimed at enhancing clinical efficiency and patient safety within healthcare environments.

-

GCX Corporation is a provider of mounting solutions and medical carts tailored for healthcare IT applications. Their offerings facilitate the integration of medical devices and computers into clinical workflows, optimizing space utilization and improving patient care in healthcare facilities.

Key Medical Carts Companies:

The following are the leading companies in the medical carts market. These companies collectively hold the largest market share and dictate industry trends.

- Ergotron

- iTD GmbH

- Capsa Healthcare

- TouchPoint Medical, Inc.

- GCX Corporation

- Advantech Co., Ltd.

- The Harloff Company

- Medline Industries, LP

- Armstrong Medical Ltd

Recent Developments

-

In November 2024, Advantech launched the AIM-68H medical tablet, a solution integrating seamlessly into various clinical environments, enhancing healthcare delivery with features such as real-time data monitoring, medical imaging, and equipment control.

-

In September 2024, Capsa Healthcare launched the Tryten P-Series tablet and monitor carts, enhancing telehealth and patient experience through improved stability, cable management, and versatility for various healthcare applications.

-

In March 2024, GCX launched the Tablet Roll Stand, enhancing healthcare delivery by providing secure, mobile access to patient services and medical records, supporting telehealth initiatives in hospitals.

-

In October 2023, Ergotron acquired Enovate Medical, enhancing its position as a leading provider of ergonomic healthcare workflow solutions and improving clinical efficiency through integrated technologies and services at the point of care.

Medical Carts Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.03 billion

Revenue forecast in 2030

USD 6.63 billion

Growth rate

CAGR of 16.95% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Ergotron; iTD GmbH; Capsa Healthcare; TouchPoint Medical, Inc.; GCX Corporation; Advantech Co., Ltd.; The Harloff Company; Medline Industries, LP; Armstrong Medical Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Medical Carts Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global medical carts market report based on product, type, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile Computing Carts

-

By Application

-

Medical Documentation

-

Medical Equipment

-

Medication Delivery

-

Telehealth Workstation

-

Others

-

-

By Energy Source

-

Powered

-

Non-powered

-

-

-

Wall-mounted Workstations

-

Medication Carts

-

Medical Storage Columns, Cabinets & Accessories

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Anesthesia Carts

-

Emergency Carts

-

Procedure Carts

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Physician Offices/Clinics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.